Blog

Financial inclusion: How fintech expand access to underserved communities and sectors

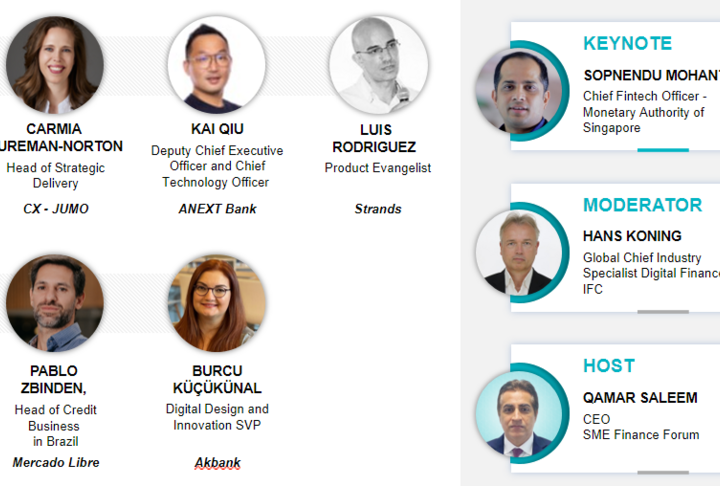

Summary of SME Finance Virtual Marketplace – October Live Session.

The SME Finance Forum, since its inception in 2015, has been featuring innovative fintechs to help connect its members with different technologies and partnership opportunities. The monthly virtual marketplace is a unique online match-making platform promoting partnership and collaboration among financial institutions, fintech companies, and DFI.

On October 5th, the fourteenth marketplace session hosted five institutions who shared their products and services to a group of practitioners in the industry. Read below a summary of their presentation.

ClickPesa - a payment platform combined with business tools

Rick Groothuizen, the Co-founder and Managing Director of ClickPesa, a Tanzania based fintech

building on the Stellar blockchain, presents how they have been facilitating transactions for businesses by simplifying payments services in emerging markets. In East Africa, the SMEs face several common pain points with digitalization of finance, including the complex account opening process, low end-to-end payment traceability, fragmented B2B payments, high transaction fees, long payment delays, as well as lack of support in multiple currency wallets. The solution ClickPesa offers is a payment platform combined with business tools. The SME payment platform consists of two major functionalities, e-KYC onboarding and multi-currency wallet, and is enriched by tools, such as e-invoice, e-bureau de exchange, in-store payments, and bulk payments. The transformative combination brings several benefits to the SMEs. After four simple steps to onboard online, small businesses are enabled to access more competitive exchange rate markets with lower transaction fees and no monthly account fees.

FeenPOP – a financing and investing platform linking all finance value chain players

Alain De Vera, CEO and Co-founder of FeenPOP, shares the disruptive technology company’s experience in developing a unique, 100% digital, blockchain based crypto-assets trading platform. FeenPOP has identified the challenges encountered by four major players in the financial ecosystem. For more than 80% of corporates and SMEs, liquidity financing is difficult and complicated. Despite the market demand, the pressure on capital obligation is limiting the banks to respond. Similarly, the credit insurance market shares are below 5% and there is no offer for the rest of the market. And the investors are looking for opportunities to diversify their investment at low risks.

FeenPOP aims to bring short-term financing and working capital improvement solutions to these groups. The fintech company obtains invoices from the businesses. After validation and analysis, FeenPOP transforms the profiles into units of investment and makes them available on the marketplace for the investors. It is an unmatched financing and investing solution based on real economy that leverages private trusted blockchain and NFTs. The FeenPOP platform covers the finance value chain and offers the SMEs a faster, safer, and cheaper access to financing.

Gojo & Company – an enabler of financial inclusion for underserved communities in the world

Taejun Shin, the Co-founder of Gojo & Company, shares their experience in partnering with financial service providers to extend financial inclusion around the world. Gojo aims to provide high-quality affordable financial services for 100 million unserved and underserved population in 50 countries by 2030. Currently, Gojo owns $170 million consolidated equity and owns various financial institutions in five countries, focusing on Asia. The group provides three channels to the clients. For non-smart phone owners, it has branch and agent channels. And for the ones with easier access to the internet, Gojo offers online channel. Gojo has three major advantages in the industry. Firstly, it has high technical and operational capacity to provide necessary supports for its opcos. Secondly, Gojo is headquartered in Japan, where they developed strong network with lenders who provide lowest cost of debt in the world. Lastly, as a “Serial Acquirer,” Gojo has its own M&A playbook that enables them to enter any country in the world. Over the past seven years, Gojo has reached 1 million customers and its AUM and Revenue have grown over 100% CAGR in the last four years. Additionally, Gojo Foundation was initiated to address the financial inclusion challenge for the lowest income segment.

ITFC – (a member of IsDB Group) advancing trade to improve local economic condition and livelihood

Ziade Zoubeiri presents how International Islamic Trade Finance Corporation (ITFC) has been advancing trade amongst 57 Organization of Islamic Cooperation (OIC) member countries and improving local socio-economic conditions. Since inception in 2008, ITFC has channeled around $ 16.5 billion to support private sector, particularly SMEs in OIC member countries. In response to the COVID-19 pandemic, ITFC has developed Strategy 2.0, emphasizing on the economic development and post-recovery of the private sector and SMEs. In this regard, under its COVID-19 Recovery Initiative ITFC has allocated US$945.0 million in favor of local and regional banks for the recovery of SMEs and the private sector clients from the negative impact of the pandemic. By expanding partnership with Banks/FIs under the integrated trade solutions offerings, ITFC has been mobilizing resources to support the private sector and SME clients. Additionally, the organization launched several trade products and SME Support Program, to enhance SME’s capacity and expand their access to finance.

Maalexi – A blockchain enabled ecosystem helping small food and agri-businesses to access cross-border trade and finance

The CEO and Co-founder of Maalexi, Dr. Azam Pasha, introduces how the platform has been strengthening global food security by linking agricultural product suppliers and buyers and allowing the SMEs to participate in cross-border trade directly. Due to their inability to mitigate trade risks and access trade finance, the SMEs encounter challenges to access and grow their cross-border trade. Maalexi’s solution to alleviate these two core issues is providing financially critical data secured through its blockchain application. With various source of data, such as business verification, demand matching, app-enabled inspection, and machine learning-based document checking, Maalexi generates comprehensive report and forwards it to FIs for their financial products. In the first stage, Maalexi is working with GCC markets and will move to the United States and Europe in the future.

In addition to increasing income and financial inclusion of the SMEs, Maalexi also empowers its FI partners to secure lending by providing end-to-end visibility of transaction through strong trade risk management that restrict fraud and build trust.