Blog

Increasing SME Access to Working Capital: E-invoicing and Digital Credit Infrastructure

Welcome to our latest blog post where we delve into the fascinating world of SME banking.

The adoption of e-invoicing is increasing rapidly, driven by the digitization of business processes and, in some markets, by government mandates. Digital invoice repositories, whether third-party platforms or government-operated systems, are forming part of the essential Digital Public Infrastructure, that not only enhance business operations and tax compliance but also significantly improve access to finance for SMEs.

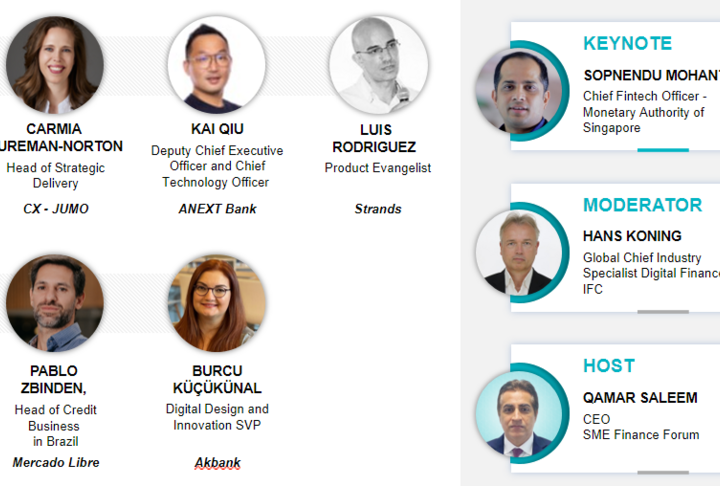

During our webinar on December 5th, our guest speakers discussed the intersection of credit infrastructure and digital invoicing for SMEs and highlighted the transformative potential of digital credit infrastructure in expanding access to finance for SMEs.

Digital infrastructure for SME financing

The IFC, together with SECO, have been instrumental in developing robust credit infrastructure in developing countries: legal frameworks for secured lending, credit information, asset recovery, and digital collateral registration.

Their work around e-invoices is focusing on:

Authentication: Ensuring the authenticity of the invoice being financed through validation by tax authorities.

Confirmation: Verifying the receipt of the invoice and goods, and the buyer's willingness to pay.

Registration: Providing notice to the market that the electronic invoice has been financed or assigned to a specific financial institution.

Electronic Assignment: Facilitating the transfer of the invoice to the financing entity.

Non-Revocability of Payment: Ensuring that once the invoice is assigned, payment must go to the financing institution.

Custody and Control: Enabling the financing institution to hold and control the invoice throughout the value chain until payment is received.

Case Studies and Practical Applications

The case studies presented highlight the potential of digital infrastructure to promote financial inclusion and improve access to finance for SMEs. These companies have developed platforms that leverage electronic invoicing and digital systems to streamline financing processes, mitigate risks, and provide innovative solutions for SMEs.

-

Liquitech, a Colombian fintech platform that provides a comprehensive solution for SMEs, connecting them with investors and facilitating the financing of invoices. Liquitech leverages the robust e-invoicing system in Colombia, which allows for the verification and tracking of invoices.

-

Velotrade matches SMEs seeking working capital with institutional investors through a digital platform. This platform facilitates the origination, distribution, risk control, collection, and recovery processes, making it easier for SMEs to obtain financing.

-

The Association of Financial Institutions in Turkey: A semi-governmental organization that has established a receivable recording center and a trade chain finance system to prevent double assignment and to provide SMEs with access to funding facilities.

-

Drip Capital uses large language models and AI to verify invoices, shipping bills, and other documents. This automation reduces the risk of fraud and ensures that financing is only provided for genuine transactions.

-

The benefits of those digital infrastructures for SME financing are numerous:

Improved Access to Finance: Digital platforms provide SMEs with access to alternative sources of funding, particularly those that may not qualify for traditional bank loans.

Faster and More Efficient Processes: Digitalization streamlines the invoice financing process, reducing the time and cost associated with traditional methods.

Enhanced Transparency and Security: Platforms provide a secure and transparent environment for invoice financing, with robust risk management and fraud prevention measures.

Data-Driven Decision Making: Platforms leverage data analytics to assess risk, optimize pricing, and improve the overall efficiency of invoice financing.

Challenges and Opportunities

Despite the significant progress made, there are still challenges to be addressed.

Encouraging Digitization Among SMEs: One major hurdle is the lack of digitization among some SMEs, which can hinder their ability to participate in digital financing ecosystems. Financing potential encourages SMEs to digitize their operations and adopt e-invoices, with education and support crucial for adoption.

Regulatory Environment: The regulatory environment for invoice financing can vary across jurisdictions, requiring platforms to navigate complex legal and compliance requirements.

Market Development: The market for invoice financing is still evolving, with opportunities for platforms to expand their reach and develop new products and services.

Conclusion

The confluence of digital technology and credit infrastructure holds great promise for SMEs worldwide.

By digitizing collateral registration systems and creating new digital financial instruments, lenders can more effectively secure loans against a wider range of assets.

This not only reduces the risk for lenders by increasing the range and amount of information available about borrowers but also makes it easier for SMEs to access the financing they need.