With the growth of digital divide rising, a new ecosystem developing in India features three “interrelated and mutually-reinforcing components” that will help support financial inclusion. These elements, according to the article include:

- National ID, bank accounts, and mobile phones provide the foundational layers and channels for people to enter and participate in the digital financial ecosystem.

- Bulk payments (typically G2P transfers) push the digital value into these accounts and thus encourages their use and development of trust in digital money as opposed to paper money.

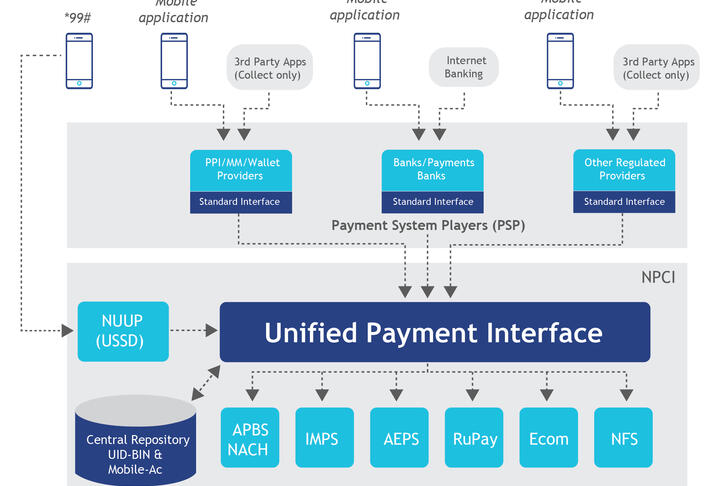

- The seamless, interoperable payments system encourages further use of digital money, thus building the digital footprints that will allow people to participate fully in the financial system, and to derive real economic value from it.