Publications

Dec 15, 2024

Digital Finance Developments offers insights into timely topics in digital finance. This edition examines new efforts to coordinate AI policy across jurisdictions and the creation of new venues for this work, as policymaker focus shifts toward international cooperation. This piece explores how: Governments and international organizations have...

Digital Transformation

Nov 27, 2024

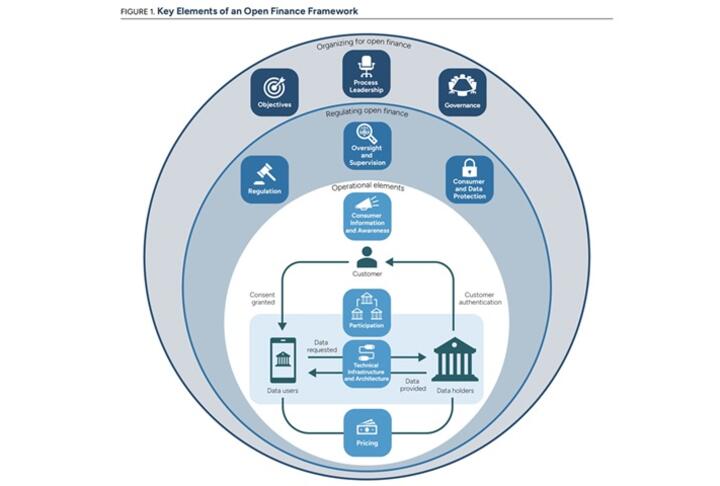

November 2024 Highlights Open finance is a financial innovation that facilitates customer-permissioned access to and use of customer data held by financial institutions to provide new and enhanced services and develop innovative business models. Open finance frameworks can spur innovation, improve competition, enhance customer empowerment, and...

Digital Transformation

Fintech

Nov 05, 2024

A follow-up series of Banking for small and medium enterprises by IBM Institute for Business Value Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world’s workforce, and contributing 50% to global GDP.* Despite their significance, SMEs face many...

Digital Transformation

Oct 29, 2024

A white paper outlining one of Mastercard's Point of View (POVs) on SMEs. Many entrepreneurs eventually outgrow their small business roots to become middle market firms. This fast-growing, resilient sector of the global economy, employing 50 to 250 employees, is responsible for a large portion of commercial spending — $24.2 trillion in B2B spend...

Sustainable Finance

Oct 20, 2024

As the world faces the urgent challenge of climate change, financial institutions, especially Public Development Banks (PDBs), are crucial in helping Small and Medium Enterprises (SMEs) transitioning to a low-carbon economy. This publication reviews the different solutions offered by 16 Public Development Banks (PDBs) to support the...

Fintech

Oct 20, 2024

October 2024 Highlights: Inclusive fintech startups are early-stage, venture-backed enterprises creating innovative credit products for microenterprises in emerging markets, which holds great promise for the future of microenterprise finance. In this note, we highlight strategies employed by fintech startups that benefit microenterprises via three...

Sustainable Finance

Oct 04, 2024

Mobilizing Investment for the Developing World's Sustainable Cooling Needs Rising global temperatures mean demand for cooling in homes, workplaces, and across supply chains is accelerating, particularly in developing economies where the impact of extreme heat is already being felt most acutely. Heat-related deaths are running at an annual average...

Financial Inclusion

Fintech

Oct 04, 2024

June 5, 2024 | Washington DC EMpact is helping build AI Labs within our partner organizations as a part of our effort to accelerate digital transformation of agricultural value chains and relevant financial services. Today, EMpact published a new white paper that delves into the pivotal role of Artificial Intelligence (AI) in propelling financial...

Data Analytics

Fintech

Oct 04, 2024

Small and medium enterprises face many challenges within a rapidly evolving economic landscape—one that demands innovative banking solutions. Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world's workforce, and contributing 50% to global GDP. But...

Supply & Value Chain Finance

Jul 25, 2024

Supply Chain Financing (SCF) is becoming an increasingly common vertical within the banking industry. The global credit crisis of 2008 forced trade finance seekers to look for alternatives as liquidity in supply chains became a major concern for businesses. This spurred an increased demand for supply chain financing as businesses worked to...

Data & Cybersecurity

Digital Financial Services

Jul 15, 2024

AI Takes Center Stage: Survey Reveals Financial Industry’s Top Trends for 2024 The world’s leading financial services institutions spotlight where AI is providing the best return on investment. January 11, 2024 by Kevin Levitt The financial services industry is undergoing a significant transformation with the adoption of AI technologies. NVIDIA’s...

Jul 11, 2024

The recent McKinsey Global Institute report A microscope on small businesses: Spotting opportunities to boost productivity estimated that micro-, small, and medium-size enterprises (MSMEs) account for two-thirds of business employment in advanced economies— and almost four-fifths in emerging economies—as well as half of all value added.1 In this...

Data & Cybersecurity

Payments

May 07, 2024

Summary Focus Advances in digital technology have transformed people's lives in recent decades. But large swathes of the financial system are stuck in the past. Many transactions still take days to complete and rely on time-consuming clearing, messaging and settlement systems and physical paper trails. Improving the functioning of the financial...

Financial Inclusion

May 07, 2024

By Anu Madgavkar , Marco Piccitto , Olivia White , María Jesús Ramírez , Jan Mischke , and Kanmani Chockalingam MSMEs are vital for growth and jobs, but struggle with productivity. The route to higher productivity lies in creating a win-win economic fabric for all companies. At a glance Micro-, small, and medium-size enterprises (MSMEs) form the...

Digital Financial Services

Apr 15, 2024

Financial makers discuss how to reimagine banking with embedded finance solutions that deliver financial services whenever and wherever they’re needed. A new generation of financial thinkers and makers is reimagining the conventional bank. Empowered by technology and a youthful hunger for change, they’re determined to make banking easier, more...

Governance

Data & Cybersecurity

Apr 15, 2024

The game-changer: How generative AI can transform the banking and financial sectors The most essential question of the moment: how can AI help address and course-correct banks’ productivity and financial performance? Following the astonishing rise of generative AI, artificial intelligence has seized the world’s attention. Executives are either...

Digital Transformation

Apr 15, 2024

Access to affordable finance poses a persistent challenge for micro, small, and medium-sized enterprises (MSMEs) worldwide, inhibiting their potential growth and the economic development of countries that are reliant on these businesses. The rise of the digital economy has opened up new pathways for financing, but has also made digital...

Fintech

Payments

Apr 15, 2024

Summary: - Regional focus: the report foretells a surge in interest from fintechs towards SMEs in Latin America by 2024. - Innovation opportunities: it highlights the potential for innovation within the industry and identifies key areas where solutions can reshape the fintech landscape to better serve SMEs. - Targeted countries: discover which...

Gender Finance

Fintech

Mar 21, 2024

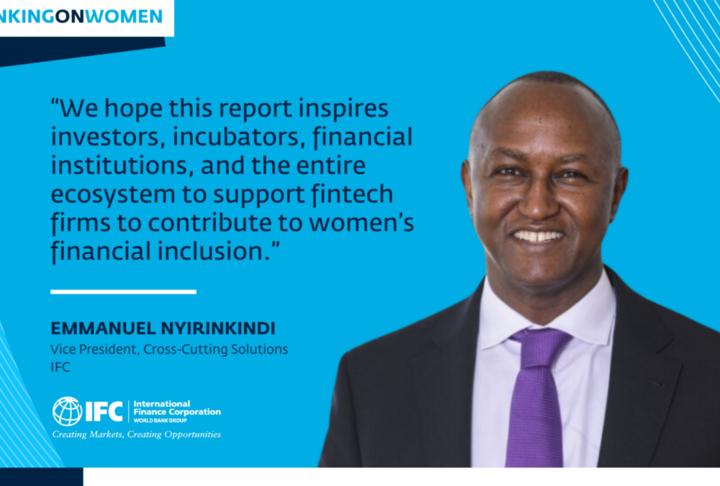

Fintech and digital financial services have been considered a game-changer for women's financial inclusion and economic empowerment. Until now, there has been limited research that quantifies the degree to which fintech firms are actively addressing women's financial inclusion and the specific strategies that are showing success. To fill this gap...

Financial Education

Financial Inclusion

Fintech

Feb 14, 2024

This paper investigates strategies of European microfinance institutions (MFIs) and inclusive FinTech organisations to address financial and digital illiteracy among vulnerable customers. It reveals that both MFIs and FinTech organisations focus on personalised financial education, training and coaching but adopt distinct strategies in their...

Sustainable Finance

Fintech

Feb 12, 2024

Slowing economic growth, rising inflation, and climbing interest rates are straining the business models for inclusive fintechs, creating significant uncertainty and new funding challenges. For the past four years, the Inclusive Fintech 50 (IF50) global innovation competition identified and elevated cutting-edge, emerging inclusive fintechs...

Alternative Financing

Feb 02, 2024

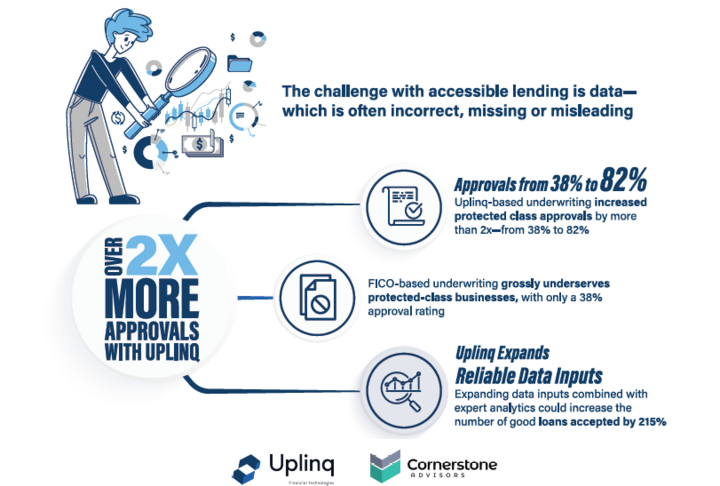

Uplinq Financial Technologies , the first global credit decisioning support platform for small business lenders, announced the publication of “ Fair and Accessible Credit for Small Businesses: A Guidebook for Financial Institutions ,” a white paper that blueprints how banks and credit unions can leverage AI technology and alternative data to...

Digital Transformation

Jan 23, 2024

With the rapid advancements in computational power, the decades-long vision of using and deploying artificial intelligence (AI) has become a reality. The technology’s swift development has allowed it to transform every walk of life, as it is a wide-ranging tool that enables people to rethink how to analyze data, integrate information and use the...

Financial Inclusion

Dec 22, 2023

The Inclusive Finance India Report provides a comprehensive review of the progress of financial inclusion in the country, tracking performance, highlighting achievements, and flagging gaps and issues that need to be addressed at the levels of both policy and practice. It is a much-awaited annual reference document for policymakers, investors,...

Sustainable Finance

Dec 01, 2023

Switching to greener technologies in construction and operation of buildings and materials, combined with more climate-friendly capital markets, could reduce the construction value chain’s carbon footprint 23 percent by 2035, while creating investment opportunities in emerging markets, according to a major report from the International Finance...

Sustainable Finance

Policy & Regulation

Nov 22, 2023

Addressing the climate crisis requires the net zero transition of millions of SMEs globally. SMEs have a significant aggregate environmental footprint and need to adopt cleaner business models. As eco-entrepreneurs and eco-innovators, they also have a key role to play in devising innovative climate solutions. Access to finance is essential for SME...

Financial Education

Financial Inclusion

Gender Finance

Supply & Value Chain Finance

Digital Transformation

Nov 02, 2023

Digitizing the MSME ecosystem through e-commerce, the gig economy, and digital MSME business services has an impact on the digital-transformation of small businesses. These digital advancements have reshaped the landscape for MSMEs and enabled new opportunities for growth and expansion. The rise of digitally enabled new solutions for MSMEs, such...

Supply & Value Chain Finance

Nov 01, 2023

With over EUR 300 billion financed to SMEs as well as to larger corporates, the global factoring and receivables finance Industry is is providing much needed liquidity to the heart of the economy to support economic growth, export and employment. How does the industry evolve and adapt to challenges such as fraud, changing regulations and ESG...

Policy & Regulation

Nov 01, 2023

The Recommendation on SME financing was adopted by the OECD Council meeting at Ministerial level on 8 June 2023 on the proposal of the Committee on SMEs and Entrepreneurship (CSMEE). The Recommendation aims to support Adherents in their efforts to enhance SME access to a diverse range of financing instruments. It supports the development of...

Financial Inclusion

Governance

Oct 24, 2023

The "OECD Financing SMEs and Entrepreneurs Scoreboard: 2023 Highlights" document SME and entrepreneurship financing trends, conditions and policy developments. The report provides official data on SME financing in close to 50 countries, including indicators on debt, equity, asset-based finance and financing conditions. Data for 2021 are...

Sustainable Finance

Payments

Oct 16, 2023

The B20 , Business at OECD (BIAC) and the International Organisation of Employers (IOE) released a joint paper, underlining the need to raise business productivity by effectively addressing the private sector’s working capital requirements. Released in the margins of the B20 India Summit, the three leading private sector organizations recommend to...

Financial Inclusion

Digital Financial Services

Digital Transformation

Sep 25, 2023

Background: The India G20 Presidency has prioritized the development of an open, inclusive and responsible digital financial ecosystem based on the presence of a sound and effective digital public infrastructure (DPI) for the advancement of financial inclusion and productivity gains. Builds on the work and achievements from previous presidencies...

Financial Inclusion

Policy & Regulation

Data Analytics

Sep 25, 2023

Small and Medium-sized Enterprises (SMEs) play a vital role in the global economy, yet they often face challenges due to limited access to financing. To address this issue, we propose the implementation of Prosperity Data Networks (PDNs), a cutting-edge tool that leverages Artificial Intelligence (AI). PDNs are AI-powered, community-controlled and...

Financial Education

Sustainable Finance

Sep 25, 2023

To help financial institutions to translate sustainable finance principles to the operations they have with MSMEs, IFC Green Bond Technical Assistance Program (GB-TAP) has developed the Sustainable MSME Finance Reference Guide. This first-of-its-kind Guide sets out a practical approach for financial institutions in emerging markets on how to...

Financial Inclusion

Operational Risk

May 22, 2023

The EIF VC Survey and the EIF Private Equity Mid-Market Survey (the largest combined regular survey exercises among General Partners on a pan-European level) provide an opportunity to retrieve unique market insights. This publication is based on the results of the 2022 waves of these two surveys and examines how the Russian offensive war against...

Digital Financial Services

Apr 24, 2023

Strands, a CRIF company, and PwC launched a report with an in-depth analysis on how customer habits, Open Finance and new players entering the financial services arena are revolutionizing the Digital Banking context. The Digital Banking context is shifting, as new players are entering the financial services arena and threatening the position of...

Financial Inclusion

Policy & Regulation

Digital Financial Services

Fintech

Payments

Mar 13, 2023

The Roadmap for Enhancing Cross-border Payments is a priority initiative of the G20. Much has been accomplished during its first two years, including agreement on a set of outcome targets endorsed by the G20 in October 2021. The work in 2021 and 2022 has focused on establishing the foundational elements of the Roadmap and beginning to pivot from...

Financial Inclusion

Gender Finance

Digital Financial Services

Fintech

Mar 06, 2023

This paper examines the role of Fintech in financial inclusion. Using Global Findex data and emerging fintech indicators, it finds that Fintech has a higher positive correlation with digital financial inclusion than traditional measures of financial inclusion. In the second stage of their empirical investigation, the authors examine the key...

Financial Inclusion

Equity

Gender Finance

Policy & Regulation

Mar 01, 2023

This working paper examines the current academic literature on access to finance for female entrepreneurs and female-led enterprises. It covers two main financing markets: credit and venture capital (VC). The paper finds wide consensus in the academic field that gender-related credit and VC gaps exist in Europe. It also collects some of the most...

Financial Inclusion

Feb 13, 2023

The COVID-19 pandemic has accelerated digital financial inclusion with increased digital financial services. According to the 2021 Global Findex Database, global account ownership has increased from 51% of the world’s population in 2011 to 76% in 2021. Notwithstanding the gains, about 25% are still outside the formal financial system. More robust...

Fintech

Jan 17, 2023

Nearly 500 million micro and small enterprises (MSEs) are estimated to be operating around the world. Access to credit and other financial services is critical to the growth and sustainability of these businesses, and consequentially to the low-income and vulnerable populations which rely on MSEs for their livelihoods. Yet despite decades of...

Financial Education

Aug 13, 2022

The EIF Business Angels Survey, together with the EIF VC Survey and the EIF Private Equity Mid-Market Survey (the largest combined regular survey exercises among GPs and Business Angels on a pan-European level) provide an opportunity to retrieve unique market insights. This publication is based on the results of the 2021/22 EIF Business Angels...

Financial Inclusion

Payments

Jul 25, 2022

In the coming years, real-time payments are set to increase exponentially and by 2026, are forecasted to account for 26% of the total electronic payments. With certain growth ahead, governing bodies and payment regulators play a crucial role in advancing their country's payment systems to create an ecosystem that unlocks economic growth and...

Rural & Agriculture Finance

Mar 29, 2022

This report takes stock of the increasingly pluralistic landscape of agricultural small- and medium-sized enterprise (agri-SME) finance in sub-Saharan Africa and Southeast Asia, with the aim to establish a new perspective on the market overall - sizing and segmenting the market in new ways, reflecting on the rapidly accelerating imperative around...

Credit Risk & Scoring

Mar 24, 2022

Latest Banking Circle white paper examines pain points faced by banks and FinTechs as a result of de-risking strategies According to new research commissioned by Payments Bank, Banking Circle, big bank de-risking is significantly hampering the efforts of many Financial Institutions to deliver services that empower financial inclusion. The root...

Alternative Financing

Guarantees

Mar 01, 2022

Asset Finance is evolving rapidly, and many legacy systems are failing to keep up with the changing needs of providers and their customers. Read about: A comprehensive overhaul of contract management The connected contract management system (CMS) Better experiences, inside and out New standards of efficiency Download HPD Lendscape new white paper...

Fintech

Payments

Feb 22, 2022

The evolution of digital money is taking hold, as policymakers and central bankers explore the idea of government-backed assets on blockchain called Central Bank Digital Currency, or CBDCs. More than 90 countries are either researching or developing CBDCs. Many see the direct advantages for their citizens and economies: decreased dependence on...

Sustainable Finance

Governance

Feb 01, 2022

Blue Finance is an emerging area in Climate Finance with increased interest from investors, financial institutions, and issuers globally. It offers tremendous opportunities and helps address pressing challenges by contributing to economic growth, improved livelihood, and the health of marine ecosystems. The ocean economy is expected to double to $...

Equity

Jan 31, 2022

Saudi Venture Capital Company (SVC) is a Government VC established in 2018 by Monshaat as part of the Financial Sector Development Program (FSDP) to stimulate venture investments by investing in funds as well as co-investing with angel groups for the primary goal of minimizing financing gaps for startups and SMEs by investing SAR 2.8 Billion ($750...

Financial Education

Non Financial Services

Jan 27, 2022

As the world works towards food system transformation, the role of various stakeholders serving small farmers and agri-SMEs has gained increasing importance. The market of business development services (BDS) for agri-SMEs has grown significantly in the last decade, with more organizations providing technical, financial, and capacity-building...

Financial Inclusion

Data Analytics

Payments

Jan 27, 2022

Biometrics technology can enhance the convenience and security of digital payments, and many observers have pointed to the potential benefits of using it to advance financial inclusion. This paper analyses how, and under what conditions, biometrics can facilitate financial and digital inclusion for lower income and unbanked populations and...

Alternative Financing

Covid-19

Jan 26, 2022

This publication "Receivables Finance: The Voice of the Industry", prepared by member HDP Lendscape , one of the world’s leading software providers for Asset Based Finance (ABF), dives into the following challenges and opportunities on the minds of industry leaders: Pandemic recovery New lending propositions and the rise of independents The...

Covid-19

Jan 24, 2022

The current crisis has put a spotlight on workout frameworks, especially out-of-court or hybrid procedures, which can provide flexible and cost-effective solutions to address firms’ liquidity and solvency issues while reducing the burden on courts. Some countries implemented reforms to their corporate workout frameworks in the wake of the COVID-19...

Financial Inclusion

Policy & Regulation

Digital Transformation

Jan 20, 2022

This reading deck describes three regulatory approaches used by policy-makers to regulate digital banks. It has a focus on harnessing the potential of digital banks to bring welcome competition and innovation to the banking sector and advance financial inclusion. It will help policy makers, especially in emerging markets and developing economies,...

Digital Transformation

Payments

Jan 19, 2022

A review of literature on digital payments’ impact on micro and small businesses reveals how digitalization is changing this segment, and why understanding this transition is key to inform effective public and private strategies and investments to accelerate the success of the small business sector as a whole. Read more about new strategies for...

Covid-19

Digital Transformation

Fintech

Nov 24, 2021

The intensity of the COVID-19 shock has clearly varied among MSMEs. On a more positive note, the COVID-19 crisis has accelerated the digitalization of many MSMEs and fostered their participation in digital ecosystems and marketplaces. In response to the emergency, governments have quickly introduced a wide range of policy and regulatory measures...

Gender Finance

Aug 09, 2021

Across the globe, e-commerce is thriving. The e-commerce market in Africa is expected to reach $84 billion by 2030. The number of online shoppers has increased by an average of 18 percent every year since 2014, with similar growth anticipated over the next decade. The IFC’s latest report Women and E-commerce in Africa is the first large-scale use...

May 07, 2021

In this publication, you will read about the SME Finance Forum highlights in 2020. Extract from the Foreword: The year 2020 has been a challenging one for all of us. We have seen the COVID-19 pandemic throw the world into uncertainty. In this context, we are proud to have launched new services to help our members deal with this extraordinary...

Policy & Regulation

Covid-19

Feb 23, 2021

EIF Working Paper 2021/071: EIF Venture Capital, Private Equity Mid-Market & Business Angels Surveys 2020: Market sentiment – COVID-19 impact – Policy measures 2020 was an unprecedented and remarkable year, and also a year with high uncertainty and increased information needs. The EIF VC Survey, the EIF Private Equity Mid-Market Survey, and...

Digital Financial Services

Fintech

Jan 26, 2021

Jobs to Be Done and cultural insights on what business owners need and the digital services that will help them meet their goal. What you will learn from that report: The entrepreneurial mindset and inspirations The growth opportunity in the SMB market How to design truly digital services for SMBs How to create cultural relevant financial brands...

Supply & Value Chain Finance

Jan 21, 2021

Micro-, small-, and medium-sized enterprises (MSMEs) face significant challenges in obtaining the financing and other resources they need to thrive. IFC, as a member of the World Bank Group, is committed to supporting these businesses by mobilizing private and public sector stakeholders to expand financial inclusion. Digital integration of “...

Covid-19

Jan 20, 2021

Sub-Saharan Africa was hit hard by the COVID-19 shock in 2020, experiencing the first recession in roughly thirty years. However, the impact of the public health crisis and pandemic-induced global recession has been less severe than in-itially feared, and weaker than in other EM regions. This is the result of commodity prices recovering faster...

Policy & Regulation

Credit Risk & Scoring

Jan 12, 2021

In recent years, as more and more regulators have begun to assume the role of supervision and oversight over credit bureau(s), the World Bank Group has supported supervisors in understanding and carrying out their duties as it relates to this role. The WBG has supported the development of the credit bureau supervisory framework and the capacity to...

Policy & Regulation

Credit Risk & Scoring

Jan 08, 2021

Coordination between secured transactions law and rules regulating financial products and institutions is of primary importance to support establishing a sound and inclusive credit ecosystem. This Primer illustrates why coordination between secured transactions law reforms and prudential regulation is needed; introduces the rationale and key...

Non Financial Services

Jan 06, 2021

After a busy year, working with thousands of entrepreneurs across Africa in our ‘new world’, the African Management Institue (AMI) has been thinking deeply about the future of business development support, and how the crisis brought about by Covid-19 might in fact open up new opportunities to serve more SMEs, more effectively. Their new report – ‘...

Guarantees

Jan 01, 2021

Lending based on movable assets is much more common in developed markets. Through the work of the World Bank Group and the International Finance Corporation, the use of lending based on movable assets continues to expand throughout the globe. Many best-practice examples can now be found in emerging markets such as Mexico, Colombia, Peru, Vietnam,...

Non Financial Services

Policy & Regulation

Dec 06, 2020

IFC had a strong year in spite of the pandemic. They committed $22 billion in long-term finance—an almost 15 percent year-on-year increase—including $11.1 billion invested for their own account. In addition, short-term financing commitments, including trade finance, totaled $6.5 billion: a 12 percent increase compared with the previous fiscal year...

Financial Education

Dec 04, 2020

To celebrate the new decade, this year’s Global SME Finance Forum looked much farther forward, to imagine where we might be in SME financing a decade from now. We tested the limits of our prescience by predicting how products, delivery channels, institutions and enabling environments might look 10 years from now. Following our practice of...

Islamic Banking

Nov 24, 2020

We are proud to share our member Islamic Corporation for the Development’s (ICD) Business Resilience Assistance for Value-adding Enterprise (BRAVE) project. ICD’s Industry and Business Environment Support (IBES) team initiated the BRAVE concept. The project was designed through joint efforts between ICD and the Small and Micro Enterprise Promotion...

Financial Inclusion

Nov 18, 2020

The Development Research Group at World Bank organized a talk on Bank lending for inclusive growth on November 17th, 2020 with speakers Claudia Ruiz-Ortega and Mario Guadamillas. You can watch the session recording HERE. Session Brief Bank lending is a key driver of economic growth. However, large inefficiencies remain—particularly in developing...

Gender Finance

Nov 09, 2020

We are delighted to share the ‘How to Invest With A Gender Lens?’, a guide created by Value for Women . The guide offers multiple concrete pathways for investors who want to keep inclusion at the core of their efforts in these important times of Covid-19 pandemic. Gender lens investing is the deliberate incorporation of gender factors into...

Trade Finance

Nov 06, 2020

The global economy is going through unprecedented times. The COVID-19 pandemic has shaken the world, threatening the lives and livelihoods of millions of people in both developed and developing economies, with a particularly devastating impact on small businesses. World trade plummeted in the first half the year, and despite signs of trade...

Trade Finance

Nov 02, 2020

We are delighted to launch the ‘Trade Finance Explained: An SME Guide for Importers and Exporters’ along with the Federation of Small Businesses (FSB), The Institute of Export & International Trade (IOE&IT), International Trade Centre (ITC), Forum of Private Business (FPB), and Trade Finance Global (TFG). What's the SME Trade Finance Guide...

Credit Risk & Scoring

Oct 15, 2020

The importance of credit reporting systems to the global financial system has been increasing over time. Robust credit reporting systems can promote not only access to affordable and sustainable credit for individuals and companies but also financial stability and economic growth. Credit reporting service providers (CRSPs) have been at the...

Credit Risk & Scoring

Oct 15, 2020

The main objective of this Knowledge Guide is to provide guidance to the World Bank Group (WBG) staff, donor institutions, government officials and other practitioners on the objectives and implementation of secured transactions reforms, as well as the factors that affect the implementation. The Knowledge Guide considers the experiences learned in...

Gender Finance

Oct 06, 2020

IFC and member FMO - Dutch entrepreneurial development bank has launched a report today on how non-financial services are the key to unlocking the growth potential of women-led businesses. The report highlights how women SME such as Patricia Mwangi’s business in Kenya benefit from non-financial services. Download the report> http://wrld.bg/...

Covid-19

Sep 29, 2020

The treatment of credit data during a crisis has potential impact on the integrity of the credit reporting system and ultimately the financial markets. Inadequate and untimely data reduces the reliance placed by credit providers on the credit reporting system and can lead to credit rationing, increase in the cost of credit and exclusion of...

Credit Risk & Scoring

Sep 24, 2020

This third edition of the Credit Reporting Knowledge Guide, like the two earlier editions, disseminates knowledge on best practices in credit reporting development, based on the experiences of the World Bank Group. Since the launch of the program, the World Bank Group has helped to develop favorable credit reporting environments in many countries...

Youth Entrepreneurship

Sep 14, 2020

Four in 10 people, or 42 percent, of the world’s population are under the age of 25. Globally, an estimated 70.9 million youth were unemployed in 2017. Thus, job creation and economic growth through private sector development have become primary areas of focus for policymakers around the world. As more youth enter the workforce, they are known to...

Covid-19

Sep 11, 2020

B20 and Business at OECD launch “GVC Passport” concept on Financial Compliance to Reinvigorate Firms’ Growth Post-COVID-19 The Business 20 (B20), the official voice of the global business community across G20 members, and Business at OECD launched a joint conceptual policy proposal that focuses on reducing barriers that firms encounter in their...

Aug 28, 2020

Member EIF has issued two working papers as a result of a research project on “Measuring Microfinance Impact in the EU. Policy recommendations for Financial and Social Inclusion” (MeMI). The project was initiated and supervised by the EIF and was funded by the EIB Institute under the EIB-University Sponsorship Programme (EIBURS). The aim of this...

Aug 24, 2020

[REPORT LAUNCH] As part of the GPFI implementing partners, the United Nations Task Force on Digital Financing on the Sustainable Development Goals has launched the report: “People’s Money: Harnessing Digitalization to Finance a Sustainable Future”. New York City, 26 August - A new report launched today, “People’s Money: Harnessing Digitalization...

Jul 30, 2020

This publication is a research paper prepared by Dr. Randa Al-Yafi, Ph.D (Associates Professor) at College of Business Administration, Management Department, King Saud University, in Riyadh, Saudi Arabia (reviewed and approved by Kafalah GD). The research is showing some backgrounds of the SME sector and highlighting Kafalah role and achievements...

Gender Finance

Jul 28, 2020

Digital financial services have expanded opportunities for millions of women across the globe. More than 240 million more women now have an account with a financial institution or mobile money service, compared to 2014.1 Through this increased engagement in the formal economy, women’s resilience to financial, economic and health shocks is...

Digital Financial Services

Jul 22, 2020

Access to finance is a critical barrier for SMEs to start, sustain and grow their businesses. About half of formal SMEs do not have access to formal credit, and instead rely on internal funds, or cash from friends and family, to launch and initially run their business. An extensive survey of SMEs in 135 countries showed that access to finance was...

Gender Finance

Youth Entrepreneurship

Digital Financial Services

Jul 19, 2020

The G20 High-Level Policy Guidelines on Digital Financial Inclusion for Youth, Women, and SMEs document was produced by the G20 Global Partnership for Financial Inclusion (GPFI) in 2020 under the Saudi Arabia G20 Presidency with the support of OECD , the World Bank Group in partnership with The Better Than Cash Alliance, the Women's World Banking...

Covid-19

Jul 08, 2020

In this white paper, Dr. Mohammad Nurunnabi, Dr. Hisham Mohammed Alhawal and Professor Zahirul Hoque, from Global SME Policy Network (GSPN), address the impact of COVID-19 and how CEOs respond to SMEs recovery planning in Saudi Arabia. The findings of this study will be useful to global SMEs and policymakers and practitioners by providing examples...

Covid-19

Jul 07, 2020

Member Kabbage published a recent report on the results of the Paycheck Protection Program (PPP). The combined Kabbage Program processed more than $5.8 billion in Paycheck Protection Program loans, providing support to more than 209,000 small businesses and maintained an estimated 782,000 jobs across Main Street America. This includes all types of...

Digital Financial Services

Jul 03, 2020

The International Council for Small Business (ICSB), in June 2016, convened a small business panel at its 61st World Congress at the United Nations, in New York City. This report is the continuation of the ICSB’s work since 2016 with the goal of bringing all stakeholders and partners together in one place, with one mission, and one focus: to help...

Supply & Value Chain Finance

Jun 30, 2020

The FCI Annual Review has been recently published by our industry partner, and it is a globally recognised publication in the world of Factoring and Receivables Finance. Peter Mulroy, FCI Secretary General, introduces the publication highlighting the major achievements in 2019 but also the challenges and opportunities facing FCI and the industry...

Covid-19

Jun 16, 2020

The novel Coronavirus (SARS-CoV-2), which causes the Coronavirus disease (COVID-19) has infected over 7.45 million people worldwide and claimed over 400,000 lives globally. It is not just a pandemic—it is also a burgeoning (global) economic crisis, especially because of the measures (including lockdowns) adopted to contain its spread. Several...

Gender Finance

Covid-19

May 29, 2020

This evaluation report highlights an exhaustive situation of what Nigerien businesses are going through in general and more particularly those grouped within "emerging women" in particular since the COVID-19 was declared in late March in Niger. It is a real question of survival that is played out for these companies confronted as highlighted by...

Covid-19

May 21, 2020

The COVID-19 pandemic has so far spared Africa in terms of reported cases and casualties, yet the lockdowns in place have significantly hurt African economies. awamo , a digital, mobile banking platform, and credit bureau, specially designed for MFIs, has analyzed real-time transaction data of rural and semi-urban microfinance institutions from...

Gender Finance

Youth Entrepreneurship

Apr 20, 2020

The GPFI’s stocktaking of data available on financing for SMEs, both at the country level and at the client level of the major international development finance institutions, reveals serious gaps. Annual aggregate data is captured annually for only a minority of the world’s countries by the IMF, OECD, and others. Little if any data is available at...

Covid-19

Apr 17, 2020

In this unprecedented time of disruption to businesses, the World Bank launched, together with INSOL Intl, the Global Guide to Measures Adopted in Support of Distressed Businesses through the COVID-19 Crisis. Read more in these Guidance Notes: COVID-19 Outbreak: Capital Markets Implications and Response COVID-19 Outbreak: Insurance Implications...

Covid-19

Apr 13, 2020

In this recent COVID-19 Notes prepared by the World Bank and IFC, contributed by Ghada Teima , Global Lead Financial Sector Specialist at IFC, you will read an assessment on the impact and policy responses in support of private-sector firms in the context of the pandemic. Summary While a COVID-19 outbreak will have a generalized impact on business...

Financial Education

Apr 03, 2020

In this publication, you will read about the SME Finance Forum highlights in 2019. Extract from the Foreword: The year 2019 has been a remarkable year for the SME Finance Forum — a year of continued, strong membership growth and effective delivery of member services. Since our launch in November 2015, we’ve grown from a few dozen committed early...

Guarantees

Mar 02, 2020

This report, prepared by the World Bank , seeks to enhance practitioners’ understanding of the potential role that capital markets can have in SME financing in EMDEs. The report reviews global experiences with the use of capital markets solutions and, more generally, of market-based solutions to expand SME financing with a view to identifying key...

Feb 11, 2020

The future of financial services will be impacted deeply by the emergence of embedded finance: finance that promises to be more internet-like, more interconnected and more customizable, with novel components that can be inserted into individual businesses in different sectors. Read more about it in this white paper called Embedded Finance: The...

Equity

Feb 04, 2020

The EIF Working Paper 2020/062: The Business Angel portfolio under the European Angels Fund: An empirical analysis. This working paper, from member EIF, analyses the Business Angel (BA) portfolio of the European Angels Fund (EAF), which is an initiative of the European Investment Fund and engages in co-investment relationships with experienced...

Trade Finance

Jan 27, 2020

A “Thought-Starter” Contribution on Trade Finance to the 2020 G20 Process On the occasion of the Saudi B20 Inception event, a new Business at OECD report released (available here ) highlights that trade finance, key to business trust in global trade activities, is a case in point for the need to make additional efforts to tackle regulatory...

Credit Risk & Scoring

Fintech

Jan 14, 2020

This note analyzes the evolution of Credit Information Systems, including the emergence of new technologies that use alternative data in credit decisioning and the opportunities and risks associated with these trends. This paper also predicts the potential development effect of these disruptive technologies and proposes a role for the World Bank...

Policy & Regulation

Dec 23, 2019

The Doing Business 2020 study, by the World Bank Group, shows that developing economies are catching up with developed economies in ease of doing business. This publication is the 17th in a series of annual studies investigating the regulations that enhance business activity and those that constrain it. Doing Business presents quantitative...

Policy & Regulation

Dec 10, 2019

The Financial Stability Board (FSB) published its final report on the Evaluation of the effects of financial regulatory reforms on small and medium-sized enterprise (SME) financing , following a public consultation earlier this year. The evaluation is motivated by the need to better understand the effects of the reforms on the financing of real...

Digital Transformation

Dec 03, 2019

Learn in this publication how member 4G Capital use machine learning technology to provide scalable credit services for individual clients in Kenya, where the MSME finance gap is over $19 bn, making it the largest in Eastern Africa. They were able to measure the impact of their working capital credit, and they saw customers increase their revenue...

Credit Risk & Scoring

Nov 18, 2019

In this publication, United Nations Secretary-General's Special Advocate for Inclusive Finance for Development (UNSGSA), H.M. Queen Máxima of the Netherlands, presents the 2009-2019 achievements and milestones accomplished as Special Advocate, as she champions financial inclusion and universal access to affordable and effective and safe financial...

Policy & Regulation

Nov 06, 2019

This report is jointly produced by the World Bank and the Cambridge Centre for Alternative Finance at the University of Cambridge Judge Business School. This study intends to understand the global regulatory landscape for alternative finance through the collation of empirical data from regulators, including securities regulators, capital markets...

Credit Risk & Scoring

Nov 05, 2019

IFC conducted the global SME Banking survey to better understand the challenges and trends SME banking operations experience in serving the small business segment in their countries. More than 110 SME Banking practitioners and leaders from around the world participated in the survey. The online survey launched in 2018 posed questions to understand...

Credit Risk & Scoring

Oct 22, 2019

The present study, presented in Brussels, analyses whether sharing more comprehensive data improves the functioning of credit markets in European countries. Assuming that mechanisms to share data do exist, does a higher comprehensiveness in the data collected matter for credit markets? The study answers this by firstly analysing whether higher...

Non Financial Services

Oct 21, 2019

This study of the Japanese model about the development of the Credit Guarantee System provides an in-depth analysis of the credit guarantee system behind the rise and sustainment of Japan’s economy, and explains how it can benefit Turkey. It outlines the credit guarantee system in Japan, which, in view of the author, the General Manager of SME...

Digital Financial Services

Oct 18, 2019

Youxin Financial provides personal financial services to customers around the world. The company is committed to using financial technology to provide innovative and financing solutions for micro and small businesses across China and contribute to the development of the real economy. In this publication, Youxin Financial shares an analysis of...

Non Financial Services

Oct 18, 2019

This Small Business Spotlight report by FinRegLab provides an overview of applied research based on data from six non-bank financial services providers, two of which are SME FInance Forum 's members — Accion , Kabbage , Brigit, LendUp, Oportun, and Petal—that have begun using cash-flow variables and scores in a bid to increase the provision of...

Financial Education

Oct 17, 2019

This report, by the International Council for Small Business (ICSB) and the International Labour Organization (ILO) , examines worldwide evidence of the contribution that the selfemployed and enterprises of different size classes make to total employment. A key finding is that, globally, the self-employed and micro- and small enterprises account...

Non Financial Services

Oct 17, 2019

This Guidebook , prepared by IFC , addresses the challenges and opportunities faced by SMEs at the various stages of their lifecycles, offering tailored corporate governance recommendations. It includes the Action Planning Tool to help SME owners, investors, and managers take a pragmatic approach to governance, as a means of strengthening their...

Gender Finance

Oct 09, 2019

On October 8th, during the 2019 Global SME Finance Forum, IFC and Goldman Sachs 10,000 Women launched a progress report titled "IFC and Goldman Sachs 10,000 Women: Investing in Women's Business Growth". This report demonstrates that WEOF has already exceeded its investment and mobilization goals and has made strong progress towards achieving all...

Digital Transformation

Sep 20, 2019

This publication, by Hans van Grieken and Andries van Dijk from Deloitte, analyzes the growing impact of ‘digital’ on all aspects of business, from strategy to operations, and how it is driving change in organisations that goes beyond the ‘traditional’ IT model. Many contemporary businesses fundamentally reimagine the way the enterprise identifies...

Credit Risk & Scoring

Sep 11, 2019

This publication is the result of a survey on Very Small Entreprises (VSEs) in the Arab World by the IFC - International Finance Corporation. While this report documents where the sector stands today in terms of serving the VSE segment, it also offers lessons learned by microfinance institutions, who have already upscaled to serve VSEs from the...

Sep 04, 2019

The 3rd Annual Americas Alternative Finance Industry Report aims to provide readers with a snapshot of the rapidly changing alternative finance landscape across the Americas at a macro level as well as on a country-by-country basis. This empirical study provides independent, systematic, and reliable data about the size, growth, and diversity of...

Gender Finance

Aug 29, 2019

With the growing recognition of women entrepreneurs’ contribution to economic growth, there is need to understand the state of their operations in India. This report, by the IFC, aims to assess the financing gap through a hybrid approach, including both secondary estimation and primary data collection, and identify the key characteristics of women...

Credit Risk & Scoring

Aug 28, 2019

Digital financial services (DFS) are defined by the Alliance for Financial Inclusion as “the broad range of financial services accessed and delivered through digital channels, including payments, credit, savings, remittances and insurance.” The integration of new digital channels for transactions, information flows and data capture, and identity...

Digital Financial Services

Aug 27, 2019

For Zambia’s digital financial services (DFS) industry, 2018 saw growth in the number of active DFS account users, growth in the number of agents nationwide and growth in the number of products available to customers. These indicators of growth in the industry are findings in the Annual Provider Survey (APS), which UNCDF has conducted for over...

Fintech

Aug 27, 2019

The IMF and the World Bank Group launched at the 2018 Annual Meetings the Bali Fintech Agenda (BFA), a framework of high-level issues that countries should consider in their own domestic fintech policy discussions. The BFA is organized around a set of twelve elements aimed at helping member countries to harness the benefits and opportunities of...

Digital Financial Services

Aug 26, 2019

This paper shows that taxation on mobile phone airtime and financial transactions may not expand the tax base significantly but, rather, may reverse the gains on retail electronic payments and financial inclusion. A higher tax rate on low-level retail electronic transactions mostly levied on low-income earners that are sensitive to transaction...

Digital Financial Services

Aug 21, 2019

The report contextualises the role of data analytics in the ongoing digital revolution and its potential for SME performance, including for enhancing SME productivity. It presents evidence on the use of data analytics in SMEs, discusses main internal and external barriers to the use of data analytics by SMEs, and illustrates policy approaches to...

Gender Finance

Aug 19, 2019

According to a World Bank report “Profiting from Parity : Unlocking the Potential of Women's Business in Africa,” launched last March, women entrepreneurs make or are obliged to make different decisions than men because of gender-specific constraints. As a result, the report notes that, on average, women-owned firms post profits that are 34 %...

Aug 16, 2019

This CGAP’s recent paper, "The Role of Financial Services in Youth Education and Employment," makes the case that financial services can play an important role in improving educational opportunities to build job skills among people ages 15 to 24. Read the paper here .

Financial Education

Aug 15, 2019

In this report, member Mastercard presents the highlights from their 2018 annual corporate sustainability covering their global operations using the Global Reporting Initiative (GRI)’s reporting principles of materiality, sustainability context and stakeholder inclusiveness and completeness, as well as the UN Sustainable Development Goals...

Financial Education

Aug 14, 2019

In a new report, the Initiative for a Competitive Inner City (ICIC) shows how important small businesses are as job creators in 10 of America’s largest cities and their under-resourced inner cities. Small businesses are the backbone of urban economies, providing critical jobs for local residents. This report offers compelling data on the jobs...

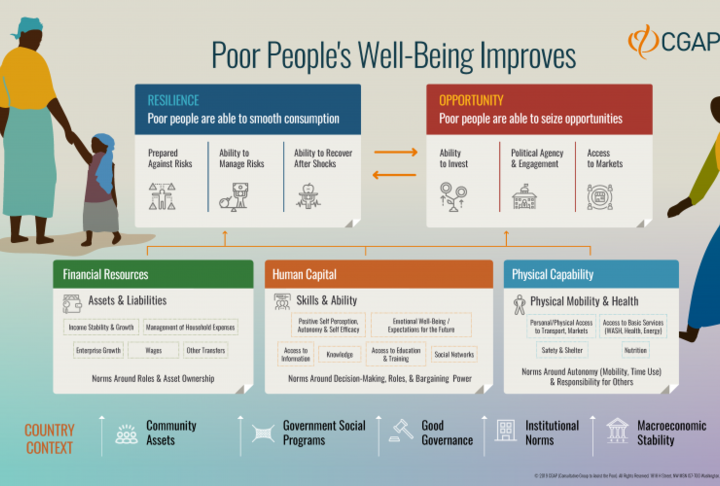

Aug 12, 2019

Credit Scoring in Financial Inclusion: How to use advanced analytics to build credit-scoring models that increase access. This guide emphasizes that the effectiveness of data analytics approaches often involves building a broader data-driven corporate culture. Publication by CGAP.

Payments

Aug 02, 2019

The new IMF series "Fintech Notes" examines pressing topics in the digital economy. The Rise of Digital Money analyses how technology companies are stepping up competition to large banks and credit card companies. Digital forms of money are increasingly in the wallets of consumers as well as in the minds of policymakers. Cash and bank deposits are...

Credit Risk & Scoring

Jul 29, 2019

The Empirical Research Findings report provides a detailed summary of our applied research based on data from six non-bank financial services providers, two of which are SME Finance Forum's members – Accion , Kabbage , Brigit, LendUp, Oportun, and Petal – that have begun using cash-flow variables and scores in an effort to increase the provision...

Digital Transformation

Jul 29, 2019

In recent years, Latin America has joined the worldwide Fintech revolution, creating innovation and start-up ecosystems that permit the development of new technology start-ups offering highly innovative products and financial services. Many studies have reflected the fervor currently felt in the Fintech sector in the Latin America and the...

Financial Education

Gender Finance

Jul 26, 2019

This year, the Group of Seven (G7) outlined an agenda to fight inequality. As part of this agenda, the G7 Partnership for Women’s Digital Financial Inclusion in Africa will support African governments, central banks, and financial institutions in their efforts to build more inclusive, sustainable, and responsible digital financial systems,...

Credit Risk & Scoring

Jul 24, 2019

The European Banking Authority (EBA) published the findings of its analysis on the regulatory framework applicable to FinTech firms when accessing the market. The Report illustrates the developments on the regulatory perimeter across the EU, the regulatory status of FinTech firms, and the approaches followed by competent authorities when granting...

Credit Risk & Scoring

Jul 23, 2019

Published annually, this report, in its 8th edition, documents trends in access to different types of finance for SMEs and entrepreneurs, financing conditions and government policy initiatives in this area. It was prepared by Kris Boschmans and Lora Pissareva, Policy Analysts, OECD Centre for Entrepreneurship, SMEs, Regions and Cities, SME and...

Digital Transformation

Jul 16, 2019

This research, by The Mastercard Foundation Partnership for Finance in a Digital Africa, collected information from 27 micro-entrepreneurs in Kenya about how they use platforms (from social media sites to ecommerce marketplaces and online freelancing websites) in their day-to-day business. The platform practices these conversations revealed...

Jul 15, 2019

SME access to finance conditions improved considerably in Slovenia, Estonia, Czech Republic and Croatia and also in Belgium and Portugal as per the European Investment Fund (EIF) SME Access to Finance Index June 2019 update. #eifsmes

Financial Education

Jul 11, 2019

IFC works with insurers to create products targeted to the needs of women at various stages of their lives as well as for women-owned SMEs—while creating income generating opportunities for women as insurance agents and distributors. IFC recently collaborated with some of its partners to produce a collection of notes and case studies,...

Financial Education

Jul 10, 2019

This e-book presents impact stories, videos and photos that put faces behind the numbers and illustrate that digital innovation not only unlocks basic, life-changing financial services for low-income people, but it also enables the delivery of clean water, solar energy, education and other essential products and services. For instance, in Yemen,...

Guarantees

Jul 10, 2019

The European Small Business Finance Outlook for June 2019 provides an overview on equity finance and how SME securitization market has performed well, showing low default rates in Europe. Special chapter dedicated to Fintech. The report also highlights that one in four SMEs still report severe difficulties in accessing finance, pointing out...

Jul 09, 2019

Lessons learned on engagements with mainstream commercial banks to serve low-income women. Major takeaways from this publication include: How to develop a successful digital savings product for women, how to create sustainable financial products for youth and their families, must haves for credit programs focused on women-owned businesses, and...

Financial Education

Alternative Financing

Equity

Payments

Jun 25, 2019

This report from the World Economic Forum and Deloitte studies the transformative role of fintech and other disruptive forces on the financial services industry. This is the third report Deloitte and the Forum have developed on this topic. The report uncovers eight disruptive forces that have the potential to shift the competitive landscape of the...

Non Financial Services

Policy & Regulation

Jun 25, 2019

The regulatory sandbox (“sandbox”), part of Innovate, allows firms to test innovative products, services and business models in a live market environment, while ensuring that appropriate safeguards are in place. It was established following a feasibility report published in November 2015 to support the FCA’s objective of promoting effective...

Policy & Regulation

Digital Transformation

Jun 25, 2019

A total of 87 financial services executives and fintechs in New York, London and Hong Kong responded to Acenture's Fintech Innovation Lab questionnaire explaining their views on the innovation onboarding process. Survey questions focused on each group’s perceptions of what was occurring during the four phases of the technology onboarding process:...

Non Financial Services

Digital Transformation

Jun 25, 2019

For this survey, EY interviewed more than 27,000 consumers in 27 markets. They examined how FinTech has improved and expanded its offerings around the world, and also how it has spurred change across the entire financial services industry. FinTech strives to make financial services more accessible for both consumers and businesses. By connecting...

Non Financial Services

Sustainable Finance

Digital Transformation

Jun 25, 2019

Blockchain has the potential to impact many industries, including financial services, so the Boston Fed sought to understand its foundational technology with first-hand research. They wanted practical experience, the kind only trial and error can bring. “Beyond Theory: Getting Practical With Blockchain” goes beyond the basics of distributed ledger...

Policy & Regulation

Credit Risk & Scoring

Jun 25, 2019

The 5G network is likely to encompass not just the Internet but all the resources connected to it. In such a scenario it is essential that there is a greater preparedness from both the service providers and consumers regarding the principles, architecture and features of the new technology. Such preparedness will help all concerned to design,...

Credit Risk & Scoring

Digital Financial Services

Jun 25, 2019

The 28 page report details the API performance of 11 major UK banks across a variety of technical performance measures through 2018. The report includes APImetrics proprietary Cloud API Service Consistency (CASC) scores for all 11 banks. CASC scores are derived using APImetrics active monitoring platform, which gathers data from up to 75 locations...

Policy & Regulation

Credit Risk & Scoring

Jun 25, 2019

This whitepaper analyzes the information content of the digital footprint – information that people leave online simply by accessing or registering on a website – for predicting consumer default. Using more than 250,000 observations, we show that even simple, easily accessible variables from the digital footprint equal or exceed the information...

Credit Risk & Scoring

Jun 19, 2019

Access to finance is an essential component of economic development and job creation. A host of studies have shown a positive correlation between financial development and economic growth. Access to finance is also critical for larger corporations and conglomerates, which, given their size, performance, and assets, typically meet funding...

Sustainable Finance

Policy & Regulation

Jun 17, 2019

The Factbook contains comparable data and information on 49 OECD, G20 and Financial Stability Board jurisdictions, and can be used by governments, regulators and the private sector to compare their own frameworks with those of other countries. The Factbook was presented at the G20/OECD Seminar on Corporate Governance in Today's Capital Markets in...

Credit Risk & Scoring

Jun 14, 2019

This note analyzes the evolution of Credit Information Systems, including the emergence of new technologies that use alternative data in credit decisioning and the opportunities and risks associated with these trends. This paper also predicts the potential development effect of these disruptive technologies and proposes a role for the World Bank...

Jun 12, 2019

This report is based on ethnographic research conducted by a team at the African Studies Center Leiden, University of Leiden, and focused on four countries of varying degrees of DFS market maturity: Cameroon, Democratic Republic of Congo, Senegal and Zambia ( original report ). It provides an in-depth description of what digital financial...

Non Financial Services

Policy & Regulation

Jun 05, 2019

The new OECD SME and Entrepreneurship Outlook presents the latest trends in performance of small and medium-sized enterprises (SMEs) and provides a comprehensive overview of business conditions and policy frameworks for SMEs and entrepreneurs. This year’s edition provides comparative evidence on business dynamism, productivity growth, wage gaps...

Financial Education

Non Financial Services

Gender Finance

Jun 03, 2019

Itaú Mulher Empreendedora was created precisely to support providing better conditions for women to leverage their businesses, using financial services in accordance with their needs. By connecting women and understanding their needs, motivations and barriers, we become capable of joining them to create management tools, inspiration and networks...

Non Financial Services

Digital Financial Services

May 21, 2019

For all the excitement around fintech, there is little information available about how specific fintech innovations solve pain points in financial inclusion. Based on two years of pilots with fintechs across Africa and South Asia, a new CGAP report identifies promising fintech innovations in emerging markets, challenges that startups often face in...

Non Financial Services

Digital Transformation

May 16, 2019

This paper documents CGAP’s work with 18 fintech pilots in Africa and South Asia. The goal of this paper is to explain innovations in a detailed way and generate insight on whether the services (i) work as stated, (ii) create value for underserved customers, and (iii) ease age-old pain points in delivering financial services to underserved...

Non Financial Services

Policy & Regulation

May 15, 2019

Since 2011, Myanmar has been on a path of transition from military rule and a state-controlled economy, towards democracy and a market-based economy whilst also managing the challenge of wealth creation. These transitions are taking place in a context of religious and ethnic diversity – the Burmese majority accounting for two-thirds of the...

Non Financial Services

Policy & Regulation

Credit Risk & Scoring

May 14, 2019

This note analyzes the evolution of CISs, including the emergence of new technologies that use alternative data in credit decisioning and the opportunities and risks associated with these trends. This paper also predicts the potential development effect of these disruptive technologies and proposes a role for the World Bank Group in leveraging...

Financial Education

Non Financial Services

Digital Transformation

Payments

May 13, 2019

In total, there are more than 1.9 million businesses, content creators, and developers in the U.S. using Amazon products and services to follow their dreams and reach customers. This second annual Amazon SMB Impact Report takes a deeper look at how small businesses are benefiting from Amazon’s tools and services. The results are striking: SMBs...

Policy & Regulation

Credit Risk & Scoring

Digital Transformation

May 13, 2019

In this EY has outlined a number of questions they believe firms need to ask themselves with respect to how they can really help the SME community, considering how they can provide additional insight, tools and services that will best serve their customers. Firms that answer these questions the best are likely to come out on top, not just in this...

Non Financial Services

Credit Risk & Scoring

May 06, 2019

Based on a survey of 34 WSBI Africa institutions in 2018, the 50-page report by WSBI’s Scale2Save Programme, a partnership between WSBI and Mastercard Foundation, finds that member banks offer a variety of transaction and savings accounts as part of their drive to attract and satisfy customers. But it also found their product and service mix still...

Non Financial Services

Gender Finance

May 02, 2019

This report from Kantar shows that financial services organisations could be missing a £130bn opportunity – by not winning over women. Download our Winning Over Women report to find out how UK financial institutions are failing to connect with female customers at each stage of the buying journey, from advertising to offerings. The report indicates...

Alternative Financing

Gender Finance

Apr 30, 2019

Crunchbase has released a report on the amount of funding that flowed to companies with at least one female founder in the first quarter of 2019. The author says that 17 percent of venture dollars representing $8.1 billion in the first quarter went to companies with at least one female founder. Of that, two percent was invested in only female...

Supply & Value Chain Finance

Policy & Regulation

Apr 30, 2019

As part of UK FinTech week 2019, Oxford Economics is publishing a report, in partnership with Funding Circle, on the financial conditions facing small businesses in each of the online platform’s four markets: the UK, US, Germany, and the Netherlands. This report calculates the total economic impact of loans made to SMEs through Funding Circle in...

Gender Finance

Policy & Regulation

Apr 25, 2019

SME Finance Forum partner Women's World Banking has released "Acquisition and Engagement Strategies to Reach Women with Digital Financial Services." In this publication, Women’s World Banking outlined how they applied different approaches in Nigeria and Pakistan to increase both the acquisition of women customers as well as women’s engagement with...

Non Financial Services

Supply & Value Chain Finance

Credit Risk & Scoring

Apr 25, 2019

The Small Business Credit Survey (SBCS), a national collaboration of the 12 Federal Reserve Banks, delivers timely information on small business financing needs, decisions, and outcomes to policymakers, lenders, and service providers. The report findings provide an in-depth look at small business performance, debt holdings, and credit experiences...

Non Financial Services

Sustainable Finance

Policy & Regulation

Apr 23, 2019

Bibby Financial Services' SME Confidence Tracker surveys 1,000 of the UK’s small and medium-sized businesses on a quarterly basis. The tracker charts the confidence of owners and senior decision-makers of businesses in manufacturing, construction, wholesale, transport, and services sectors. The tracker includes an SME Confidence Index statistic...

Non Financial Services

Supply & Value Chain Finance

Policy & Regulation

Credit Risk & Scoring

Apr 22, 2019

BNY Mellon released its "Overcoming the Trade Finance Gap: Root Causes and Remedies" report, which finds that the trade finance gap remains a significant issue for global trade, according to 100 global, regional, and domestic banks, specialist trade providers and other market participants responding to its survey. The $1.5 trillion global trade...

Non Financial Services

Supply & Value Chain Finance

Credit Risk & Scoring

Digital Transformation

Apr 22, 2019

The Small Business Lending Survey is a nationally-representative survey of U.S. banks and their small business lending practices. The report of survey findings offers new information for both small and large banks on many aspects of their small business lending. The results provide context for the implications of current bank consolidation trends...

Non Financial Services

Supply & Value Chain Finance

Credit Risk & Scoring

Apr 19, 2019

The report provides a comprehensive review on the development of the so-called Micro and Small Finance (MSF) market in China, meaning credit services to Small and Micro Enterprises (MSEs), unincorporated but registered urban businesses and MSE owners. As the Chinese Medium Enterprises are relatively large, this definition corresponds more or less...

Financial Education

Non Financial Services

Alternative Financing

Apr 16, 2019

The 2019 edition of the OECD Scoreboard on Financing SMEs and Entrepreneurs was launched in Washington D.C. by Angel Gurría, OECD Secretary-General and Mario Marcel Cullell, Governor of the Central Bank of Chile. Sufficient and affordable access to different sources of finance is crucial to allow SMEs and entrepreneurs to reach their full...

Financial Education

Credit Risk & Scoring

Payments

Apr 11, 2019

Since 2014, in order to better serve low-income women in Sub-Saharan Africa with financial products, Women’s World Banking and Financial Sector Deepening Africa (FSDA), an initiative funded by the U.K.’s Department for International Development (DFID), have partnered to build the capacity of leading financial institutions in Nigeria, Tanzania and...

Non Financial Services

Gender Finance

Governance

Fintech

Payments

Apr 10, 2019

It is important for all stakeholders to take action to deliver the significant benefits of mobile and the internet to women, their families, communities and the economy. Mobile can help empower women, making them more connected, safe and able to access information and services. Closing the mobile gender gap also represents a significant commercial...

Financial Education

Equity

Sustainable Finance

Policy & Regulation

Apr 09, 2019

The report is the most comprehensive assessment so far of the potential global market for impact investing. It estimates that as much as $269 trillion—the financial assets held by institutions and households across the world—is potentially available for investment. Channeling just 10 percent of this amount into projects focused on improving social...

Financial Education

Non Financial Services

Apr 04, 2019

This report summarizes early findings from the evaluation of the Grameen America program, a microfinance model that provides loans to low-income women in the United States who are seeking to start or expand their small businesses. The program is based on the Grameen Bank model developed in Bangladesh during the mid-1970s. Its objective is to...

Financial Education

Gender Finance

Policy & Regulation

Apr 03, 2019

This report – developed jointly by the OECD, ASEAN and national stakeholders – seeks to better understand the causes behind these persistent gaps and advances policy solutions to help close them. It is structured around three chapters: Chapter 1 provides an overview of progress made in achieving gender equality in employment and education,...

Non Financial Services

Supply & Value Chain Finance

Credit Risk & Scoring

Digital Financial Services

Digital Transformation

Mar 18, 2019

Capgemini and LinkedIn, in collaboration with Efma, developed the World FinTech Report 2018 based on a global survey encompassing responses from traditional financial services firms and FinTech firms including banking and lending, payments and transfers, investment management, and insurance. Questions sought to yield perspectives from both FinTech...

Equity

Gender Finance

Mar 08, 2019

Private equity and venture capital funds with gender-balanced senior investment teams generated 10 percent to 20 percent higher returns compared with funds that have a majority of male or female leaders, according to a report released today by IFC, a member of the World Bank Group. The report, Moving Toward Gender Balance in Private Equity and...

Non Financial Services

Policy & Regulation

Digital Financial Services

Digital Transformation

Mar 07, 2019

Technology-enabled innovation in financial services (FinTech) can extend the benefits of financial inclusion to millions of unbanked and underbanked people around the world. However, the rise of FinTech presents many regulatory challenges - for emerging and developing economies in particular. Consequently a number of regulators in advanced,...

![[REPORT LAUNCH] People’s Money: Harnessing Digitalization to Finance a Sustainable Future [REPORT LAUNCH] People’s Money: Harnessing Digitalization to Finance a Sustainable Future](https://smefinanceforum.org/sites/default/files/styles/720x486/public/Read%20now.jpeg?itok=0UHp2Qnv)