Our events

Open Webinar - Fundraising for SMEs and Startups: DeFi vs. CeFi

07 July 2021

Time:

to

( GMT +00:00

)

8 : 00

9 : 30

Convert

Online

Decentralized finance (DeFi) is usually considered as a blockchain-based form of financial technology (FinTech) that removes intermediaries when offering financial instruments such as loans, securities and commodities. Centralized finance (CeFi), on the other hand, is another form of FinTech that requires users to trust a party to manage their financial transactions. According to CoinGecko, the total market cap of DeFi has reached USD 128 billion and 1-2 million users are interacting with DeFi protocols.

Since late 2018, DeFi has attracted a rapidly increasing number of FinTech startups, venture capitalists, traders, and even traditional financial institutions. At the same time, it raises a series of questions: What is it? How does DeFi differ from previous forms of FinTech applications using smart contracts (CeFi)?

Expanding financial services for small businesses and underserved entrepreneurs is an urgent issue for achieving UN SDG goals. DeFi’s model of de-intermediation and peer-to-peer transactions on a global scale has created enormous opportunities for financing early-stage projects that are oftentimes ignored by banks or traditional VCs. On Wednesday July 7th, 2021 at 8:00 am EDT, financial industry executives and practitioners with background on DeFi, will share lessons learned from the boom of this nascent industry, and how DeFi modules could support real world assets (RWAs) in the context of SME finance.

What you will learn

● What are the driving forces behind the DeFi boom? How much is its future growth potential?

● With more RWAs being added to the DeFi market, how will DeFi play a crucial role in raising capital for entrepreneurs and startups?

● What are the lessons learned when trying to integrate RWAs into DeFi protocols?

● Will regulated financial institutions eventually adopt DeFi? What are the roadblocks?

● How’s the current regulatory environment?

Host

Matthew Gamser, CEO, SME Finance Forum

Moderator

Lechi Zhang is a consultant at the SME Finance Forum of IFC. He has extensive experience assisting various fintech and blockchain companies in devising their business strategies. Prior to IFC, Lechi worked briefly in investment banking and private equity. He holds a Master's degree in Financial Policy from Cornell University and has acquired certified skills of developing blockchain network from IBM.

Lechi Zhang is a consultant at the SME Finance Forum of IFC. He has extensive experience assisting various fintech and blockchain companies in devising their business strategies. Prior to IFC, Lechi worked briefly in investment banking and private equity. He holds a Master's degree in Financial Policy from Cornell University and has acquired certified skills of developing blockchain network from IBM.

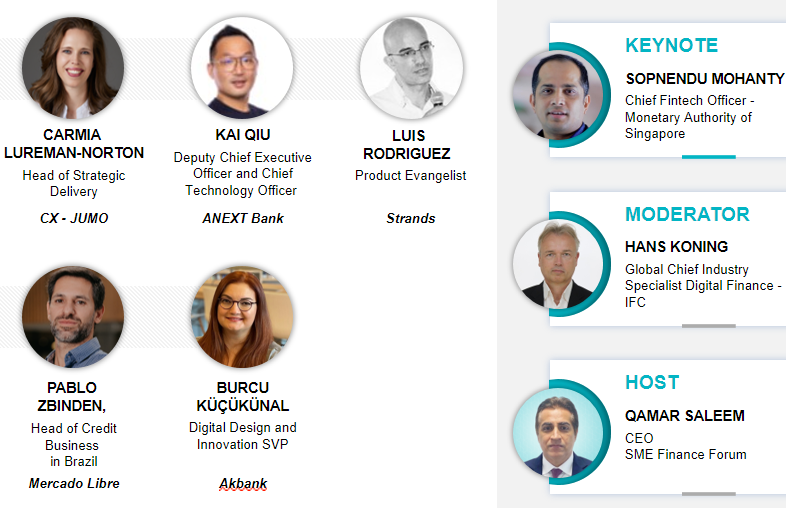

About the Speakers

Martin Quensel is the Co-founder of Centrifuge. Martin started his career at SAP in the mid-90s as a developer and architect, where he built payment infrastructure, supplier collaboration, and procurement solutions. In the new century, he moved on to co-found several successful startups, the latest before Centrifuge being Taulia, the leading bank agnostic supplier financing network. Taulia provided in the last year $30bn of funding to its network of 2 million suppliers in around 160 countries. His expertise lies in Supply Chain Financing, Purchase-to-Pay, Order-to-Cash, and how to decentralize it. His current project Centrifuge is all about providing decentralized credit to the world.

Martin Quensel is the Co-founder of Centrifuge. Martin started his career at SAP in the mid-90s as a developer and architect, where he built payment infrastructure, supplier collaboration, and procurement solutions. In the new century, he moved on to co-found several successful startups, the latest before Centrifuge being Taulia, the leading bank agnostic supplier financing network. Taulia provided in the last year $30bn of funding to its network of 2 million suppliers in around 160 countries. His expertise lies in Supply Chain Financing, Purchase-to-Pay, Order-to-Cash, and how to decentralize it. His current project Centrifuge is all about providing decentralized credit to the world.

Radoslav Albrecht is the Founder & CEO of Bitbond, a financial technology company that utilizes blockchain to provide innovative financing solutions. In 2019 Bitbond conducted Germany’s first regulated security token offering (STO). Before founding Bitbond, Radoslav worked for Roland Berger Strategy Consultants and Deutsche Bank London in sales & trading. Bitbond radically improves the issuance, settlement and custody of bonds with the help of blockchain technology and tokenization. In 2019 Bitbond received regulatory approval by BaFin to run Europe’s first Security Token Offering (STO). The company makes its tokenization expertise and software and credit solutions available to banks and other intermediaries.

Gloria WU is the Chief of Ecosystem Partnerships at Ontology, the high performance, public blockchain specializing in decentralized identity and data. With a wealth of experience ranging from consultancy and product marketing, to operations and social enterprise, Gloria previously served as VP Investment and Accelerations at Blue Elephant Capital, a leader in marketplace lending investing, where she focused on early stage EdTech incubation, acceleration, and seed investment. Gloria has also held senior roles at DHL, the world's largest logistics company, and AIESEC, the world's largest youth-run organization, where she served as Director Global Experience Product Management and Marketing.

Gloria WU is the Chief of Ecosystem Partnerships at Ontology, the high performance, public blockchain specializing in decentralized identity and data. With a wealth of experience ranging from consultancy and product marketing, to operations and social enterprise, Gloria previously served as VP Investment and Accelerations at Blue Elephant Capital, a leader in marketplace lending investing, where she focused on early stage EdTech incubation, acceleration, and seed investment. Gloria has also held senior roles at DHL, the world's largest logistics company, and AIESEC, the world's largest youth-run organization, where she served as Director Global Experience Product Management and Marketing.

A summary of the webinar will be posted soon.

For more information, please contact: Lechi Zhang or send us an email to smefinanceforum@ifc.org.

By registering to this event, you agree to the SME Finance Forum/IFC Event Privacy Notice.