2016 was the year when the Chinese FinTech dragons roared and some previously feted Western FinTech leaders wilted. In our first Digital Disruption GPS report, we argued that China was very important to the FinTech story (March 2016, link here). In this follow-on report, we follow the venture capital (VC) and corporate investments money trail to revisit the theme of the Chinese FinTech dragons as they roar at home and expand overseas.

Our conclusion: the rise of the Chinese dragons reflects a unique combination over the past decade of incredibly rapid digitization and the simultaneous rise of the Chinese mass middle class, along withpoorly prepared incumbent financial institutions facing off against entrepreneurial e-commerce and social media ecosystems. It is no surprise to us that China accounted for over 50% of total FinTech investments globally in the first nine months of 2016 (9M 2016) and was the only major region where FinTech investments increased in 2016 — in fact doubling in China in the first nine months of 2016 versus the same period in 2015.

In this report we also take a look at how different the FinTech evolution has been in the West: (1) the U.S. pivoted to InsurTech in 2016; and (2) two of the largest U.S. FinTech VC funding rounds in 2016 were in the health insurance space. Big data, the Internet of Things (IoT), and wearable devices, among other trends, will help insurance companies use FinTech to be more creative and customized. So far the InsurTech focus is more about improving distribution efficiency and user experience, as with much B2C FinTech in general.

Lending hasn't gone away. Our VC contributors for this report remain enthusiastic about peer-to-peer lending as an opportunity, especially in China or emerging markets where it is about financial inclusion and accessing underserved clients. By contrast, in the U.S. it has often been a (sub-prime/near-prime) credit card debt consolidation play. Lending accounts for about 80% of 9M 2016 VC FinTech investments ex-U.S. — but if we exclude Asia from our data (basically China), then the share of lending drops to sub-30%.

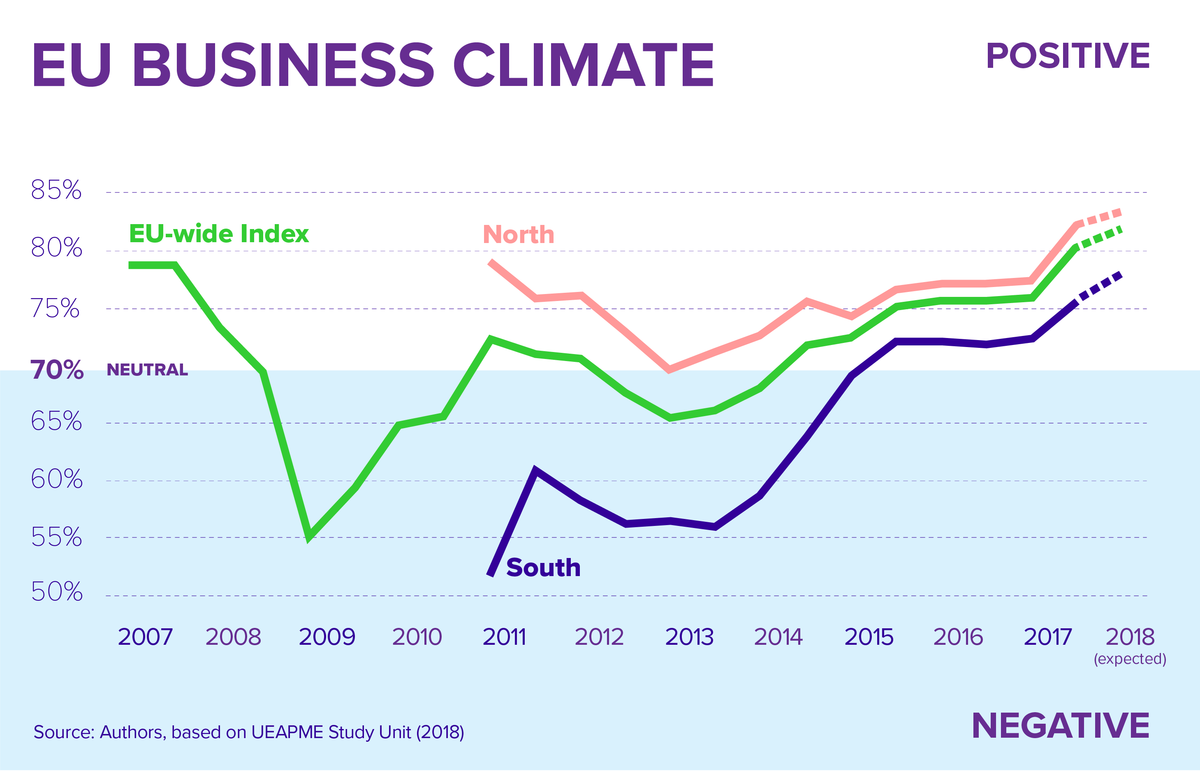

Europe remains a laggard for start-ups/VC investing at about 10% of global FinTech VC investment in 2015-16. This is not a big surprise as Europe has a smaller VC market versus the U.S., it has none of the large technology/Internet companies that exist in the U.S. or China and its banking system (despite the sector’s weak stock prices, earnings and capital challenges of the past decade) offers more of a full-service provision versus U.S. or Chinese peers.

European banks are among the top investors in VC-backed FinTech companies led by Spanish banks Banco Santander and BBVA (if we include Propel Ventures). European banks are increasingly interested in FinTech and with more bank investors and affiliates, we will see more of a shift to business-to-business (B2B). In 2017 we expect more focus on B2B FinTech topics, such as Artificial Intelligence, especially in London which is a hotspot with DeepMind and its concentration of universities; regulatory tech both in the U.K. and the U.S.; and cybersecurity primarily in the U.S. and Israel.

Back in the business-to-consumer (B2C) world, 2017 will also be the year when the Chinese dragons continue to make progress in expanding outside their home market, albeit this will not be the strategic "Blue Ocean" that China was a decade ago. The simple call for us to make is that Alipay will grow internationally as it follows the ongoing expansion of overseas Chinese tourism. The harder call is how many non-Chinese clients will Chinese companies like Ant Financial and WeChat gain in payments and associated products.

In the second half of this report, we switch from our analytical conclusions to highlights from our discussions in recent months with eight leading FinTech VC'S who are based across the world and in many of the key FinTech industry hotspots. We asked the eight VCs to nominate their favorite business models: (1) Payments, especially e-commerce payments, can reap large economy of scale (2) Lending is still popular especially among emerging markets (3) Shift in interest in B2B business models in developed markets (4) InsurTech is gaining momentum in the U.S.