Our events

The World of Tokenization: Transformative Potential for SMEs

Joint Event: SME Finance Forum and IDB Lab

Tokenization is revolutionizing finance by transforming asset transactions through digital tokens on a blockchain, enhancing security, transparency, and efficiency. This session will introduce financial service providers, regulators, development banks, and other financial ecosystem players to the fundamentals of tokenization, the necessary digital infrastructure, and real-world examples from Latin America, Africa, and Asia. We will explore the transformative potential of tokenization for both financial assets and real-world assets, highlighting how SMEs can benefit.

Tokenization and Required Infrastructure:

Tokenization involves converting rights to an asset into a digital token on a blockchain. This can include both financial assets, such as stocks and bonds, and real-world assets, such as real estate and commodities. Effective implementation requires a robust digital infrastructure, including secure and scalable blockchain technology, clear regulatory frameworks, and collaboration among financial institutions, technology providers, and regulators. Education and awareness are crucial to inform stakeholders about the benefits and functionalities of tokenization.

This session will discuss initiatives in Latin America and the Caribbean, Africa, and Asia, along with the current global discussions and key concerns. For Latin America and the Caribbean, we will share learnings from IDB Lab’s LACChain initiative, which aims to promote financial inclusion and innovation through a secure, scalable, and interoperable blockchain infrastructure. . The session will focus on proven experiences from, emphasizing practical examples over future projections.

Key Questions Addressed

1. What is tokenization? Why it matters?

2. What type of digital infrastructure is needed, and what is the current status (national, regional, global layer 1 infrastructures??

3. What are the examples from Latin America, Africa, and Asia?

4. What are the next steps to advance tokenization?

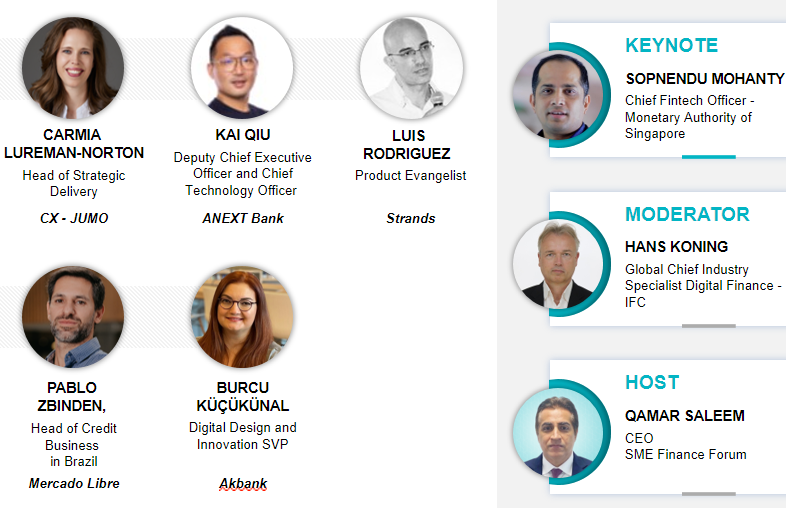

Speakers:

Moderator: Irene Arias Hofman, CEO IDB Lab

Irene is the CEO of IDB Lab, the innovation and venture laboratory of the Inter-American Development Bank Group. Their purpose is to discover new ways to drive social inclusion, environmental action and productivity in Latin America and the Caribbean. IDB Lab leverages financing, knowledge, and connections to support early-stage entrepreneurship, foster the development of new technologies, activate innovative markets, and catalyze existing sectors.

Previously, Irene worked for 20 years at the IFC, the private sector arm of the World Bank Group, where she managed the Financial Institutions Group and the LAC region with its 16-billiondollar portfolio. Her focus has been on innovation and technology, venture capital, and organizational development.

Eduardo Abreu, Vice President, Product Management Crypto and Blockchain for Latin America and the Caribbean at Mastercard

Rajeev Tummala, Head of Digital, Asia & MENA - HSBC Securities Services Singapore

Rajeev is the Head of Digital & Data for Asia and MENA Region at HSBC Securities Services. Since joining HSBC in 2018, he has pioneered tokenisation and digital assets product capabilities, including the development of HSBC Orion, a unique tokenisation platform operating in Luxemburg and Hong Kong. In 2023, he expanded tokenisation into structured products and collective investment schemes in Singapore. Rajeev has over 25 years of experience in the financial services industry across India, Japan, and Singapore, with a focus on business transformation and technology strategy. Before HSBC, he held leadership roles at Bank of America Merrill Lynch. He holds an MBA from the Booth School of Business, University of Chicago, and a Bachelor of Engineering from BITS-Pilani, India. Publications: a) 10x potential of tokenization b) Tokenisation: Propelling innovation at speed c) On the Yellow Brick Road to Web3 and the Metaverse.

Conan French, Director, Digital Finance Institute of International Finance (IIF)

Conan is the Director in the Digital Finance Department at the IIF, a research and advocacy organization for the global financial services industry with 400 members from 60 countries. Focus areas for his work include digital assets—central bank digital currencies (CBDC), blockchain, tokenization, and ledger technologies—cloud computing, artificial intelligence and machine learning applications, payments innovation, and digital identity. He initially joined the IIF as Senior Technology Advisor in 2015 to expand the Institute’s work on fintech innovations through research, events, and industry engagement. Prior experience included launching a paytech venture and service in the public sector. Conan earned his MBA from Georgetown University and his BA in History and Economics from Dickinson College.

Sergio Navajas, senior specialist at the IDB Lab

Sergio Navajas is a senior specialist at the IDB Lab with over twenty years of experience in financial inclusion. He has led groundbreaking research initiatives such as the Global Microscope on Financial Inclusion in collaboration with Economist Impact, as well as numerous regional projects and influential publications. His recent work focuses on digital payments, artificial intelligence and engaged in advancing tokenization for development. Previously, he served as a senior economist at USAID, a researcher at The Ohio State University, and a loan officer at Banco Bisa de Bolivia. He holds a bachelor's degree in Economics from the National University of Tucumán and both a master's degree and a Ph.D. in Development and Finance from The Ohio State University..

Nayam Hanashiro, Senior Tech Advisor, LACChain

Nayam Hanashiro is an experienced technology advisor specializing in blockchain and data analytics. He currently serves as the Senior Tech Advisor in Blockchain, Web 3.0 & Emerging Tech at LACChain (an IDB Lab initiative), where he coordinates strategic projects. Nayam's previous roles include Chief Technology Officer at tokenization startups Bolsa OTC Brasil and Dataland, where he led technology strategy, engineering, and product management initiatives. He also served as Head of Partnerships & Ecosystem, LATAM at R3, a leading enterprise blockchain technology company, and as a senior consultant at EY.

Host: Qamar Saleem, Head SME Finance Forum

Prior to this role, Qamar was the Manager Financial Institutions Group Advisory Services for Asia and Pacific driving leading a large team across 20 countries aimed at providing integrated investment/advisory client solutions across mainly MSME, Gender, Climate, Digital, Housing, Trade, and Supply Chain Finance. Qamar has been with IFC since 2012 and served in his previous roles as global technical lead for SME and Supply Chain Finance as well as regional SME Banking lead for EMENA. Qamar has 30+ years of global financial services experience having worked across 60+ countries internationally managing large business lines while leading multi-cultural and cross-functional teams. He is a recognized thought leader, featured speaker, and an industry mentor in SME Finance. Prior to joining IFC, Qamar was associated with international organizations like HSBC, Standard Chartered Bank, Deutsche Bank as well as large regional banks while serving in several emerging markets where he also led SME Banking and Commercial Banking Divisions. Qamar holds a Master’s degree in Business Administration and carries several certifications in the areas of Strategy, Climate Finance, Digital Banking, Business Transformation, Social Impact, MSME Banking, Team Leadership, Supply Chain Finance, Credit, Risk, Trade, Sales Effectiveness, Transaction Banking and Project Implementation.