Our events

SME Finance Virtual Marketplace

21 May 2025

Time:

to

EDT

( GMT

)

8 : 00

9 : 00

-04:00

Convert

-04:00

Virtual

Empowering SMEs with Simplified ESG reporting Fintech Solutions

About the Virtual SME Marketplace

Each month we are running sessions featuring leading small business lenders and SME growth facilitators who present their MSMEs offerings in a 7-minute pitch to an audience of potential financial institution clients and partners looking for impactful fintech solutions. Through those sessions - run by the SME Finance Forum - we foster collaboration between financial institutions, fintech companies, development finance institutions and investors. We have featured 150+ companies active in many different markets, attracted +2000 participants and generated many business leads, leading to investments, partnerships, and innovation advancement.

Topic

Fintech solutions can provide tools for SMEs to gather and report ESG (Environmental, Social, and Governance) data more efficiently. Those tools can help SMEs meet the stringent reporting requirements often associated with sustainable finance. They also allow SME’s stakeholders like banks to receive sustainability quality data that is comparable and actionable.

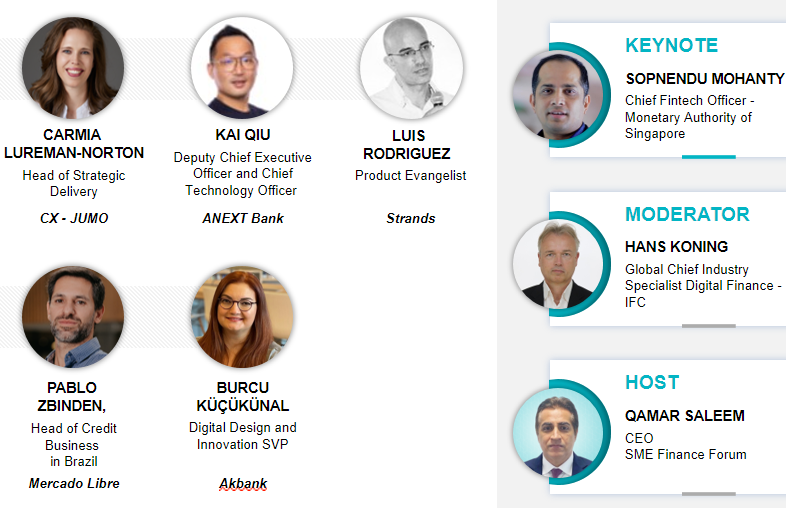

Organizer

The SME Finance Forum (SMEFF) is a network of 300+ members and affiliates with a coverage spanning across 190+ countries. The members are primarily financial services providers such as banks, fintechs, non-bank financial institutions, development finance institutions, credit guarantee companies, and microfinance institutions. The affiliates consist of policy advocacy groups, academia, SME and banking associations, training providers, and non-profit organizations. SMEFF was established in 2012 by the G20 and is managed by the International Finance Corporation with a core objective to scale financial services for SMEs. As the leading SME finance network globally, the forum steers industry innovations, supports replication of best practices, recognizes global champions, drives thought leadership, convenes influential stakeholders, and fosters global knowledge transfer.