The global unbanked and underbanked market continues to grow exponentially each year, and will reach an estimated three billion individuals and over 250 micro, small and medium-sized enterprises (MSMEs) in the next several years. This segment of the banking industry has the potential to reach over $150bn of new revenue and steal up to 10% of existing banking profits. Both new and traditional banking entities continue to seek opportunities to provide competitive solutions to this underserved corner of the market.

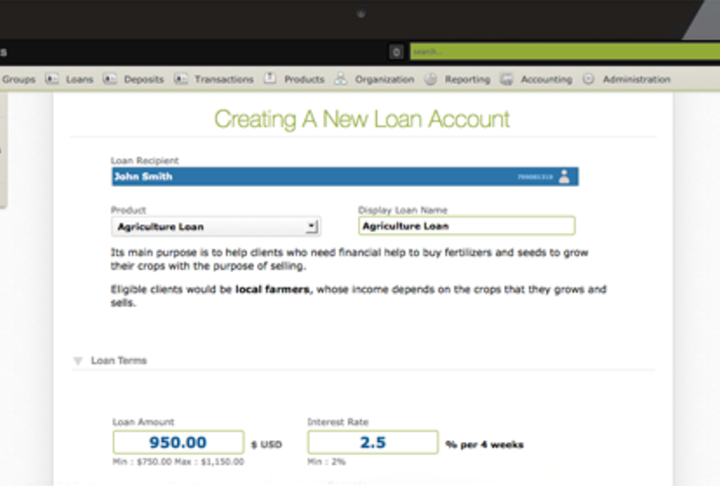

In this whitepaper, SME Finance Forum member, Mambu, details its software as-a-service (SaaS) cloud architecture that has been implemented by lenders from around the globe. It offers a simplified user-friendly, loan origination process for individuals and small businesses that balances data capture requirements and technology workflows with a customer experience across channels that factors in the human element to stay competitive.