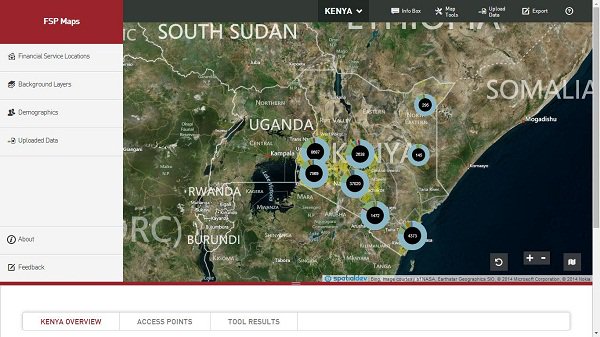

Nearly 20 years ago, the launch of online payments giant PayPal shook the financial services industry. Now, a new generation of financial technology or “fintech” companies is once again breaking down the oversized doors of the conservative banking business. From facilitating loans to wealth management to mobile payments to tax preparation, fintech companies are attacking traditional — and often inefficient — practices that shut out as many as two billion consumers (most outside the United States) from the most basic financial services.

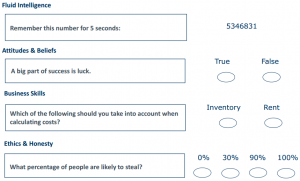

The recent growth of fintech start-ups is impressive. Four of the top 20 companies in Inc. magazine’s latest list of the 500 fastest-growing private companies are financial services start-ups, who hold 27 slots on the list overall. In data collected by KPMG, thirteen fintech startups are valued at over $1 billion, achieving the status Silicon Valley investors refer to as a “unicorn” because of their rarity. These include Square (mobile payments), Prosper (peer-to-peer lending), Shopify (retail sales management) and Credit Karma (financial management).