A recent article in the Financial Times (June 25, 2014) brings the topic and discussion around it back on the table. Psychometric tests as part of a credit analysis become increasingly popular, especially with commercial banks and large microfinance institutions. It is mostly those institutions which are trying to reduce the administrative burden and cost of doing microfinance, visiting the client in his business, at home, counting inventory, talking to the neighbors as references, etc.

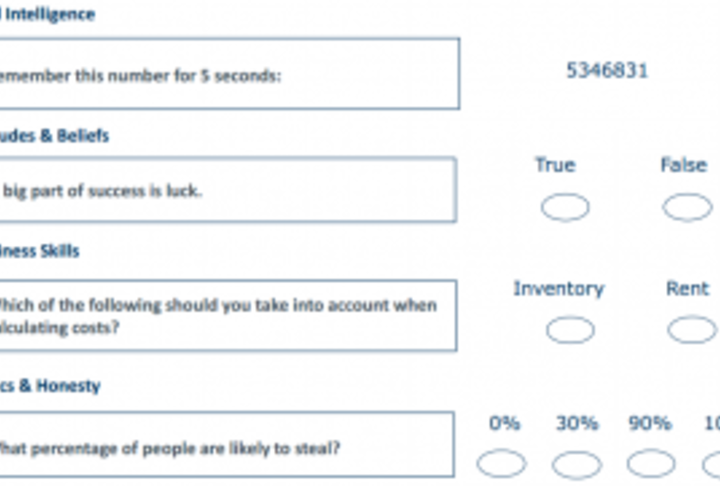

By yielding profiles of loan applicants´ honesty, intelligence, aptitude and beliefs, the tests facilitate lending to the otherwise called “unbankable” borrowers without a credit history, hard collateral, or an active account. But is the thorough credit analysis in microfinance with an in-depth knowledge about the customer and his business really possible to pack into a list of a few questions?