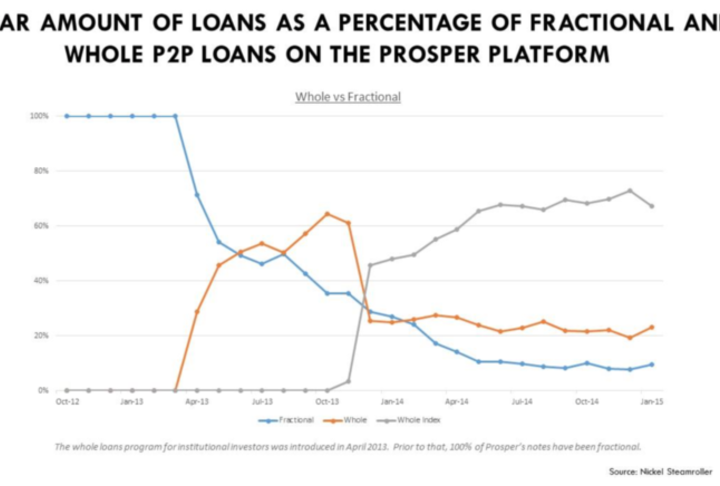

Peer-to-peer lending (frequently referred to as ‘P2P’) is only one of many innovations that are rapidly changing today’s financial services industry. Yet it can be argued that P2P has achieved mainstream success more rapidly, and to a greater degree, than any other trends in recent memory. EY and the University of Cambridge recently released a report that claims it has ‘gone mainstream’ in Europe. According to the AFP, P2P is surging in the United States as well.According to the EY and Cambridge report, between 2012 and 2014 P2P loans increased by over 280% in Europe, while in the United States the volume of loans on P2P platforms has surged an average of 84% each quarter since 2007, doling out nearly US$5.5 billion in loans in 2014. Its strong growth can be attributed to widespread frustration with the traditional banking system, where rapidly escalating compliance costs and risk aversion on the part of loan officers make it all but untenable for individuals and small businesses to receive lending services.

Articles

P2P Lending Breaches New Frontiers

Apr 27, 2015