Our events

Beyond the SME / Bank Disconnect: Key findings from New IBM Study

A recent research paper by the IBM Institute for Business Value, the SME Finance Forum, and the Banking Industry Architecture Network sheds light on the challenges facing SMEs in accessing adequate financial support.

The Banking for Small and Medium Enterprises: Serving the World Economy with Data and AI report shares insights and analysis resulting from a global survey of SME business owners and managers with 50 or more employees, senior banking executives and fintech leaders.

The study reveals that the global banking industry's preoccupation with risk mitigation, regulatory obligations, and cost containment may be hindering SMEs' growth potential.

While SMEs seek tailored financial solutions and support, banks often prioritize compliance, fraud monitoring, and cost efficiency, leading to a disconnect between their needs and the services offered.

The study suggests that banks can better serve SMEs by leveraging technologies such as automation and Generative AI to meet their specific requirements and improve their overall service offerings.

Join us for a presentation of the report's findings and a conversation about the recommendations included in the research.

WEBINAR AGENDA

-

Opening remarks - Qamar Saleem, Head of the SME Finance Forum

-

Findings presentation and live polling - Paolo Sironi, Global Research Leader in Banking, IBM Institute for Business Value

-

Discussion between 4 banking executives: SME Banking Needs vs. Services Offered

- Closing - Qamar Saleem, Head of the SME Finance Forum

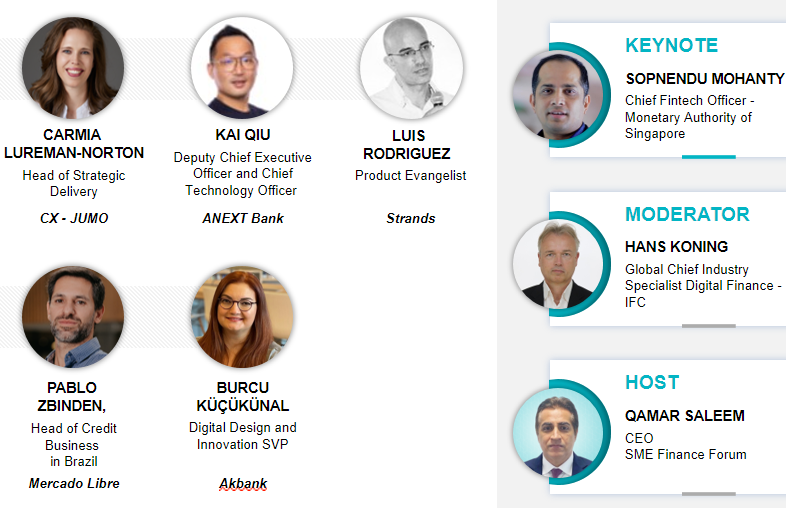

Speakers:

Opening Remarks

Qamar Saleem, Global Head of The SME Finance Forum

Qamar Saleem, Global Head of The SME Finance Forum

QAMAR SALEEM leads the world’s most prominent SME Finance center for knowledge exchange, solution building, innovation, best practice transfer and public-private dialogue. Prior to this role, Qamar was heading Financial Institutions Group Advisory Services for Asia and Pacific driving a large team across Asia and Pacific aimed at providing integrated investment/advisory client solutions across mainly MSME, Gender, Climate, Digital, Housing, Trade, and Supply Chain Finance. Qamar has been with IFC since 2012 and served in his previous roles as global technical lead for SME and Supply Chain Finance as well as regional SME Banking lead for EMENA.

Qamar has 30+ years of global financial services experience having worked across 80+ countries, advised more than 300 financial institutions internationally in scaling SME Finance. He has been managing large business lines while leading multi-cultural and cross-functional teams. He is a recognized thought leader, featured speaker, and an industry mentor in SME and Supply Chain Finance. Prior to joining IFC, Qamar was associated with international organizations like HSBC, Standard Chartered Bank, Deutsche Bank as well as large regional banks while serving in several emerging markets where he also led SME Banking and Commercial Banking Divisions.

Qamar holds a Master’s degree in Business Administration and carries several certifications in the areas of Strategy, Climate Finance, Digital Banking, Business Transformation, Social Impact, MSME Banking, Team Leadership, Supply Chain Finance, Credit, Risk, Trade, Sales Effectiveness, Transaction Banking and Project Implementation.

Guest speaker:

Paolo Sironi, Global Research Leader in Banking, IBM Institute for Business Value

Paolo Sironi is the global research leader in banking and financial markets at IBM Institute for Business Value. He is a former start-up entrepreneur who started his career as quantitative risk manager in investment banking. Paolo is a respected fintech voice worldwide and hosts “THE BANKERS’ BOOKSHELF” interviewing authors and researchers of the most interesting publications in financial services. He is recognised author on quantitative finance, banking and fintech innovation like the Amazon bestseller “Banks and Fintech on Platform Economies”.

Discussants:

Ayodele Olojede, Divisional Head of Retail and SME, Wema Bank PLC

Ayodele Olojede, Divisional Head of Retail and SME, Wema Bank PLC

Ayo Olojede is the Divisional Head of Retail and Sme Banking for Wema Bank with solutions anchored on the highly successful Alat /Alat4Business, the first digital Bank in Nigeria. She was previously Group Head, Emerging Businesses at Access Bank where she led the SME business across 12 countries in Africa. Ayo has over 24 years experience in corporate, commercial and Retail Banking across diverse geographies including North America and Africa. Prior to joining Access Bank, Ayo worked for HSBC, Canada holding leading positions in Business Banking. Ayo’s achievements also includes transformational solutions in payments, embedded finance, ecosystem lending as well as leading partnerships projects with governments of Nigeria and Ghana on financial inclusion initiatives. She is also one of the board members at SMEFF, NPO, top 100 career women in Africa. Ayo completed her MBA at Kellogg School of Management, Northwestern University. She has various international recognition and awards.

Mario Cali', Senior Manager - Data Science and Responsible AI, Intesa Sanpaolo

Mario Cali', Senior Manager - Data Science and Responsible AI, Intesa Sanpaolo

Mario Cali' is a Senior Manager in the Data Science and Responsible AI area of Intesa Sanpaolo. With a strong technical background in engineering, he has a long-lasting experience in the banking industry. Among other experiences, he worked as Innovation Manager focusing on new technologies applied to Capital Markets and Investment banking, mentoring startups during their development process in incubators around the world. He has also an experience on the London Trading Desk as EGB sales. In the last few years, he focused on the application of AI technologies in the banking business, designing stategies and use cases to exploit AI and generative AI capabilities.

Maximiliano Damian Rodrigues, General Manager of SME Business, Nubank

Maximiliano Damian Rodrigues, General Manager of SME Business, Nubank

Maximiliano Damian Rodrigues engaged in different journeys in small companies, incumbents, and startups. In all of them, he applied his technical/analytical background, curiosity, and willingness to improve customers’ life to deliver sustainable business results. In his experience, he has built operations from scratch and improved efficiency of others but what all of them had in common was solid teamwork behind the scenes. In late years, he gathered deep knowledge over banking and payments market - focused in digital banking, credit, fast payments, and open banking (Brazil's market).

Adeel Hyder, Managing Director SME Banking, Starling Bank

Adeel Hyder, Managing Director SME Banking, Starling Bank

As Managing Director of SME Banking, Adeel is responsible for Starling’s offering to business customers across the UK. He joined Starling in 2024 from TSB, where he ran the Business Bank and previously served as Strategy Director. Before TSB, he was a management consultant at McKinsey & Company and a corporate banker at RBS Global Banking and Markets. He holds an MBA from London Business School and an undergraduate degree from the LSE.

Organizers:

This webinar is organized jointly by the SME Finance Forum and its affiliate, the IBM Institute for Business Value.