Our events

Digital Finance Innovation Hub

The digital finance innovation hub gathers a group of 255 SME Finance experts, from 103 different institutions - among our members and affiliates with the contribution of IFC experts - to discuss how FIs and MSMEs are transforming rapidly through generative AI, data analytics and the power of the ever-growing SME Finance ecosystem.

The Innovation hub is designed to address specific and evolving problems identified by its members. The hub leverages knowledge, expertise, and networks to solve those problems through:

- Solutions Clinic

- Hackathons and Tech-Sprints

- On-going virtual discussion groups (Private LinkedIn discussion group) and annual in-person roundtable

- Research and survey

- Running pilots

- 1–2-day study tour to a digital finance or embedded finance platform with a proven business model

The expected outcome is to source industry solutions and define global best practice standards and tools. Best practices will be gathered and ultimately turned into a report that shares the challenges and solutions that have emerged throughout the year.

All of which will be finalized and ready to present at the Global SME Finance Forum meeting in South Africa in September 2025.

UPCOMING EVENTS - 2025

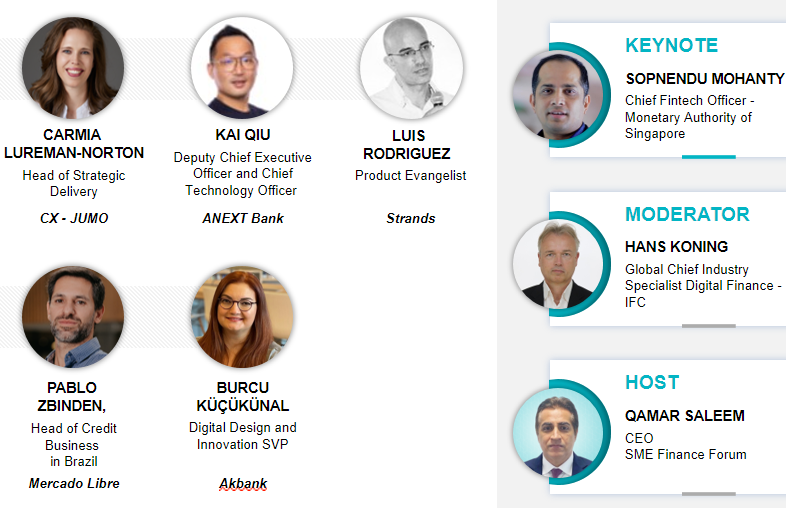

Solutions Clinic – February 18th, 2025 - 8:00 to 9:30 EST

- What are the main pillars while executing digital transformation and how does SME banking get impacted by the choices you make during the journey?

- Is digital transformation a magic bullet or are there other institutional cultural elements at play?

- How does digital transformation unable meaningful data which can help scale SME financial services?

- What are the roles of AI and new digital tools and how to use them effectively?

Other activities planned in 2025

- SME Marketplace session: Digital Lenders for Women Entrepreneurs – March 12

-

Immersion program – Akbank, Turkey – March 12-13

AKBank’s credit analytics and underwriting frameworks, which leverage advanced data insights to optimize risk management while expanding access to credit. AKBank’s efforts in digital design and innovation, offering a firsthand look at how the bank integrates technology and human-centered design to deliver seamless customer experiences and service design.

-

Global SME Finance Awards 2025 – Competition launch, March

Product innovation of the year by region and type of institution

- SME Banking Leaders League - April

- Digital and embedded finance Solutions clinic – June

- Global SME Finance Forum 2025 – September 8-10 – Johannesburg, under the theme “Transforming African SMEs through Value Chain Integration and Digital Innovation”

Innovation Hub milestones - 2024

Launch – February

The hub was initially launched on February 7th, 2024, with a session focusing on AI in SME Finance: Opportunities and Threats

Public Webinars

-

December 16th: Leading Innovations in SME Finance: A Leadership Perspective

-

November 13th: Spotlight on Innovation: SME Finance Leaders 2024

SME finance Marketplace - Fintech showcase

-

July 3rd - Digital Finance: Special focus on Digital Banks // WeBank - Maya Bank - Tyme Bank

Global SME Finance Forum – September 2024 – Brazil, under the theme, “AI-powered Digital and Sustainable SME Finance”

First Solutions Clinic

During that session the following themes were discussed:

-

Imagining new models for the customer journey

-

Making better use of alternative data

-

Digitizing the SME borrower

Sessions dedicated to AI and digital transformation

-

A primer on AI in SME finance

-

The Great AI Debate: Catalyst for financial inclusion vs. Catalyst for financial exclusion

-

Digital banks: Powering SME growth

-

Fireside chat: Innovation meets impact

-

New ideas and applications of technology to solve SME pain points

-

Leveraging AI: Enhancing efficiencies and greater customer engagement

-

Unlocking SME needs: New findings and insights

-

AI and alternative data: Balancing efficiency and risk in SME financing

Training: Digitizing the SME Ecosystem

Digitizing the lender's process, digitizing the SME's back-office, digitizing the SME's payment channel, and digitizing the SME's sales ecosystem.

Study visits in Sao Paulo with a focus on digital transformation

- Bradesco: Bradesco’s innovative initiatives through Inovabra, their dedicated innovation hub and their efforts to drive technological advancements and digital transformation in the banking sector.

- BNDES: Using digitalization to scale-up the support to SMEs

- Mastercard: What are the most promising AI-driven innovations in SME financing globally? How can data analytics improve credit assessment and risk management for SMEs?

- MercadoPago: Digital bank model and SME financial inclusion in Brazil

- NuBank: Digital, hassle-free business loan service with transparent and flexible terms, supporting both long-term investments and immediate business needs.

-

Santander: Innovations in technology and value proposition and service model for SMEs

- Sicredi: Digital solutions and partnerships with fintech to meet the evolving business needs of SMEs

- Visa: Empowering micro and nano merchant businesses through digital payments