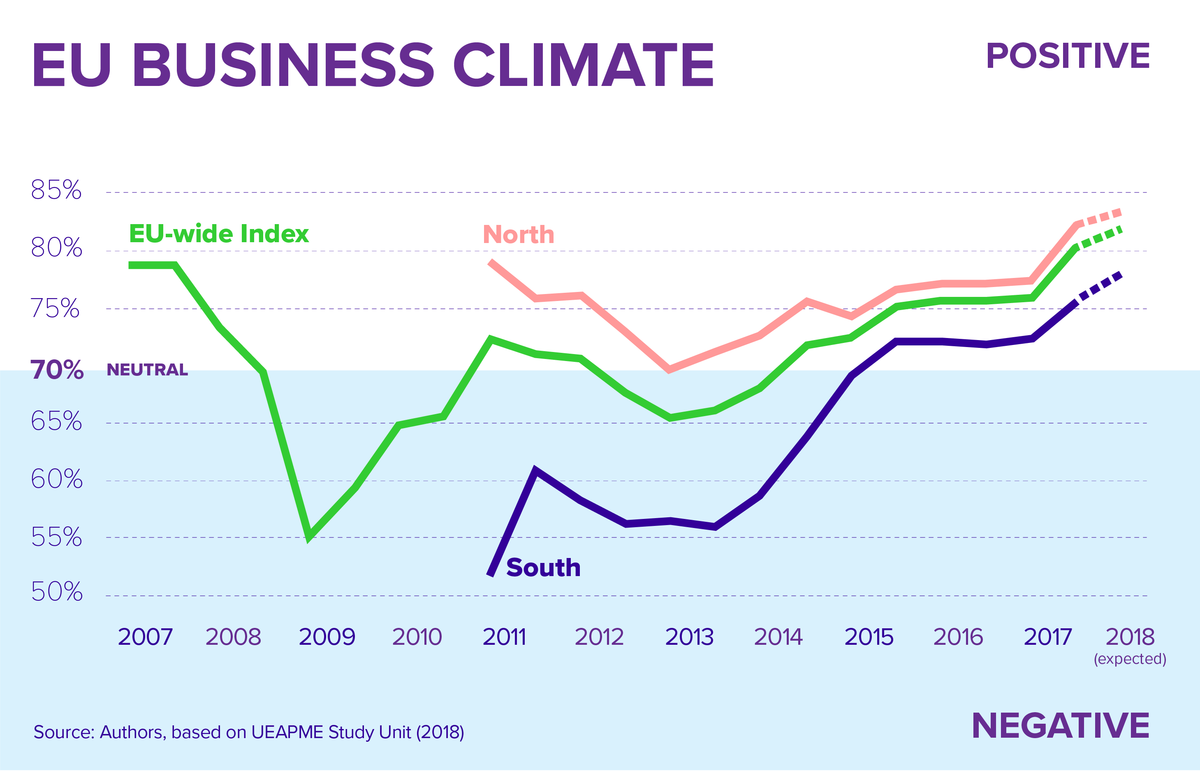

SMEs are the backbone of the European economy. The financing situation for European SMEs is slightly improving, but also differs very much from country to country. In Europe, SMEs’ financing strongly depends on banks and also after the crisis banks will remain the main external financing source for SMEs.

Against this background SME securitisation (SMESec) can form an important element in the efforts to enhance access to finance for SMEs in Europe. It can be essential in helping financial intermediaries broaden their funding base, achieve capital relief and ultimately, increase their SME financing. Despite the financial and sovereign crisis, the European securitisation market has performed relatively well so far, with the SME segment showing low default rates. The reputation of the SME securitisation market segment is continuously improving; a de-stigmatisation is happening, and the general perception is shifting from one of "toxic waste" to an instrument that could help overcome the negative effects of the crisis.

But overall, the SMESec market in Europe is underdeveloped and is still suffering from the crisis. A compelling case can be made for public assistance to enhance access to finance for SMEs (market failure based on information asymmetries, high transaction costs, and spill-overs – exacerbated by the recent credit crunch in many economies associated with the financial crisis), and for supporting the European SMESec market. The present working paper describes the current state of the SMESec market and puts EIF’s support for this market segment into perspective.

In order to revitalise the SMESec market, significant changes to the regulatory environment (i.e. liquidity risk standards and capital requirements) would be necessary to avoid unintended negative impacts – from both perspectives, issuers and investors. However, despite regulatory efforts, no dramatic improvements are currently foreseeable. Mitigation of the originally unintended negative effects can be achieved through the creation of a High Quality Securitisation (HQS)2 market segment that should receive preferential regulatory treatment. We present and discuss the latest developments in this paper.

At pan-European level, the EIF - and the EIB Group3 as a whole – has supported SMESec already since many years and continues to do so – to help the market to take the correct direction at the crossroads (and beyond).