Small Business Minister Bruce Billson wants to push ahead with legislation to limit the ability of banks to use non-financial conditions such as loan to value ratios to foreclose on small businesses borrowing up to $250,000.

But bank documentation is not the big the issue which the Minister recognised when he said “the fact that so many small businesses are financed on credit cards at 22 per cent interest shows its not even cost of capital that’s the main issue, it’s accessibility.”

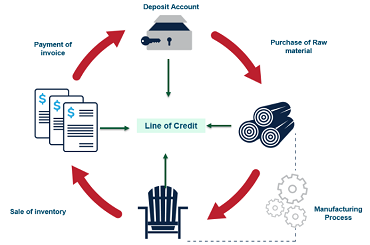

The problem is that the current model for bank lending to small businesses satisfies neither bank customers nor shareholders. Fortunately there is a solution at hand and it is the fintech model. Fintechs and banks possess attributes the other doesn’t but together everyone, especially the SMEs, could be a winner.

A small business owner won’t go to a fintech if a bank will provide the required funding within an acceptable time frame and with acceptable security. Fintechs appeal to small businesses when the bank has said “no”, or if the owner feels it would take the bank too long to make a decision, or if they don’t have or aren’t prepared to offer the security the bank required. Fintechs don’t take security so they have to be extra sure that the borrower can afford to service and repay a loan from cash flow so their credit analysis, while quick, is comprehensive. Statistics from the US reveal only 38 per cent of small business loan applications to fintechs are approved.