Library

Data Analytics

Apr 22, 2025

Digitalization accelerated by the pandemic has exponentially increased the number and variability of alternative data sources. The stay-at-home requirements during the pandemic forced several business models to be digitized. This helped spur the digitization that had been ongoing pre-pandemic, largely driven by governments as countries sought to...

Financial Education

Financial Inclusion

Apr 17, 2025

Washington D.C, March 7, 2025 – Yemen Microfinance Network (YMN) , Yemen's microfinance institutions association, an NGO co-funded by UNDP and SFD has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal...

Supply & Value Chain Finance

Apr 16, 2025

Washington D.C, March 12, 2025 – Fauree , UAE’s leading provider of supply chain finance and working capital solutions, has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to...

Equity

Data Analytics

Apr 14, 2025

Washington D.C, March 26, 2025 – Convergence Blended Finance , the global blended finance network driving private investment in developing countries, has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the...

Supply & Value Chain Finance

Apr 07, 2025

Washington D.C, April 7, 2025 – Vayana , India's largest Supply Chain Finance Network has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide...

Supply & Value Chain Finance

Apr 03, 2025

IFC and C2FO are working under a strategic partnership to bolster job growth and economic prosperity in emerging markets and developing economies. The first initiative will work to enhance financing for local enterprises in Africa by developing a specialized, web-based multinational working capital platform for micro, small, and medium enterprises...

Supply & Value Chain Finance

Apr 03, 2025

Washington D.C, April 3, 2025 – FaturamPara , Turkey's first company with both RegTech and FinTech features has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to...

Policy & Regulation

Apr 03, 2025

The OECD Financing SMEs and Entrepreneurs Scoreboard: 2025 Highlights tracks financing trends, conditions and policy developments across nearly 50 countries. The paper provides official data on SME financing from 2007 to 2023, with additional insights for 2024 and early 2025, covering debt, equity, asset-based finance and overall financing...

Data & Cybersecurity

Apr 02, 2025

Washington D.C, April 2, 2025 – ADAPTA , US Tech Firm Expanding AI-Driven Risk Management in Global Agriculture has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to...

Credit Risk & Scoring

Mar 28, 2025

Since 2020, #VietNam has experienced a surge in nonperforming loans (NPLs). Not only does the growing number of NPLs reduce the stability of the banking system, but each one represents a borrower excluded from credit markets. Many of the NPLs are consumer debts, meaning poorer households are particularly hard hit. IFC - International Finance...

Data Analytics

Mar 26, 2025

Washington D.C, March 26, 2025 – The Global Legal Entity Identifier Foundation (GLEIF) , which enhances market transparency and combats financial crime through the implementation and use of the Legal Entity Identifier (LEI) has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the...

Financial Inclusion

Mar 24, 2025

Washington D.C, March 24, 2025 – First Finance , a leading SME financial services provider in Iraq which adheres to international best practices to support and empower small and medium-sized enterprises has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum operate in 190...

Mar 21, 2025

MSMEs employ more than 80% of the workforce in #Ghana and account for over 70% of GDP. The majority of these enterprises are informal, consisting mainly of micro and sole enterprises operated by women and young entrepreneurs. While these small businesses play a critical role in economic growth and job creation, lack of information and collateral...

Gender Finance

Mar 17, 2025

Abidjan, Côte d’Ivoire, March 11, 2025 – To boost access to finance for women-led SMEs in Côte d’Ivoire, IFC and the Africa Local Currency Bond Fund (ALCB Fund) today announced an anchor investment in a gender bond from Ecobank Côte d’Ivoire, the first gender bond to be issued in the West Africa Economic and Monetary Union (WAEMU). Proceeds from...

Financial Inclusion

Feb 27, 2025

Washington D.C, Feb 27, 2025 – Beltone SMEs , a subsidiary of Beltone Holding - has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide...

Feb 23, 2025

Washington D.C, Jan 10, 2025 – Cenfri , a global think-tank and not-for-profit enterprise with offices in South Africa and Rwanda has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding...

Feb 17, 2025

Washington D.C, Feb 17th, 2025 – Banco de Crédito del Perú , the largest bank and the largest supplier of integrated financial services in Perú has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of...

Financial Inclusion

Feb 11, 2025

About the Impact Pathfinder Welcome to the Impact Pathfinder, an evidence platform designed to shed light on the impact of financial inclusion on development. By leveraging existing research, this platform outlines pathways that show how financial services and products can contribute to key development outcomes, such as building resilience,...

Equity

Feb 11, 2025

Highlights • Inclusive credit fintech has the potential to address the estimated US$4.9 trillion global credit gap for micro and small enterprises (MSEs). • However, access to diverse and suitable funding sources remains a critical challenge, especially for early-stage fintechs that are not yet profitable. • This focus note explores financing...

Digital Financial Services

Feb 11, 2025

BII sees opportunities for impact in firms of all sizes. Sole-traders, microenterprises, small, medium, and large firms are all sometimes unable to find the financing they need, to the detriment of society. The growth of firms is at the heart of development. Countries escape poverty as people move out of informal employment into wage-paying jobs...

Alternative Financing

Guarantees

Feb 05, 2025

EXECUTIVE SUMMARY KEY ACTIONS AGREED BY THE EXPERT GROUP: shorted by importance and short term feasibility: Banking channel PUBLIC-PRIVATE SHARED INVESTMENT MODELS: Building on the success of initiatives like “France Relance,” this action advocates for collaborative investment strategies that engage both public and private sectors in financing...

Policy & Regulation

Feb 03, 2025

Summary The G20 Global Partnership for Financial Inclusion (GPFI) Action Plan for Micro, Small, and Medium enterprises (MSME) Financing is a call to action to intensify the efforts of G20 and willing non-G20 countries to close the financing gap for MSMEs. MSMEs represent a significant share of economic activity and capture a large share of...

Digital Financial Services

Feb 02, 2025

Tania Ziegler (CCAF), Krishnamurthy Suresh (CCAF), Zhifu Xie (CCAF), Felipe Ferri de Camargo Paes (CCAF), Peter J Morgan (ADBI), Bryan Zhang (CCAF). This first edition of ‘The ASEAN Access to Digital Finance Study’, aims to provide valuable data and insights into how individual households, consumers, and micro, small and medium enterprise (MSME)...

Digital Financial Services

Feb 02, 2025

Tania Ziegler (CCAF), Felipe Ferri de Camargo Paes (CCAF), Cecilia López Closs (CCAF), Erika Soki (CCAF), Diego Herrera (IDB), Jaime Sarmiento (IDB) This edition of ‘The SME Access to Finance: A Deep Dive into LATAM’s Fintech Ecosystem’ provides insights into micro, small and medium enterprises’ (MSMEs’) access to funding through the alternative...

Digital Financial Services

Feb 02, 2025

By Krishnamurthy Suresh (Principal Researcher, CCAF), Felipe Ferri de Camargo Paes (Principal Researcher, CCAF), Loh Xiang Ru (CCAF), Richard Kithuka (CCAF), Peter Morgan (ADBI), Pavle Avramovic (CCAF), and Bryan Zhang (CCAF). This is the second edition of our ‘Access to Digital Finance’ study in Asia-Pacific. Building on our previous publication...

Data Analytics

Jan 14, 2025

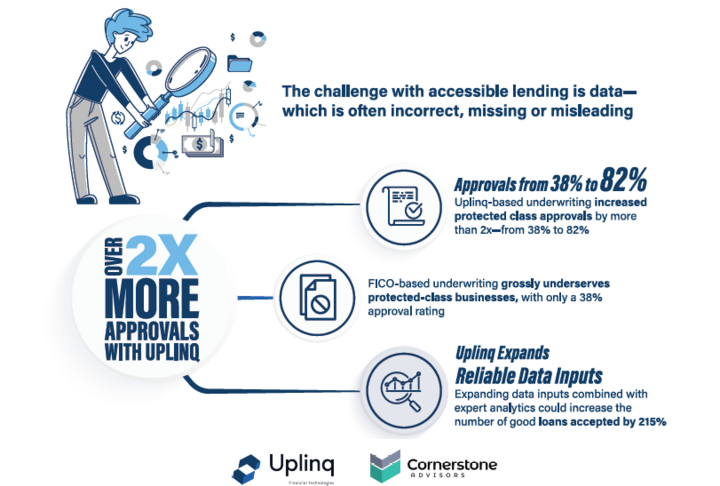

Uplinq is thrilled to unveil our latest collaboration with Visa . Together, we’ve released a groundbreaking case study titled "Transforming global small business underwriting with augmented data" —a deep dive into how AI-powered credit decisioning is reshaping small business lending worldwide. Leveraging sophisticated AI and machine learning...

Data & Cybersecurity

Fintech

Dec 15, 2024

"International AI Policy Focuses on Safety" discusses the increasing global emphasis on ensuring the safe and responsible use of artificial intelligence (AI). Key points and main ideas include: International Collaboration on AI Safety: Governments and international organizations are recognizing the need for harmonized approaches to AI safety,...

Digital Transformation

Nov 27, 2024

November 2024 Highlights Open finance is a financial innovation that facilitates customer-permissioned access to and use of customer data held by financial institutions to provide new and enhanced services and develop innovative business models. Open finance frameworks can spur innovation, improve competition, enhance customer empowerment, and...

Sustainable Finance

Nov 22, 2024

The Small and Medium Enterprise (SME) sector in Pakistan plays a pivotal role in the national economy, contributing approximately 40% to GDP and providing employment to millions. Despite its significance, the sector faces numerous challenges that hinder its growth and development. Key barriers include limited access to finance, complex...

Financial Education

Nov 19, 2024

10 Years of Leadership Excellence - Registration Now Open for the 2025 GABV Leadership Academy Dear GABV members, We are excited to announce the 10th edition of the GABV Leadership Academy —a milestone in shaping resilient leaders in values-based banking! Registrations are now open until 5 December 2024. This year’s programme, ' Resilience in the...

Digital Financial Services

Nov 14, 2024

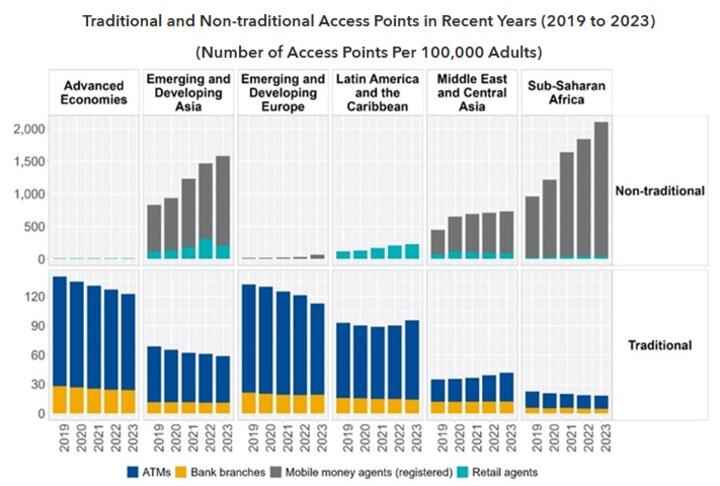

IMF Releases the 2024 Financial Access Survey Results October 30, 2024 Washington, DC: The International Monetary Fund (IMF) released the results of the 2024 Financial Access Survey (FAS), marking the 15th anniversary of the FAS. The report “FAS: 2024 Highlights,” published along with the data release, summarizes the key trends on access to and...

Governance

Nov 11, 2024

Washington D.C, Nov 11, 2024 – Nepal Bankers’ Association , an Umbrella Organisation of all 'A' Class Commercial Banks of Nepal has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding...

Digital Transformation

Fintech

Nov 05, 2024

A follow-up series of Banking for small and medium enterprises by IBM Institute for Business Value Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world’s workforce, and contributing 50% to global GDP.* Despite their significance, SMEs face many...

Financial Inclusion

Nov 01, 2024

Washington D.C, Nov 1, 2024 – 10x1000 Tech for Inclusion , an open and global learning platform has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small...

Digital Transformation

Oct 29, 2024

The white paper by Mastercard underscores the pivotal role of middle market businesses (firms with 50 to 250 employees) in driving global economic growth, with a notable $24.2 trillion in B2B spending in 2022. These businesses face unique challenges as they scale, such as the need for digitization, automation, and streamlined operations, along...

Sustainable Finance

Oct 20, 2024

As the world faces the urgent challenge of climate change, financial institutions, especially Public Development Banks (PDBs), are crucial in helping Small and Medium Enterprises (SMEs) transitioning to a low-carbon economy. This publication reviews the different solutions offered by 16 Public Development Banks (PDBs) to support the...

Fintech

Oct 20, 2024

October 2024 Highlights: Inclusive fintech startups are early-stage, venture-backed enterprises creating innovative credit products for microenterprises in emerging markets, which holds great promise for the future of microenterprise finance. In this note, we highlight strategies employed by fintech startups that benefit microenterprises via three...

Fintech

Oct 08, 2024

By: Tommy Felts - October 04, 2024 Sandy Kemper, founder and CEO of C2FO, speaks during a panel conversation at the 2024 SME Finance Forum in São Paulo, Brazil; photo courtesy of C2FO C2FO would’ve been profitable in the US alone, CEO says; how solving for global needs made it an even stronger fintech leader T he impact of one Kansas City-built...

Trade Finance

Policy & Regulation

Oct 08, 2024

Business Ready (B-READY) 2024 report assesses the regulatory framework and public services directed at firms, and the efficiency with which regulatory framework and public services are combined in practice.

Sustainable Finance

Oct 04, 2024

Washington, D.C., October 1, 2024 - The World Bank Group and partners have launched the “ Sustainable Finance Knowledge Center for Francophone Africa ” today. A first preview of the center was presented two weeks ago at the annual Global Meeting of the SME Finance Forum in Brazil. This virtual platform, available in both English and French, is...

Sustainable Finance

Oct 04, 2024

Mobilizing Investment for the Developing World's Sustainable Cooling Needs Rising global temperatures mean demand for cooling in homes, workplaces, and across supply chains is accelerating, particularly in developing economies where the impact of extreme heat is already being felt most acutely. Heat-related deaths are running at an annual average...

Financial Inclusion

Fintech

Oct 04, 2024

June 5, 2024 | Washington DC EMpact is helping build AI Labs within our partner organizations as a part of our effort to accelerate digital transformation of agricultural value chains and relevant financial services. Today, EMpact published a new white paper that delves into the pivotal role of Artificial Intelligence (AI) in propelling financial...

Data Analytics

Fintech

Oct 04, 2024

Small and medium enterprises face many challenges within a rapidly evolving economic landscape—one that demands innovative banking solutions. Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world's workforce, and contributing 50% to global GDP. But...

Non Financial Services

Equity

Sep 30, 2024

Washington D.C, September 30th, 2024 – KoreFusion Consulting , a boutique strategy consulting and investment bank focused on SME payments and financing in North America and Western Europe has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating...

Financial Inclusion

Digital Transformation

Sep 26, 2024

Divergent views among business leaders and bankers on priorities uncover a white space for nimble financial institutions to compete in this varied market segment. ARMONK, N.Y., September 18th, 2024 – New findings from IBM’s (NYSE: IBM) Institute for Business Value and the Banking Industry Architecture Network (BIAN), with contributions from the...

Supply & Value Chain Finance

Aug 30, 2024

Washington D.C, Aug 30, 2024 – InvoSoko Africa, a leading SMEs focused Supply Chain Finance solutions provider in Sub-saharan Africa has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding...

Digital Financial Services

Digital Transformation

Jul 29, 2024

The Global SME Finance Forum is the largest, most geographically diverse and cutting-edge gathering on SME finance, which brings together experienced global leaders to facilitate the exchange of insights, promote best practices, and chart the future trajectory. Since 2015, its forward-thinking agenda, tackling topics such as sustainable finance...

Supply & Value Chain Finance

Jul 25, 2024

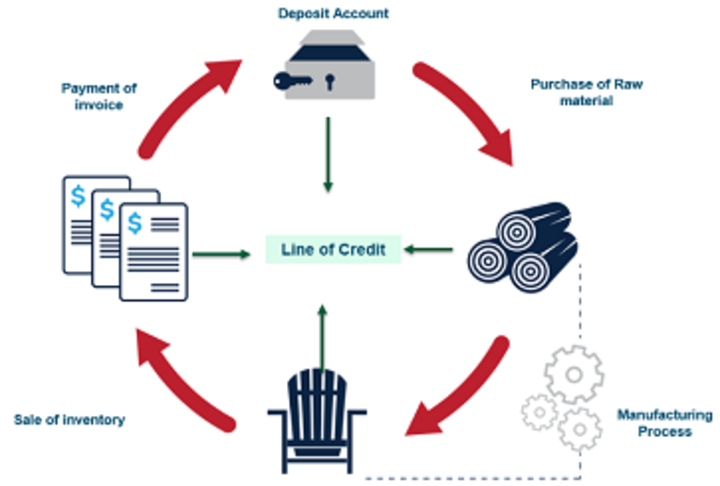

Supply Chain Financing (SCF) is becoming an increasingly common vertical within the banking industry. The global credit crisis of 2008 forced trade finance seekers to look for alternatives as liquidity in supply chains became a major concern for businesses. This spurred an increased demand for supply chain financing as businesses worked to...

Trade Finance

Jul 18, 2024

We are glad to announce the launch of the " 360tf SMEs Trade Finance Survey 2024 Edition ," in partnership with Middlesex University Dubai . This survey is a unique opportunity for the SME community to voice their opinions and shape the future of SME trade finance in the UAE . The survey aims to gather feedback and insights that will drive...

Data Analytics

Digital Financial Services

Jul 18, 2024

Washington D.C, July 18, 2024 – Jocata, a leading digital lending transformation partner has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Rural & Agriculture Finance

Jul 15, 2024

Washington D.C, July 15, 2024 – WeGro , a leading agri-fintech in Bangladesh has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through...

Data & Cybersecurity

Digital Financial Services

Jul 15, 2024

AI Takes Center Stage: Survey Reveals Financial Industry’s Top Trends for 2024 The world’s leading financial services institutions spotlight where AI is providing the best return on investment. January 11, 2024 by Kevin Levitt The financial services industry is undergoing a significant transformation with the adoption of AI technologies. NVIDIA’s...

Rural & Agriculture Finance

Jul 11, 2024

Washington D.C, July 11, 2024 – Bank of Kigali , the largest bank in Rwanda by total assets has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Jul 11, 2024

The recent McKinsey Global Institute report A microscope on small businesses: Spotting opportunities to boost productivity estimated that micro-, small, and medium-size enterprises (MSMEs) account for two-thirds of business employment in advanced economies— and almost four-fifths in emerging economies—as well as half of all value added.1 In this...

Supply & Value Chain Finance

Jul 09, 2024

Washington D.C, July 9th, 2024 – Receivables Exchange of India Limited (RXIL) , a leading MSMEs focused digital platform in India has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding...

Financial Inclusion

Sustainable Finance

Jun 16, 2024

The 2024 MSME Day offers an opportunity to discuss and exchange ideas on how Key stakeholders, including policy makers, large companies, financial institutions, and the international community can support micro-, small and medium-sized businesses to advance the 2030 Agenda and contribute to achieving the SDGs, including poverty eradication and...

Jun 13, 2024

Washington D.C, June 13, 2024 – Akbank , a Turkish bank founded in 1948 has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through...

Jun 04, 2024

Washington D.C, June 4, 2024 – ICICI Bank , one of the leading private sector banks in India, has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Fintech

May 27, 2024

Washington D.C, May 27, 2024 – Kapitale , one of the most innovative fintechs in receivables anticipation in Brazil, has joined the SME Finance Forum as the global membership network’s latest member. Created by the G20 in 2012 and managed by the International Finance Corporation (IFC), the SME Finance Forum has more than 300 members/affiliates who...

Alternative Financing

Digital Financial Services

May 23, 2024

Washington D.C, May 23, 2024 – AgriAnalytica , a leading digital platform for MSMEs in Ukraine has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Financial Inclusion

Digital Financial Services

Digital Transformation

May 21, 2024

Learn from Sucharita Mukherjee - Co-founder & CEO at Kaleidofin, about her of experience in attending the Global SME Finance Forum and the importance of digitization in the Indian market for financing SMEs, the role of digital platforms in serving underserved markets, and the potential for structured, systematic south-to-south learning and...

Guarantees

Digital Financial Services

May 21, 2024

Learn from Sandeep Varma, CEO at CGTMSE, about his experience attending the Global SME Finance Forum and the role of credit guarantee schemes in helping MSMES access to finance. He also discusses the potential of technology to improve the efficiency and reach of credit guarantee schemes. This interview was led by Hans Koning, Global Chief Industry...

Digital Financial Services

Digital Transformation

May 21, 2024

Learn from Peter Simon, Managing Director at WSBI-ESBG, about his experience attending the Global SME Finance Forum and how WSBI helps its member banks to adapt and improve their digital services. This interview was led by Hans Koning, Global Chief Industry Specialist, Digital Finance at IFC. " Very impressive to see so many different actors f rom...

Financial Inclusion

Credit Risk & Scoring

Fintech

May 21, 2024

Learn from Prashant Muddu - Founder and CEO at Jocata, about his experience attending the Global SME Finance Forum, the importance of digital public infrastructure, the challenges and opportunities in adopting AI, and the need for financial literacy and technology adoption across different geographies. This interview was led by Hans Koning, Global...

Digital Financial Services

May 21, 2024

Learn from Rajeev Chalisgaonkar - Executive Vice President at Mashreq Bank, about his multiple years of experience attending the Global SME Finance Forum and the importance of digital stacks for SME financing, fintech pitches, and the evolution of ideas into successful businesses. This interview was led by Hans Koning, Global Chief Industry...

Rural & Agriculture Finance

May 20, 2024

Washington D.C, May 20, 2024 – Amret Microfinance Institution , a Cambodia leading microfinance institution and one of the top 10 financial institutions in the country has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who...

May 15, 2024

Washington D.C, May 15, 2024 – Caja Huancayo , a leading financial institution in Peru has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

May 14, 2024

Washington D.C, May 14, 2024 – Bank of Punjab , a leading SME focused bank from Pakistan has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Digital Transformation

May 07, 2024

Global SME Finance Awards 2024 - INFORMATION SESSIONS The SME Finance Forum organizes the Global SME Finance Awards ( The Awards ) as a core part of its mission to create a unique platform for peer connections, knowledge dissemination, and innovations in SME Finance. The Forum’s extensive 240+ global network, crowds in financial institutions,...

Data & Cybersecurity

Payments

May 07, 2024

Summary Focus Advances in digital technology have transformed people's lives in recent decades. But large swathes of the financial system are stuck in the past. Many transactions still take days to complete and rely on time-consuming clearing, messaging and settlement systems and physical paper trails. Improving the functioning of the financial...

Financial Inclusion

May 07, 2024

By Anu Madgavkar , Marco Piccitto , Olivia White , María Jesús Ramírez , Jan Mischke , and Kanmani Chockalingam MSMEs are vital for growth and jobs, but struggle with productivity. The route to higher productivity lies in creating a win-win economic fabric for all companies. At a glance Micro-, small, and medium-size enterprises (MSMEs) form the...

Digital Transformation

Apr 18, 2024

Washington D.C, April 18th, 2024 – Singapore-based fintech Boost Capital has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge...

Apr 18, 2024

Washington D.C, April 18, 2024 - Singapore-based fintech Digi Ally has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange...

Digital Financial Services

Apr 15, 2024

Financial makers discuss how to reimagine banking with embedded finance solutions that deliver financial services whenever and wherever they’re needed. A new generation of financial thinkers and makers is reimagining the conventional bank. Empowered by technology and a youthful hunger for change, they’re determined to make banking easier, more...

Governance

Data & Cybersecurity

Apr 15, 2024

The game-changer: How generative AI can transform the banking and financial sectors The most essential question of the moment: how can AI help address and course-correct banks’ productivity and financial performance? Following the astonishing rise of generative AI, artificial intelligence has seized the world’s attention. Executives are either...

Digital Transformation

Apr 15, 2024

Access to affordable finance poses a persistent challenge for micro, small, and medium-sized enterprises (MSMEs) worldwide, inhibiting their potential growth and the economic development of countries that are reliant on these businesses. The rise of the digital economy has opened up new pathways for financing, but has also made digital...

Fintech

Payments

Apr 15, 2024

Summary: - Regional focus: the report foretells a surge in interest from fintechs towards SMEs in Latin America by 2024. - Innovation opportunities: it highlights the potential for innovation within the industry and identifies key areas where solutions can reshape the fintech landscape to better serve SMEs. - Targeted countries: discover which...

Financial Inclusion

Apr 15, 2024

In November 2023, the United Nations Development Programme (UNDP) moderated the closed-door roundtable "How Universal Trusted Credentials (UTC) can transform financial inclusion" . This event brought together senior representatives from central banks, financial institutions, and other stakeholders from around the world to discuss the opportunities...

Digital Financial Services

Fintech

Apr 15, 2024

The launch event for isybank, Intesa Sanpaolo's digital bank, was held on 15 June at the "Shard of Glass" tower in Milan. The bank is primarily intended to serve the four million Intesa Sanpaolo customers interested in using innovative services exclusively online and on their smartphones. isybank is among the most important initiatives in the 2022...

Equity

Apr 15, 2024

Intesa Sanpaolo acquires Romania’s First Bank from US-based private investment fund J.C. Flowers & Co., strengthening its presence in the CEE region and doubling the Group’s presence in the country. More in detail , Intesa Sanpaolo and JCF Tiger Holdings S.A.R.L., the controlling shareholder of First Bank S.A., have signed a share purchase...

Sustainable Finance

Apr 15, 2024

Under the guidance of Niti Aayog, government primer think thank, and RMI as a knowledge partner, Small Industries Development Bank of India (SIDBI) has developed a book titled “De-risking lending for a Brisk EV Uptake: A practical guide on de-risking measures for Electric two- and three-wheelers in India" The report was released in Washington DC...

Financial Inclusion

Sustainable Finance

Digital Transformation

Apr 15, 2024

Karandaaz Pakistan, a development finance platform at the forefront of promoting financial inclusion and driving digital transformation across the country, announced the launch of GreenFin Innovations (GFI), a groundbreaking initiative dedicated to scaling innovative and sustainable solutions aimed at promoting a green economy and addressing the...

Digital Financial Services

Fintech

Payments

Apr 15, 2024

Bespoke tech solutions providers team up to empower digital transactions of small- and medium-sized business enterprises across MENA with cloud-based software Riyadh, Saudi Arabia, September 5th, 2023 – TRAY, a global leader in cloud-native enterprise-class POS systems, is pleased to announce a strategic partnership with Alraedah Digital Solutions...

Gender Finance

Fintech

Mar 21, 2024

Fintech and digital financial services have been considered a game-changer for women's financial inclusion and economic empowerment. Until now, there has been limited research that quantifies the degree to which fintech firms are actively addressing women's financial inclusion and the specific strategies that are showing success. To fill this gap...

Financial Education

Financial Inclusion

Alternative Financing

Gender Finance

Youth Entrepreneurship

Mar 08, 2024

The Forum established the Women’s Entrepreneurship Finance CoP (WEF CoP) Practice for groups of practitioners from member institutions to meet and share experiences, seek solutions to challenges that they face in financing women-SMEs. Since launching in 2022, the WEF CoP has evolved into a powerful example of how to empower women entrepreneurs...

Alternative Financing

Digital Transformation

Fintech

Feb 28, 2024

Johannesburg, 6 February 2024 – MTN’s Mobile Money Platform, MoMo, and banking technology company JUMO have partnered to launch Qwikloan, which offers affordable, short-term loans in South Africa and will drive financial inclusion across the country. Qwikloan enables MoMo users to obtain small, short-term loans on their mobile phones, ranging from...

Financial Education

Financial Inclusion

Fintech

Feb 14, 2024

This paper investigates strategies of European microfinance institutions (MFIs) and inclusive FinTech organisations to address financial and digital illiteracy among vulnerable customers. It reveals that both MFIs and FinTech organisations focus on personalised financial education, training and coaching but adopt distinct strategies in their...

Sustainable Finance

Fintech

Feb 12, 2024

Slowing economic growth, rising inflation, and climbing interest rates are straining the business models for inclusive fintechs, creating significant uncertainty and new funding challenges. For the past four years, the Inclusive Fintech 50 (IF50) global innovation competition identified and elevated cutting-edge, emerging inclusive fintechs...

Alternative Financing

Feb 02, 2024

Uplinq Financial Technologies , the first global credit decisioning support platform for small business lenders, announced the publication of “ Fair and Accessible Credit for Small Businesses: A Guidebook for Financial Institutions ,” a white paper that blueprints how banks and credit unions can leverage AI technology and alternative data to...

Financial Inclusion

Jan 31, 2024

Washington D.C, January 31, 2024 – Nigeria’s Zenith Bank has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and...

Jan 31, 2024

The SME Finance Forum membership network consists of more than 240 member institutions active in 190 countries . The network is a unique community of SME-oriented commercial banks, non-bank financial institutions, fintech companies, and development finance institutions. UPCOMING EVENTS - Q1 and Q2 2024

Digital Transformation

Jan 23, 2024

With the rapid advancements in computational power, the decades-long vision of using and deploying artificial intelligence (AI) has become a reality. The technology’s swift development has allowed it to transform every walk of life, as it is a wide-ranging tool that enables people to rethink how to analyze data, integrate information and use the...

Financial Inclusion

Jan 18, 2024

Washington D.C, January 18, 2024 – AccèsBanque Madagascar has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and...

Sustainable Finance

Digital Transformation

Dec 22, 2023

Learn from Michael Jongeneel, about ESG data aggregation practices within FMO and digitalization benefits for SMEs. Interview led by Hans Koning, Global Chief Industry Specialist, Digital Finance at IFC. ‘I have been in Mumbai for less than 24 hours, but I already had a couple of very interesting discussions and potential collaboration with Indian...

Digital Financial Services

Payments

Dec 22, 2023

Learn from Jane Prokop - EVP of Small and Medium Enterprises at Mastercard, about her experience attending the Global SME Finance Forum for the first time and the latest challenges of digitalization. This interview was led by Hans Koning, Global Chief Industry Specialist, Digital Finance at IFC. ‘It is my first time joining the SME Finance Forum...

Financial Inclusion

Dec 22, 2023

The Inclusive Finance India Report provides a comprehensive review of the progress of financial inclusion in the country, tracking performance, highlighting achievements, and flagging gaps and issues that need to be addressed at the levels of both policy and practice. It is a much-awaited annual reference document for policymakers, investors,...

Payments

Dec 21, 2023

Former SVP and Managing Director of Marqeta takes on new role at leading global issuer-processor to propel its growth journey across the globe 12 th Dec Paymentology , a leading global issuer-processor, today announces the appointment of its new CEO Jeff Parker, who will be succeeding the interim Co-CEOs Abe Smith and Angy Watson. Jeff is a leader...

Islamic Banking

Dec 18, 2023

In the latest episode of Couchonomics, Arjun was joined by Paul Melotto, Executive Board Member at Alraedah Finance . Paul has played a key part in Arjun’s journey to understand the Saudi ecosystem, especially regarding fintech and financial services. In the episode, Arjun and Paul discussed: The state of Non-Banked Financial Institutions in KSA...

Credit Risk & Scoring

Dec 13, 2023

Former CEO of TransUnion Europe – Satrajit Saha – brings his expertise to Creditinfo, planning to drive growth across its credit bureaus globally. London – 29 th November 2023: Creditinfo, a global service provider for credit information and risk management solutions, has today announced the appointment of Satrajit Saha as its Global Chief...

Financial Inclusion

Non Financial Services

Rural & Agriculture Finance

Dec 06, 2023

Washington D.C, December 6, 2023 – Leading agri-services company SE Holdings has joined the SME Finance Forum as its global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge...

Non Financial Services

Equity

Dec 05, 2023

Learn from PVSLN, Murty, Chairman and Managing Director, North Eastern Development Finance Corporation (NEDFi), about their mission to champion the entrepreneurial spirit of the North Eastern Region of India, financing commercially viable industries and providing consultancy services. The interview is led by Hans Koning, Global Chief Industry...

Supply & Value Chain Finance

Dec 05, 2023

Learn from Sandy Kemper, Founder and Chairman of C2FO, about their on-demand working capital platform as he is answering questions from Hans Koning, Global Chief Industry Specialist, Digital Finance at IFC. 'The IFC has the goal of getting to a hundred billion USD funding by 2030 and we, at C2FO are trying to get to a trillion USD of funding by...

Sustainable Finance

Dec 01, 2023

Switching to greener technologies in construction and operation of buildings and materials, combined with more climate-friendly capital markets, could reduce the construction value chain’s carbon footprint 23 percent by 2035, while creating investment opportunities in emerging markets, according to a major report from the International Finance...

Supply & Value Chain Finance

Nov 28, 2023

FCI, an SME Finance Forum Industry Partner, held its 55th annual meeting in Marrakech, Morocco from October 29 to November 3 2023. More than 250 attendees joined to network and discuss current issues within the Factoring and Receivables Finance Industry. With over EUR 300 billion financed to SMEs as well as to larger corporates, the global...

Sustainable Finance

Policy & Regulation

Nov 22, 2023

Addressing the climate crisis requires the net zero transition of millions of SMEs globally. SMEs have a significant aggregate environmental footprint and need to adopt cleaner business models. As eco-entrepreneurs and eco-innovators, they also have a key role to play in devising innovative climate solutions. Access to finance is essential for SME...

Financial Education

Financial Inclusion

Nov 21, 2023

Washington D.C, November 21, 2023 – Ethiopia’s Dashen Bank has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and...

Financial Inclusion

Rural & Agriculture Finance

Nov 14, 2023

Washington D.C, November 14, 2023 – Maldivian non-banking finance institution SDFC has joined the SME Finance Forum as its global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through...

Financial Education

Financial Inclusion

Gender Finance

Supply & Value Chain Finance

Digital Transformation

Nov 02, 2023

Digitizing the MSME ecosystem through e-commerce, the gig economy, and digital MSME business services has an impact on the digital-transformation of small businesses. These digital advancements have reshaped the landscape for MSMEs and enabled new opportunities for growth and expansion. The rise of digitally enabled new solutions for MSMEs, such...

Supply & Value Chain Finance

Nov 01, 2023

With over EUR 300 billion financed to SMEs as well as to larger corporates, the global factoring and receivables finance Industry is is providing much needed liquidity to the heart of the economy to support economic growth, export and employment. How does the industry evolve and adapt to challenges such as fraud, changing regulations and ESG...

Supply & Value Chain Finance

Policy & Regulation

Nov 01, 2023

During FCI 55th Annual Meeting , Qamar Saleem, CEO of the SME Finance Forum, launched the ‘ Knowledge Guide on Factoring Regulation and Supervision ’. This guide complements UNIDROIT's model law and provides guidance on law reforms seeking to support receivables finance. It indicates options and recommendations to establish a cohesive regulatory...

Policy & Regulation

Nov 01, 2023

The Recommendation on SME financing was adopted by the OECD Council meeting at Ministerial level on 8 June 2023 on the proposal of the Committee on SMEs and Entrepreneurship (CSMEE). The Recommendation aims to support Adherents in their efforts to enhance SME access to a diverse range of financing instruments. It supports the development of...

Financial Inclusion

Governance

Oct 24, 2023

The "OECD Financing SMEs and Entrepreneurs Scoreboard: 2023 Highlights" document SME and entrepreneurship financing trends, conditions and policy developments. The report provides official data on SME financing in close to 50 countries, including indicators on debt, equity, asset-based finance and financing conditions. Data for 2021 are...

Sustainable Finance

Payments

Oct 16, 2023

The B20 , Business at OECD (BIAC) and the International Organisation of Employers (IOE) released a joint paper, underlining the need to raise business productivity by effectively addressing the private sector’s working capital requirements. Released in the margins of the B20 India Summit, the three leading private sector organizations recommend to...

Policy & Regulation

Oct 12, 2023

New Delhi, September 15, 2023 – IFC Vice President for Industries, Mohamed Gouled, currently on a two-day official visit to India, has commended India's leadership at the G20 for its strong emphasis on the significance of digital public infrastructure (DPI) in achieving financial inclusion. "This formal recognition that technology must be used for...

Financial Inclusion

Digital Financial Services

Digital Transformation

Sep 25, 2023

Background: The India G20 Presidency has prioritized the development of an open, inclusive and responsible digital financial ecosystem based on the presence of a sound and effective digital public infrastructure (DPI) for the advancement of financial inclusion and productivity gains. Builds on the work and achievements from previous presidencies...

Financial Inclusion

Policy & Regulation

Data Analytics

Sep 25, 2023

Small and Medium-sized Enterprises (SMEs) play a vital role in the global economy, yet they often face challenges due to limited access to financing. To address this issue, we propose the implementation of Prosperity Data Networks (PDNs), a cutting-edge tool that leverages Artificial Intelligence (AI). PDNs are AI-powered, community-controlled and...

Financial Education

Sustainable Finance

Sep 25, 2023

To help financial institutions to translate sustainable finance principles to the operations they have with MSMEs, IFC Green Bond Technical Assistance Program (GB-TAP) has developed the Sustainable MSME Finance Reference Guide. This first-of-its-kind Guide sets out a practical approach for financial institutions in emerging markets on how to...

Non Financial Services

Policy & Regulation

Digital Financial Services

Fintech

Sep 16, 2023

Day 3 of the Global SME Finance Forum 2023 saw panel discussions and keynote addresses by thought leaders like Shri Chanchal Chand Sarkar, Economic Adviser, DEA, Ministry of Finance, India, Shri T. Rabi Sankar, Deputy Governor, RBI, Shri Ajay Seth, Secretary, DEA, Ministry of Finance, India, Ashwini Kumar Tewari, Managing Director, SBI, Ms. Nisha...

Non Financial Services

Policy & Regulation

Digital Financial Services

Fintech

Sep 16, 2023

Mumbai, India, September 14, 2023 - The 2023 Global SME Finance Award winners were announced during the Global SME Finance Forum 2023 in Mumbai, India. Across all categories, a record 165 applications were submitted from 120 different institutions. 30 applications were identified by an independent, expert panel of 85 judges as winners. The award...

Non Financial Services

Policy & Regulation

Digital Financial Services

Fintech

Sep 16, 2023

Day 2 of the Global SME Finance Forum 2023 saw panel discussions and keynote addresses by thought leaders like A K Goel, Chairman, Indian Banks’ Association, KV Kamath, Chairman, NaBFID, Alok Kumar Choudhary, MD, SBI, Sopnendu Mohanty, Chief Fintech Officer, Monetary Authority of Singapore, Rajiv Anand, DMD, Axis Bank, Chanchal Sarkar, Economic...

Non Financial Services

Policy & Regulation

Digital Financial Services

Fintech

Sep 16, 2023

SME Finance Forum 2023 commence their 9th edition of the Global SME Finance Forum 2023 in Mumbai The Day 1 of the Global SME Finance Forum 2023 saw panel discussions and key note address by some of the renown names as speakers like Mr. Makhtar Diop, Managing Director, International Finance Corporation (recorded speech), Mr. Nandan Nilekani, Co-...

Financial Inclusion

Sep 04, 2023

Newly released financial survey from our member Karandazz! The report delves deep into financial service access and demand, with a special focus on digital financial services. To support financial inclusion in Pakistan, it is important to have clear definitions, metrics, and estimates for planning and intervention designs. Karandaaz notes that...

Financial Inclusion

Payments

Aug 28, 2023

The partnership will enable a more robust financial ecosystem in Guatemala, Honduras, and El Salvador, granting underserved and unbanked segments of the population access to the digital economy. Guatemala, August 2023 : Paymentology , the leading global issuer-processor, today announces an expanded partnership with Mastercard to bolster financial...

Fintech

Payments

Aug 16, 2023

Paymentology’s card issuing platform and analytics capabilities support DolarApp with several industry firsts in Mexico Paymentology , the leading global issuer-processor, today announces its partnership with DolarApp , the Mexican startup which provides digital dollar accounts to consumers across Latin America. Established in 2021, DolarApp has...

Financial Inclusion

Youth Entrepreneurship

Aug 14, 2023

Over 163 million informal workers in emerging markets have found new opportunities through #gigplatforms, but many remain financially excluded. That's why platforms are stepping up to offer financial services to #gigworkers, helping them save, invest, and access credit. The impact can be positive for the workers and the economy. If you're...

Aug 03, 2023

Washington D.C. August 1st, 2023 - Matt Gamser, having reached the mandatory retirement age for World Bank Group employees, will step down as the CEO of SME Finance Forum, effective September 30th, 2023. This will bring to a close Matt’s 18+ years of service to the IFC, including the creation of the SME Finance Forum. Under his leadership, the SME...

Equity

Gender Finance

Sustainable Finance

Aug 01, 2023

Washington D.C, August 1st, 2023 – Leading impact fund manager C4D Partners has joined the SME Finance Forum as its global membership network’s latest member. The members of the Forum are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and...

Financial Inclusion

Operational Risk

Jul 27, 2023

Washington D.C July 2023 – Consolidated Bank Ghana LTD (CBG) joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve...

Fintech

Jun 13, 2023

Our Industry Partner, CFTE, has just launched the Online Certificate for Fintech in Africa. This is a great opportunity for those who want to learn about Fintech in Africa. The Online Certificate for Fintech in Africa is a foundational programme in Fintech. Learners will go through the building blocks of the future of finance: Fintech, AI,...

Financial Education

Financial Inclusion

Non Financial Services

Jun 01, 2023

Washington D.C. June 1 st , 2023 - The SME Finance Forum is proud to announce its recent victory at the KNOWbel Awards, a World Bank Group program that recognizes teams and individuals who utilize knowledge to drive better business outcomes and foster a productive knowledge culture. This esteemed accolade underscores the power of collaboration and...

Financial Inclusion

Operational Risk

May 22, 2023

The EIF VC Survey and the EIF Private Equity Mid-Market Survey (the largest combined regular survey exercises among General Partners on a pan-European level) provide an opportunity to retrieve unique market insights. This publication is based on the results of the 2022 waves of these two surveys and examines how the Russian offensive war against...

Alternative Financing

Equity

Gender Finance

Guarantees

Islamic Banking

Rural & Agriculture Finance

Supply & Value Chain Finance

Sustainable Finance

Trade Finance

Youth Entrepreneurship

Credit Risk & Scoring

Digital Financial Services

Fintech

May 16, 2023

The “SME Finance Virtual Marketplace” is an online match-making platform that promotes partnership and collaboration between financial institutions, fintech companies and development finance institutions/ investors. The virtual Marketplace is powered by GlobalLinker, an AI powered ‘Digital Ecosystem’ offering SMEs a range of services to build...

May 11, 2023

3rd May 2023: Nairobi, Kenya: 4G Capital, the market-leading neobank powering micro and small business growth in Kenya and Uganda, has been ranked as one of Africa’s Fastest-Growing Companies by the Financial Times. The Financial Times compiled the ranking with data company Statista and based findings on compound annual growth rate (CAGR) in...

May 02, 2023

360ᵗᶠ Spreading Far and Wide: As a Knowledge Partner of FCI (Factoring Chain International), 360ᵗᶠ conducted a pan-India Export Finance Survey for Indian Corporates. the initial findings of this survey were presented at the FCI IFSCA GIFT-City conference and will be shared with Regulators and the Ministry of Commerce, India. Our engagement with...

Digital Financial Services

Apr 24, 2023

Strands, a CRIF company, and PwC launched a report with an in-depth analysis on how customer habits, Open Finance and new players entering the financial services arena are revolutionizing the Digital Banking context. The Digital Banking context is shifting, as new players are entering the financial services arena and threatening the position of...

Digital Transformation

Fintech

Apr 20, 2023

29 March, London: Paymentology , the leading global issuer-processor, has joined forces with Wio Bank PJSC , the region’s first platform bank, to power its innovative banking model with customer-centric card payment services. Wio Bank PJSC is leveraging Paymentology’s industry leading in-cloud card issuing platform and data analytics capabilities...

Financial Inclusion

Guarantees

Apr 19, 2023

Washington D.C April 2023 – Credit Guarantee Corporation of Papua New Guinea joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “...

Non Financial Services

Supply & Value Chain Finance

Apr 13, 2023

Washington D.C April 2023 – arara joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been implementing our...

Fintech

Apr 12, 2023

Learn from Danang Kusama, VP Sales for Digital Partnership for Investree, about strategic partnerships with banks and fintech businesses. “In this space in Indonesia, there are a lot of stakeholders…we are helping them get more access to SMEs and MSMEs and help consolidate those portfolios.” The SME Finance Forum’s Leader Dialogues is a series of...

Digital Financial Services

Fintech

Payments

Apr 11, 2023

Washington D.C April 2023 – Paymentology joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been implementing...

Financial Inclusion

Gender Finance

Sustainable Finance

Digital Financial Services

Apr 06, 2023

The Global SME Finance Awards 2023 recognize financial institutions and fintech companies for their outstanding achievements in delivering exceptional products and services to their SME clients. Endorsed by the GPFI, the Global SME Finance Awards provide an opportunity for institutions to showcase and share their good practices and knowledge and...

Financial Inclusion

Apr 04, 2023

Washington D.C April 2023 – Altus Financial Services joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been...

Covid-19

Digital Transformation

Apr 04, 2023

Learn from Joyce Tee, Managing Director for DBS Group Holdings, about how COVID-19 has transformed the SME finance space. “COVID has actually redefined how SME has to do business…how do you pivot to digital and how do you stay sustainable, how do you continue to learn from all these new orders in the market? COVID has brought digitization to the...

Sustainable Finance

Mar 30, 2023

Small and medium sized businesses in the SME Climate Hub community are committed to taking authentic climate action. This includes reporting annually on greenhouse gas emissions - ensuring transparency and accountability throughout their journeys towards net zero. Thanks to its new reporting tool, businesses part of the SME Climate Hub will now be...

Financial Inclusion

Covid-19

Digital Transformation

Mar 29, 2023

Learn from Carrie Suen, Senior Advisor for ANT Group, as she talks about tourism sector growth and digitalization after the COVID-19 pandemic in Singapore. “With tourism coming back, how do we tap into this momentum? A lot of SMEs suffered from the pandemic disruption…we are working with a lot of micro-SMEs like mom-and-pop shops to incentivize...

Financial Inclusion

Covid-19

Mar 29, 2023

Learn from Michael Schlein, President and CEO of Accion, about the struggle against poverty globally and the importance of digitalization in post-COVID-19 reconstruction. “In our lifetime we have seen poverty go down… over several decades. We’ve seen the greatest reduction of poverty ever in human history until today. Since the pandemic we’ve seen...

Financial Inclusion

Gender Finance

Rural & Agriculture Finance

Youth Entrepreneurship

Mar 28, 2023

Washington D.C March 2023 – MEDA joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been implementing our...

Digital Transformation

Fintech

Mar 22, 2023

Washington D.C March 2023 – ShopUp joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been implementing our...

Digital Transformation

Fintech

Mar 21, 2023

Matthew Gamser, CEO of the SME Finance Forum, participated in the “Financial Technology Development and Innovative Applications” panel at the 2023 APFF Asia-Pacific Financial Forum on 17 March 2023 in Beijing, China. “It was a great pleasure to speak on this panel at the APFF Asia-Pacific Financial Forum in Beijing,” Gamser said. “My panel, which...

Trade Finance

Data Analytics

Digital Financial Services

Fintech

Mar 21, 2023

Washington D.C March 2023 – CredAble joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been implementing our...

Financial Inclusion

Policy & Regulation

Digital Financial Services

Fintech

Payments

Mar 13, 2023

The Roadmap for Enhancing Cross-border Payments is a priority initiative of the G20. Much has been accomplished during its first two years, including agreement on a set of outcome targets endorsed by the G20 in October 2021. The work in 2021 and 2022 has focused on establishing the foundational elements of the Roadmap and beginning to pivot from...

Financial Inclusion

Digital Financial Services

Payments

Mar 13, 2023

In a recent blog post, CGAP authors Joep Roest and Bongani Maponya wrote about the transformative power of open government-to-person (G2P) systems to connect G2P recipients with different Payment Service Providers (PSPs) in order to make the best choice, thereby incentivizing improved services from PSPs. The post was also a case study on how South...

Financial Inclusion

Mar 09, 2023

Washington D.C, March 9, 2023 – Standard Bank joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been...

Financial Inclusion

Gender Finance

Digital Financial Services

Fintech

Mar 06, 2023

This paper examines the role of Fintech in financial inclusion. Using Global Findex data and emerging fintech indicators, it finds that Fintech has a higher positive correlation with digital financial inclusion than traditional measures of financial inclusion. In the second stage of their empirical investigation, the authors examine the key...

Sustainable Finance

Digital Financial Services

Mar 02, 2023

Fyndoo, the end-to-end SaaS Lending platform developed and owned by our member Topicus , has launched a new podcast called The Lending Bean – Powered by Fyndoo . Each episode, host Mike Cooper talks with experts about lending to inspire listeners to join Fyndoo in their mission to make lending effortless and accessible. In Episode 1 , Cooper talks...

Financial Inclusion

Mar 01, 2023

Washington D.C, March 1st, 2023 – Industrial Bank of Korea (IBK) joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016,...

Financial Inclusion

Equity

Gender Finance

Policy & Regulation

Mar 01, 2023

This working paper examines the current academic literature on access to finance for female entrepreneurs and female-led enterprises. It covers two main financing markets: credit and venture capital (VC). The paper finds wide consensus in the academic field that gender-related credit and VC gaps exist in Europe. It also collects some of the most...

Alternative Financing

Credit Risk & Scoring

Fintech

Feb 28, 2023

Partnership Aimed at Expanding Access to Finance for Small and Medium Businesses Across the Globe WASHINGTON, D.C., and TORONTO, February 28, 2023 – Uplinq , the first global credit assessment and scoring platform for SMB lenders, today announced a partnership with the SME Finance Forum , a global network aimed at expanding finance to small and...

Supply & Value Chain Finance

Feb 22, 2023

Washington D.C February 22nd, 2023 – Air8 joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been implementing...

Financial Inclusion

Rural & Agriculture Finance

Feb 16, 2023

Washington D.C, February 16, 2023 – One of the Philippines‘ leading banks, Security Bank Corporation joined the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge...

Financial Inclusion

Feb 15, 2023

The Karandaaz Financial Inclusion Survey (K-FIS) responds to the need identified by multiple stakeholders for timely demand-side data and practical insights into the state of financial inclusion in Pakistan, including traditional banking, mobile money, and the potential for their expanded use among the poor. The aim is to: Track access to and...

Financial Inclusion

Feb 13, 2023

The COVID-19 pandemic has accelerated digital financial inclusion with increased digital financial services. According to the 2021 Global Findex Database, global account ownership has increased from 51% of the world’s population in 2011 to 76% in 2021. Notwithstanding the gains, about 25% are still outside the formal financial system. More robust...

Credit Risk & Scoring

Feb 08, 2023

Our member, Asante Financial Services Group, is driven by passion to see to the growth of the MSME sector in Africa. It is through strategic partnerships such as the one with SOLV Kenya, a member company of Standard Chartered Banking Group, that we are able to extend our reach to the Kenyan MSMEs In Sub-Saharan Africa, micro, small and medium...

Financial Inclusion

Jan 31, 2023

Learn from H.E. Achille Bassilekin III, Minister of SME, Social Economy, and Handicrafts, about SME development in Cameroon. “We have been developing some tours to ensure that we facilitate the financial inclusion of small businesses in my country. In that vein the Head of State decided the establishment of an SME bank...which is the financial...

Fintech

Jan 17, 2023

Nearly 500 million micro and small enterprises (MSEs) are estimated to be operating around the world. Access to credit and other financial services is critical to the growth and sustainability of these businesses, and consequentially to the low-income and vulnerable populations which rely on MSEs for their livelihoods. Yet despite decades of...

Dec 30, 2022

Dear Members, Partners, and Friends, Working together during 2022 has been a pleasure, and we're proud to have you all with us. 2022 was a turbulent year in global markets, and SMEs all over the world have been dealing with soaring inflation, disrupted supply chains and volatile foreign currency markets. And yet, we have been inspired by how our...

Gender Finance

Dec 28, 2022

Learn from H.E. Dr. Chea Serey, Director General of the National Bank of Cambodia, about women empowerment and women's access to finance in Cambodia. “We have been working on access to finance particularly for women and committed to reduce exclusion rates by half by 2024…we have come up with a national financial inclusion strategy involving all...

Rural & Agriculture Finance

Dec 26, 2022

Washington D.C., December 26th, 2022 – Koltiva joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “When we started in 2012, we...

Fintech

Dec 21, 2022

Learn from Aria Widyanto, Director & CRSO of Amartha, about Amartha’s shift toward fintech. “We innovate …and therefore we favored fintech in 2016, and since then we are building more digital products…during the pandemic in 2020 we were ready to serve and retain our customers because we have started our digital transformation processes.” The...

Non Financial Services

Dec 19, 2022

Sponsorship opportunities are still available for members who are interested in working more directly with the Forum and helping shape our Global Event. Sponsors can improve brand recognition, develop partnerships and demonstrate leadership via the growing outreach and networks of the Forum. SPONSORSHIP OPPORTUNITIES

Alternative Financing

Digital Financial Services

Dec 15, 2022

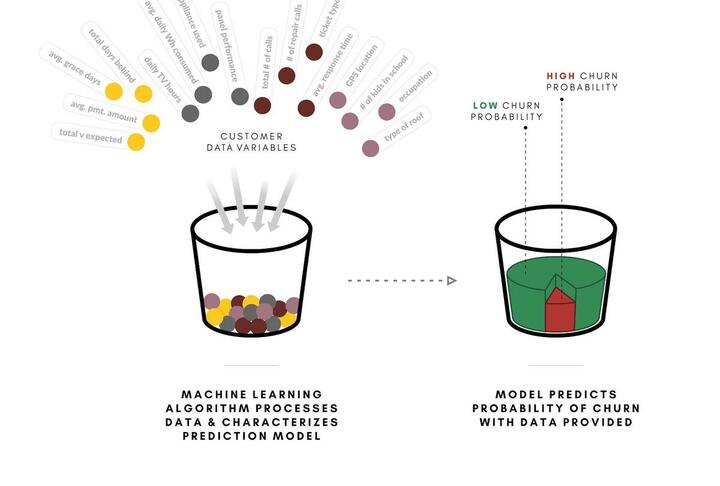

Digital lending or alternative lending is a catalyst to inclusive financial services for segments that are not a key target for traditional financial institutions. The use of AI-powered decisioning systems for evaluating individual credit eligibility by digital lending platforms has now become critical for micro, small and medium enterprises (...

Rural & Agriculture Finance

Fintech

Dec 14, 2022

Learn from Manfred Borer, CEO of Koltiva, about the integration of fintech in agribusiness during the COVID and post-COVID era. “Everyone talks about digitization...but I still see a future in a hybrid model. We have several hundred field agents across Indonesia...because our industry clients, agrobusiness, know they need boots on the ground for...

Financial Inclusion

Gender Finance

Supply & Value Chain Finance

Trade Finance

Dec 06, 2022

Washington D.C., December 7 th , 2022 – ACLEDA Bank joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “ When we started in 2012,...

Sustainable Finance

Dec 06, 2022

Learn from Ongki Dana, President Director & Commissioner of BTPN , about capacity building and the mindset-shift in SME Finance. “If our customers are SME and MSME...they will always need money from us...so we need to build their capacity to grow...it is crucial to both have the financial and the non-financial and going digital enables us to...

Nov 30, 2022

Learn from Robin Bairstow, Managing Director at I&M Bank about the future of SME Finance in Rwanda after the COVID pandemic. “One of the areas we have now been able to leverage on...is trade finance, and we've seen a lot of growth in that area...growth has been 50% year on year within the same SME sector...we've also added in loan origination...

Supply & Value Chain Finance

Fintech

Nov 21, 2022

Washington D.C., November 21 2022 – Progcap joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “When we started in 2012, we were...

Sustainable Finance

Nov 05, 2022

HEALRWORLD, a social impact, for profit ESG Fintech, unveils its new corporate debit card at CC Forum - an investment conference which is 100% dedicated to investment in sustainability. In collaboration with Mastercard and its Priceless Planet initiative, Railsr, Toqio, and Penrose Digital, the HealRWorld corporate debit card will be the first of...

Credit Risk & Scoring

Oct 26, 2022

Lending is one of the main elements of the modern financial system. In one way or another, most people rely on loans from banks – whether these are credits, mortgages, installments, credit cards to pay for critical goods and services. An important role in this process is played by credit bureaus that collect, store, process and transmit...

Sustainable Finance

Oct 20, 2022

LONDON, 4 October 2022 – JUMO, a technology company advancing next-generation financial inclusion in emerging markets, today released VELA, a pioneering asset management engine built to give investors access to real social impact investments at the highest standards of governance and control. VELA is a powerful asset management tool underpinned by...

Non Financial Services

Policy & Regulation

Oct 17, 2022

Washington D.C., October 17th, 2022 – The Small and Medium Business Development Agency of the Republic of Azerbaijan (KOBİA) joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses...

Sustainable Finance

Digital Transformation

Oct 05, 2022

What we heard on September 21 st …. We kicked off the second day of the Global SME Finance Forum 2022 with Ruth Horowitz - Regional Vice President for Asia and the Pacific, IFC and his Excellency Phan Phalla - Secretary of State for the Ministry of Economy and Finance of Cambodia. Both Ruth Horowitz and Secretary Phan Phalla spoke about the...

Trade Finance

Digital Financial Services

Oct 04, 2022

Washington D.C., September 2022 – 360tf joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “When we started in 2012, we were in an...

Sustainable Finance

Digital Transformation

Oct 04, 2022

What we heard on September 20 th …. Opening remarks were given by H.E. Chea Chanto – Governor, National Bank of Cambodia and Tomasz Telma – Director, Financial Institutions Group, IFC Chea Chanto laid out examples of how Cambodia is increasingly leveraging digitalisation to improve access to finance and Tomasz Telma talked about data driven...

Sustainable Finance

Digital Financial Services

Digital Transformation

Fintech

Sep 29, 2022

Washington DC, September 29 2022 - The future of delivering inclusive and effective banking support for the world’s small and medium sized enterprises will be driven by digital transformation, according to the lead organizers behind this year’s Global SME Finance Forum 2022 in Phnom Penh, Cambodia. More than 350 leaders and senior executives from...

Sep 28, 2022

Washington DC, September 28, 2022 - The 2022 Global SME Finance Awards winners were announced during the Global SME Finance Forum 2022. To learn who the winners are, please visit https://www.smefinanceforum.org/awards-2022 Organized by IFC, a member of the World Bank Group, and the SME Finance Forum and endorsed by the G20’s Global Partnership for...

Trade Finance

Sep 14, 2022

This podcast prepared by our industry partner Trade Finance Global, features Matt Gamser, CEO of the SME Finance Forum and Magda Bianco, co-chair of the Global Partnership for Financial Inclusion (GPFI). It gives an overview of current G20 initiatives designed to help SMEs get easier access to finance. Among those initiatives is the Global SME...

Fintech

Sep 08, 2022

London, 06.09.2022: Funding Options , the leading marketplace for business finance, has launched Funding Cloud: Insights to bring unparalleled data to SME lenders with a breadth of market insight capable of driving new product innovation. The intuitive and user-friendly platform provides near real-time knowledge and intelligence that has scarcely...

Financial Education

Aug 13, 2022

The EIF Business Angels Survey, together with the EIF VC Survey and the EIF Private Equity Mid-Market Survey (the largest combined regular survey exercises among GPs and Business Angels on a pan-European level) provide an opportunity to retrieve unique market insights. This publication is based on the results of the 2021/22 EIF Business Angels...

Alternative Financing

Fintech

Aug 12, 2022

Washington D.C., August 4, 2022 – Credit Bureau Cambodia (CBC) joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “When we started...

Financial Inclusion

Jul 29, 2022

Washington D.C., July 28, 2022 – Awash Bank joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. Awash Bank becomes the first bank...

Financial Inclusion

Payments

Jul 25, 2022

In the coming years, real-time payments are set to increase exponentially and by 2026, are forecasted to account for 26% of the total electronic payments. With certain growth ahead, governing bodies and payment regulators play a crucial role in advancing their country's payment systems to create an ecosystem that unlocks economic growth and...

Alternative Financing

Digital Financial Services

Fintech

Jul 19, 2022

Washington D.C., July 19, 2022 – Mambu joins the SME Finance Forum as the newest member of our global membership network. Our members are SME financing experts from 80+ countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and innovation. “Since 2016, we’ve been implementing our...

Non Financial Services

Fintech

Jul 13, 2022