Articles

Financial Inclusion

Apr 15, 2024

In November 2023, the United Nations Development Programme (UNDP) moderated the closed-door roundtable "How Universal Trusted Credentials (UTC) can transform financial inclusion" . This event brought together senior representatives from central banks, financial institutions, and other stakeholders from around the world to discuss the opportunities...

Financial Inclusion

Youth Entrepreneurship

Aug 14, 2023

Over 163 million informal workers in emerging markets have found new opportunities through #gigplatforms, but many remain financially excluded. That's why platforms are stepping up to offer financial services to #gigworkers, helping them save, invest, and access credit. The impact can be positive for the workers and the economy. If you're...

Credit Risk & Scoring

Feb 08, 2023

Our member, Asante Financial Services Group, is driven by passion to see to the growth of the MSME sector in Africa. It is through strategic partnerships such as the one with SOLV Kenya, a member company of Standard Chartered Banking Group, that we are able to extend our reach to the Kenyan MSMEs In Sub-Saharan Africa, micro, small and medium...

Alternative Financing

Digital Financial Services

Dec 15, 2022

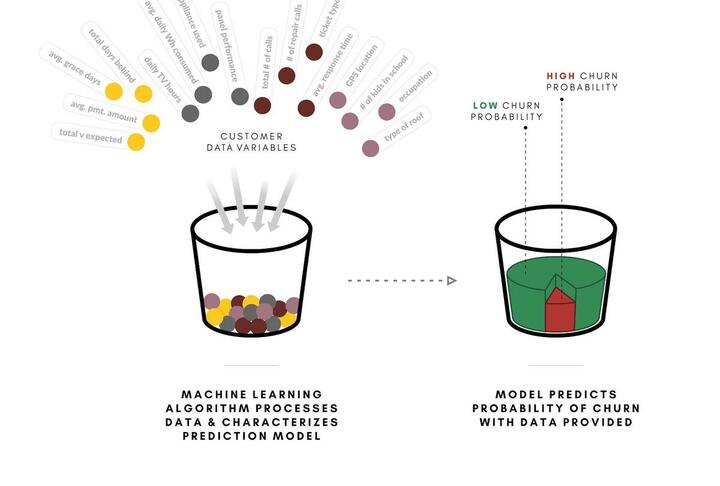

Digital lending or alternative lending is a catalyst to inclusive financial services for segments that are not a key target for traditional financial institutions. The use of AI-powered decisioning systems for evaluating individual credit eligibility by digital lending platforms has now become critical for micro, small and medium enterprises (...

Sustainable Finance

Digital Transformation

Oct 05, 2022

What we heard on September 21 st …. We kicked off the second day of the Global SME Finance Forum 2022 with Ruth Horowitz - Regional Vice President for Asia and the Pacific, IFC and his Excellency Phan Phalla - Secretary of State for the Ministry of Economy and Finance of Cambodia. Both Ruth Horowitz and Secretary Phan Phalla spoke about the...

Sustainable Finance

Digital Transformation

Oct 04, 2022

What we heard on September 20 th …. Opening remarks were given by H.E. Chea Chanto – Governor, National Bank of Cambodia and Tomasz Telma – Director, Financial Institutions Group, IFC Chea Chanto laid out examples of how Cambodia is increasingly leveraging digitalisation to improve access to finance and Tomasz Telma talked about data driven...

Trade Finance

Sep 14, 2022

This podcast prepared by our industry partner Trade Finance Global, features Matt Gamser, CEO of the SME Finance Forum and Magda Bianco, co-chair of the Global Partnership for Financial Inclusion (GPFI). It gives an overview of current G20 initiatives designed to help SMEs get easier access to finance. Among those initiatives is the Global SME...

Sustainable Finance

Dec 01, 2021

Conference Proceedings of the 2021 Global SME Finance Forum Day 1 - October 18th Opening Remarks Makhtar Diop, Managing Director and EVP, International Finance Corporation (IFC) We need contribution from SMEs to help us reach our sustainability goals. Individually not a major source of greenhouse gases but collectively account for a significant...

Guarantees

Covid-19

May 27, 2021

Posted originally in the Financial Resilience Around the World, World Bank Blog Series Burkina Faso, a landlocked country in the heart of the Sahel region, was already facing difficult challenges when the COVID-19 outbreak occurred. The security context had been deteriorating since June 2018, with an upsurge in violent attacks by terrorists and...

Digital Transformation

Mar 15, 2021

*This article is an excerpt with key highlights from WeBank’s recent presentation at the 2021 Knowledge Annual Conference of the IFC. The pandemic has shoved the global economy into a state of chaos, affecting both large corporations and SMEs across nearly all sectors. However, the global outbreak has also brought opportunities to innovate...

Covid-19

Digital Financial Services

Mar 04, 2021

The past 12 months have brought a multitude of unprecedented challenges for small businesses. It was inspirational to witness how they responded with versatility, creativity and tenacity, and how that brought about rapid innovation, new collaboration and empathy that continues to benefit society as a whole. It was also exciting to see the...

Non Financial Services

Gender Finance

Covid-19

Jan 15, 2021

The COVID-19 pandemic has profoundly impacted many lives across the globe. In this blog we focus on women. Worldwide, the pandemic has hit women harder than men. Women run a higher risk of COVID-19 contagion due to their occupations in health-related activities. They are also overrepresented in jobs where social distancing has been more difficult...

Fintech

Dec 23, 2020

Our member Raiffesisen Bank International’s Partnership Program Elevator Lab’s fourth round took place virtually in the second half of 2020. Elevator Lab had been selected as one of the “Best Financial Innovation Labs in 2020” by the Global Finance. The Lab aims at finding innovative fintech solutions and building mutually beneficial partnerships...

Financial Inclusion

Dec 22, 2020

Our member Kabbage plans to expand on the work done by researchers from NYU Stern on the kind of lenders that had the highest minority share among their Payment Protection Program (PPP) loans. They will work on exploring the reasons behind the found correlation between the lender type and borrower race. The current research note focused on...

Fintech

Dec 17, 2020

We are happy to share that our member Bitbond , Germany’s leading tokenization and digital asset custody technology provider, and Bankhaus von der Heydt (BVDH), one of Europe’s oldest banks, have joined forces to issue a Euro (EUR) stablecoin (EURB) on the Stellar network. The EURB stablecoin is the first stablecoin issued directly by a banking...

Sustainable Finance

Dec 15, 2020

As the world reflects on progress on climate action since the Paris Agreement signing, it has been clear that action by small and medium-sized companies is essential for accelerating the transition to a net-zero emissions global economy. The SME Climate Hub has joined forces with Oxford University to provide small and medium-sized enterprises (...

Covid-19

Dec 10, 2020

We are happy to share that our member U GRO Capital has recently entered into a strategic partnership with the Wadhwani Foundation, a global non-profit organization. The partnership between the two organizations will mutually benefit the micro, small and medium enterprises that are predominantly present in education, healthcare, hospitality,...

Islamic Banking

Dec 08, 2020

We are happy to share that our member Islamic Corporation for the Development of the Private Sector’s (ICD) has established Finnovation Award to recognize, showcase and encourage financial institutions that provide an outstanding solution to the financial industry. Finnovation awards are a part of their new online platform “ Finnovation ” which...

Operational Risk

Dec 07, 2020

Our member Afreximbank has taken the lead in creating a platform for Customer Due Diligence (CDD)/Know Your Customer (KYC) issues, with a special emphasis on African financial institutions and corporates. The platform referred to as Mansa will provide a single source of primary data required for performing customer due diligence checks on...

Digital Financial Services

Dec 04, 2020

We’re delighted to share that our member Fern Software’s premier CRM and loans management system, FaaSBank is now used by over 50 community and SME lending organizations from coast to coast in Canada. FaaSBank was collaboratively designed with Community Futures Development Corporations (CDFDCs) in Ontario, Canada. User friendly and intuitive,...

Fintech

Dec 03, 2020

COVID-19 has immensely changed the way we work. With an increase in reliance over online communication and remote work, there has also been an increase in security and data threat issues. Therefore, to meet the needs of modern-day digital challenges, our member Fern Software has partnered with Salesforce, one of the largest cloud-based software...

Islamic Banking

Dec 03, 2020

One of the main goals of our member Islamic Corporation for the Development of the Private Sector’s (ICD) asset management department is to create an “Enabling Environment” for the growth of Islamic Finance and build “Partnerships” with the private sector to enhance resource mobilization. The SME Funds at Asset Management Department of ICD is...

Covid-19

Dec 02, 2020

Our member Triodos Investment Management has shared an informative column on “How Covid-19 is changing financial inclusion,” by Frank Streppel, Head of Global Investments at Triodos IM. He is a seasoned impact investing specialist with more than 20 years of expertise. According to him, financial inclusion facilitates access to all other basic...

Equity

Dec 02, 2020

Small and medium businesses have been some of the hardest hit in the COVID-19 pandemic. And all that has been as true in emerging markets as it has been for SMBs in the developed world. Tunde Kehinde has had a front-row seat witnessing and responding to that crisis. He’s the CEO and co-founder of our global member Lidya , a startup out of Nigeria...

Equity

Dec 01, 2020

We are pleased to share that our member Triodos Investment Management through its Triodos Microfinance Fund and Triodos Fair Share Fund in collaboration with Germany’s GLS Bank and UmweltBank has acquired 78% of Opportunity Bank Serbia (OBS), which is a member of Opportunity International, a network of banks and microfinance organizations. Triodos...

Sustainable Finance

Nov 27, 2020

We’re delighted to share that our member FinDev Canada has announced a USD 20 million loan support to FirstRand, one of South Africa’s leading financial institutions. The loan will add further financial capacity and assist in providing innovative lending solutions to FirstRand’s approximately 700,000 SME clients. Paulo Martelli, Director of...

Nov 26, 2020

We’re pleased to share our member Islamic Corporation for the Development’s (ICD) valuable work from their Business Resilience Assistance for Value-adding Enterprise (BRAVE) Women Program. The project was fully funded by the Women Entrepreneurship Finance Initiative (We-Fi). The total amount of approved funding by We-Fi for the BRAVE Women...

Sustainable Finance

Nov 25, 2020

We’re proud to share that our member FinDev Canada has announced a USD 10 million loan support to Colombia’s Business Development Bank (Bancóldex). Alongside IDB Invest, FinDev Canada’s financing will support Bancóldex’s COVID-19 emergency liquidity lending program, which will support SMEs severely affected by the pandemic in Colombia. Created in...

Digital Financial Services

Nov 25, 2020

We all know that a lot has changed in 2020 as society gets used to the new routines; working from home or working on the front lines. Our member Fern Software is ready to enable this transition with a new platform that allows users to work from anywhere. Using AI technology to identify trends, they've embraced digital to the fullest with the...

Trade Finance

Nov 24, 2020

We are delighted to share that our member HPD LendScape’s key client Allied Irish Bank (AIB) has completed a major technology initiative with the migration of its receivables finance operations to HPD LendScape’s fully cloud-hosted platform. The Cloud migration and software upgrade will allow the bank to easily scale up its offering and improve...

Rural & Agriculture Finance

Nov 23, 2020

We are excited to share that our member The Arab Gulf Programme for Development (AGFUND) has announced that the nominations are now open for Prince Talal International Prize for Human Development for the year 2020 under the subject "Zero Hunger: Eliminating hunger, providing food security and improved nutrition, and promoting sustainable...

Credit Risk & Scoring

Nov 11, 2020

We are delighted to share that our member Triodos Investment Management’s Microfinance Fund, Fair Share Fund and Hivos-Triodos Fund have provided a EUR 3 million debt facility to KoinWorks, the leading digital lender in the growing peer-to-peer (P2P) lending space in Indonesia. KoinWorks is a company which connects borrowers (SMEs) to lenders on...

Sustainable Finance

Nov 06, 2020

We are proud to announce that our member Triodos Investment Management’s Hivos-Triodos Fund , has taken an equity share in Indian clean-tech company GPS Renewables (GPS), together with the local impact investor Caspian. GPS is a leading and innovative bio-energy technology company that develops disruptive organic-waste-to-energy solutions. The...

Non Financial Services

Nov 06, 2020

Fyndoo by our member Topicus has partnered with de Volksbank to accelerate financing to the self-employed and entreprenuers. This partnership enables complete digitization of loan applications and loan processing. Entrepreneurs can now obtain financing with 5 working days upon completion of all documentation. “With Fyndoo Lending we offer...

Trade Finance

Nov 02, 2020

Global Executive Forum Series by Trade Finance Global and SME Finance Forum. Our partner Trade Finance Global launched the Global Executive Forum Series, in a joint collaboration with the SME Finance Forum. The second interview in the series discusses ‘1.5°C Supply Chain Leaders’ with Maria Mendiluce, CEO of We Mean Business, Majda Dabaghi,...

Financial Education

Nov 02, 2020

We are proud to announce that our member Proparco and Agence Française de Développement Group (AFD) has committed approx. €2.5 billion to finance MSMEs and entrepreneurs in Africa, by the year 2022. The Choose Africa initiative is implemented by the AFD group and coordinated by Proparco. About 10,000 African companies will be supported by this...

Financial Education

Nov 02, 2020

We are proud to announce that our member Triodos Investment Management’s Microfinance Fund and the German Development Finance Institution (DEG) have invested close to USD 25 million in Ipak Yuli Bank, a universal commercial bank in Uzbekistan. Both investors have acquired an equal minority stake in the share capital of the bank through an issuance...

Supply & Value Chain Finance

Oct 16, 2020

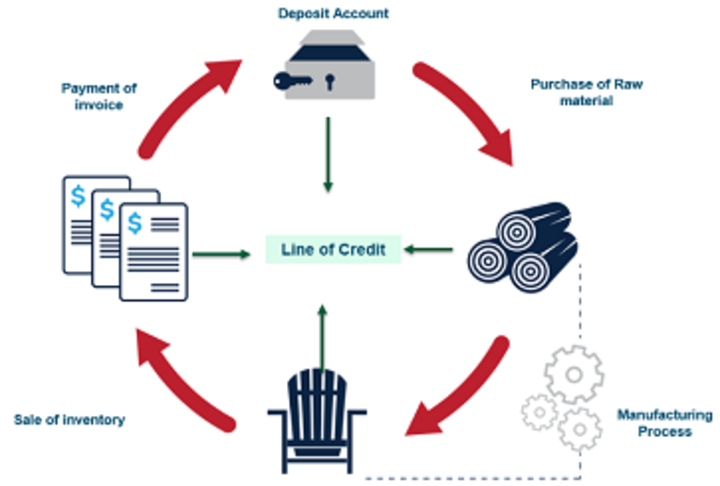

We are proud to share that our member HPD LendScape has partnered with Emirates Development Bank (EDB) to launch UAE’s National Supply Chain Finance (SCF) platform. This initiative will offer UAE businesses improved access to working capital, particularly as they cope with the added pressures of the COVID-19 pandemic. SCF solutions will enable...

Non Financial Services

Oct 15, 2020

Fyndoo is the name of a lending ecosystem, a cloud technology stack developed and owned and by our member, Topicus. They make financing accessible, efficient and transparent for all parties involved and connect financers, entrepreneurs and advisors with their cloud-based business lending platform. Lack of access to lending is a challenge for...

Digital Financial Services

Oct 15, 2020

This blog has been originally posted on the World Bank Blogs website. Micro, Small and Medium Enterprises (MSMEs) play a huge role in facilitating economic development due to their flexibility and affinity to innovation. Even more so in emerging economies with a high contribution from the informal sector. Yet, MSMEs face several challenges when...

Digital Financial Services

Oct 15, 2020

Our member CashDirector, an AI-enabled Digital CFO for SMEs with operations in Poland, France, Germany and Italy, is further expanding its services in Europe with the support of EIT Digital Accelerator and a recent financing round led by one of the largest Polish Investment Funds, EEC Magenta. Through CashDirector, banks obtain valuable...

Financial Education

Oct 15, 2020

We're proud to share that our members 4G CAPITAL GROUP Limited (“4G CAPITAL”) and Citi with the U.S. International Development Finance Corporation (“DFC”) and the Ford Foundation have collaborated to expand financial inclusion through the provision of working capital to support the growth of micro-enterprises in Kenya. 4G Capital will receive a...

Supply & Value Chain Finance

Oct 07, 2020

On Wednesday September 19, 2019, our member Afriland First Bank organized a meeting between SMEs and SMIs. This was the second edition of this event which brought together around 100 Cameroonian companies. The theme of the event was “From factory to market: solutions to the challenges of production and distribution by SMEs / SMIs in Cameroon.” The...

Covid-19

Oct 06, 2020

Originally posted in Nanopay website In this piece, prepared by member Nanopay, Ivy Luu, Director of Liquidity Management Solutions, talks about the future of liquidity management and draws parallels between today’s crisis and the one that occurred in 2008. Continue reading here>

Covid-19

Sep 29, 2020

Our partner Trade Finance Global launched the Global Executive Forum Series, in a joint collaboration with the SME Finance Forum , with the first B20 / Business at OECD - OCDE Interview with Gianluca Riccio, CFA, Vice-Chair Finance Committee, Business at OECD. The COVID-19 pandemic has highlighted the world’s considerable dependence on Global...

Credit Risk & Scoring

Sep 29, 2020

This blog has been originally posted on the World Bank Blogs website. For most MSMEs, capital and wealth are concentrated in movable assets -- in the developing world, 78% of the capital stock of businesses are inventory, equipment or receivables, and only 22% land and buildings. Conversely though, lending practices in most of the developing world...

Gender Finance

Sep 25, 2020

Women play a significant role in the development of our economy but are one of the most vulnerable groups impacted by unprecedented events. The ongoing pandemic has heightened the need to address the gender finance gap in societies around the world and drive initiatives to support them in achieving financial independence. We’re proud to see our...

Gender Finance

Sep 25, 2020

As 2020 started, Wandia Gichuru’s eyes were set on a 40% revenue growth on her business from the previous year. Wandia is Founder and Owner of Vivo, a manufacturer and retailer of women’s clothing with 14 shops throughout Kenya. Little did she know that only a few months later the world would go into a rare lockdown which would make even matching...

Credit Risk & Scoring

Sep 24, 2020

This blog has been originally posted on the World Bank Blogs website . Two months from now, about 200 million people will be out of jobs due to the economic effects of the coronavirus (COVID-19). The disruption of supply chains and reduction in demand are impacting businesses’ cash flows and profitability—in some cases permanently. To avert a...

Sep 04, 2020

Originally published on The Next Web . History has taught us that times of crisis drive demand for technological advancement. Those that leverage innovative technology, to tackle challenges and turn them into opportunities, are often the most successful in helping society to recover. Earlier this year, when the novel coronavirus sparked a global...

Credit Risk & Scoring

Aug 17, 2020

Despite a low growth economy, which was hit even harder by COVID-19, local small and medium enterprise (SME) financier Retail Capital, has retained its national BB+ credit rating. While its international rating has dropped by one notch to B- in line with South Africa’s credit downgrade in March, both ratings have a stable outlook. This has...

Financial Education

Jul 30, 2020

Originally posted by The Banker and reproduced with author's permission. Accounting has a long tradition. In Europe, it can be traced back to the 15th century, when double-entry bookkeeping became more widely known through the publication of a book by friar Luca Pacioli, in 1494, where he described the practice that Venetian merchants had been...

Covid-19

Jul 21, 2020

Originally posted on the The Alliance for Financial Inclusion (AFI) website . Since the early onset of the global pandemic, Central Bank of Jordan (CBJ) has adopted ongoing preventive and supportive measures aimed at containing the negative repercussions of COVID-19 on the local economy. Furthermore, the central bank has facilitated the use of...

May 11, 2020

Last December, we invited Nick Ogden, founder of ClearBank and WorldPay, to our offices for a presentation about RTGS, and a new interbank network the company was developing, where the benefits of the real-time gross settlement are uniquely matched to real-time guaranteed liquidity. RTGS Limited was founded by Nick Ogden, the entrepreneur who, as...

Covid-19

Apr 29, 2020

Over a period of less than two weeks, since it was officially declared a pandemic by WHO, COVID-19 has disrupted lives and economies around the globe. According to a briefing issued by the United Nations Department of Economic and Social Affairs, the COVID-19 pandemic will likely shrink the global GDP by almost one percent in 2020. Countries have...

Gender Finance

Covid-19

Apr 27, 2020

Promoting good practices in women entrepreneur financing has always been an important focus of the SME Finance Forum. Financial inclusion for women has always been challenging, particularly in emerging and developing markets where women entrepreneurs have lower access to capital, which severely restricts their progress and ability to contribute to...

Covid-19

Apr 17, 2020

SME Finance Forum members CRIF and Strands have joined forces in an exciting move to create a new provider of digital solutions for Open Banking. Earlier this month, it was announced that CRIF had acquired Strands, and we had the exclusive opportunity to talk to Enrico Lodi , CRIF’s General Manager, and Erik Brieva , Strands’ CEO, to discuss what...

Covid-19

Apr 14, 2020

Posted originally on The Banker website. Article by Lesly Goh , SME Finance Forum Senior Advisor, and former chief technology officer at the World Bank . Closer partnerships between governments and innovative companies will help our communities during and after the COVID-19 crisis, says the World Bank's Lesly Goh. It is a grim reality for small...

Financial Education

Covid-19

Apr 07, 2020

The Department of the Treasury and Small Business Administration issued guidance for the Paycheck Protection Program. The guidance can be found here: Paycheck Protection Program – Interim Final Rule Assistance for American Workers and Families In the weeks immediately after the passage of the CARES Act, Americans will see fast and direct relief in...

Covid-19

Apr 03, 2020

Member: World Savings and Retail Banking Institute (WSBI) statement on COVID-19 Posted originally on https://www.wsbi-esbg.org/ Due to COVID-19, the financial industry will face an unprecedented challenge, and this may last for quite some time. A health pandemic was not on the cards and banks need to work together with authorities to avoid the...

Mar 30, 2020

Originally posted on the IFC Intranet on March 30th,2020 Strategy Analyst Khondoker Tanveer Haider spoke with Communications Consultant Gregory James Felder about the importance of youth engagement at IFC and launching the MSME Finance Competition. This is an edited version of their conversation. Q: Khondoker is an interesting name. What does it...

Guarantees

Feb 10, 2020

In this article published by ALIDE , prepared by Pablo Pombo, Horacio Molina, and Jesús N. Ramírez, the authors aim to provide a better understanding of the operation of guarantee schemes through their typology and their corresponding business models. When discussing guarantee coverage in favour of micro, small and medium enterprises, it would...

Digital Financial Services

Fintech

Jan 14, 2020

Business Reporter, a UK based B2B media outlet are producing the ‘global Future of Banking & FinTech filmed thought leadership series’ in 2020, a series of interviews and on-location documentaries aimed at educating business owners globally on the innovation trends that are reshaping the way financial services are structured, provided and used...

Digital Transformation

Jul 09, 2019

The MSME sector is the backbone of Nigeria’s economy. Studies by the International Finance Corporation (IFC) show that approximately 96% of Nigerian businesses are Micro, Small and Medium Enterprises (MSMEs). Thanks to digital technology, it is worth noting that ecommerce platforms have so far played a key role in boosting and accelerating MSMEs...

Gender Finance

Sustainable Finance

Digital Transformation

Apr 18, 2019

IFC invested $75 million in a Gender Bond issued by Turkey’s Garanti Bank (a SME Finance Forum member). IFC details the story of how and why the investment with Garanti was a bold one. The bank, which is known in the market for its commitment to access to finance for women, is the first private sector bank in the world to launch a gender bond...

Supply & Value Chain Finance

Credit Risk & Scoring

Digital Transformation

Apr 04, 2019

Radoslav Albrecht is the Founder and CEO of Bitbond, a global lending platform for small business loans. The SME Finance Forum member, leverages blockchain technology to connect creditworthy borrowers with individual and institutional investors. Recently, Anthony Manfre interviewed Radoslav to learn more about how Bitbond is leading innovation in...

Financial Education

Non Financial Services

Sustainable Finance

Dec 07, 2018

While alternative dispute resolution has exploded in popularity for larger businesses, it hasn’t found its way to the MSME community. As a friend in the arbitration business said recently, “micro businesses couldn’t afford the coffee at most arbitration centers.” But the emerging field of online dispute resolution, or ODR, promises to change the...

Sustainable Finance

Payments

Jul 18, 2018

With over one million units sold in the last five years and over 50,000 units installed each month, the PAYGo model makes solar affordable for end-users and provides sufficient margin for providers to scale last-mile distribution. However, for the model to succeed PAYGo operators must retain customers and build a base of loyal and engaged...

Gender Finance

Policy & Regulation

Credit Risk & Scoring

Digital Financial Services

Payments

Jul 17, 2018

Industry Partner GBA for Women says that digital solutions for product distribution are rapidly increasing banks’ ability to reach the unbanked – a segment disproportionately made up of women. During the recent All-Stars Academy in South Africa, GBA heard from two of its members who are making huge strides in this area: Diamond Bank of Nigeria -...

Credit Risk & Scoring

Dec 20, 2017

Financial Inclusion Week is a week of global conversation on the most important steps to advance financial inclusion. This year, stakeholders explored how new products and partnerships are empowering customers. Building on the momentum, SME Finance Forum member, Mambu, shared stories of their clients who have gone digital to inspire organisations...

Non Financial Services

Sustainable Finance

Digital Financial Services

Dec 19, 2017

Financial Inclusion Week is a week of global conversation on the most important steps to advance financial inclusion. This year, stakeholders explored how new products and partnerships are empowering customers. Building on the momentum, SME Finance Forum member, Mambu, shared stories of their clients who have gone digital to inspire organisations...

Gender Finance

Credit Risk & Scoring

Oct 13, 2017

Microfinance is a $92 billion industry , with more than 100 million borrowers in more than 75 countries around the world. But as regular readers of NextBillion know, it is no silver bullet to poverty, and previously held assumptions that extending microloans to impoverished people is a sure path out of poverty have been challenged. Microcredit...

Financial Education

Policy & Regulation

Sep 26, 2017

In this short paper, Terry Tse contrasts U.S. and Asian regulations, describes the emerging P2P business environment in Asia (which appears to be extremely well positioned for growth), explains the key structural incentives Asian P2P lenders have implemented to discourage borrowers from defaulting, and concludes with practical suggestions to help...

Supply & Value Chain Finance

Credit Risk & Scoring

Sep 15, 2017

The inability to provide collateral has been a major hindrance for small and medium enterprises (SMEs) seeking loans to fund their working capital needs, finance their expansion or take advantage of growth opportunities. Although the government has been taking steps to provide the necessary financing to SMEs, traditional lending institutions offer...

Islamic Banking

Credit Risk & Scoring

Jul 21, 2017

Emirates Islamic Bank has integrated blockchain technology into cheques to strengthen their authenticity and minimize potential fraud. Referred to as ‘Cheque Chain,” the bank, like others are looking at opportunities to increase efficiency, cut costs and improve customer services. New business opportunities are also presenting themselves,...

Financial Education

Guarantees

Credit Risk & Scoring

Jul 06, 2017

KBZ Bank or Kanbawza Bank has more than 470 branches throughout Myanmar, with plans to grow its division devoted to SMEs. Running for a year, the new initiative uses credit guarantee insurance to attract borrowers, offers client banking training and has improved its IT operations to better serve SMEs. More than 90 percent of the country’s...

Credit Risk & Scoring

May 26, 2017

In the story of Ali Baba and the 40 Thieves, the magical word “sesame” was used to open the seal of a cave where Ali Baba found hidden treasure. In China today, the same word is connected to another kind of magic, one that reveals hidden identities of the socially and economically disadvantaged. Sesame Credit (“芝麻信用” in Mandarin) is a product...

Payments

Feb 07, 2017

Modelo Perú, a first-of-its kind payments initiative in Peru, will mark its one year anniversary. The initiative established an interoperable nationwide payments platform, Bim, with a particular focus on expanding access to underserved customer segments. Thirty three institutions, including microfinance organizations, commercial banks, and telecos...

Fintech

Dec 30, 2016

Since many years, I enjoy working in the Financial Industry and future trends such as FinTech seemed obvious, until recently reflecting on possible trends for 2017 . In my humble opinion FinTech is addressing a customer experience driven demand strongly supported by technical evolution such as mobile, cloud, big data, etc… Has the...

Financial Education

Dec 29, 2016

Almost half of adults in emerging economies still lack basic financial services. Here are five ways to help more people benefit from digital finance. 1) Make sure digital technology is available to everyone 2) Take advantage of biometrics to serve the poor 3) Ramp up use of direct deposit by the private sector 4) Stop using cash to distribute...

Financial Education

Non Financial Services

Nov 03, 2016

After decades of directing financial services to micro-enterprise owners, many microfinance institutions are finding that some of these enterprises have grown and that they’re now serving an expanding number of small business owners. With increasing global attention being directed to small and medium-sized enterprises (SMEs), it is fitting to look...

Fintech

Aug 18, 2016

“Fintech” – an intersection of financial services and technology – is taking the traditional financial world by storm. Indonesia is no exception, with a fast-evolving ecosystem that includes a host of financial services offered by new generation fintechs. Indonesia is the fourth largest mobile market in the world with 339.9 million connections – a...

Jul 20, 2016

At the 7th Annual Responsible Finance Forum held in Xi’an China, the role of data was highlighted in the context of crowdfunding and credit risk analysis. Crowdfunding platforms (including P2P) spoke of their ability to access a vast array of consumer data, often described as “big data.” Sometimes these data are facilitated through affiliations...

Digital Transformation

Fintech

Mar 16, 2016

The traditional retail banking model based on the transaction/branch-based banking model is dying, and in future retail banking will be fully automated. That’s the view of 203 senior retail banking executives across the globe who were surveyed by The Economist ’s Economic Intelligence Unit (EIU) for a report called “In Tech We Trust”. One standout...

Credit Risk & Scoring

Feb 08, 2016

Small and medium-sized companies are contributing in a big way to the world's largest economies—and making choices about where to do their banking. To win them over, banks must create valuable, long-lasting relationships.

Gender Finance

Sep 11, 2015

On Labor Day, the governments of the United States and Canada recognize and celebrate the achievements and contributions of workers—female and male alike. And women’s economic contributions in these countries are well-documented: the increase in women in the U.S. labor force over the past several decades, for example, has led to more than $3.5...

Gender Finance

Aug 26, 2015

Interview with Anne Ravanona @ anneravanona , CEO and Founder of Global Invest Her helping women entrepreneurs become investor-ready and funded faster. TEDxSpeaker and Huffington Post Contributor.

Credit Risk & Scoring

Aug 11, 2015

What is the Bill and Melinda Gates Foundation doing with mobile money and the objective of raising people out of poverty by 2030? Our vision is that every life has equal value. The Foundation is then active in many ways to realise that vision in health, family planning, agriculture and other markets. One of the facts we found, from quite a lot of...

Alternative Financing

Aug 05, 2015

Crowdfunding –the practice of using a large number of investors to raise capital - has become an increasingly popular method of raising money for business. SME spoke to Luke Lang, CMO and co-founder of Crowdcube to find out just how the platform works How does Crowdcube work? Crowdcube is an investment platform where people who are backing or supporting a business invest money and, either through equity or getting a stake in the company, get to own a part of the business. As a platform, we’re quite distinct from other sites such as Kickstarter, which is a reward-based platform that is very common place and well-known. Crowdcube is often used by larger companies or businesses looking to develop and launch new products.

Financial Education

May 20, 2015

If market forces that drive digital financial services could solve the challenges of the poor, our role as donors would be irrelevant. However, market failure is often the norm in many of the more than 70 markets that USAID serves — often including incongruent policy and regulatory environments, and financial service provider business models incapable of supporting a robust offering of the most basic financial services. In Kay McGowan’s previous blog post, she notes, “Donors — USAID included — will never be the providers of financial services. But we often have a critical role to play in setting the conditions so that the private sector can fill the void that has left some two billion people globally without access to safe, affordable basic financial management tools and forces governments, businesses and individuals to transact in cash, which is expensive, dangerous, inefficient, and enables corruption.” USAID’s Critical Role Financial exclusion is the common denominator of development challenges. Across the globe and across sectors, the dearth of high-quality, low-cost basic financial management tools and products undermines efforts to improve agriculture, strengthen health systems, expand access to education, help governments become more transparent and efficient, and respond quickly and effectively to humanitarian crises. USAID is supporting greater access to relevant services for the poor in two essential ways: first, by encouraging governments to adopt a regulatory regime that fosters safe but rapid growth, and — equally importantly — to establish policies that prioritize the expansion of financial services for the poor, often starting with the digitization of payment flows, such as payroll and social protection transfers. And second, by fostering institutional demand across sectors for scalable and sustainable financial services by digitizing payments, be they from donor-funded projects or from big institutional “payers” such as large corporate actors.

Payments

May 20, 2015

This week, the topic of financial inclusion will garner attention as the World Bank uses its spring meetings to lay out a roadmap toward universal financial access and releases new data via the Global Financial Inclusion Database . As USAID seeks to harness the power of science, technology, innovation and partnerships, we are increasingly focusing on digital finance as the critical pathway toward scaling meaningful financial inclusion. But what does that mean? What is our role in services primarily offered by banks and mobile network operators? Lawrence Camp notes that mobilizing private capital entails “using public funds to encourage investment that will result in private profit, but which will also have a development impact.” In many ways, this definition captures USAID’s approach to accelerating the growth of commercially sustainable digital payments systems. Donors — USAID included — will never be the providers of financial services. But we often have a critical role to play in setting the conditions so that the private sector can fill the void that has left more than 2 billion people globally without access to safe, affordable basic financial management tools and forces governments, businesses and individuals to transact in cash, which is expensive, dangerous, inefficient and enables corruption. This blog series will outline USAID’s contribution to meeting the audacious goal of universal financial access through the creation of enduring, inclusive market infrastructure.

Sustainable Finance

Apr 15, 2015

Transaction accounts can open up access to those currently left out of the banking system, providing a basic entry point, or pathway, to broader financial inclusion . Using transaction accounts to move away from cash to digital payments has made it easier to be part of the formal financial system, even when brick-and-mortar banks are too far away or prefer not to serve poor people. A transaction account used to only mean an account at a bank. Nowadays, a transaction account could be a bank account, a mobile wallet, payment card, or a similar electronic instrument. A lot has happened in the five years since the G20 meeting where the international community recognized financial inclusion as a main pillar of the global development agenda. Since then, more than 50 countries have made formal commitments or set targets for financial inclusion . But much work remains. Worldwide, 2.5 billion adults still lack access to basic financial services. Closing this gap is vital to ending extreme poverty and boosting shared prosperity. World Bank Group President Jim Kim set the year 2020 as a target date to achieve Universal Financial Access (UFA). The UFA2020 goal calls for adults everywhere to have access to a transaction account to store money, send and receive payments.

Credit Risk & Scoring

Feb 26, 2015

“Banks are not lending to any startups without providing annual financial statements audited by licensed entities in Saudi Arabia,” said Al-Hazmi, co-founder of Riyadh-based Supply & Logistics Solutions that started operations last year providing storage and cargo services. “How would I be able to provide a bank with statements if I just started?” Lending under the nation’s SME Loan Guarantee Program, also known as Kafalah, plunged 76 per cent to SAR 572 million ($153 million) last year as banks tightened rules, according to data from the Saudi Industrial Development Fund. That compares with a 12 per cent increase for total bank credit last year to SAR 1.25 trillion, according to Saudi central bank data. “Banks in Saudi Arabia find it challenging servicing the SME market,” Yahya Alyahya, chief executive officer of Bahrain- based Gulf International Bank, which is majority owned by Public Investment Fund of Saudi Arabia, said in an e-mail on 24 February. “SMEs tend not to have reliable financial information, specifically audited financial accounts.”

Credit Risk & Scoring

Payments

Feb 17, 2015

This year saw 72 exhibitors and an audience of over 1200 people in London. There were even more innovators of relevance for both SME finance and for emerging markets. The biggest change to me was the presence of a new core of firms focused on trade and supply chain finance, which is clearly a priority area for SMEs, and which is ripe for innovation, due to the inefficiency of existing systems (and their prejudice against small ticket transactions) and the potential of new solutions to merge e-commerce with e-financing options. The firms Invoice Sharing ( www.invoicesharing.com ), Taulia ( www.taulia.com ) and Trade River Finance ( www.traderiverfinance.com ) all are focused on Europe and/or USA right now, but hopefully all will see the potential in emerging markets, particularly the booming ecommerce scene in Asia. There was a fascinating new entrants in the "alternative scoring" sphere, Aire ( www.aire.io ) focusing on getting scores for thin file candidates. Many new entrants came, as expected, in the "new channel" space, offering alternative delivery systems and even whole new banking models, alongside our old friends Quisk ( www.quisk.co ) which continues to refine its alternative payments offering. mBank and Telenor/Asseco demonstrated their models for banks of the future, already working in central and southeastern europe ( www.mbank.pl www.telenorbanka.rs and www.asseco.com/see ) . Mobino and Mistral Mobile ( www.mistralmobile.com ) offered new payments solutions that can provide the foundations for whole new services developments. LifePay ( www.life-pay.ru ) offers a unique payments solution and ecosystem for Russian SMEs. FOBISS offered an artificial intelligence solution to managing cash payments in branch networks which I figure could be even more useful in agent networks ( www.fobiss.com ). Bendigo and Adelaide Bank ( www.bendigoadelaide.com.au ) unveiled their new community banking digital ecosystem solution, combining digital payments with SME loyalty programs with an additional community investment element ... this was perhaps the one I least thought would be relevant from the name, and was most pleasantly surprised about (so surprised I invited them to talk to our IFC clients the next day, where they were a big hit!). Three crowdfunding operations caught my eye: Streetshares (www. streetshares.com), while still focused only on the USA, is a very interesting way of getting individuals involved again in social enterprise ventures, building on affinity groups in a way that could easily transfer to emerging markets when they're ready. Bitbond ( www.bitbond.com ) offers a global SME crowdfunding platform based on bitcoin, which they say allows true peer to peer to cross borders (there's much about this one I don't quite understand yet, particularly their clever way of letting one cash out of bitcoins). Finally, InvestUp ( www.investup.co ) they say is the first crowdfunding "supermarket", pooling 10 leading platforms at present. Finally, last but certainly not least, there were the innovators offering products that help SMEs run their businesses better and help them to work better with banks. Our old friends Bizequity ( www.bizequity.com ) and topicus finance ( www.topicusfinance.com ) both rolled out new wrinkles, the former opening up in the UK market, and the latter an improved business lending platform that learns about each bank it works with. Got to meet Strands for the first time ( www.finance.strands.com ), a very impressive group of polyglots offering both personal and business financial management solutions in digital packages for a number of leading multinational banks. see www.finovate.com to see the presentations of all these and other firms, as well as more information about each. matt

Jan 26, 2015

On May 12 & 13, Finovate returns to San Jose with FinovateSpring 2015 , a two-day showcase of the best new innovations in financial and banking technology from a mixture of leading established companies and hot young startups. Tickets are selling fast, well ahead of last year’s record-setting volume, with early attendance projections predicting over 1,400 attendees! Count yourself among them by registering now (and save an extra 20% through our special partnership with Finovate when you do)! Though there are many reasons to attend this year’s event, we've narrowed the list to the top five. Without further delay, here are the top five reasons to register for FinovateSpring 2015: 1. Unique value-packed formula: In just two days, you'll watch 72 companies debut their exciting innovations live on stage, plus you'll have the chance to enjoy intimate networking time with leading executives from organizations like Visa, Citi Ventures, Wells Fargo, MasterCard, Intuit and more . 2. Finovate's signature demo-only format: Companies receive just 7 minutes on stage to show (and not just talk about) their latest fintech – no slides or canned videos are allowed. This highly focused format makes sure you see the most important aspects of all 72 fintech innovations in just two days. 3. Cutting-edge fintech: Competition in the fintech arena is fiercer than ever and only the most groundbreaking innovations make it onto Finovate stages. 4. Diversity of ideas: From biometric security to wearable devices, from crowd funding to payments platforms and much more -- you'll see the best new fintech innovations across an incredible range of areas. 5. High-quality networking: Learn from and connect with 1,400+ financial & banking executives, venture capitalists, industry analysts, press, bloggers, and fintech entrepreneurs during TEN HOURS of networking throughout both days. Bring plenty of business cards! These are just five reasons to attend FinovateSpring -- to discover many more, register now! And because of SME Finance Forum’s partnership with FinovateSpring , you’ll save an extra 20% on tickets with the discount code SME20 . See you in San Jose!

Gender Finance

Jan 22, 2015

For every nine men raising equity financing to start and scale their businesses, only one woman does, according to Access to Capital by High-Growth Women-Owned Businesses, a report by the National Women’s Business Council. That sucks! Fundraising for your company is hard, even for men, but, women face greater challenges.

Equity

Jan 13, 2015

In the interview, Anabela Chambuca Pinho, PCA/CEO, Bolsa de Valores de Mocambique discusses: The main challenges African Capital markets are facing How exchanges can play a key role in tackling those challenges The future of the Mozambican market What Anabela believes can and should be done to attract SMEs in her market A preview of the interactive brainstorming session Anabela will be part of in March

Alternative Financing

Equity

Gender Finance

Guarantees

Rural & Agriculture Finance

Supply & Value Chain Finance

Sustainable Finance

Trade Finance

Islamic Banking

Governance

Policy & Regulation

Credit Risk & Scoring

Payments

Dec 04, 2014

Please see the link for the official announcement from the Turkish government. 2015 should be a very exciting one for SME finance and SME development. Turkey has been a leader in the SME agenda of the G20 since its inception, and has served as co-chair of the SME finance subgroup since SME finance became a priority for the G20 in 2009. As a technical partner to the G20's Global Partnership for Financial Inclusion, the SME Finance Forum looks forwarding to supporting the Turkish agenda during this coming year. Our readers may also see that Turkey will be forming a new global body to represent SMEs' own interests during 2015. Unfortunately the working name for this entity is "SME Forum", which risks some brand confusion, for obvious reasons!. We'll also be working with our G20 colleagues on this, hopefully with some resolution that helps build and grow this very worthwhile complementary institution, while avoiding too many cases of mistaken identity. matt

Rural & Agriculture Finance

Oct 28, 2014

Today, much of the conversation around smallholder agricultural finance is happening among an inspiring yet small group of social lenders and investment funds. These pioneering institutions have developed new products and disbursed millions of dollars in support of smallholder agriculture worldwide. However, as highlighted in Dalberg's recent report, an estimated gap of $400 billion still exists between demand and supply of finance to smallholder farmers. Without access to financial products and services, smallholders and agricultural enterprises are unable to purchase necessary supplies, expand production and increase their incomes. About the authors : Jane Abramovich and Matt Foerster from TechnoServe .

Gender Finance

Oct 01, 2014

The Women’s Finance Hub (part of the SME Finance Forum) recently hosted a conversation about the World Bank Group’s WomenX program, as part of the Financing Women Entrepreneurs for Growth series. The event was moderated by Sebastien A-Molineus, Director, World Bank, with panelists Mehnaz Safavian, Program Lead, Sarah Iqbal, Program Coordinator, Women Business and the Law, and Andrew McCartney, Senior SME Banking Specialist, IFC. Globally, women-owned enterprises are steadily growing, contributing to household incomes and growth of national economies. However, women entrepreneurs continue to face time, human, physical, and social constraints that limit their ability to grow their businesses. Recognizing the unique challenges of female entrepreneurs, the WomenX program facilitates linkages between financial institutions and women entrepreneurs seeking necessary capital for business growth. The program is aimed at empowering women by improving their entrepreneurial ecosystem. Presently there are two country pilots ongoing in Pakistan and Nigeria. The program aims to unleash the power of women entrepreneurs by: Removing legal restrictions to level the playing field Strengthening women’s managerial capability to increase productivity, grow enterprises and encourage sector switches Ensuring that women can tap into networks and gain access to markets Building women’s confidence through mentorship Linking women to banks and sources of capital for growth and expansion. Globally there are 865 million women who have the potential to contribute more fully to the economy, with 94% of them in developing countries. In the absence of women entrepreneurs, output per worker is 12% lower. Pakistan has the lowest rate of female entrepreneurship in the world. Only 1% of women in Pakistan are entrepreneurs compared to 21% of men. To date, despite the compelling case made for women’s participation in the global economy, women entrepreneurs are greatly outnumbered by their male counterparts, and they continue to face gender-specific obstacles that vary by country and region (in addition to the challenges faced by all SMEs in developing countries). Access to finance remains the top concern for women entrepreneurs. About 5.3 million to 6.6 million women-owned SMEs in developing countries are estimated to be unserved or underserved by financial institutions. In Pakistan a mere 3% of the female population has access to an account at a formal financial institution. The experience of WomenX indicates a clear need for financial and non-financial solutions for women entrepreneurs. On the financial side, banks require training to ensure they are ready with the right policies, processes, skills and products to serve the financing needs of women. On the advisory side, there is a clear need for women entrepreneurship training in markets like Pakistan. Such training needs to be scalable and sustainable, but also requires one or more integral banking partners to ensure the linkage with access to finance is made. WEBINAR MATERIALS WomenX Overview - Mehnaz Safavian WomenX in Pakistan - Sarah Iqbal WomenX and Access to Finance in Pakistan - Andrew McCartney About the author: Farah Siddique is a Consultant at the SME Finance Forum.