Blog

Balancing the demand of SME lending while managing credit risk & regulatory compliance

--------------

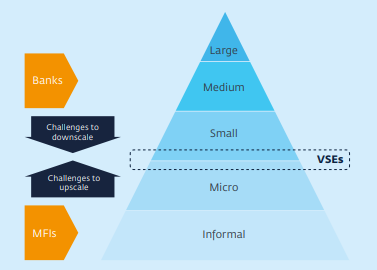

In the first article of this series, we talked about the challenges faced by banks and lenders in providing financing to SMEs and enumerated the potential solution areas. In this second article, we are going to dig deeper into those areas.

A majority of MSMEs lack credit history and therefore are ‘invisible’ to mainstream lending and consequently high risk. For those with some history, it is based on a narrow criterion that does not provide a clear correlation to the probability of default. There is an immediate need for better risk assessment technology leveraging alternate sources of data that helps meet MSME lending targets within a lenders’ risk appetite. Effective use of AI/ML can help bring objectivity to risk assessment while making lending more inclusive to those traditionally excluded. Furthermore, the system needs to have fault tolerance where it can still operate when data is missing, highlights error, seeks additional data or suggest ways to facilitate a small business lending request in a fair and ethical manner.

To satisfy regulatory requirements, any solution should have monitoring natively built-in rather than an ill-fitting afterthought. Lenders should be able to do fairness testing of each loan for any biases against marginalized populations, women, and other vulnerable groups. Such a technology will transform a lenders’ mindset of regulations as a burden to that of a competitive advantage. Moreover, it can help put an end to a vicious cycle which forces MSMEs to knock at the doors of predatory lenders, potentially impacting their survival.

Driving Lender ROA with scalable and operationally efficient risk management

As MSMEs loans are rising, so may be the concern around delinquency and default. The higher repo rates, bond yields and MCLR (marginal cost of funding-based lending rates) has pushed up the cost of funding, compressing a lender’s net interest margins and prompting them to raise rates.

From the perspective of MSMEs though, banks and lenders are not doing enough. High turnaround times and most loan applications getting declined combined with high interest rates, are a very sub-optimal customer experience. In the Fall of 2022, RBI, the Indian central bank, announced the launch of a pilot project to solve the challenge of getting credit in rural areas for small businesses, ancillary industries, and farmers. The current turnaround time for loan application in rural areas can be up to many weeks.

To solve for this dual challenge of meeting profitability and ROA targets for lenders, while creating a superior experience for customers, a solution with the following salient features is needed -

-

Easy to implement: integrate with current bank/ lender systems whether it is legacy, modern, or going through an evolution.

-

Regulatory compliant: meet compliance standards through risk management, provisioning and accounting standards such as Basel-III and IFRS 9, and allows for loan level stress testing.

-

Fitment and screening: based on government, investor, lending and product guidelines at the level of an individual loan.

-

Lending transparency: understanding the reasons, both positive and negative, impacting the risk behind a business loan application.

-

Alternate data: credit risk assessment models that have the flexibility to access traditional and alternate data whether macroeconomic, microeconomic or local market data such as infrastructure, demographics, satellite data, traffic counts, demand and supply, currency movements, commodities, trade of goods and much more, in order to accommodate vast variance in business types (manufacturing, services, trade, supply chain, etc.)

-

MSME agnostic: works across all SME sizes, lending products (secured, unsecured, guarantees), loan sizes and geographies.

-

Economic monitoring: capability to monitor the loan and portfolio with economic changes. For example, understanding assets that are not on a business balance sheet, incorporating factors such as resilience of business and resourcefulness of its’ principal, to determine the real risk and probability of default.

Conclusion

From regular economic cycles or through economic upheavals, natural disasters, pandemic and other crises, lenders end up taking a blanketed approach towards all SMEs. This doesn’t work but is a hard problem to solve given the immense variance amongst SMEs. Lenders’ need solutions that provide them the ability, intelligence, and the agility to tackle these variances across the various geographies that they operate.

There is a need for risk assessment expertise and technology that would help banks understand the context in which a business operates and its’ economic potential. Furthermore, this needs to be done in a cost effective and operationally scalable way that is regulatory compliant. This can help facilitate the flow of money to SMEs, who are traditionally under-served, thereby enabling inclusion, and driving the growth and productivity of the Indian economy.

--------------

This blog is brought to you by UPLINQ, a Member of the SME Finance Forum