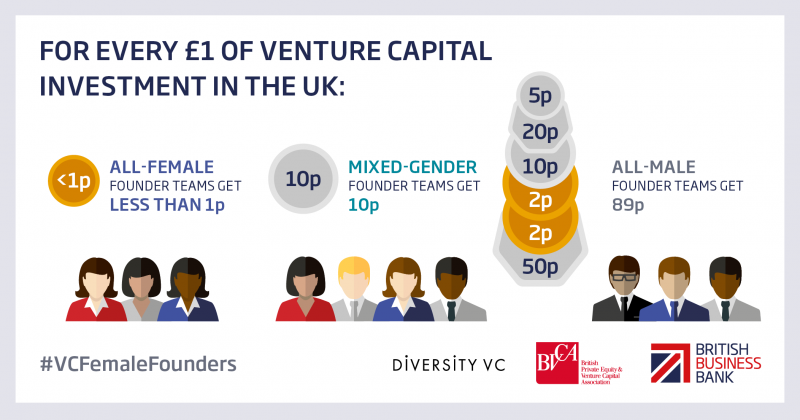

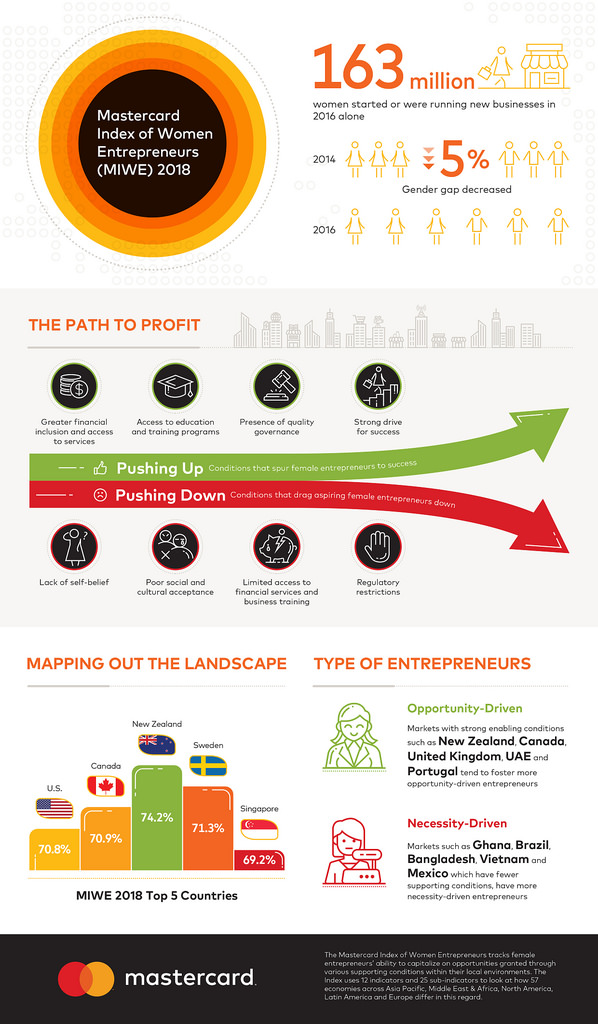

Small businesses are powerful drivers of economic growth, but many micro, small, and medium enterprises (MSMEs) lack access to the capital they need in order to expand. Women-owned MSMEs are particularly affected by this credit gap: the SME Finance Forum found that around 50% of all women-owned MSMEs in developing economies are unserved or underserved by the formal financial sector. In Mexico, where the Asociación de Bancos de México estimates that MSMEs represent 90% of the country’s enterprises, this represents a significant market opportunity to provide credit to women entrepreneurs

Articles

Three steps to serving women-owned MSMEs

Oct 20, 2016