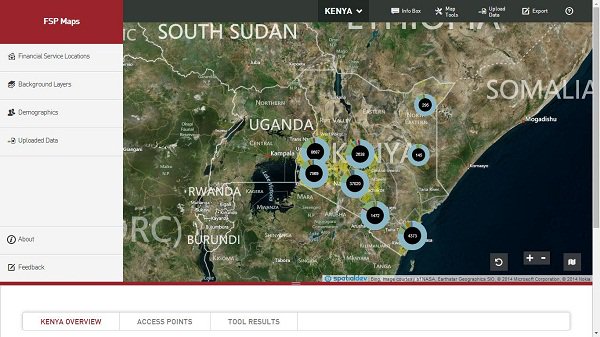

It’s the time of year to reflect on achievements, and to ponder what there may be in store for the future. Here are a few brief thoughts about the past year, and the year to come, with respect to SME Finance and Women Entrepreneurs Finance.Milestones from 2013· Crowdfunding moves to center stage – with the US Jobs Act regulations finally coming out, and platforms proliferating in Europe (where regs came earlier, in particular) and into many emerging markets, the year saw increased attention to this emerging alternative finance mechanism. There still remains much opacity in this field, and I really doubt crowdfunding will ever replace more conventional debt financing, in particular…but definitely showed in 2013 it’s something to watch!· Fintech may be even more front and center? The overall domain of financial technology, whether coming through the Internet, smartphones, tablets, even SMS, showed it’s going to be the key factor in how fast we can close the SME Finance Gap. Alibaba moving aggressively into SME Finance in China is perhaps the most obvious sign of this. But there are other, less obvious moves happening now, with successful firms from the US and Europe opening up shop in emerging markets, offering everything from enhanced credit decision making, to improved portfolio management, to cloud-based financial and other management support through entrepreneurs’ own cellphones … the technology route is showing an increasingly viable alternative to “shoe leather” based, kick-the-tires means of solving the information challenges posed by SMEs for FIs. · Financial inclusion recognized to need to include SMEs too - whether in the G20 deliberations, in the emerging market policymakers networks like the Alliance for Financial Inclusion, or in the strategic planning of international financial institutions, 2013 statements make it clear that financial inclusion must also mean SMEs getting finance (credit, in particular) if it is to lead to the greater incomes and jobs that are the real objective. Seeing how many times SME Finance came up in the St Petersburg Leaders Declaration from the G20, as a key to sustainable growth, certainly impressed!· Women Entrepreneurs Finance emerges as a key business opportunity – the launch of the Womens Finance Hub, the impressive growth in membership of the Global Banking Alliance for Women, and the increasing evidence gleaned from early movers such as Westpac (Australia), Garanti Bank (Turkey) , and BLC (Lebanon), have shown that it’s not just fulfilling social obligations to do more for women entrepreneur customers – it’s very good business, too!· Basel II/III and other enabling environment issues getting more attention – while the principles behind the new, stabilizing regulations are sound, growing evidence from putting these into practice in different regions shows that implementation approaches need more attention…recent EU clarifying regulations on trade finance are but one example of this response, with other areas, particularly around the development of common financial markets infrastructure, and around administrative requirements for SME accounts, in need of more detailed examination. Predictions for 2014 None of these may happen – but if any do, they will shake the SME finance world a good bit.· Both crowdfunding and fintech will make a bigger splash in emerging markets than either has to date in developed markets - not sure where, or exactly when, but there are many deals in gestation..· The G20 will turn more attention to improving the enabling environment for SME Finance, moving away from more short-term direct intervention measures. Will this influence the wider world?· Rightly or wrongly, more “womens banks” will be started in more countries, dedicated exclusively to womens interests, mostly publicly owned and supported. · “impact investing” will have its first major scandal, in all likelihood due to perceived mis-allocation of investor funds…which will lead to more decisive movement on transparency and meaningful standards.· The global private sector will take some “baby steps” towards its own collective commitment to closing the SME Finance Gap, following on the growing number of public (national) commitments made under the Maya framework. These baby steps should become big steps by some time in 2015.

Articles

SME Finance and Women Entrepreneurs Finance, Key Milestones and Predictions for 2013-2014 by Matt Gamser, Head of the SME Finance Forum

Jan 13, 2014