Blog

Financing Missing Middle SMEs in Emerging Markets: Insights about Small Cap Mezzanine Finance

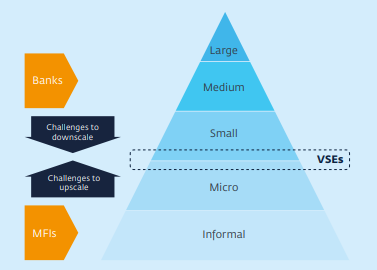

SMEs form a crucial part of the economies of emerging countries. Limited access to finance for these SMEs is commonly seen as their main barrier to growth. The lack of financing options is particularly problematic for SMEs in the so-called “Missing Middle” which refers to entrepreneurs requiring medium to long-term financing in ticket sizes in the range of USD 100,000 – 2million.

These enterprises are too big for microfinance and informal sources of capital, but too small or too risky for regular banks and private equity firms. In search for new models to provide risk capital, mezzanine finance, which blends elements from traditional Private Equity (PE) and debt financing into a unique product, provides an additional offer in the SME finance ecosystem for missing middle entrepreneurs.

As a relatively young and rather complex segment in the impact investing space, the Dutch Good Growth Fund (DGGF) commissioned a study on New perspectives on financing small cap SME’s in emerging markets. Mezzanine tends to be used as a catch-all phrase of a range of investment structures somewhere between pure equity and straight debt; the study identifies two stereotypes of small cap SME mezzanine finance providers. On the one hand, the more debt-like mezzanine instruments used are typically relatively risky, (partially) uncollateralized, flexible and long term loans, which often capture “upside” - indicating that the finance provider shares in the profits if the company performs well, contrary to a conventional loan which has a fixed interest rate. On the other end of the spectrum, the more equity-like mezzanine instruments typically involve equity instruments with some sort of self-liquidating mechanism.

For small cap SME mezzanine finance funds, especially the ones focusing on the <2m USD segment, it is always a challenge to make their economics “work”, due to the unfavorable ratio of transaction costs versus ticket sizes and high failure rates, acknowledging that views differ on what “attractive returns” to investors are. Unsubsidized fund may need to have a minimum size of between USD 30m and 70m in order to be sustainable, the exact number being highly dependent on the geographic span of the fund, other components that make up the strategy of a fund, and return expectations. As far as the minimum deal size required to be financially viable is concerned, the transaction sizes range from as low as USD 50k USD up to USD 1 to 2m. The wide difference is probably caused by different interpretations of what net returns are expected from this segment.

Small cap SME mezzanine is a relatively new and small field in the SME finance landscape and may remain a challenging segment, with a risk-return balance that will not easily attract large amounts of capital from other investors than DFIs and foundations.

Small cap SME mezzanine finance providers are beyond the stage of pioneering but not yet at the stage where – similar to microfinance or larger scale private equity investing - the approach can be brought to scale. There are opportunities to reach scale in the sector and to play a more significant role. The use of evergreen structures and – to a certain extent – product and process standardization contribute to this opportunity. Reaching scale will decrease relative transaction costs (as a consequence of economics of scale), which improves fund economics of small cap SME mezzanine providers.

Understanding the specificities, diversity and complexities of it, notably in differentiating this segment with debt and equity models, is critical in order to spur innovative thinking on both the fund managers and investors sides so products may be improved and models may be more scalable. This study is the first of its kind and represents a first step into building small cap SME mezzanine finance as an asset class on its own.