Our events

Information Session on Product Innovation, Global SME Finance Awards 2025

Global SME Finance Awards 2025

Information Session on Product Innovation

Be recognized, Share impact in SME FINANCE

The SME Finance Forum organizes the Global SME Finance Awards (The Awards) as a core part of its mission to create a unique platform for peer connections, knowledge dissemination, and innovations in SME Finance. The Forum’s extensive 240+ global network, crowds in financial institutions, fintech companies, development banks, policymakers, and industry experts from across the globe, fostering collaboration, knowledge sharing, and partnership building on a global scale. Hence, the Global SME Finance Awards has evolved into a pinnacle of global recognition for those making a real impact in the SME finance landscape.

Since its launch in 2018, The Awards recognize and celebrate the outstanding achievements of financial service providers in delivering exceptional products and services to scale SME finance in their respective markets. It provides an opportunity for institutions to highlight and share good practices, impact, knowledge, and be recognized amongst the global peer group of world leaders in SME finance and services.

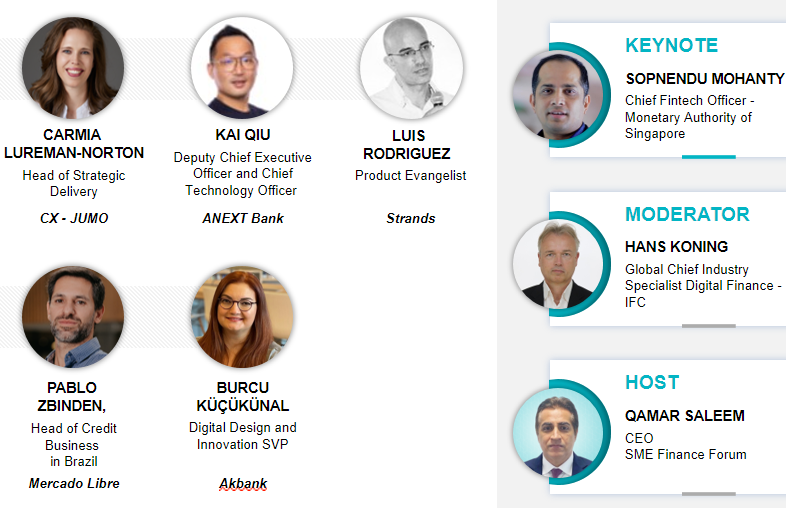

We are rolling out a series of Information Sessions during the 2025 Awards Season to share with Financial Service Providers (FSPs) and Industry Stakeholders the role and importance of The Awards in showcasing remarkable achievements and impact in the industry. The sessions also aim to provide information on the application process, respective awards categories, and related information on the awards. Speakers include industry leaders and practitioners from the Forum’s global network, as well as past applicants and winners.

MODERATOR

Sameer Vakil, CEO, GLOBALLINKER

Sameer Vakil, CEO, GLOBALLINKER

Sameer Vakil has worked in Banking, Payments, Consumer Goods industry in leadership roles in multiple geographies (India, Japan & USA in a global role) for 20+ years, before starting his own venture - GlobalLinker.com.

In his earlier roles, Sameer worked as President & Regional Director Citi Cards Japan & MD Global Direct Banking, Citibank New York; President MasterCard, South Asia; Founding CEO GE Capital JV with State Bank of India; Regional Head Consumer Banking HSBC & National Sales & Marketing Head HSBC Cards.

Sameer Vakil, Cofounder & Chief Executive Officer of GlobalLinker is a strong believer & practitioner of the 'Partnership Growth Model' and of digitally delivered customer centric solutions.

GlobalLinker is a unique SME networking portal that invites financial organizations & banks to offer co-branded versions of their platform to assist their SME customers in growing their businesses and accordingly becoming an integral part of their ecosystems. In a short span, GlobalLinker has been launched in 3 countries, and the partners include 4 financial institutions, the Government of India, & significant trade bodies.

SPEAKERS

SANJAY UPPAL, Founder & CEO, FinbotsAI

Sanjay Uppal is the Founder and CEO of FinbotsAI, a Singapore-based AI-first company founded in 2017, that is transforming quantitative modeling that drives over 80% of global decisions. He brings over 25 years of global experience in driving growth and transformation in financial institutions. His previous roles include Group Chief Financial Officer for UAE-based EmiratesNBD Bank, Malaysia-based Hong Leong Bank, and Chief Financial Officer for Standard Chartered Bank’s businesses in Taiwan, Philippines and the UAE.

Trusted by financial institutions globally, FinbotsAI’s product, CreditX, is redefining credit risk modelling and decisioning. CreditX enables lenders of all sizes to develop high-performance credit models in hours and days, compared to the 6-18 months taken by legacy methods.

FinbotsAI is accredited under MAS’ Veritas and IMDA’s AI Verify frameworks for Responsible AI. In November 2024, CreditX was named “Product Innovation of the Year - Global Champion” by the International Finance Corporation (IFC) for its impact in driving credit decisioning and financial inclusion.

Liudmyla Tymoshenko, Founder and CEO of AgriAnalytica

Liudmyla Tymoshenko, Founder and CEO of AgriAnalytica

Liudmyla Tymoshenko is the Founder and CEO of AgriAnalytica, a Ukrainian fintech company revolutionizing access to finance for small and medium-sized farmers through AI-powered innovation. With a PhD in economics and over 30 years of leadership in agri-financing, she has built a cutting-edge digital ecosystem that connects farmers to finance, markets, and expert support—all in one seamless platform.

Since founding AgriAnalytica in 2018, Liudmyla has led groundbreaking efforts to transform agricultural finance in emerging and crisis-affected regions. The platform improves transparency, reduces risk, and accelerates inclusive lending for underserved rural communities. In 2024, AgriAnalytica was honored with the Platinum Prize for Product Innovation at the Global SME Finance Awards.

A passionate advocate for digital inclusion, resilience, and financial empowerment in agriculture, Liudmyla continues to pioneer scalable solutions that redefine the future of agri-finance and uplift agri-MSMEs around the world.

Almutasem Alkhateeb, Senior Business Development Specialist at Kafalah SME Loan Guarantee

Almutasem Alkhateeb, Senior Business Development Specialist at Kafalah SME Loan Guarantee

Almutasem Alkhateeb is a Senior Business Development Specialist at Kafalah SME Loan Guarantee, where he strategically cultivates partnerships and drives initiatives aligned with Saudi Vision 2030's digital transformation objectives. Has a record of leading the end-to-end development of several innovative products, from initial concept to successful implementation.

Syed Abdul Momen, Additional Managing Director & Head of SME at BRAC Bank Limited

Syed Abdul Momen, Additional Managing Director & Head of SME at BRAC Bank Limited

Syed Abdul Momen joined BRAC Bank in August 2005. He has 13 years of multifaceted experience in the Banking Sector primarily concentrating in Technology, Operations and Business Functions.

During the first 2 years in BRAC Bank, he restructured technology infrastructure and played a crucial role in the Core Banking Platform migration. In August 2007, Momen was posted in BRAC Afghanistan Bank as Chief Operating Officer (COO) on a 2 year secondment. During his tenure in Afghanistan, he looked after the bank's SME Business & expanded bank's network in three provinces. He has also contributed in the development of SME Banking Policies & Guidelines of Central Bank of Afghanistan. After his return from Afghanistan in 2009, he joined BRAC Bank's SME Division and ran a special collection project, which was portfolio's prime concern. After successfully driving the countrywide collection initiative, he was appointed as the Head of Small Business in July 2010 and since then he is leading the industry's largest small business portfolio. His team was awarded Chairman's Excellence Award in 2012 for extraordinary business achievement.

Mr. Momen started his career in ANZ Grindlays Bank in 1999 where he played an instrumental role in the migration of Core Banking Platform in Middle East & South Asia region including Bangladesh, Jordan, Oman, Qatar, UAE, Bahrain, Nepal, Sri Lanka after the acquisition of Grindlays Bank's operation by Standard Chartered Bank. He was also instrumental in Standard Chartered Bank's IT service delivery & business process centralization Project.

Mr. Momen is a Computer Communications Graduate from Middlesex University, UK with distinction. During his 13 years of banking career, he attended numerous seminars, trainings and workshops in and out of country.

*Categories, objectives and speakers' information will be shared soon