Our events

Round Table - Leading Innovations in SME Finance: A Leadership Perspective

Join us in a discussion with leading SME Finance Forum members sharing innovations and future perspectives on SME Finance. All of the speakers are leading SME Businesses and hence would share learnings from their business management dimensions. The webinar aims to explore groundbreaking strategies and innovations in SME finance, featuring leaders from prominent financial institutions, mostly members of SME Finance Forum. We will delve into topics such as cutting-edge technologies in digital banking, innovative approaches to credit assessment, leadership perspectives on financial inclusion, sustainable business models, and effective risk management strategies tailored for SMEs.

Expert presenters will cover:

1. Managing global, regional, and/or domestic SME business lines

2. What innovations have performed well and which have faced most challenges

3. How do you compete and differentiate in SME Finance

4. The future outlook and what trends would shape the industry

Why Attend?

This webinar is a must-attend for senior management teams of financial institutions aspiring to grow and/or gain market leadership in SME Finance. Especially leadership perspective you would learn:

· How to navigate relationship with top management for SME business to gain its rightful focus

· What business levers are most important to drive revenue growth and manage costs/risks

· How to innovate and leverage market leading trends

Agenda:

· Opening remarks by Global Head of SME Finance Forum

· Perspectives from each of the speakers

· Moderated discussion and Q&A

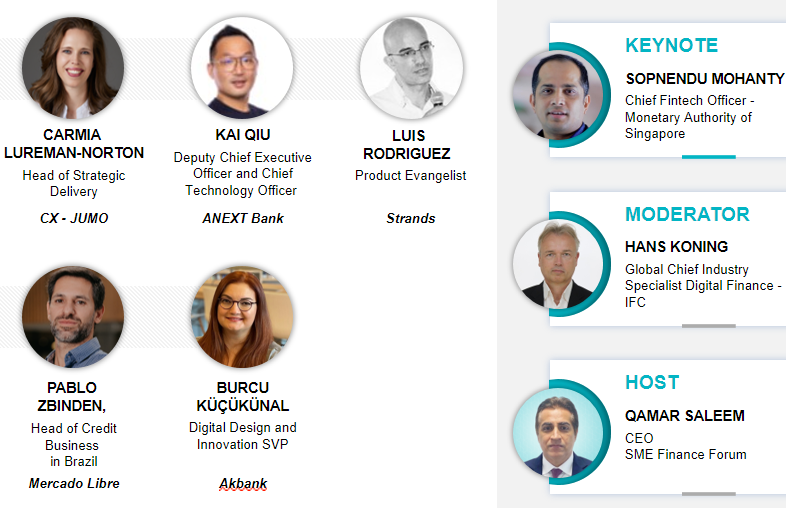

Speakers:

Asif Riaz, SEVP-G/Group Chief - Consumer Banking, The Bank of Punjab

Asif Riaz is a seasoned career banker with over 29 years of experience spanning various facets of banking such as Branch Banking, Commercial & SME Banking, Agriculture/Rural Banking, Consumer Finance, and Government-led initiatives. Renowned for his leadership, strategic planning, and adept decision-making, he has demonstrated expertise in Business Growth Strategies, Branch Optimization & Portfolio Management and Stakeholder Engagement.

Currently serving as the SEVP-G/Group Chief – Consumer Banking at The Bank of Punjab, he has been instrumental in achieving accolades such as the PBA's Best Bank for Small and Medium Businesses award twice, Asia Money's Best SME Bank award and Digital Banker’s Country’s Best SME Bank. His innovative contributions include launching digital lending solutions, integrating AI in SME banking, and pioneering concepts like Area Yield Index Insurance and Electronic Warehouse Receipt Financing. Asif is a champion of Financial Inclusion, Diversity, and Tech-based advisory solutions, with a proven ability to inspire teams and deliver results in dynamic financial landscapes. Under his leadership, BOP has also achieved significant progress in Affordable Housing.

Candice Ho, Head of SME Banking, Institutional Banking Group, DBS Singapore

Candice Ho is the Head of SME Banking, DBS Singapore and a member of the Singapore Management Committee since February 2023. She joined DBS Hong Kong in 2010 to build the CASA liabilities business from scratch in both Hong Kong and Greater Bay Area and drove digital solutions and adoption for SME clients in Hong Kong. Her last role was in DBS Hong Kong as the Country Head of IBG4, before taking the role of Regional Head of Product (Cash, T&M, Banca and Cards) in SME Banking in 2021. Candice has over 30 years of banking experience in the mid-sized corporate and SME segments, with 21 years in the Hong Kong market.

Carol Oyedeji, Group Commercial Banking Head, Ecobank Transnational Incorporated

Carol Oyedeji currently oversees the Commercial Banking Business in the 33 Africa markets where Ecobank operates. This scope entails Client relationships in Local Corporate type companies, Small and Medium Enterprises, Faith Based Organizations, Educational institutions, Agric and Government Business. Prior to her present role, she was the Deputy Managing Director of the Bank’s Nigeria subsidiary.

With over 30 years in the Financial Services industry , she has extensive experience across all the client facing segments of Consumer/Retail Banking, Commercial Banking and Corporate / Institutional Banking.

Before joining Ecobank, Carol was the Regional Head of Client Acquisition & Client Relationship for Africa and the Middle East at Standard Chartered Bank, where she oversaw Retail Distribution in the countries across the Region. Carol was also at various times, Head of Business Clients for Standard Chartered Africa, Regional Head for the Bank’s Consumer Banking in West Africa, and Non-Executive Director at Standard Chartered Bank Gambia. She started her Career as a Credit Analyst and later moved into Core Banking in 1995 when she joined the then FSB International Bank (now Fidelity Bank Nigeria).

She has developed critical skills in Strategy development, Sales Management, Credit Analysis, Digital Banking, Product Development, Wealth Management, Asset & Liability Management, and several other areas of financial expertise.

She is a graduate of Chemistry from the University of Lagos and holds an MSc in Financial Management from the University of London and an MBA in Banking and Finance from the University of Lagos. She has attended several Leadership courses in Oxford University, INSEAD, Singapore, UCLA and Stanford University. Carol is a member of the Women Corporate Directors Nigeria chapter, honorary member Chartered institute of Bankers Nigeria and member Institute of Directors Nigeria. She also has Board level experience from several Institutions.

Daniella Keet, Head of partnerships for FNB Business, FirstNational Bank

Daniella Keet is currently the Head of partnerships for FNB Business. She is involved the SME funding and value proposition strategies for FNB that drives the need for external Partnerships. She is a qualified Chartered Accountant with over 15 years Banking experience. She has experience in leading teams for both the Corporate and Commercial segments of FirstRand Bank.

Melis Özdeğirmenci, Senior Vice President-SME Marketing, Akbank

Melis Özdeğirmenci joined Akbank in April 2002 as a management trainee. She served as Manager in Corporate & Commercial Credits and Commercial Banking Departments. She was a Vice President in SME Banking Sales Department between October 2011 and January 2017. Then she was appointed as Branch Manager in charge of Icerenkoy and Bagdat Street. Ozdegirmenci served as Senior Vice President of Bancassurance & Consumer Finance between June 2019 and December 2021. She has been in charge of SME Banking Marketing Department since January 2022. Ozdegirmenci is a graduate of Middle East Technical University, Bachelor of Economics and holds an Executive MBA degree from Sabancı University.

Rajeev Chalisgaonkar, Head of Business Banking, Mashreq Bank

Rajeev Chalisgaonkar, Head of Business Banking, Mashreq Bank

Rajeev Chalisgaonkar is the Group Head of Business Banking for Mashreq Bank, and he also heads Mashreq’s highly successful SME focused digital neobank, NeoBiz. He was previously Global Head of Business Banking at Standard Chartered Bank. Rajeev has more than 29 years of experience in Corporate, Commercial and Retail Banking across diverse geographies including Europe, the Middle East, Africa, and India. In his previous assignment, Rajeev was Head of Corporate Banking with Barclays Bank India and before that led the SME and Business Banking for Barclays Emerging Markets across 14 countries in Asia, Middle East and Africa. Prior to joining Barclays, Rajeev worked for Citibank and Export-Import Bank of India holding leadership positions in Central Europe and India. Rajeev completed his MBA at IIM Calcutta. His academic achievements also include a Bachelor of Engineering (Metallurgical Engineering) from Malaviya National Institute of Technology, India.

Hosted by:

Qamar Saleem, Global Head of The SME Finance Forum

Qamar Saleem, Global Head of The SME Finance Forum

Qamar Saleem leads the world’s most prominent SME Finance center for knowledge exchange, solution building, innovation, best practice transfer and public-private dialogue. Prior to this role, Qamar was heading Financial Institutions Group Advisory Services for Asia and Pacific aimed at providing integrated investment/advisory client solutions across MSME finance, Gender, Climate, Digital, Housing, Trade, and Supply Chain Finance. Qamar has been with IFC since 2012 and had also served as global technical lead for SME and Supply Chain Finance. Qamar has 30+ years of global financial services experience having worked across 80+ countries, advised more than 300 financial institutions internationally in scaling SME Finance. Prior to joining IFC, Qamar was associated with international organizations like HSBC, Standard Chartered Bank, Deutsche Bank as well as large regional banks while serving in several emerging markets and had launched numerous new business lines, including SME banking, in his banking career.