Blog

The Future of SME Finance

It was extremely exciting to kick off this year's CEOs' and Senior Leaders' Roundtable on The Future of Small Business Banking with two most illustrious keynote speakers: James Kynge, the Emerging Markets Editor of the Financial Times; and Jyrki Koskelo, former Vice President for Operations of the International Finance Corporation, now Head, Emerging Markets for Atlas-Mara Co NVest, a new firm started by Bob Diamond, Aashish Thakar and Arnold Expe to use innovation and capital markets to make a difference for financial inclusion in Africa. Kynge started the group off by noting that it was a time of both great opportunity and great threat for SME banking. It is a time of opportunity because of continued population and GDP growth in emerging markets. He reminded the group that emerging markets should make up over 50 percent of global GDP by 2030 (from 37 percent today), and he cited the IFC/McKinsey MSME credit gap numbers to remind us of the multi-trillion dollar business opportunity. But Kynge reminded the audience that changes in global liquidity and commodity situations pose a threat to all markets. Changes in the yields on 10 year US Treasuries, and any major slowdown in China's demand for commodities could change today's picture radically - and if both happen at the same time all this will affect the costs of financing SMEs. So while there's lots of innovation, growth and hope, Kynge said, financial institutions need to monitor the situation carefully.

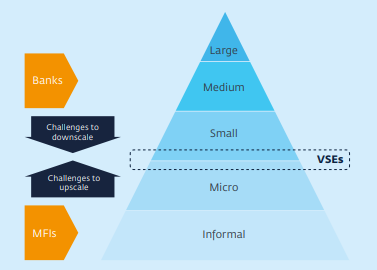

Koskelo, ever the iconoclast, challenged the group with a presentation that started out by stating that SME Banking as we've known it is dead! He explained why the main big bank players, particularly the European banks who have buttressed global trade finance, are suffering a major capital squeeze, and are retreating from emerging markets to share up their ratios. They particularly must retreat from SME lending because their regulators treat it as high risk, requiring more reserve capital they don't have. The challenge is to replace these players, and he argued that global alternative, non-bank institutions are well placed to take a big role. He mentioned in particular the large commodity traders like Glencore, value chain buyers and sellers such as WalMart, and "shadow bank" operators such as Vodafone/MPesa, who use technology for disruptive enterprises such as mobile phone banking. Koskelo described how Atlas-Mara is hoping to capitalize on this situation through its novel co-investment vehicle for Africa, where rather than taking big upfront fees as in conventional equity funds, the partners have agreed to take no fees at all until investors receive at least a 15 percent return. Their initiative also goes beyond finance to offer mentorship and "adventure fund" services for tens of thousands of SMEs, to help accelerate their growth, using the partners' considerable network of expert resources throughout the continent. Koskelo concluded by exhorting the bankers to push forward on MSME finance, despite the present difficulties, because they are the only way to deliver the 600 million new jobs the World Bank Group has estimated are necessary to keep emerging market employment at current levels by 2030. He said that the bankers won't be able to do this on their own . They also must help inform and advise the regulators how innovative, responsible SME finance can be far less risky than they may believe, sharing data that can justify better treatment of these assets by supervisors. Both he and Kynge pointed out how regulatory change to remove unnecessary obstacles to MSME finance can leverage huge increases in investment. Koskelo concluded his challenges by warning the bankers not to wait for government subsidies, which may not come in this time of belt tightening, but to explore innovation in technology and in institutional partnerships now.