Blog

Alternative data and fintechs transforming the SME financing space in Latam

A personal wrap on FINNOSUMMIT Miami by Lendit/Finnovista

I spent a thoroughly engaging two and a half days in Miami last week at the FINNOSUMMIT Miami meeting co-hosted by our good friends at Lendit and their colleagues at Finnovista, an impact organization that empowers Fintech and Insurtech ecosystems in Latin America and Spain. The meeting had over 600 registered, very few of them bankers (so soon after Felaban!), showing how far the sector has grown since we organized FinPYME Forum: the first Latin American and Caribbean Forum for Innovation in SME Finance, in Medellin, Colombia, back in September 2015, with member IDBInvest (then the IIC) and IFC.

It was a chance to reconnect with some fintechs much grown from when we had last met, and to make many new connections with exciting companies working in and around the lending space. The mood in the region, despite some of the political turmoil making headlines, is very positive for fintech and financial inclusion. Regulators and policymakers throughout the region have recognized the importance of opening up their markets to more competition, and to encourage new entrants with new approaches for the base of the pyramid in particular. In countries like Mexico and Brazil, they’re offering new licenses suited to the innovators, and they’re finally improving critical infrastructure such as credit information and secured transactions -collateral regimes. This combines right to operate with access to data – a powerful combination for innovation in the lending space! Moreover, with other initiatives such as Open Banking now being promised, the future looks perhaps even brighter.

It was a chance to reconnect with some fintechs much grown from when we had last met, and to make many new connections with exciting companies working in and around the lending space. The mood in the region, despite some of the political turmoil making headlines, is very positive for fintech and financial inclusion. Regulators and policymakers throughout the region have recognized the importance of opening up their markets to more competition, and to encourage new entrants with new approaches for the base of the pyramid in particular. In countries like Mexico and Brazil, they’re offering new licenses suited to the innovators, and they’re finally improving critical infrastructure such as credit information and secured transactions -collateral regimes. This combines right to operate with access to data – a powerful combination for innovation in the lending space! Moreover, with other initiatives such as Open Banking now being promised, the future looks perhaps even brighter.

The meeting noted, as we have since our inaugural conference Global SME Finance Forum in 2015 in Antaliya, Turkey, that competition is being replaced by cooperation between banks and fintechs. The one discordant note, if that’s what it might be called, was about what will happen as a third group, the large tech companies (including ecommerce marketplaces) venture more deeply into finance – precisely our “convergence” theme from 2019 Global SME Finance Forum meeting in Amsterdam.

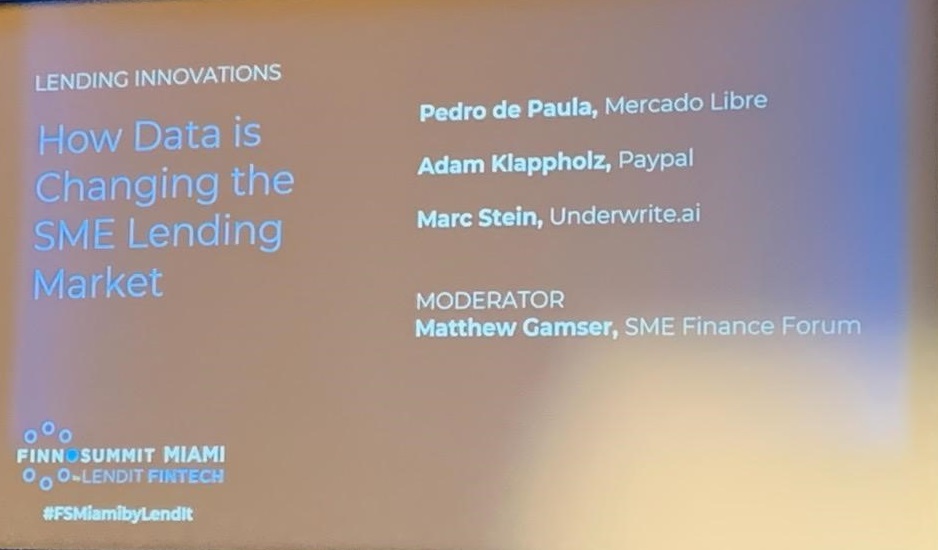

I was very happy to help expand on this theme, moderating a panel that focused on how alternative data and alternative institutions are transforming SME financing. The panelists on my session, Pedro de Paula of Mercado Libre, Brazil, and Adam Klappholz from PayPal, shared direct, powerful lessons of how institutions that have not only data, but also control of key payments and market access channels, can develop a level of scale and efficiency in SME financing previously inconceivable -all with risk decreased, as the last thing borrowers want to risk by being late in payments is that additional access to those key payment and marketing services! And, risk is further decreased by repayment in many cases being run through those same channels every time the borrower makes a sale.

I was very happy to help expand on this theme, moderating a panel that focused on how alternative data and alternative institutions are transforming SME financing. The panelists on my session, Pedro de Paula of Mercado Libre, Brazil, and Adam Klappholz from PayPal, shared direct, powerful lessons of how institutions that have not only data, but also control of key payments and market access channels, can develop a level of scale and efficiency in SME financing previously inconceivable -all with risk decreased, as the last thing borrowers want to risk by being late in payments is that additional access to those key payment and marketing services! And, risk is further decreased by repayment in many cases being run through those same channels every time the borrower makes a sale.

However, all is not lost for the banks and fintechs, as my other panelist, Marc Stein of underwrite.ai pointed out. New artificial intelligence tools (AI) can enable much better use of the abundant data they, too, can access, but all too often are neglecting; therefore, Open Banking initiatives will increase their resources.

My personal insight at this point would be what if a tie-up between Mercado Libre, PayPal and Softbank for the region could potentially leave other merchant lenders far behind, as the Ant Financials and WeBanks have done with the banks and other fintechs in China?

I was really impressed with the growth of digital banks and alternative SME lenders in the region, and to see the pivots of some lenders that started in the consumer space, like Cumplo (Chile/Mexico), into more fertile ground lending to small businesses. There is still a long way to go, and I was struck by the relatively low level of participation of women innovators in the speaking agenda (as opposed to in the audience), and to the dearth of attention to financing women entrepreneurs. However, some private conversations encourage me that soon we shall be hearing much more in this regard!

Finally, although the focus of the conference was about Latin America, it was great to see SME Finance Forum member Pedro Coelho from Banco BNI Europa leading a panel sharing European lessons with the audience.

"Thanks to #technology underbanked clients can be understood in the same way that banked clients are", #BorisBatine of @IDFinance_com in a panel with #JoãoLimaPinto of @ITSCREDIT_SA & @ppc83035 of @BNIEuropa at #FSMiamibyLendit pic.twitter.com/KkuILtCJjf

— FINNOSUMMIT (@FINNOSUMMIT) December 3, 2019