Library

Fintech

Jun 09, 2025

Washington D.C, June 4, 2025 – Africa Fintech Summit (AFTS) , a Global Forum Driving Collaboration and Growth has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to...

Fintech

Jun 06, 2025

Washington D.C, May 23, 2025 – ezee.ai , a global leader in digital lending technology has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

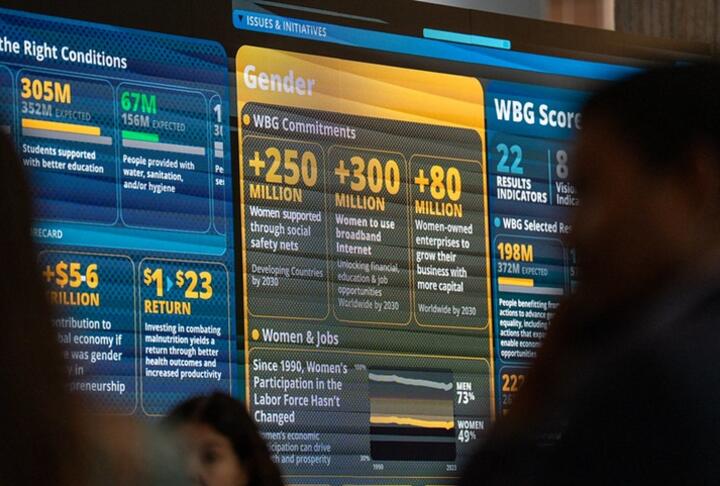

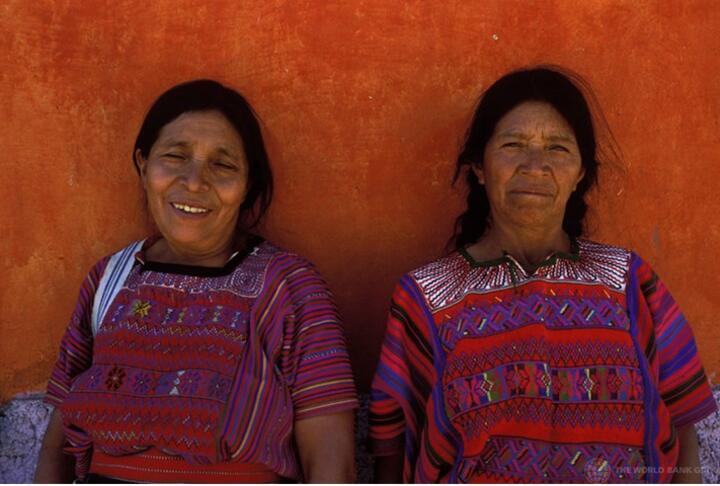

Gender Finance

Digital Transformation

Jun 06, 2025

Highlights Women represent a distinct and profitable customer segment that is often underserved by traditional financial products and services. Financial institutions must identify, acknowledge, and address gender biases rooted in cultural norms, stereotypes, and institutional processes. A structured approach, including understanding gender...

Digital Transformation

Jun 04, 2025

Amsterdam, 4 April 2025 – In a bold move reshaping the future of finance, Topicus proudly announces the launch of Akkuro , a cutting-edge composable banking platform set to revolutionize how financial institutions innovate, scale, and serve their customers. This strategic debut unifies the deep capabilities of Five Degrees, including its Matrix...

Alternative Financing

Jun 04, 2025

Washington D.C, May 23, 2025 – Cambridge Centre for Alternative Finance , a leading research hub at Cambridge Judge Business School dedicated to advancing alternative financial systems, has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating...

Trade Finance

Jun 04, 2025

Washington D.C, May 20, 2025 – Trade Treasury Payments (TTP) , the global multimedia and thought leadership platform for liquidity and risk management, has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the...

Jun 03, 2025

Washington D.C, June 3rd., 2025 – Cascade Debt , a global cutting-edge platform revolutionizing private credit has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to...

Supply & Value Chain Finance

Jun 02, 2025

Overview The Centre for Impact Investing and Practices (“CIIP”), a non-profit entity established by Temasek Trust, embarked on this report to study the role of Southeast Asian MSMEs in global supply chains. Throughout the course of this study, CIIP engaged and sought the views of Khazanah Nasional Berhad as we have a shared interest in...

Equity

Gender Finance

Rural & Agriculture Finance

Sustainable Finance

Policy & Regulation

Jun 02, 2025

This report offers strategic and actionable guidance to policymakers in strengthening their access to finance policies for small and medium enterprises (SMEs). This report emphasizes the need to improve the enabling environment for SME debt and equity financing. It outlines a roadmap of eight key actions to guide policymakers in achieving this...

Financial Education

Digital Financial Services

May 22, 2025

CARE’s new Strive Women report finds digital divide, financial stress and household responsibilities limit business success in emerging markets Atlanta, May 12, 2025 – Women entrepreneurs in emerging markets face considerable barriers that hinder their long-term success. While difficulties accessing small business credit and training are...

Financial Inclusion

Sustainable Finance

May 18, 2025

Washington D.C, May 14, 2025 – Dalberg , a global leader in inclusive and sustainable development, has joined the SME finance forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small...

Financial Education

Financial Inclusion

Non Financial Services

May 18, 2025

Global Finance & Technology Network and the SME Finance Forum j oin f orces on SME financing across developed and emerging markets 18th May 2025 – The Global Finance & Technology Network (GFTN), a Singapore head - quartered G lobal F oru m s , A dvisory and Investment company and the SME Finance Forum, a global network established by the...

Guarantees

May 15, 2025

Click here for Catalytic First Loss Guarantee - Expression of Interest (EOI)

Supply & Value Chain Finance

May 08, 2025

Washington D.C, Apr 16th, 2025 – M1xchange revolutionizes MSME Financing in India with Digital TReDS Platform, Facilitating Over Rs 170,000 Crores in Invoice Discounting has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries...

Financial Inclusion

May 07, 2025

10x1000 Tech for Inclusion's Global Challenger Video Contest 2025 is now accepting submissions until June 1, 2025. This is an opportunity for potential game-changers and innovators to gain global exposure, receive mentorship, and fast-track their innovations. Together, let's make your voices heard and make a difference on a global stage. Quick...

May 02, 2025

Washington D.C, May 2nd, 2025 – Produbanco , stands as a key player of Ecuador's SME sector, offering significant financial resources and strategic partnerships that foster sustainable progress, they have joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing...

Data Analytics

Apr 22, 2025

Digitalization accelerated by the pandemic has exponentially increased the number and variability of alternative data sources. The stay-at-home requirements during the pandemic forced several business models to be digitized. This helped spur the digitization that had been ongoing pre-pandemic, largely driven by governments as countries sought to...

Financial Education

Financial Inclusion

Apr 17, 2025

Washington D.C, March 7, 2025 – Yemen Microfinance Network (YMN) , Yemen's microfinance institutions association, an NGO co-funded by UNDP and SFD has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal...

Supply & Value Chain Finance

Apr 16, 2025

Washington D.C, March 12, 2025 – Fauree , UAE’s leading provider of supply chain finance and working capital solutions, has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to...

Equity

Data Analytics

Apr 14, 2025

Washington D.C, March 26, 2025 – Convergence Blended Finance , the global blended finance network driving private investment in developing countries, has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the...

Supply & Value Chain Finance

Apr 07, 2025

Washington D.C, April 7, 2025 – Vayana , India's largest Supply Chain Finance Network has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide...

Supply & Value Chain Finance

Apr 03, 2025

IFC and C2FO are working under a strategic partnership to bolster job growth and economic prosperity in emerging markets and developing economies. The first initiative will work to enhance financing for local enterprises in Africa by developing a specialized, web-based multinational working capital platform for micro, small, and medium enterprises...

Supply & Value Chain Finance

Apr 03, 2025

Washington D.C, April 3, 2025 – FaturamPara , Turkey's first company with both RegTech and FinTech features has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to...

Policy & Regulation

Apr 03, 2025

The OECD Financing SMEs and Entrepreneurs Scoreboard: 2025 Highlights tracks financing trends, conditions and policy developments across nearly 50 countries. The paper provides official data on SME financing from 2007 to 2023, with additional insights for 2024 and early 2025, covering debt, equity, asset-based finance and overall financing...

Data & Cybersecurity

Apr 02, 2025

Washington D.C, April 2, 2025 – ADAPTA , US Tech Firm Expanding AI-Driven Risk Management in Global Agriculture has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to...

Credit Risk & Scoring

Mar 28, 2025

Since 2020, #VietNam has experienced a surge in nonperforming loans (NPLs). Not only does the growing number of NPLs reduce the stability of the banking system, but each one represents a borrower excluded from credit markets. Many of the NPLs are consumer debts, meaning poorer households are particularly hard hit. IFC - International Finance...

Data Analytics

Mar 26, 2025

Washington D.C, March 26, 2025 – The Global Legal Entity Identifier Foundation (GLEIF) , which enhances market transparency and combats financial crime through the implementation and use of the Legal Entity Identifier (LEI) has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the...

Financial Inclusion

Mar 24, 2025

Washington D.C, March 24, 2025 – First Finance , a leading SME financial services provider in Iraq which adheres to international best practices to support and empower small and medium-sized enterprises has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum operate in 190...

Mar 21, 2025

MSMEs employ more than 80% of the workforce in #Ghana and account for over 70% of GDP. The majority of these enterprises are informal, consisting mainly of micro and sole enterprises operated by women and young entrepreneurs. While these small businesses play a critical role in economic growth and job creation, lack of information and collateral...

Gender Finance

Mar 17, 2025

Abidjan, Côte d’Ivoire, March 11, 2025 – To boost access to finance for women-led SMEs in Côte d’Ivoire, IFC and the Africa Local Currency Bond Fund (ALCB Fund) today announced an anchor investment in a gender bond from Ecobank Côte d’Ivoire, the first gender bond to be issued in the West Africa Economic and Monetary Union (WAEMU). Proceeds from...

Financial Inclusion

Feb 27, 2025

Washington D.C, Feb 27, 2025 – Beltone SMEs , a subsidiary of Beltone Holding - has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide...

Feb 23, 2025

Washington D.C, Jan 10, 2025 – Cenfri , a global think-tank and not-for-profit enterprise with offices in South Africa and Rwanda has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding...

Feb 17, 2025

Washington D.C, Feb 17th, 2025 – Banco de Crédito del Perú , the largest bank and the largest supplier of integrated financial services in Perú has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of...

Financial Inclusion

Feb 11, 2025

About the Impact Pathfinder Welcome to the Impact Pathfinder, an evidence platform designed to shed light on the impact of financial inclusion on development. By leveraging existing research, this platform outlines pathways that show how financial services and products can contribute to key development outcomes, such as building resilience,...

Equity

Feb 11, 2025

Highlights • Inclusive credit fintech has the potential to address the estimated US$4.9 trillion global credit gap for micro and small enterprises (MSEs). • However, access to diverse and suitable funding sources remains a critical challenge, especially for early-stage fintechs that are not yet profitable. • This focus note explores financing...

Digital Financial Services

Feb 11, 2025

BII sees opportunities for impact in firms of all sizes. Sole-traders, microenterprises, small, medium, and large firms are all sometimes unable to find the financing they need, to the detriment of society. The growth of firms is at the heart of development. Countries escape poverty as people move out of informal employment into wage-paying jobs...

Alternative Financing

Guarantees

Feb 05, 2025

EXECUTIVE SUMMARY KEY ACTIONS AGREED BY THE EXPERT GROUP: shorted by importance and short term feasibility: Banking channel PUBLIC-PRIVATE SHARED INVESTMENT MODELS: Building on the success of initiatives like “France Relance,” this action advocates for collaborative investment strategies that engage both public and private sectors in financing...

Policy & Regulation

Feb 03, 2025

Summary The G20 Global Partnership for Financial Inclusion (GPFI) Action Plan for Micro, Small, and Medium enterprises (MSME) Financing is a call to action to intensify the efforts of G20 and willing non-G20 countries to close the financing gap for MSMEs. MSMEs represent a significant share of economic activity and capture a large share of...

Digital Financial Services

Feb 02, 2025

Tania Ziegler (CCAF), Krishnamurthy Suresh (CCAF), Zhifu Xie (CCAF), Felipe Ferri de Camargo Paes (CCAF), Peter J Morgan (ADBI), Bryan Zhang (CCAF). This first edition of ‘The ASEAN Access to Digital Finance Study’, aims to provide valuable data and insights into how individual households, consumers, and micro, small and medium enterprise (MSME)...

Digital Financial Services

Feb 02, 2025

Tania Ziegler (CCAF), Felipe Ferri de Camargo Paes (CCAF), Cecilia López Closs (CCAF), Erika Soki (CCAF), Diego Herrera (IDB), Jaime Sarmiento (IDB) This edition of ‘The SME Access to Finance: A Deep Dive into LATAM’s Fintech Ecosystem’ provides insights into micro, small and medium enterprises’ (MSMEs’) access to funding through the alternative...

Digital Financial Services

Feb 02, 2025

By Krishnamurthy Suresh (Principal Researcher, CCAF), Felipe Ferri de Camargo Paes (Principal Researcher, CCAF), Loh Xiang Ru (CCAF), Richard Kithuka (CCAF), Peter Morgan (ADBI), Pavle Avramovic (CCAF), and Bryan Zhang (CCAF). This is the second edition of our ‘Access to Digital Finance’ study in Asia-Pacific. Building on our previous publication...

Data Analytics

Jan 14, 2025

Uplinq is thrilled to unveil our latest collaboration with Visa . Together, we’ve released a groundbreaking case study titled "Transforming global small business underwriting with augmented data" —a deep dive into how AI-powered credit decisioning is reshaping small business lending worldwide. Leveraging sophisticated AI and machine learning...

Data & Cybersecurity

Fintech

Dec 15, 2024

"International AI Policy Focuses on Safety" discusses the increasing global emphasis on ensuring the safe and responsible use of artificial intelligence (AI). Key points and main ideas include: International Collaboration on AI Safety: Governments and international organizations are recognizing the need for harmonized approaches to AI safety,...

Digital Transformation

Nov 27, 2024

November 2024 Highlights Open finance is a financial innovation that facilitates customer-permissioned access to and use of customer data held by financial institutions to provide new and enhanced services and develop innovative business models. Open finance frameworks can spur innovation, improve competition, enhance customer empowerment, and...

Sustainable Finance

Nov 22, 2024

The Small and Medium Enterprise (SME) sector in Pakistan plays a pivotal role in the national economy, contributing approximately 40% to GDP and providing employment to millions. Despite its significance, the sector faces numerous challenges that hinder its growth and development. Key barriers include limited access to finance, complex...

Financial Education

Nov 19, 2024

10 Years of Leadership Excellence - Registration Now Open for the 2025 GABV Leadership Academy Dear GABV members, We are excited to announce the 10th edition of the GABV Leadership Academy —a milestone in shaping resilient leaders in values-based banking! Registrations are now open until 5 December 2024. This year’s programme, ' Resilience in the...

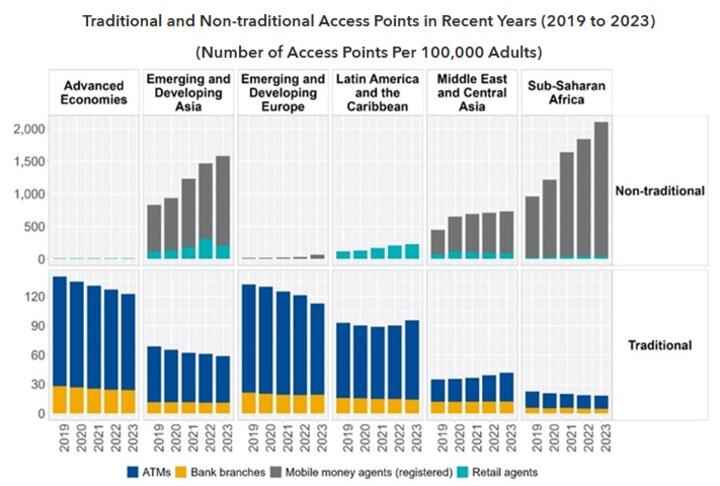

Digital Financial Services

Nov 14, 2024

IMF Releases the 2024 Financial Access Survey Results October 30, 2024 Washington, DC: The International Monetary Fund (IMF) released the results of the 2024 Financial Access Survey (FAS), marking the 15th anniversary of the FAS. The report “FAS: 2024 Highlights,” published along with the data release, summarizes the key trends on access to and...

Governance

Nov 11, 2024

Washington D.C, Nov 11, 2024 – Nepal Bankers’ Association , an Umbrella Organisation of all 'A' Class Commercial Banks of Nepal has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding...

Digital Transformation

Fintech

Nov 05, 2024

A follow-up series of Banking for small and medium enterprises by IBM Institute for Business Value Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world’s workforce, and contributing 50% to global GDP.* Despite their significance, SMEs face many...

Financial Inclusion

Nov 01, 2024

Washington D.C, Nov 1, 2024 – 10x1000 Tech for Inclusion , an open and global learning platform has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small...

Digital Transformation

Oct 29, 2024

The white paper by Mastercard underscores the pivotal role of middle market businesses (firms with 50 to 250 employees) in driving global economic growth, with a notable $24.2 trillion in B2B spending in 2022. These businesses face unique challenges as they scale, such as the need for digitization, automation, and streamlined operations, along...

Sustainable Finance

Oct 20, 2024

As the world faces the urgent challenge of climate change, financial institutions, especially Public Development Banks (PDBs), are crucial in helping Small and Medium Enterprises (SMEs) transitioning to a low-carbon economy. This publication reviews the different solutions offered by 16 Public Development Banks (PDBs) to support the...

Fintech

Oct 20, 2024

October 2024 Highlights: Inclusive fintech startups are early-stage, venture-backed enterprises creating innovative credit products for microenterprises in emerging markets, which holds great promise for the future of microenterprise finance. In this note, we highlight strategies employed by fintech startups that benefit microenterprises via three...

Fintech

Oct 08, 2024

By: Tommy Felts - October 04, 2024 Sandy Kemper, founder and CEO of C2FO, speaks during a panel conversation at the 2024 SME Finance Forum in São Paulo, Brazil; photo courtesy of C2FO C2FO would’ve been profitable in the US alone, CEO says; how solving for global needs made it an even stronger fintech leader T he impact of one Kansas City-built...

Trade Finance

Policy & Regulation

Oct 08, 2024

Business Ready (B-READY) 2024 report assesses the regulatory framework and public services directed at firms, and the efficiency with which regulatory framework and public services are combined in practice.

Sustainable Finance

Oct 04, 2024

Washington, D.C., October 1, 2024 - The World Bank Group and partners have launched the “ Sustainable Finance Knowledge Center for Francophone Africa ” today. A first preview of the center was presented two weeks ago at the annual Global Meeting of the SME Finance Forum in Brazil. This virtual platform, available in both English and French, is...

Sustainable Finance

Oct 04, 2024

Mobilizing Investment for the Developing World's Sustainable Cooling Needs Rising global temperatures mean demand for cooling in homes, workplaces, and across supply chains is accelerating, particularly in developing economies where the impact of extreme heat is already being felt most acutely. Heat-related deaths are running at an annual average...

Financial Inclusion

Fintech

Oct 04, 2024

June 5, 2024 | Washington DC EMpact is helping build AI Labs within our partner organizations as a part of our effort to accelerate digital transformation of agricultural value chains and relevant financial services. Today, EMpact published a new white paper that delves into the pivotal role of Artificial Intelligence (AI) in propelling financial...

Data Analytics

Fintech

Oct 04, 2024

Small and medium enterprises face many challenges within a rapidly evolving economic landscape—one that demands innovative banking solutions. Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world's workforce, and contributing 50% to global GDP. But...

Non Financial Services

Equity

Sep 30, 2024

Washington D.C, September 30th, 2024 – KoreFusion Consulting , a boutique strategy consulting and investment bank focused on SME payments and financing in North America and Western Europe has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating...

Financial Inclusion

Digital Transformation

Sep 26, 2024

Divergent views among business leaders and bankers on priorities uncover a white space for nimble financial institutions to compete in this varied market segment. ARMONK, N.Y., September 18th, 2024 – New findings from IBM’s (NYSE: IBM) Institute for Business Value and the Banking Industry Architecture Network (BIAN), with contributions from the...

Supply & Value Chain Finance

Aug 30, 2024

Washington D.C, Aug 30, 2024 – InvoSoko Africa, a leading SMEs focused Supply Chain Finance solutions provider in Sub-saharan Africa has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding...

Digital Financial Services

Digital Transformation

Jul 29, 2024

The Global SME Finance Forum is the largest, most geographically diverse and cutting-edge gathering on SME finance, which brings together experienced global leaders to facilitate the exchange of insights, promote best practices, and chart the future trajectory. Since 2015, its forward-thinking agenda, tackling topics such as sustainable finance...

Supply & Value Chain Finance

Jul 25, 2024

Supply Chain Financing (SCF) is becoming an increasingly common vertical within the banking industry. The global credit crisis of 2008 forced trade finance seekers to look for alternatives as liquidity in supply chains became a major concern for businesses. This spurred an increased demand for supply chain financing as businesses worked to...

Trade Finance

Jul 18, 2024

We are glad to announce the launch of the " 360tf SMEs Trade Finance Survey 2024 Edition ," in partnership with Middlesex University Dubai . This survey is a unique opportunity for the SME community to voice their opinions and shape the future of SME trade finance in the UAE . The survey aims to gather feedback and insights that will drive...

Data Analytics

Digital Financial Services

Jul 18, 2024

Washington D.C, July 18, 2024 – Jocata, a leading digital lending transformation partner has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Rural & Agriculture Finance

Jul 15, 2024

Washington D.C, July 15, 2024 – WeGro , a leading agri-fintech in Bangladesh has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through...

Data & Cybersecurity

Digital Financial Services

Jul 15, 2024

AI Takes Center Stage: Survey Reveals Financial Industry’s Top Trends for 2024 The world’s leading financial services institutions spotlight where AI is providing the best return on investment. January 11, 2024 by Kevin Levitt The financial services industry is undergoing a significant transformation with the adoption of AI technologies. NVIDIA’s...

Rural & Agriculture Finance

Jul 11, 2024

Washington D.C, July 11, 2024 – Bank of Kigali , the largest bank in Rwanda by total assets has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Jul 11, 2024

The recent McKinsey Global Institute report A microscope on small businesses: Spotting opportunities to boost productivity estimated that micro-, small, and medium-size enterprises (MSMEs) account for two-thirds of business employment in advanced economies— and almost four-fifths in emerging economies—as well as half of all value added.1 In this...

Supply & Value Chain Finance

Jul 09, 2024

Washington D.C, July 9th, 2024 – Receivables Exchange of India Limited (RXIL) , a leading MSMEs focused digital platform in India has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding...

Financial Inclusion

Sustainable Finance

Jun 16, 2024

The 2024 MSME Day offers an opportunity to discuss and exchange ideas on how Key stakeholders, including policy makers, large companies, financial institutions, and the international community can support micro-, small and medium-sized businesses to advance the 2030 Agenda and contribute to achieving the SDGs, including poverty eradication and...

Jun 13, 2024

Washington D.C, June 13, 2024 – Akbank , a Turkish bank founded in 1948 has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through...

Jun 04, 2024

Washington D.C, June 4, 2024 – ICICI Bank , one of the leading private sector banks in India, has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Fintech

May 27, 2024

Washington D.C, May 27, 2024 – Kapitale , one of the most innovative fintechs in receivables anticipation in Brazil, has joined the SME Finance Forum as the global membership network’s latest member. Created by the G20 in 2012 and managed by the International Finance Corporation (IFC), the SME Finance Forum has more than 300 members/affiliates who...

Alternative Financing

Digital Financial Services

May 23, 2024

Washington D.C, May 23, 2024 – AgriAnalytica , a leading digital platform for MSMEs in Ukraine has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Financial Inclusion

Digital Financial Services

Digital Transformation

May 21, 2024

Learn from Sucharita Mukherjee - Co-founder & CEO at Kaleidofin, about her of experience in attending the Global SME Finance Forum and the importance of digitization in the Indian market for financing SMEs, the role of digital platforms in serving underserved markets, and the potential for structured, systematic south-to-south learning and...

Guarantees

Digital Financial Services

May 21, 2024

Learn from Sandeep Varma, CEO at CGTMSE, about his experience attending the Global SME Finance Forum and the role of credit guarantee schemes in helping MSMES access to finance. He also discusses the potential of technology to improve the efficiency and reach of credit guarantee schemes. This interview was led by Hans Koning, Global Chief Industry...

Digital Financial Services

Digital Transformation

May 21, 2024

Learn from Peter Simon, Managing Director at WSBI-ESBG, about his experience attending the Global SME Finance Forum and how WSBI helps its member banks to adapt and improve their digital services. This interview was led by Hans Koning, Global Chief Industry Specialist, Digital Finance at IFC. " Very impressive to see so many different actors f rom...

Financial Inclusion

Credit Risk & Scoring

Fintech

May 21, 2024

Learn from Prashant Muddu - Founder and CEO at Jocata, about his experience attending the Global SME Finance Forum, the importance of digital public infrastructure, the challenges and opportunities in adopting AI, and the need for financial literacy and technology adoption across different geographies. This interview was led by Hans Koning, Global...