Our events

Open Webinar - Digital Banking Solutions Series on Automation - Part II

The SME Finance Forum is hosting a two-session webinar series on Digital Banking Solutions, the first on platforms and the second on automation.

Members and non-members are welcome to participate!

Digitalization has led to disruption in banking, challenging conventional practices, opening up many new partnership opportunities and making it possible for new entrants to provide innovative products and services at a lower cost to the customer. In this series, we will be looking at some of the most important new digital models and how banks and financial institutions can utilize data, analytics, and partnerships, to incorporate innovative SME finance products and redesign traditional business models.

Part Two: Automation

With rapid digitalization in the financial services ecosystem, banks are embracing automation and other innovations to improve SME lending processes. By using data, AI, and machine learning, banks are integrating paperless online applications and single platforms to process loan application, eliminating paperwork, and the slow and expensive processes to make lending decisions. These technologies enhance, not eliminate the role of loan officers and manual underwriters, and aggregate data for verification, analyze and monitor financial statements, allowing for quicker and in some cases, nearly instantaneous lending decisions.

In this webinar, we will hear from two SME lenders who are embracing these technologies. First, we will hear from the SME Credit Risk Strategy Team at member Garanti BBVA, who will discuss their credit automation pilot that they launched in 2018. We will also hear from OakNorth, a multi-billion-dollar digital bank focused on redefining lending to small and medium-sized businesses globally using its next-generation credit platform. OakNorth Bank, backed by SoftBank's Vision Fund has taken the top spot on the FT's annual list of the 1,000 fastest-growing companies in Europe.

These firms will discuss how they utilized these technologies to reduce manual processes, decrease the time for lending decisions and improve loan monitoring, making the end-to-end loan origination process more efficient and less risky.

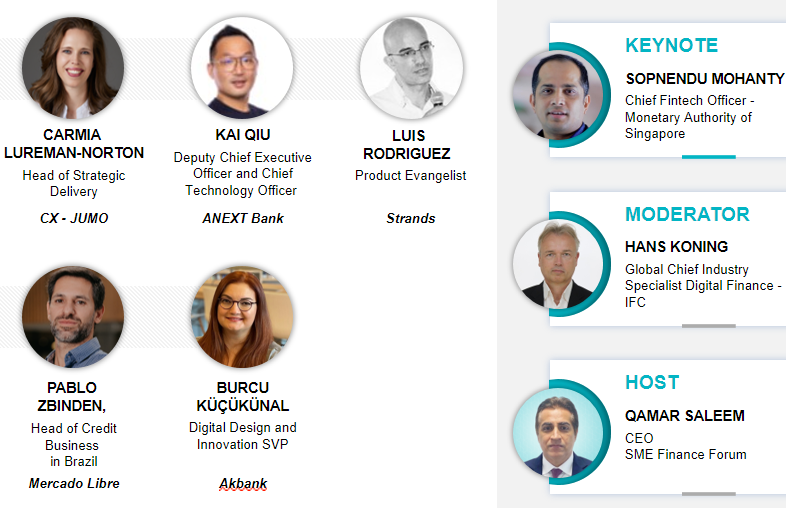

Speakers

Sean Hunter is the Chief Information Officer at OakNorth, a multi-billion-dollar fintech firm focused on redefining lending to small and medium-sized businesses globally using its next-generation credit platform. Prior to joining OakNorth, Sean was one of the first commercial engineers at Palantir Technologies in Europe where he led trader oversight partnerships with large financial institutions, particularly Credit Suisse, which led to being co-head of the JV called Signac. Before Palantir, Sean was a strategist at Goldman Sachs for 8 years, working in a number of areas including equities, fixed income, and algorithmic trading.

Sean Hunter is the Chief Information Officer at OakNorth, a multi-billion-dollar fintech firm focused on redefining lending to small and medium-sized businesses globally using its next-generation credit platform. Prior to joining OakNorth, Sean was one of the first commercial engineers at Palantir Technologies in Europe where he led trader oversight partnerships with large financial institutions, particularly Credit Suisse, which led to being co-head of the JV called Signac. Before Palantir, Sean was a strategist at Goldman Sachs for 8 years, working in a number of areas including equities, fixed income, and algorithmic trading.

Alper Eker is the Head of Retail Credit Risk at Garanti BBVA. He has with 20+ years of experience and background in process automation and corporate risk management in international corporations like General Electric and universal banks like BBVA and Garanti BBVA bank, started his career in GE Corporate R&D Center in NY, USA, as a technology expert, led different technology development projects in GE power systems, healthcare, and GE Capital. Shifting his career to finance with GE Capital in Connecticut, USA obtained a Black belt degree on Lean &Six Sigma Change management program, then, moving to GE Consumer Finance, founded GE Central Eastern Europe Region Risk Analytics Center of Excellence in Prague, Czech Republic. In 2008, moving to İstanbul, Turkey, led first, GE and then BBVA Representative Office Risk departments in Garanti Bank Turkey, focusing on integration framework for Corporate risk policies procedures and Commercial Credit Committee process until 2015 end. Since 2016, leading Retail Credit risk area for Consumer and SME loans in Garanti bank, responsible from wing to wing management of Underwriting to Monitoring areas for unsecured products i.e. personal loans, overdrafts, credit cards, as well as secured products such as Mortgage and Auto loans. In his role, Alper Eker has focused on optimized workflows and digitalization of credit circuits, lately in SME retail microcredit. Alper Eker, holds a Ph.D. degree in System Controls and Process Optimization from the University of Houston Chemical Engineering Department.

Alper Eker is the Head of Retail Credit Risk at Garanti BBVA. He has with 20+ years of experience and background in process automation and corporate risk management in international corporations like General Electric and universal banks like BBVA and Garanti BBVA bank, started his career in GE Corporate R&D Center in NY, USA, as a technology expert, led different technology development projects in GE power systems, healthcare, and GE Capital. Shifting his career to finance with GE Capital in Connecticut, USA obtained a Black belt degree on Lean &Six Sigma Change management program, then, moving to GE Consumer Finance, founded GE Central Eastern Europe Region Risk Analytics Center of Excellence in Prague, Czech Republic. In 2008, moving to İstanbul, Turkey, led first, GE and then BBVA Representative Office Risk departments in Garanti Bank Turkey, focusing on integration framework for Corporate risk policies procedures and Commercial Credit Committee process until 2015 end. Since 2016, leading Retail Credit risk area for Consumer and SME loans in Garanti bank, responsible from wing to wing management of Underwriting to Monitoring areas for unsecured products i.e. personal loans, overdrafts, credit cards, as well as secured products such as Mortgage and Auto loans. In his role, Alper Eker has focused on optimized workflows and digitalization of credit circuits, lately in SME retail microcredit. Alper Eker, holds a Ph.D. degree in System Controls and Process Optimization from the University of Houston Chemical Engineering Department.

Read a recap of this webinar here.

The webinar recording is available for members only on the member portal here.

For more information, please contact: Jessica Alfaro