Publications

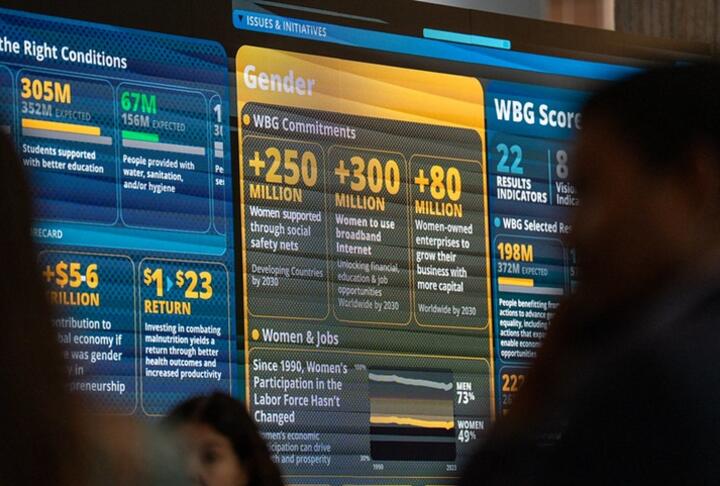

Gender Finance

Digital Transformation

Jun 06, 2025

Highlights Women represent a distinct and profitable customer segment that is often underserved by traditional financial products and services. Financial institutions must identify, acknowledge, and address gender biases rooted in cultural norms, stereotypes, and institutional processes. A structured approach, including understanding gender...

Supply & Value Chain Finance

Jun 02, 2025

Overview The Centre for Impact Investing and Practices (“CIIP”), a non-profit entity established by Temasek Trust, embarked on this report to study the role of Southeast Asian MSMEs in global supply chains. Throughout the course of this study, CIIP engaged and sought the views of Khazanah Nasional Berhad as we have a shared interest in...

Equity

Gender Finance

Rural & Agriculture Finance

Sustainable Finance

Policy & Regulation

Jun 02, 2025

This report offers strategic and actionable guidance to policymakers in strengthening their access to finance policies for small and medium enterprises (SMEs). This report emphasizes the need to improve the enabling environment for SME debt and equity financing. It outlines a roadmap of eight key actions to guide policymakers in achieving this...

Financial Education

Digital Financial Services

May 22, 2025

CARE’s new Strive Women report finds digital divide, financial stress and household responsibilities limit business success in emerging markets Atlanta, May 12, 2025 – Women entrepreneurs in emerging markets face considerable barriers that hinder their long-term success. While difficulties accessing small business credit and training are...

Data Analytics

Apr 22, 2025

Digitalization accelerated by the pandemic has exponentially increased the number and variability of alternative data sources. The stay-at-home requirements during the pandemic forced several business models to be digitized. This helped spur the digitization that had been ongoing pre-pandemic, largely driven by governments as countries sought to...

Supply & Value Chain Finance

Apr 03, 2025

IFC and C2FO are working under a strategic partnership to bolster job growth and economic prosperity in emerging markets and developing economies. The first initiative will work to enhance financing for local enterprises in Africa by developing a specialized, web-based multinational working capital platform for micro, small, and medium enterprises...

Policy & Regulation

Apr 03, 2025

The OECD Financing SMEs and Entrepreneurs Scoreboard: 2025 Highlights tracks financing trends, conditions and policy developments across nearly 50 countries. The paper provides official data on SME financing from 2007 to 2023, with additional insights for 2024 and early 2025, covering debt, equity, asset-based finance and overall financing...

Credit Risk & Scoring

Mar 28, 2025

Since 2020, #VietNam has experienced a surge in nonperforming loans (NPLs). Not only does the growing number of NPLs reduce the stability of the banking system, but each one represents a borrower excluded from credit markets. Many of the NPLs are consumer debts, meaning poorer households are particularly hard hit. IFC - International Finance...

Mar 21, 2025

MSMEs employ more than 80% of the workforce in #Ghana and account for over 70% of GDP. The majority of these enterprises are informal, consisting mainly of micro and sole enterprises operated by women and young entrepreneurs. While these small businesses play a critical role in economic growth and job creation, lack of information and collateral...

Equity

Feb 11, 2025

Highlights • Inclusive credit fintech has the potential to address the estimated US$4.9 trillion global credit gap for micro and small enterprises (MSEs). • However, access to diverse and suitable funding sources remains a critical challenge, especially for early-stage fintechs that are not yet profitable. • This focus note explores financing...

Digital Financial Services

Feb 11, 2025

BII sees opportunities for impact in firms of all sizes. Sole-traders, microenterprises, small, medium, and large firms are all sometimes unable to find the financing they need, to the detriment of society. The growth of firms is at the heart of development. Countries escape poverty as people move out of informal employment into wage-paying jobs...

Alternative Financing

Guarantees

Feb 05, 2025

EXECUTIVE SUMMARY KEY ACTIONS AGREED BY THE EXPERT GROUP: shorted by importance and short term feasibility: Banking channel PUBLIC-PRIVATE SHARED INVESTMENT MODELS: Building on the success of initiatives like “France Relance,” this action advocates for collaborative investment strategies that engage both public and private sectors in financing...

Policy & Regulation

Feb 03, 2025

Summary The G20 Global Partnership for Financial Inclusion (GPFI) Action Plan for Micro, Small, and Medium enterprises (MSME) Financing is a call to action to intensify the efforts of G20 and willing non-G20 countries to close the financing gap for MSMEs. MSMEs represent a significant share of economic activity and capture a large share of...

Digital Financial Services

Feb 02, 2025

Tania Ziegler (CCAF), Krishnamurthy Suresh (CCAF), Zhifu Xie (CCAF), Felipe Ferri de Camargo Paes (CCAF), Peter J Morgan (ADBI), Bryan Zhang (CCAF). This first edition of ‘The ASEAN Access to Digital Finance Study’, aims to provide valuable data and insights into how individual households, consumers, and micro, small and medium enterprise (MSME)...

Digital Financial Services

Feb 02, 2025

Tania Ziegler (CCAF), Felipe Ferri de Camargo Paes (CCAF), Cecilia López Closs (CCAF), Erika Soki (CCAF), Diego Herrera (IDB), Jaime Sarmiento (IDB) This edition of ‘The SME Access to Finance: A Deep Dive into LATAM’s Fintech Ecosystem’ provides insights into micro, small and medium enterprises’ (MSMEs’) access to funding through the alternative...

Digital Financial Services

Feb 02, 2025

By Krishnamurthy Suresh (Principal Researcher, CCAF), Felipe Ferri de Camargo Paes (Principal Researcher, CCAF), Loh Xiang Ru (CCAF), Richard Kithuka (CCAF), Peter Morgan (ADBI), Pavle Avramovic (CCAF), and Bryan Zhang (CCAF). This is the second edition of our ‘Access to Digital Finance’ study in Asia-Pacific. Building on our previous publication...

Data & Cybersecurity

Fintech

Dec 15, 2024

"International AI Policy Focuses on Safety" discusses the increasing global emphasis on ensuring the safe and responsible use of artificial intelligence (AI). Key points and main ideas include: International Collaboration on AI Safety: Governments and international organizations are recognizing the need for harmonized approaches to AI safety,...

Digital Transformation

Nov 27, 2024

November 2024 Highlights Open finance is a financial innovation that facilitates customer-permissioned access to and use of customer data held by financial institutions to provide new and enhanced services and develop innovative business models. Open finance frameworks can spur innovation, improve competition, enhance customer empowerment, and...

Digital Transformation

Fintech

Nov 05, 2024

A follow-up series of Banking for small and medium enterprises by IBM Institute for Business Value Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world’s workforce, and contributing 50% to global GDP.* Despite their significance, SMEs face many...

Digital Transformation

Oct 29, 2024

The white paper by Mastercard underscores the pivotal role of middle market businesses (firms with 50 to 250 employees) in driving global economic growth, with a notable $24.2 trillion in B2B spending in 2022. These businesses face unique challenges as they scale, such as the need for digitization, automation, and streamlined operations, along...