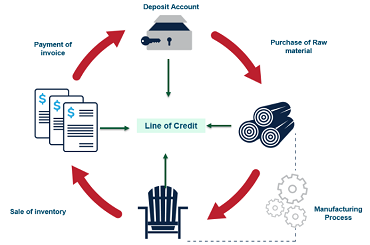

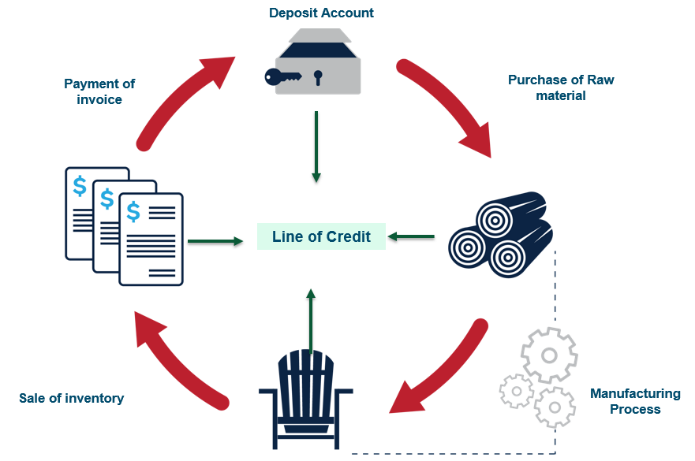

If there is one word that banks do not want to hear from your start-up is bad loans and or default. So averse to this risk are the lenders that the traditional credit market has been wired to base loan decisions on security rather than your ability to pay. As a result, most small and medium enterprises are failing to scale up due to the difficulty in accessing growth finance.

With the historic collapse of close to 30 banks between 1980 and 2,000, the Central Bank introduced credit information sharing regime to keep away serial defaulters from banking halls. Credit information sharing has been changing the lending market with financial institutions sharing both positive and negative records of potential borrowers.

And now, one of the three credit reference bureaus in Kenya is planning to take the scheme to the next level by creating a business clinic where SMEs can be examined and rated on their ability to borrow with a view to smoothing their access to growth finance.