Blog

What is so “Alternative” about Lending to Small Businesses?

What is so “alternative” about lending to small businesses? As a provider of SME lending technology, I have heretofore generally accepted the classification of our company, Advanced Merchant Payments (AMP, for short), as one of the burgeoning class of “alternative lenders”. (See, for example, this insightful piece from Forbes Magazine). This growing awareness of “alternative lending”, therefore, has me wondering just what is so “alternative” about lending to small businesses.

Before going further, some context is in order. At AMP, we provide to financial institutions an outsourced processing platform which supports large portfolios of small business loans secured by their electronic cashflow (e.g.: card transactions) on a profitable and efficient basis. To further the efforts, we operate our own direct lending portfolios in Hong Kong, Singapore, and the Philippines, wherein we have collectively issued more than US$16MM in loans to small businesses, with a very low default rate and a respectable rate of return. Our average loan size is approximately US$30,000, and is determined relative to the business’ provable monthly free cashflow. Significantly, every borrower has at least one commercial bank account.

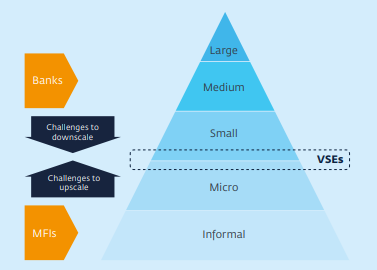

In short, our borrowers are precisely the sort of business to which you would expect a bank to lend; and yet, they have not done so. Which raises, to me, the question, what is so alternative about AMP lending to these small businesses? The term (defined as “the choice between two mutually exclusive possibilities”) suggests that the small business borrower has a choice, as between borrowing from a more “traditional” source - to wit, a bank – and the “alternative” lender. In reality, it is largely a Hobson’s choice.

According to a survey of AMP borrowers, almost 80% said they did not bother to apply to their bank before making application directly to AMP. Initially, this result surprised me, as I had expected SMEs to apply to us only after being declined by their bank. Upon investigation, we discovered that many borrowers viewed the process of applying for a bank loan as largely a “waste of time”, owing to what is perceived as onerous documentation requirements, time spent in the bank branch to discuss the loan application, and the relatively scant chance that the loan would anyway be approved. For the small business borrower, time is money, and the burgeoning market for alternative lending shows their willingness to pay a premium over nominal bank pricing for the convenience of relatively quick and hassle-free access to the loan.

This “convenience” factor seems, to my mind, very often overlooked in discussions about the availability of loans to small businesses. It also helps to explain the perception gap between those banks which proudly boast of their SME lending capabilities, and the numerous SMEs which feel shut out from traditional sources of finance. What enables alternative lenders to lend to these small businesses is the ability to leverage new forms of data from which to render credit decisions and manage risk on an efficient and scalable basis across large portfolios.

In time, we expect that banks will embrace these new methodologies, employing outsourced platforms such as ours to offer loans to their SMEs, at which point, “alternative” lending will indeed have become mainstream –at least until some newer model comes along with better ways to service some significant niche of small business borrower, once again creating an alternative to the traditional banks. In this context, then, perhaps there is nothing alternative about alternative lending at all, and it is simply a matter of evolution? I invite your views.