Blog

AI in SME Finance: Opportunities and Threats

AI technology plays a pivotal role in revolutionizing SME finance by offering many benefits and transforming traditional practices. It brings new opportunities for the financial and non-financial institutions by automating operational workflows, harnessing alternative data sources, and building new forecasting and credit models to serve previously excluded MSMEs. Nonetheless, the integration of AI technology also poses its own set of challenges.

- The utilization of AI within their respective organizations, both internally and in their interactions with SME clients;

- How their institutions operationalize AI for maximum gain;

- How their institutions navigate the inherent risks associated with the implementation of AI.

Keynote - Sopnendu Mohanty, Chief Fintech Officer - Monetary Authority of Singapore:

Understanding how AI technology can empower SMEs is an important topic in the financial industry. Among all the digital banks emerging in recent years, the most exemplary ones are those seamlessly integrating AI into their offerings. The leadership of these financial institutions echoes the sentiment that prioritizing effective service to SMEs greatly enhances their chances of success. The SMEs have been unserved or under-served by the traditional banks; however, the digital banks are empowered by the latest technologies to provide a platform to include this sector.

Many people believe that AI brings an opportunity to solve all the past problems. However, the effectiveness of AI hinges on the availability of substantial underlying data. AI is not a new technology and has been existing for almost 50 years in various forms, from machine learning, deep learning, machine vision, to Generative AI. But there is an underlying need for a more extensive and comprehensive dataset for AI to leverage. While AI may initially appear costly, the recent developments in the industry have made AI more accessible for the SMEs. For example, many cloud providers have created a hybrid cloud infrastructure that allows the SMEs to access AI in an affordable and impactful way. The hybrid cloud-based AI solution is flexible, scalable, and cost-effective, allowing the SMEs to leverage the services as they grow. Currently, an increasing number of SMEs are starting to use AI services, such as chat boxes, data analytics and marketing tools.

One obstacle in adopting AI technologies lies in accessing reliable datasets and facilitating data sharing among multiple partners, including cross-border collaborations. AI relies on available data to offer insights that aid businesses in refining their practices.

Many SMEs remain uncertain about the relevance of integrating AI into their operations, primarily due to their price sensitivity and the potentially high costs associated with deploying fully automated solutions. AI service providers must navigate this challenge by decluttering their applications and offering SMEs a range of customizable options.

MAS launched Project Greenprint, a digital platform aimed at assisting SMEs in providing data to secure sustainability-related loans. We have learned a few lessons from this initiative:

-

SMEs, by design, do not embrace technology for the sake of technology. They must see the economic value behind the transformation;

-

The underlying capability of SMEs to understand technology is limited;

-

SMEs are extremely sensitive to the costs.

MAS undertook extensive exercise to tailor the platform for the SMEs to provide data. At the project's inception, SMEs found it difficult to furnish the data required for disclosure. MAS developed a survey supported by a learning AI engine, capable of predicting the data SMEs would disclose. This approach enabled SMEs to comprehend the requirements and required only minor adjustments to the pre-filled data provided by the AI tool. Consequently, this process has changed the mindset of SMEs regarding data disclosure. Despite SMEs may have limited capacity, service providers can offer guidance to users to disclose their data, enabling them to effectively utilize AI technology.

The purpose of AI is not solely to enhance the power of software, but rather to increase its usefulness for SMEs, particularly those facing difficulties in utilizing these tools to their fullest capacity. AI can serve as an assistant tool to enhance the functionality of software. Additionally, the service providers should consider developing a better dataset for AI to leverage on and focus on issues such as the verification of data.

There are many challenges in using AI technology. The issues include inadequacy of data, cyber security, as well as potential biases and exclusion. From the perspective of a regulator, MAS is looking at tools and frameworks for financial institutions to incorporate AI into their services in a fair, ethical, accountable, and transparent manner.

In conclusion, AI is not a standalone solution to problems but serves as an assisting toolkit for financial institutions. Industry practitioners should address fundamental challenges by initially automating basic processes, thereby generating high-quality datasets for financial institutions to utilize and better serve SME clients. Solving financing challenges for SMEs demands a multi-dimensional approach. AI has introduced a new dimension to SME automation, altering their perception and interaction with software.

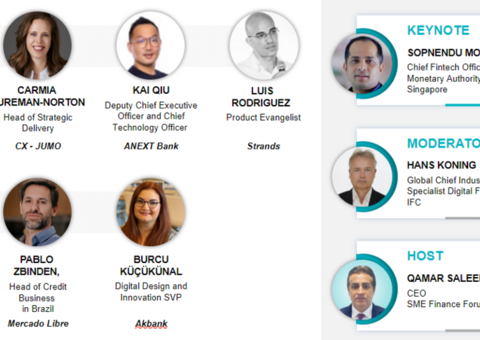

Summary of the Panel Discussion:

Introduction - Hans Koning, Global Chief Industry Specialist Digital Finance - International Finance Corporation:

The early foundation of AI can be traced back to the 1950s. Alan Turing developed the Turing Test to examine the machine's ability to exhibit intelligent behavior equivalent to, or indistinguishable from, that of a human. From the 1990s to the 2000s, the failure of technology to meet the expectations of the investors has led to an ‘AI Winter.’ However, the increase of computational power and growing available dataset over the past few years have empowered the development of AI technology and attracted a large amount of investment. Traditional AI technology focuses on recognizing patterns and making predictions based on the existing data, however, an emerging subsidiary, Generative AI, is able to generate new and original contents. This session will discuss the ‘hype’ and the ‘reality’ of AI technology and the problems that arise.

Introduction of the Institutions:

JUMO: JUMO is a Pan-African banking as a service platform that predominately extends lending services to those who have been excluded by the traditional financial system.

Akbank: Akbank was founded in 1948 and has a strong presence in the Turkish financial industry as a universal bank. Akbank’s mission is to create sustainable value for all the stakeholders and to deliver innovative and reliable solutions for the customers.

Mercado Libre: Mercado Libre was established in 1999 and is currently the largest e-commerce platform in Latin America. In 2013, Mercado Libre launched its payment solutions, which is a part of the platform’s overall ecosystem.

Strands: Strands is part of the CRIF group. The fintech company provides tools to financial institutions and non-financial institutions to enhance their customer engagement and promote accessible banking.

ANEXT Bank: ANEXT Bank was founded in June 2022 and is one of the newest digital banks in Singapore that mainly serves MSMEs. ANEXT’s mission is to reimagine financial inclusion and to provide accessible financial services to MSMEs in the region, especially through the platforms where the small businesses are present.

Question to all panelists: how do you use AI in your organizations internally and externally to serve the MSME client base?

Carmia Lureman-Norton, Head of Strategic Delivery & CX – JUMO:

JUMO leverages AI to analyze extensive non-conventional datasets, thereby reassessing conventional credit models through the incorporation of non-traditional data sources. Employing this approach, JUMO can approach its potential clientele, 70% of whom represent MSMEs, offering them tailored credit products.

-

With AI technology, JUMO facilitates the provision of unsecured loans to small businesses at rates optimized to their specific circumstances, removing barriers for MSMEs to access finance, such as the absence of credit profile or collateral assets. The technology also mitigates the costs of risks in JUMO’s portfolios. The cost efficiencies empower JUMO to extend its services to previously underserved market segments while concurrently optimizing pricing structures for its existing SME customers.

-

JUMO also has two partners – an ecosystem partner that provides the dataset and an FSP partner that provides the capital for JUMO’s portfolios. The collaboration with both partners harness the analytical prowess of AI, thereby enriching the development of industry and infrastructure.

Burcu Küçükünal, Digital Design and Innovation SVP – Akbank:

Akbank has embarked on a transformative journey that revolutionizes its relationships with the SME customers through digital innovations. The utilization of AI technology has not only simplified the banking experience for its SME customers but also empowered them to make informed financial decisions.

With a digital banking arm serving over 10 million customers, Akbank possesses a considerable client base, ideal for the implementation of AI technologies. The SME customers are eager to adopt the latest digital solutions to streamline their day-to-day commercial activities and manage cash flows effectively. The Akbank LAB actively collaborates with fintechs, start-ups, and other AI solution providers to offer innovative products to its huge customer base.

Akbank has also been leveraging predictive AI models in navigating the complex banking landscape, including risk management, fraud detection, and customer relationship management. Generative AI is a powerful tool for Akbank to automate and augment its banking services. In the future, the bank plans to increase investments in AI-based products and services to further enhance customer experiences, optimize operational efficiency, and foster sustainable growth.

Pablo Zbinden, Head of Credit Business in Brazil - Mercado Libre:

For the past 15 years, Mercado Libre has implemented machine learning technology across its platform. In 2016, the company expanded its services into the financial sector, offering loans to both merchants and consumers.

-

Mercado Libre aimed to provide working capital loans, anticipating a positive impact on an additional 60% of merchants who lacked access to traditional bank loans. This injection of funds would enable small businesses to invest and thrive within the Mercado Libre ecosystem, resulting in increased sales and greater engagement.

-

AI played a key role in enhancing financial inclusion within the Mercado Libre ecosystem. Unlike traditional banks, which primarily rely on conventional data, Mercado Libre possesses extensive information including merchants' sales history, tenure on the platform, business activities, service performance, and interactions with customers. Leveraging both quantitative and qualitative data, Mercado Libre's credit model makes informed decisions, empowering the platform to offer financial opportunities to underserved individuals despite their limited credit history.

-

Mercado Libre has also deployed different segmentation strategies to maximize data utilization. The platform categorizes the merchants by size, industry, sales channel, and region and applies different credit policies that are tailored for the specific segment.

-

In 2023, Mercado Libre introduced its own credit card, reflecting a more comprehensive approach to provide merchants with credit options beyond working capital loans and short-term credit lines.

Luis Rodriguez, Product Evangelist – Strands:

Strands plays a pivotal role as an enabler that assists the financial institutions serve their SME clients. Strands has two main approaches:

-

Provide forecasting models and recommendation systems to assist the SMEs with their financial management. Through these tools, Strands equips SME owners with insights into their cash flow and potential risks, empowering them to make informed decisions.

-

Provide financial institutions with analyses of alternative data and supplementary KPIs for risk evaluation purposes. By complementing the conventional datasets possessed by banks, Strands enables small businesses to access finance more swiftly.

Strands maximizes the value of financial institutions' databases and enriches portfolio insights by harnessing both traditional and alternative data sources.

Kai Qiu, Deputy Chief Executive Officer and Chief Technology Officer - ANEXT Bank:

To ANEXT, AI technology serves two purposes: solving pain points and creating demands. As a subsidiary of Ant Group, technology and innovation is part of ANEXT Bank’s DNA. The bank's AI implementation journey unfolds in two phases: initially focusing on enhancing operational efficiency with AI, followed by leveraging insights for business decisions and risk management. AI is an enabler that ANEXT has integrated across multiple domains and modules within its end-to-end processes, encompassing remote operations, onboarding, KYC, and fraud detection. After two years in operation, ANEXT is ready to embark on a new phase. The bank has been exploring new use cases, such as conversational AI modules and credit modeling. The overarching goal in employing AI is to ensure that the SME customers can enjoy accessible financing.

Summary of the panel discussion

Burcu, can you share with us some examples of how Akbank uses AI technology and collaboration with Strands?

Burcu Küçükünal: Empowered by advanced AI technology and modeling, Akbank aimed to become a financial companion for their clients and started to develop user-friendly services via the mobile app since 2020. Collaborating with both fintech providers and in-house developers, Akbank engineered an engine known as Banking IQ, which engages the consumers by offering 40 unique types of hyper personalized insights, including budget management, cashflow advice, and payment reminder. Akbank generates over 400 million personalized insights annually, fostering effective communication with customers and delivering tangible value. Since the introduction of Banking IQ, there has been a notable 24% increase in customer engagement rate.

Akbank has partnered with Strands to develop an innovative product tailored to serve its SME clients. This collaboration involves the direct integration of Akbank’s mobile app solution with Strands' Business Financial Management (BFM) platform. The AI-powered BFM platform tracks historical and current transaction data, producing cashflow analysis and generating personalized transaction calendars for SME clients. In 2023, Akbank has generated 35 million insights through BFM. Comprising six distinct modules including financial cashflow, financial calendar, cashflow, and scheduled transactions, the platform offers SME consumers a comprehensive suite of functionalities accessible through the Akbank mobile app. Notably, the BFM platform detects abnormal activities, sends reminders for upcoming payments, and alerts users to duplicated transactions and large purchases. Despite the complex algorithm and technologies behind the scenes, the platform maintains a user-friendly interface. The partnership between Akbank and Strands empowers the SME customers with full control over their businesses through a single, integrated platform.

We have just discussed several opportunities presented by AI. Sopnendu, in alignment with your opening remarks, could you elaborate on the potential threats and risks from the standpoint of regulatory authorities?

Sopnendu Mohanty: As a regulator, MAS’ intervention in the industry is not only to establish new frameworks, but also to guide the financial institutions in practice. The Monetary Authority of Singapore (MAS) has introduced the Fairness, Ethics, Accountability, and Transparency (FEAT) principles to encourage responsible utilization of AI technology within financial institutions. However, banks have encountered difficulties in translating these principles into tangible actions, such as demonstrating fairness during software deployment, and ensuring accountability and transparency. Hence, MAS launched a toolkit enabling financial institutions to anticipate the consequences of their AI implementations and assess whether they align with the FEAT principles. With a growing number of financial institutions integrating Generative Artificial Intelligence (GenAI) into their services and products, MAS has amended the framework to encompass seven risk dimensions. Additionally, MAS will soon introduce a toolkit to aid banks in identifying these risks.

Another policy challenge confronting MAS is the utilization of data. Typically, data originates from two channels: banks' proprietary datasets shared within the industry for collective purposes and the exchange of datasets between banks and third parties. This exchange and accessibility of data raise issues such as security. And the availability of data for AI to utilize presents a concern.

Thirdly, the cost of computing remains high, while financial institutions have limited budgets for funding AI-related projects. These institutions may explore options to mitigate costs for data and computing infrastructure, such as utilizing public or hybrid cloud.

Finally, a shortage of talent has been observed in delivering the value of AI within the financial sector. Capacity building is an ongoing endeavor, and financial institutions should recruit more experts to leverage this cutting-edge technology and to enhance their customer experience.

Pablo, you also mentioned fraud detection mechanism at Mercado Libre. How do Mercado Libre identify the right profiles? And how does Mercado Libre manage AI-related risks?

Pablo Zbinden: There are two major challenges associated with using AI technology at Mercado Libre:

-

Bias and fairness of the AI models: AI has the potential to inadvertently perpetuate biases present in the data, resulting in biased outcomes and unfair treatment of specific groups.

-

Lack of transparency: Unlike linear models, understanding the inner workings of algorithms and the creation of different clusters by AI is not straightforward.

To address these two concerns, Mercado Libre implements a comprehensive validation process for its AI models. Prior to deploying any new versions, the company conducts thorough testing to assess how the models perform across various customer segments. It is essential to identify the strengths and weaknesses of each trained AI model.

The AI model serves as a segmentation tool, enabling Mercado Libre to formulate decisions and policies tailored to different customer groups. Nonetheless, instances arise where either data is inadequate or the product is too novel, requiring users to exercise caution in applying the AI models to mitigate inaccuracies. For example, the users can compensate a weak model with a good credit policy to manage the potential risks.

Kai, as a new bank, what are the risks that ANEXT Bank encountered when launched the lending services for the SMEs?

Kai Qiu: When ANEXT Bank introduced lending services for clients previously excluded from traditional banking, it faced the challenge of managing new risks. Embracing AI technology also introduced potential threats like data security breaches, biased decision-making, and concerns about job security. Hence, financial institutions intending to leverage AI must recognize these risks and proactively seek solutions. At ANEXT Bank, the approach to mitigate these risks lies in human intervention, and the bank adheres to the principle of retaining human elements in all procedures when adopting AI.

ANEXT collaborates with partner platforms on embedded finance solutions, requiring both ANEXT and its partners to jointly analyze data and develop suitable financial services and products for customers. Therefore, ANEXT Bank must implement strategies, such as adopting privacy-preserving computing technology, to mitigate data leakage and address privacy concerns while maintaining partnerships with third parties.

As Sopnendu mentioned earlier, there are tools available in the market to assist financial institutions in diagnosing and identifying potential risks associated with the use of AI technology. ANEXT Bank is utilizing Veritas, a toolkit introduced by MAS in 2022, to evaluate its own AI-empowered solutions.

Sopnendu Mohanty: AI is not a completely new tool for the banks; In fact, many financial institutions have employed machine learning and AI technologies long before they recently became mainstream. Regulatory intervention in the financial sector's AI usage actually stemmed from the rising market concerns, particularly regarding the application of AI and individual privacy. Personally, I believe that financial institutions have the capability to utilize AI in a responsible way.

Many SMEs do not have a high-level of data literacy. They often cannot provide data in a required format or quality essential to maximize the power of AI. How do your institutions solve this issue when aiming to extend financial services to the SMEs, considering the potential unavailability of data or the limited data literacy among them?

Carmia Lureman-Norton: JUMO doesn't require SMEs to submit any data. Instead, it leverages the data ecosystem to identify suitable customers using AI models. While JUMO doesn't rely on external digital rating systems, it utilizes the existing interactions between SMEs and their customers on the platform.

In addition, amidst discussions about the biases and threats of AI technology, we may have overlooked the opportunities it presents to mitigate these risks. Firstly, we will eliminate factors such as gender and age that could lead to social discrimination from our AI models. These models assist financial institutions in making decisions based on evidence and past behaviors of SMEs, rather than relying on pre-defined notions of risk perceived by bankers.

Luis, when Strands build solutions, how does it bridge the gaps for SMEs lacking credit bureau scores or necessary data?

Luis Rodriguez: Like JUMO, Strands endeavors to remove the need for SMEs to provide data and instead utilizes alternative data sources. For example, if customers are newly established without credit history, they can opt to grant Strands access to their accounting system. Even if these SMEs do not have readily available data, they likely utilize multiple platforms for their daily operations. With permission from these small businesses, Strands can access third-party data and furnish its analysis to lenders.

Mercado Libre has an extensive database. How does it cater to even more underserved groups, such as women-owned businesses and the SMEs in rural areas?

Pablo Zbinden: Mercado Libre has a large dataset, and we have been focusing on searching for new data sources after the pandemic. And for the unbanked and underbanked segments, Mercado Libre applies a different strategy that has been proven successful in China by Alibaba. Initially, the lender extends a modest loan to the SMEs and monitors their behaviors to determine eligibility for larger loan amounts. However, those demonstrating reliability ultimately repay and become long-term participants on the platform, as Mercado Libre offers them their first credit opportunity. Merchants can utilize the credits within the ecosystem, thereby attracting more users to the digital wallet and e-commerce platforms. Consequently, the impact is not solely confined to the credit aspect but extends across the entire Mercado Libre ecosystem.

What kind of leadership is required among the institutions to foster the AI-driven and data-driven culture?

Sopnendu Mohanty:

-

Financial institutions should decide to allocate additional capital now, not only for experimentation but also for the deployment of AI-empowered solutions.

-

Leadership should invest time in building the capacity of various departments within the institution to comprehend the potential of AI and explore how it can be employed responsibly.

-

Another obstacle confronting the industry is the challenge of developing a public good accessible to all stakeholders. I encourage the leadership to be open for collaboration and to find a constructive way to share data for the collective benefit. With concerted efforts across all sectors, institutions can harness AI more intelligently.

Burcu Küçükünal: The financial intuitions operate in a highly regulated environment. Integrating emerging technologies like AI requires compliance with various regulatory frameworks, which may be time-consuming. Hence, we must create space for teams and allocate efficient time and resources to such projects.