Blog

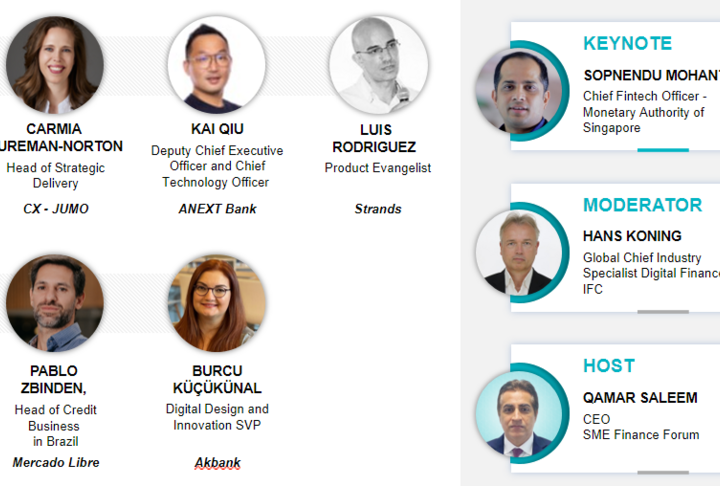

Round Table - Leading Innovations in SME Finance: A Leadership Perspective

Key Takeaways from the Round Table on Leading Innovations in SME Finance

On December 16th, 2024, industry leaders convened for a round table session to discuss the latest trends and innovations in SME finance. This high-level gathering brought together experts who shared their insights on various innovative approaches in SME finance. Below are the main highlights from the session:

Key Points Discussed

1. Digital Transformation. The significance of digital transformation in SME banking was a central theme. Speakers emphasized how digital tools and platforms are revolutionizing the way SMEs access financial services.

2. Customer-Centric Approaches. There was a strong focus on understanding the unique needs of SMEs and tailoring financial products to meet those needs. Personalized banking solutions are becoming increasingly critical.

3. Partnerships and Collaborations. The role of partnerships in driving innovation was a key discussion point. Collaborations between banks, fintech companies, and other stakeholders are essential for developing new financial solutions for SMEs.

4. Risk Management. Effective risk management strategies were highlighted as crucial for supporting SMEs, particularly in uncertain economic climates. Innovative risk assessment tools are enabling banks to better serve their SME clients.

5. Sustainability and Inclusivity. Speakers also addressed the importance of sustainable and inclusive finance. Ensuring that financial services are accessible to all SMEs, including those in underserved regions, is a top priority.

Insights from Industry Leaders

-

Asif Riaz, SEVP-G/Group Chief - Consumer Banking, The Bank of Punjab

Asif underscored the critical role of digital transformation in SME banking. He highlighted how technology can enhance service delivery and expand access to finance for underserved markets. Quote: "Digital transformation is not just a trend; it's a necessity for banks to stay relevant and serve SMEs effectively."

-

Candice Ho, Head of SME Banking, Institutional Banking Group, DBS Singapore

Candice discussed the importance of personalized banking solutions tailored to the unique needs of SMEs. She emphasized the role of data analytics in understanding and anticipating customer behavior. Quote: "Understanding the specific needs of SMEs through data analytics allows us to offer more personalized and effective banking solutions."

-

Carol Oyedeji, Group Commercial Banking Head, Ecobank Transnational Incorporated

Carol highlighted the significant challenges SMEs face in accessing finance in Africa. She shared innovative approaches Ecobank is implementing to bridge this gap and support SME growth. Quote: "Access to finance remains a significant hurdle for many SMEs in Africa, and we are committed to finding innovative solutions to support their growth."

-

Daniella Keet/Fourie, Head of Partnerships for FNB Business, First National Bank

Daniella spoke about the importance of strategic partnerships in expanding the reach of SME banking services. She emphasized the role of collaboration in driving innovation and providing comprehensive support to SMEs. Quote: "Partnerships are crucial in extending our reach and bringing innovative solutions to SMEs, ensuring they have the support they need to thrive."

-

Melis Özdeğirmenci, Senior Vice President-SME Marketing, Akbank

Melis discussed the role of marketing in SME banking. She highlighted how Akbank is leveraging digital marketing strategies to engage with SMEs more effectively and understand their evolving needs. Quote: "Effective marketing strategies, especially in the digital space, are key to engaging with SMEs and understanding their evolving needs."

-

Rajeev Chalisgaonkar, Head of Business Banking, Mashreq Bank

Rajeev focused on the integration of digital tools in business banking. He explained how Mashreq Bank is leveraging technology to streamline processes and enhance the customer experience for SMEs. Quote: "Integrating digital tools into our business banking services has allowed us to streamline processes and provide a more seamless experience for our SME clients."

Launch of the SME Banking Leaders League

We are pleased to announce the formation of the SME Banking Leaders League, consisting of members getting together with the following objectives:

- Act as a think tank and sounding board for new ideas.

- Share best practices and leading innovations that can help steer SME financial services forward.

- Engage industry stakeholders who need to be involved.

-

Target Outcomes

Key deliverables in the near term include

- Agree on relevant themes and segments: Focus on the most pertinent areas for SME finance.

- Quarterly innovation hub take-aways: Review and discuss insights from innovation hubs once a quarter.

- Annual roundtable: Hold a roundtable at the annual event planned for September 2025 in South Africa, specifically for leaders in this group.

- Annual publication: Consider an annual publication seeking input from this group and an extended group of SME banking heads.

- Consolidate the SME Banking Leaders League. The group will consist of around 15-20 leading institutions, ensuring a global coverage. We are looking for business heads who have direct influence and decision-making capacity within their institutions to drive results for SME business lines. This includes SME business heads and heads of retail or commercial banking businesses where SME is emerging. Ideally, it needs to be a senior-level executive (one step from CEO is preferred) to bring in practical learnings and deploy them to make an impact.

For more information, contact the SME Finance Forum at smefinanceforum@ifc.org.

****************

The SME Finance Forum (SMEFF) is a network of 300+ members and affiliates with a coverage spanning across 190+ countries. The members are primarily financial services providers such as banks, fintech, non-bank financial institutions, development finance institutions, credit guarantee companies, and microfinance institutions. The affiliates consist of policy advocacy groups, academia, SME and banking associations, training providers, and non-profit organizations. SME Finance Forum was established in 2012 by the G20 and is managed by the IFC with a core objective to scale financial services for SMEs. As the leading SME finance network globally, the forum steers industry innovations, supports replication of best practices, recognizes global champions, drives thought leadership, convenes influential stakeholders, and fosters global knowledge transfer.