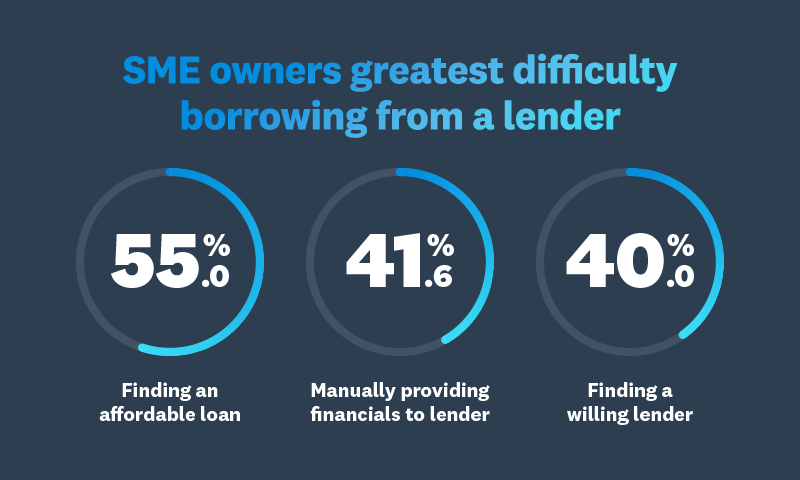

How do small businesses that apply to online alternative lenders compare to those that apply to traditional financial institutions only? And in what ways do their experiences with lenders differ? This analysis draws from data in the Federal Reserve’s 2015 Small Business Credit Survey to examine these questions. Among the main findings: Firms using online lenders tend to be smaller, younger, and less profitable than firms using traditional lenders, and are more likely to be minority-owned. Furthermore, firms that sought credit from online lenders reported lower overall approval rates—despite the perception among many small-business owners that they have a higher chance of being funded by an online lender. Finally, successful applicants reported lower levels of satisfaction with their online lenders, citing in particular concerns with high interest rates.

Publications

New Insights on Online Lender Applicants from the Small Business Credit Survey

Nov 14, 2017