This report analyzes why collaboration — not competition — will be the primary driver of disruption in the FinTech industry. Ernst & Young Global Limited (EY), a UK company, analyzed 45 major global banks revealing that while all banks are engaged with FinTechs one way or another, only around a quarter are extensively engaged due to barriers to collaboration with FinTechs. In this report EY looked at some of the common barriers to effective collaboration — from navigating procurement and vendor risk management to technical implementation — and how banks and FinTechs can overcome them.

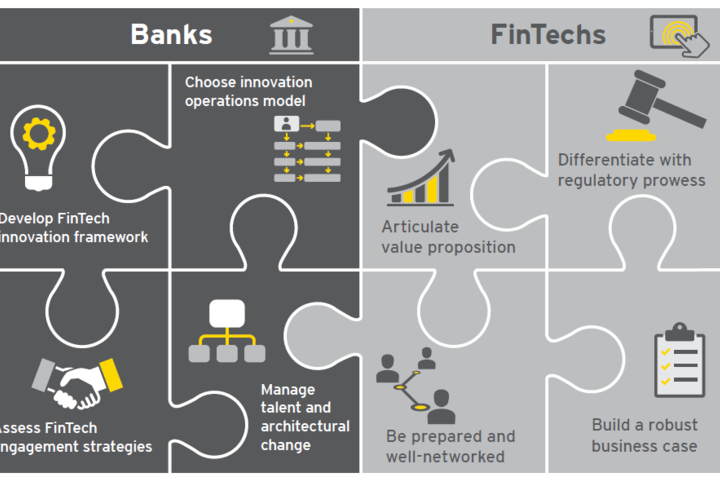

Suggestions for banks include:

1. Develop a FinTech framework that rewards innovation

2. Choose an innovation operating model that connects new ideas to business needs while balancing innovation with risk

3. Assess the pros and cons of your FinTech engagement strategies

4. Carefully manage talent and architectural change

Actions for FinTechs includes:

1. Articulate a value proposition

2. Differentiate themselves with regulator prowess

3. Be prepared and well-networked

4. Avoid overreaching yourself by building a robust business case