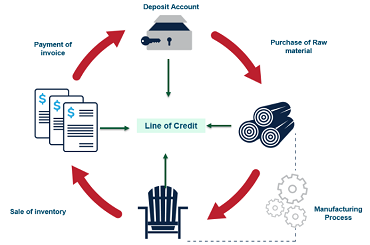

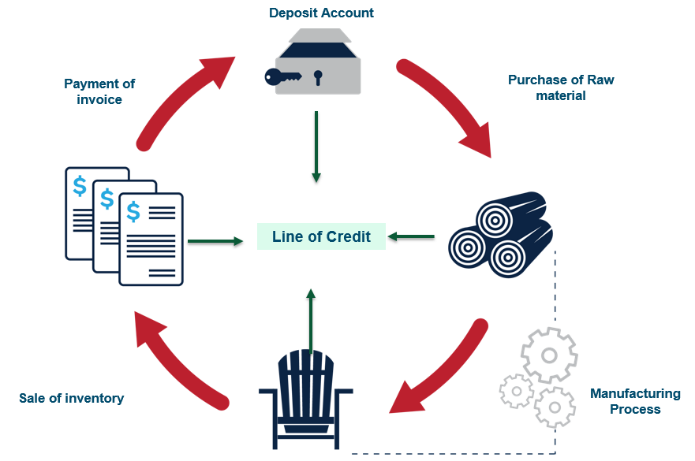

Small businesses are the engine of employment, contributing up to 85 percent of new full-time jobs in low-income countries, and two out of three new jobs in countries like the U.S. The IFC finds a strong correlation between the health of the small business community, economic growth, and poverty alleviation.Despite these Herculean responsibilities, micro, small, and medium enterprises (MSMEs) the world over struggle to access the financing they need to maintain cash flow, hire new employees, purchase new inventory or equipment, and grow their businesses. The IFC estimates that the unmet demand for MSME finance in emerging markets is $2.1-2.6 trillion (around 1/3 of outstanding loan balances to this segment). Unlike larger firms that can access capital markets, MSMEs must seek financing from banks or non-bank finance companies (NBFCs). Yet traditional lending approaches often fail to address this “missing middle” because the cost of diligence and underwriting is too high relative to the potential revenues from the smaller loans that MSMEs need. This situation is worse in emerging markets because of a lack of reliable financial data and high levels of informality. According to the Harvard Business Review, the financial crisis only exacerbated the situation: borrower balance sheets are still recovering, and banks, faced with new regulatory requirements, have reduced the share of lending to MSMEs in 9 out of 13 OECD countries.

Articles

Fueling the Economic Engine: Global Experiments in Small Enterprise Lending

Nov 03, 2014