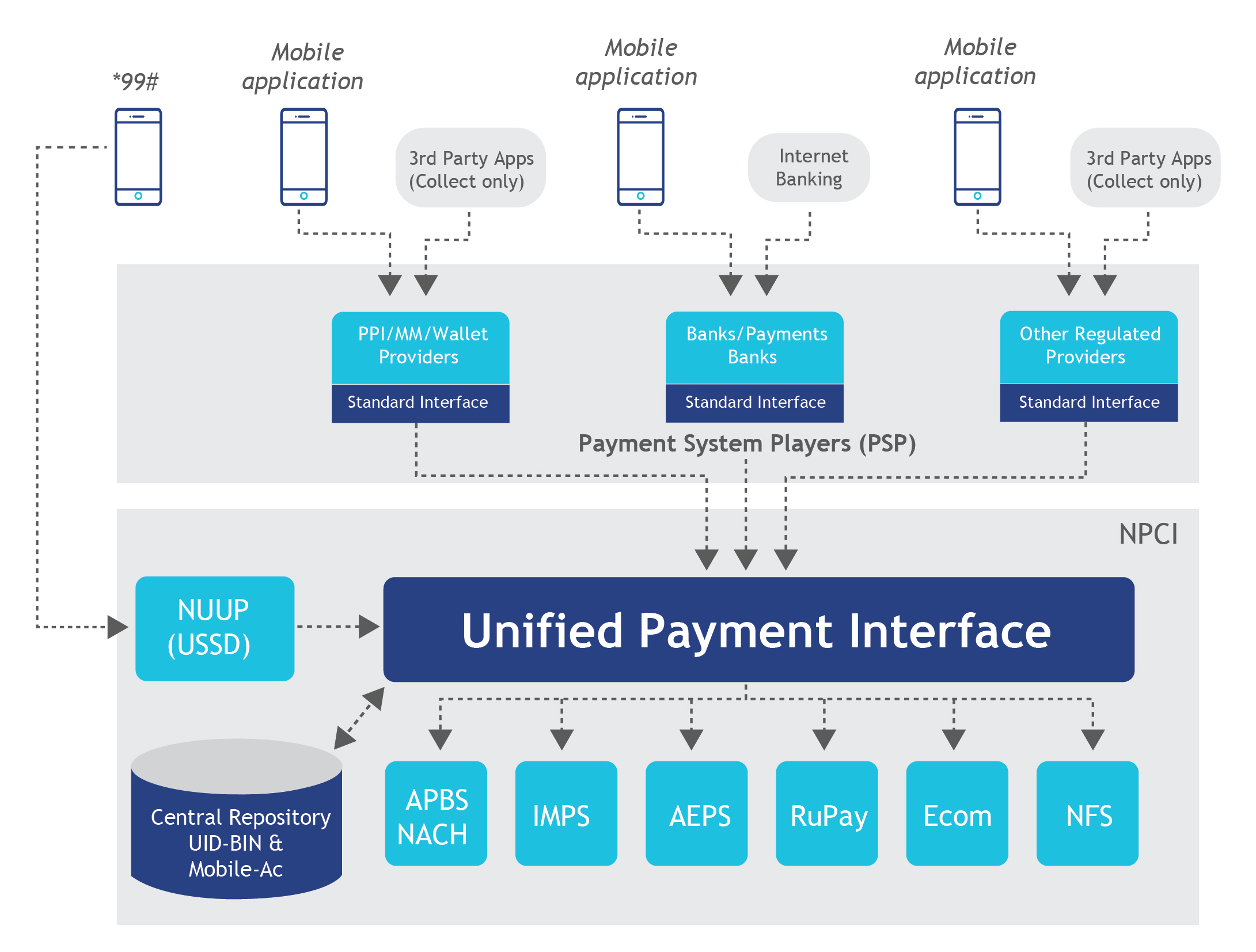

This week, the topic of financial inclusion will garner attention as the World Bank uses its spring meetings to lay out a roadmap toward universal financial access and releases new data via the Global Financial Inclusion Database. As USAID seeks to harness the power of science, technology, innovation and partnerships, we are increasingly focusing on digital finance as the critical pathway toward scaling meaningful financial inclusion. But what does that mean? What is our role in services primarily offered by banks and mobile network operators? Lawrence Camp notes that mobilizing private capital entails “using public funds to encourage investment that will result in private profit, but which will also have a development impact.” In many ways, this definition captures USAID’s approach to accelerating the growth of commercially sustainable digital payments systems.

Donors — USAID included — will never be the providers of financial services. But we often have a critical role to play in setting the conditions so that the private sector can fill the void that has left more than 2 billion people globally without access to safe, affordable basic financial management tools and forces governments, businesses and individuals to transact in cash, which is expensive, dangerous, inefficient and enables corruption. This blog series will outline USAID’s contribution to meeting the audacious goal of universal financial access through the creation of enduring, inclusive market infrastructure.

Articles

Digital Finance: The View from USAID

May 20, 2015