Blog

A recap on Wells Fargo, Size Up, Veem and Kountable Study Visit

The SME Finance Forum’s immersion visit to Wells Fargo, a member of the Forum, was successfully organized and held on January 22-23, 2020 in San Francisco, California with the participation of 12 representatives from seven institutions and five countries, namely BRAC Bank, Equity Bank, PhilipBank, PPCBank, Accion, Acremac, and Experian.

I was delighted to have the opportunity to take part in the visit and learn a great deal of Wells Fargo’s experiences in successfully and profitably serving small businesses. Like in other countries, most of the SMEs in the United States are small of which two thirds have revenues below US$25,000.

I was delighted to have the opportunity to take part in the visit and learn a great deal of Wells Fargo’s experiences in successfully and profitably serving small businesses. Like in other countries, most of the SMEs in the United States are small of which two thirds have revenues below US$25,000.

Wells Fargo, as a leader in small business finance, started its SME lending about 25 years ago to serve small businesses with the financing needs as low as US$5,000. While other banks tended to serve their small business clients with expensive credit card loans, Wells Fargo offers lines of credit that are unsecured and easy to apply, particularly for those small businesses that are already in business for several years.

SME lending has become profitable for the bank after dramatic changes made to its lending processes. These include, among other things, allowing small business owners to make loan applications by mail, or phone instead of requiring them to do so in a branch or with a loan officer. Tax returns or financials are often not required; most decisions are made quickly based on a scorecard system. While the traditional process required that an application be reviewed by the lender, no annual reviews are required. Most small business loans are unsecured while traditionally collaterals are required; booked on consumer loan system instead of commercial loan system.

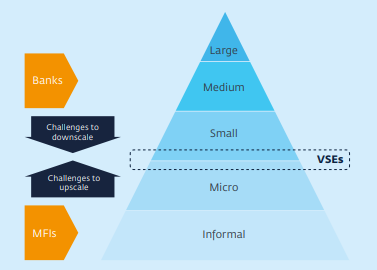

Financing small businesses is not easy, and making it profitable is even more challenging due to a variety of reasons: small loan sizes, lack of collaterals, lack of credit history, lower revenues and profitability, etc. Hence, using scorecards is an effective way to serve them.

Based on Wells Fargo’s experiences, developing and using scorecards for small business lending is one of the key success factors. It’s critical that the bank collects as much data about the small business as possible, including the type of market and industry, and making sure that the data is accurate and clean.

Besides financing, Wells Fargo also provides free resources to help their small business clients to improve their business performance such as tools to develop business plans.

SizeUp, one of the fintech partners, provides tools that enable business owners to make more intelligent decisions. Especially, they allow them to benchmark their business performance with all competitors in the industry, to map their competition as well as their customers and suppliers, and to identify the best advertising practices to reach the right customers.

My two take-aways from the visit to Wells Fargo are that:

• High rates don’t scare bad customers, but they are likely to scare the good ones.

• If small businesses manage their finances well, they will generally manage their business well.

On January 23rd, the participating members of the SME Finance Forum and I also had the opportunity to visit Veem, a global payments platform, using SWIFT, treasury and cryptocurrency.

In the afternoon, we visited Kountable - a global trade and technology platform that delivers data driven insights and real-time information from transactions where SMEs work with enterprise level suppliers and buyers.

It’s truly encouraging to learn about all the innovative solutions and good practice examples, and how they contribute to solving challenges faced by SMEs around the world.