Day 2 of the Global SME Finance Forum 2023 saw panel discussions and keynote addresses by thought leaders like A K Goel, Chairman, Indian Banks’ Association, KV Kamath, Chairman, NaBFID, Alok Kumar Choudhary, MD, SBI, Sopnendu Mohanty, Chief Fintech Officer, Monetary Authority of Singapore, Rajiv Anand, DMD, Axis Bank, Chanchal Sarkar, Economic Adviser, DEA, Ministry of Finance, India.

Mumbai, 13 September 2023 - The ongoing Global SME Finance Forum 2023 witnessed a vibrant exchange of ideas during the second day of the conference in Mumbai. Eminent personalities from the banking and finance world addressed emerging trends in SME financing in India and globally.

The conference began with an opening speech by A K Goel, Chairman, Indian Banks’ Association. He highlighted that “As per World Bank, SME accounts for over 90 percent of the businesses and more than 50 percent of the employment worldwide. Formal MSME contributes to 40 percent of the national income in emerging economies. However, these numbers are significantly higher when informal MSME are included. It is estimated that around 600 million jobs will be needed by-2030 to absorb the global workforce, which makes MSME development a higher priority for many governments around the world.”

He further added that, “Through G20 presidency, India fosters collaborative solutions that not only benefit its population but also contribute to the global community, echoing the spirit of 'Vasudev Kutumbh'—One Family. The theme of this year's Global SME Finance Forum - 'Digital ecosystem and the future of SME finance” - makes it compelling in this digital era. Since all sectors are undergoing digital transformation, entities must scrutinize their internal processes, embracing digitization to enhance operational efficiencies.."

During the keynote address, KV Kamath, Chairman, NaBFID, expressed, “Thanks to groundbreaking technological disruptions, the Digital super cycle and MSME sector play a pivotal role in shaping India's economic growth, as they are poised to contribute a substantial 20 to 25 percent of the GDP. With a demographic reach that transcends age groups, a, and affordable connectivity that bridges urban-rural divides, India has effectively dematerialized and demonetized monetary transactions, turning businesses into virtual entities. This newfound agility, bolstered by the robust digital ecosystem, not only streamlines operations but also creates an abundance of employment opportunities, both directly and indirectly. It is this convergence of innovation and inclusivity that paves the way for a brighter economic future, where India's digital and the MSME sector stand as pillars of progress and prosperity.”

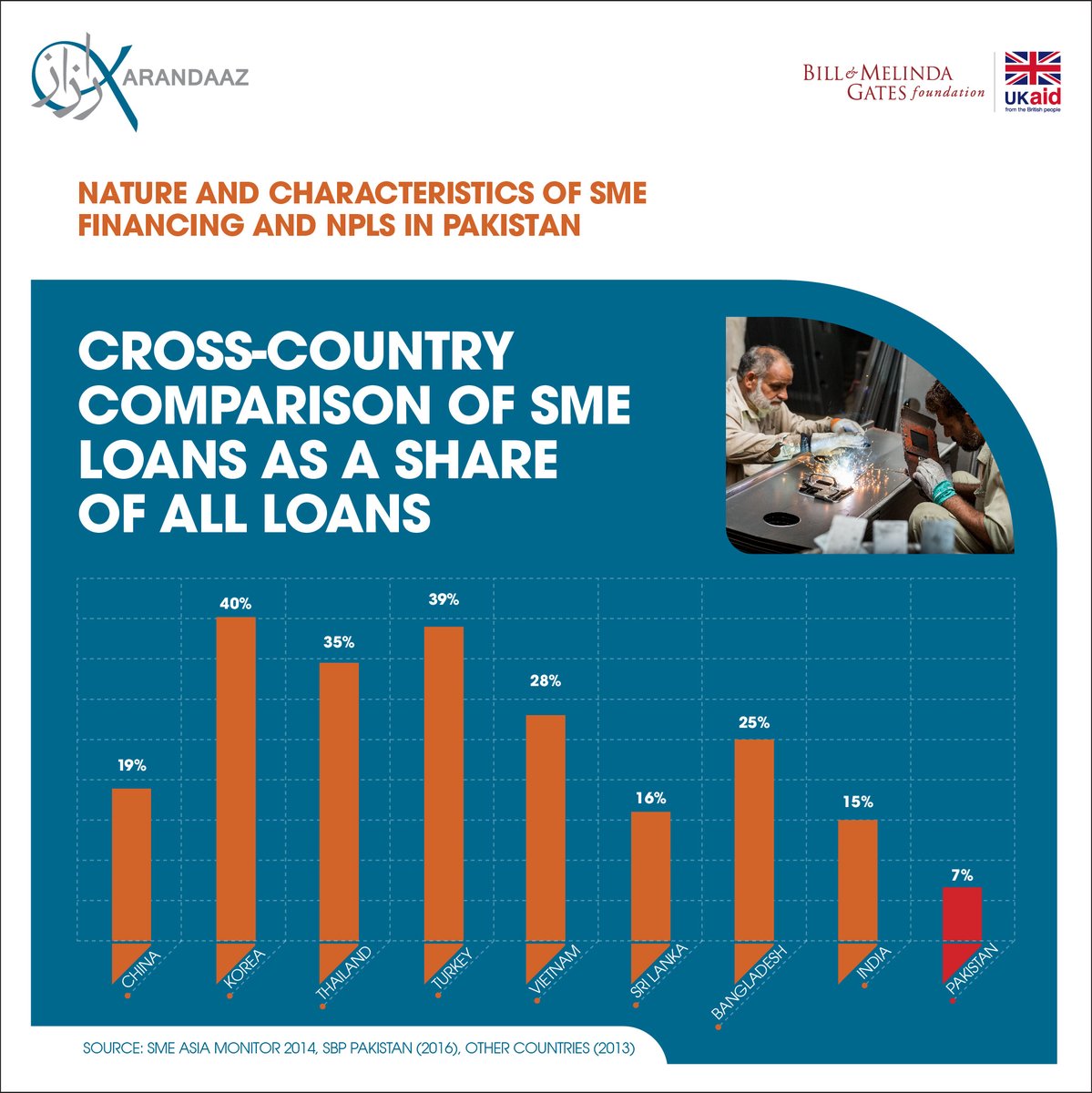

The experts from the following session focused on 'SME Financing: Vision 2030', addressing the pressing question of the SME finance gap, which currently stands at over US$ 5 trillion in developing countries every year. Experts analyzed how innovations in financial services, such as digital platforms, advanced data analytics, and market interoperability, are redefining the SME finance landscape.

The panelists also debated whether AI-driven banking can play a pivotal role in closing the SME finance gap.During this spirited debate, Axis Bank Deputy MD, Rajiv Anand shared, “In the future, an omni-channel experience will prove to be increasingly efficient for businesses. While digitalization allows us to assess a person's ability to pay, it falls short in gauging their willingness to pay. Therefore, the integration of both AI and human intervention is essential for gaining a holistic understanding of our customers. Over the past decade, we witnessed significant growth in the retail sector within the banking industry. However, it is anticipated that in the next decade, the focal point of growth will shift towards the MSME sector.”

Further, during the panel discussion on 'ecosystems and key crosscutting issues', Sudatta Mandal, DMD, SIDBI, explained “In India, out of 6.3 crore MSMEs only 1.5 crore MSMEs are registered. To receive credit and digital assistance, MSMEs need to have identification. SIDBI is authorised by the Ministry of MSMEs to act as the implementing agency for executing the Udyam Assist Platform and bringing the informal segment into the formal segment. Once an enterprise is registered under Udyam, it will act like an Aadhaar (identity number) and provide identification through which they can avail of various government benefits. Digitalization is the catalyst that empowers India's MSMEs to leap into the future, where innovation, efficiency, and global competitiveness converge.''

In another panel session on 'Cross-border Payment Ecosystems', experts explored how emerging technologies and innovative business models could enhance transaction speed and lower costs for SMEs engaged in cross-border payments. The discussion delved into the various initiatives undertaken by major payment networks on a global scale and the promising prospects of decentralized finance technologies and open banking for SMEs in the future.

Hosted by the Small Industries Development Bank of India (SIDBI) and the Indian Banks' Association (IBA), this three-day conference brings together a diverse assembly of over 700 participants, including senior bankers, tech luminaries, and thought leaders from 70 countries and 250 institutions. Under the overarching theme, "Digital Ecosystems and the Future of SME Finance," the event delved into pressing issues facing SMEs and the opportunities offered by digital ecosystems.

-------------------------------------------------------

About International Finance Corporation (IFC)

IFC - a member of the World Bank Group - is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2023, IFC committed a record $43.7 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises.

For more information, visit www.ifc.org.

About SME Finance Forum

The SME Finance Forum was established by the G20 Global Partnership for Financial Inclusion (GPFI) in 2012 as a knowledge center for data, research, and best practice in promoting SME finance. As an implementing partner for the GPFI, the International Finance Corporation (IFC) was tasked with managing the initiative. The Forum operates a global membership network of +240 members that brings together financial institutions, technology companies, and development finance institutions to share knowledge, spur innovation, and promote the growth of SMEs.

Discover the SME Finance Forum members: www.smefinanceforum.org/members/member-list

About Small Industries Development Bank of India (SIDBI)

SIDBI, set up on 2nd April 1990 under an Act of Indian Parliament, is the Principal Financial Institution for Promotion, Financing and Development of the MSME sector. SIDBI has been playing a significant role in developing the financial services for MSME sector through various interventions including Refinance to Banks, Credit Guarantee programs, Development of the MFI sector, Contribution to Venture capital/AIF funds, MSME ratings, promoting digital lending ecosystem, etc. The Bank has proactively been working towards Energy Efficiency (EE) in MSMEs since 2005-06 using support of multilateral institutions like World Bank, ADB, GiZ, FCDO, JICA, AFD, KfW etc. for energy efficient projects. Furthermore, SIDBI has been touching the lives of citizens across various strata of society through its integrated, innovative, and inclusive approach. Be it traditional, domestic small entrepreneurs, bottom-of-the-pyramid entrepreneurs, to high-end knowledge-based entrepreneurs, SIDBI has directly or indirectly impacted the lives of Micro and Small Enterprises (MSEs) through various credit and developmental measures.

To know more, check out www.sidbi.in

About State Bank of India (SBI)

State Bank of India (SBI) a Fortune 500 company, is an Indian Multinational, Public Sector Banking and Financial services statutory body headquartered in Mumbai. The rich heritage and legacy of over 200 years, accredits SBI as the most trusted Bank by Indians through generations. SBI, the largest Indian Bank with 1/4th market share, serves over 48 crore customers through its vast network of over 22,405 branches, 65,627 ATMs/ADWMs, 76,089 BC outlets, with an undeterred focus on innovation, and customer centricity, which stems from the core values of the Bank - Service, Transparency, Ethics, Politeness and Sustainability. The Bank has successfully diversified businesses through its various subsidiaries i.e., SBI General Insurance, SBI Life Insurance, SBI Mutual Fund, SBI Card, etc. It has spread its presence globally and operates across time zones through 235 offices in 29 foreign countries. Growing with times, SBI continues to redefine banking in India, as it aims to offer responsible and sustainable Banking solutions.

To know more, check out sbi.co.in