Lending practices in most of the developing world, where wealth concentration in movables can be even greater, is disproportionate with concentration on immovables as the sole type of eligible collateral, most often due to inadequate legal and institutional protections available.

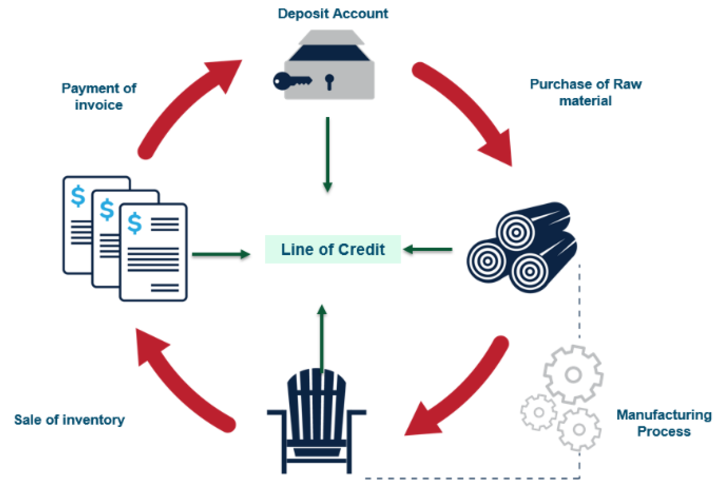

To find clarity and a potential solution to this challenge, the author reached out to colleague with experience in Secured Transactions and Asset Based Lending (ABL) reforms. ABL consists of lending products using the borrower’s tangible/intangible assets and payment instruments as collateral. SLOC is one of those products which is secured by inventory and accounts receivable. Read more here.

Article via The World Bank.