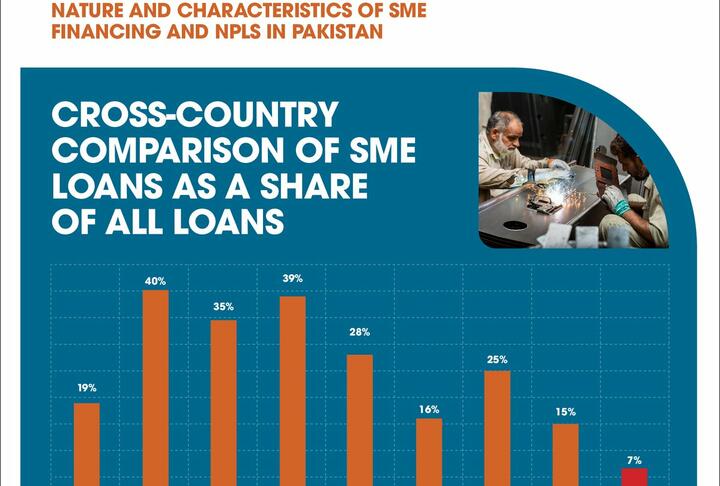

The study explores trends in SME financing over the past decade, and reasons that have contributed to high ratio of NPLs. The report includes several factors, such as SME Financing: A Comparative Overview, Breaking Down SME Financing and NPLs and Interventions Supporting SME Access to Finance.

The report says, part of the reason for low SME financing has been low overall private credit but there are also a myriad of supply side and demand side issues that curb credit to SMEs. Lack of documentation, inadequate incentives, poor cash flow management, unawareness of banking products, and incentives are all reasons why demand from SMEs for bank lending is low. The bigger issues, however, are the requirement for adequate collateral and the information asymmetry between banks and SMEs. These are being addressed to an extent through government initiatives such as the credit guarantee schemes and through the Financial Institutions (Secured Transactions) Act 2016 for the registry of immovable and movable property.