Blog

Tapping into the potential of the dynamic VSE sector

A recap of “Serving Informal and Very Small Enterprises,” SME Finance Forum Webinar.

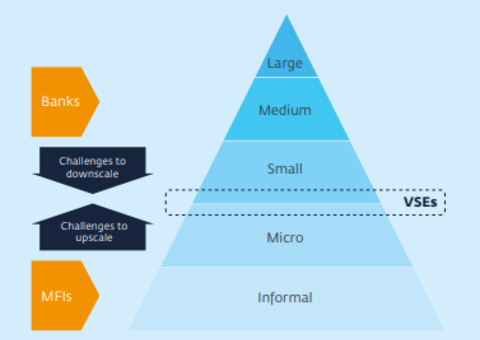

Policymakers and bankers from around the world exhort their support for SMEs as the backbone of the economy. Less attention, however, is given to informal and very small enterprises (VSEs) as a pipeline for economic growth, jobs, and financial inclusion. The VSE market represents an untapped opportunity for financial institutions to bolster a largely underserved sector.

VSEs are situated somewhere in between micro and small enterprises (MSMEs) in terms of personnel, asset size, and loan eligibility. The IFC defines a very small enterprise as a business with two to twenty employees, less than $100,000 USD in total assets, and less than $10, 000 USD in loan eligibility at origination. VSEs face a major financing gap that slows their progress towards upscaling and expanding their businesses. Across the board, VSEs are in need of higher loan amounts, faster decision-making on credit approvals, solutions for working capital and/or investments, and simple methods of cash management. But finance is just an entry point into a myriad of possibilities for innovative solution-making in the VSE sector. VSEs are also in need of insurance and non-financial services to increase their access to market opportunities. Digitalization addresses many of these central challenges for VSEs as a low-cost solution. Recognizing this, SME Finance Forum members Accion and MYBank are devising strategies to provide financial and technological support simultaneously to VSEs across the world. Representatives from each organization shared their insights on the most effective ways to service this underbanked sector during the webinar on September 11.

Accion is a global nonprofit that has been committed to fostering financial development through financial inclusion for over 50 years. Scott Stefanski, Vice President of Digital Strategy and Product Innovation for Accion, introduced the organization’s integrated approach to ensuring financial inclusion. Accion invests in financial service providers in developing economies that are well positioned to effect change, provides advisory services to partner organizations, and facilitates events that stimulate the sort of thought leadership that will spur the MSME finance industry and catalyze economic development. Iain Brougham, Senior Manager of Digital Strategy for Accion, contextualized the severity of the MSME global finance gap; 3 billion people within the MSME sector are living close to or below the poverty line. Providing better financial opportunities to MSMEs combats widespread poverty by enhancing local job creating and security, while also promoting local, regional, and even international trade. Accion is promoting the use of digitalized supply chain finance strategies to expand financial inclusion in developing countries in the Global South. Supply chain finance is reimagining the traditional business model by creating interim sources of capital through tying this capital to the expedited flow of goods and services – the system depends on multiple institutions rather than typical bilateral methods between buyers and lenders. Everyone along the supply chain stands to benefit from this model; more data is generated on transactions between buyers and sellers, which allows financial service providers to build a better understanding of the risk and credit represented by VSE investment opportunities, suppliers get paid sooner for their goods and services, and buyers have more time to pay off their loans. Supply chain finance opens doors to financial inclusion through its inherent lower risk for financial service providers and offers a means for reaching and learning about small businesses that otherwise may be shut out of traditional lending processes due to lack of credit history.

MYBank, a subsidiary of Ant Financial, is similarly working on digital solutions to MSME financing in China. Small businesses account for more than 50 percent of national fiscal income in China, 60 percent of GDP, 80 percent of employment opportunities and 90 percent of job creation – yet 70 percent of MSMEs have difficulty accessing finance. Jing Zhang, Senior Risk Management Expert, provided a look into MYBank’s approach to supporting this robust yet underserved sector. Powered by mobile internet, big data, and cloud computing technology, Ant Financial and MYBank are dedicated to using technology to provide inclusive financial services. In fact, MYBank is one of only three 100 percent online banks in China. This digital platform reduces transaction costs and the speed of loan processing for MSMEs. MYBank serves online merchants, QR merchants, rural and industry customers in their quest to access simple and affordable finance. To date, MYBank has assisted 3.48 million customers and disbursed $212 billion in loans. In evaluating businesses to lend to, MYBank considers individual risk (such as how long the business has been operating, their cash flows, the credit of the business owner, etc.) and social network risk (how the individual business compares to industry norms). In this way, MYBank tailors their services to the unique circumstances of each VSE it supports.

The key takeaway from this webinar is centered on the idea that innovative strategies and partnerships are integral components of expanding financial access to VSEs. Organizations like Accion and MYBank are at the forefront of developing novel solutions to the long-standing MSME finance gap. As the global economy continues to digitize, opportunities for conventional microfinance institutions and financial service providers to service informal and very small enterprises expand, and more institutions are able to tap into the potential of the dynamic VSE sector.