The Small and Medium Enterprise (SME) sector has been playing a key role in the emergence of India as one of the leading economies of the world. The sector is fomenting inclusive growth of our country by creating employment opportunities through industrialisation in the rural and semi-urban areas of the country.

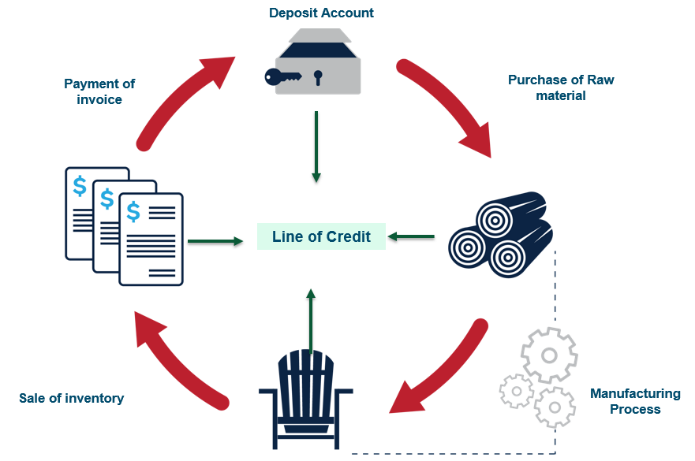

As per the new wave Indian MSME Report 2015, the sector’s contribution to GDP is likely to increase from 8 per cent in 2015 to 15% by 2020. It has the potential to spread industrial growth across the country, if the positive business environment and finance options are made available to SMEs. Improved access to finance will also help them invest in upgrading the skill sets of workers and buying capital equipment.

Acknowledging the challenges faced by the SME sector, government has come-up with progressive policy initiatives like Start-up India, Stand Up India' which will help in the gradual improvement of the business environment for the sector. Financing is a major challenge for the SME sector and is one of the prime reasons for SMEs to go out of business. This is an area where other stakeholders notably, NBFCs and private banks must play an expanded role if the vision of creating a vibrant and progressive SME sector is to be realized.