Blog

Exploring the Future of SME Banking: Insights from IBM's Latest Research

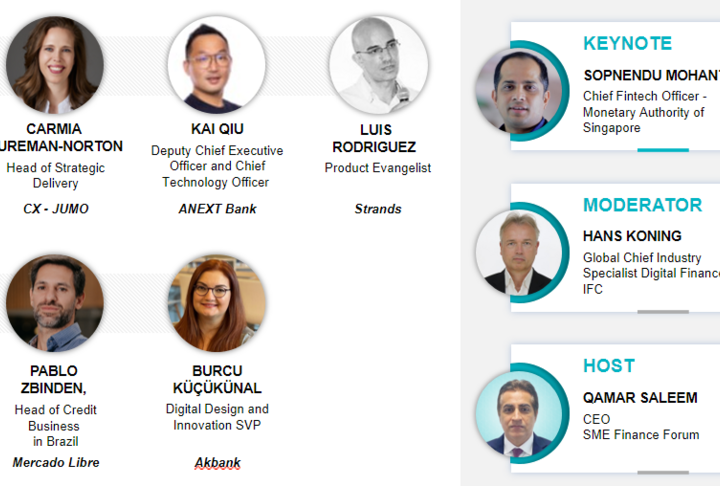

Welcome to our latest blog post where we delve into the fascinating world of SME banking. During our latest webinar on November 25, we invited Paolo Sironi to share some of the key findings from IBM's Institute for Business Value (IBV)’s recent study, which features contributions from the SME Finance Forum.

Together with four banking executives from Nubank (Brasil), Starling Bank (UK), Wema Bank (Nigeria), and Intesa Sanpaolo (Italy) – invited to comment on IBV report’s results - we learned how banks need to understand and integrate into the SME ecosystem.

IBV’s innovative research approach

The study involved interviews with nearly 600 executives from financial institutions with over $10 billion in total assets, as well as more than 1200 SME owners. This comprehensive approach allowed IBV to compare the opinions of SME owners with those of bankers, uncovering a "white space" that is crucial for future strategies.

The SME Banking gap

The data reveals a significant gap between what bankers think and what SMEs demand and expect from financial institutions.

While SMEs seek tailored financial solutions and support, banks often prioritize compliance, fraud monitoring, and cost efficiency, leading to a disconnect between their needs and the services offered.

-

SMEs value banks that are part of their ecosystem, offering tailored services and understanding their sector.

-

Digital apps, branch proximity, and dedicated managers are also important but secondary to ecosystem integration.

- SMEs prioritize support for financial and business planning, market analysis, and fast access to funds. Banks often misjudge this, focusing more on credit score guidance and flexible funding options.

- Instant payments and analysis of operating expenses are crucial for SMEs. There is a significant interest in super apps that integrate non-banking and banking services to streamline operations.

The SME bankers’ blueprint: digitalization and localization

By digitalizing processes, banks can save time and reduce the hassle for their customers. For instance, tasks like tax submissions, loan applications, and business plans can be streamlined through technology.

In addition, AI and generative AI can offer tailored advice, predictive financial modeling, and 24/7 support.

While digitalization offers numerous benefits, it also comes with its own set of challenges. Issues like biases in data sets, the accuracy of AI-generated information and high implementation costs need to be carefully managed, especially in a highly regulated environment.

Despite these challenges, the potential for technology to revolutionize SME banking is immense. By leveraging technology and advances in AI to provide efficient, tailored services that save time and support business growth, banks can not only improve their services but also gain a competitive edge in this dynamic market.

The SME market is vast and diverse, requiring tailored and localized onboarding approaches.

The importance of digital adaptation for instance varies by country and region. For example, branch proximity remains significant in the UK, while in Brazil, digital solutions like Pix have revolutionized payments.

Financial literacy and digital skills, gained through training and mentorship programs, are also essential for SMEs to leverage banking services effectively.

For more detailed insights, you can download the IBM IBV’s report, and the conversations held with industry leaders in their series “Banking for SMEs: The voice of the Makers”.

The webinar’s recording is also available for those who missed the session.