Library

Fintech

Jun 06, 2025

Washington D.C, May 23, 2025 – ezee.ai , a global leader in digital lending technology has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses...

Gender Finance

Digital Transformation

Jun 06, 2025

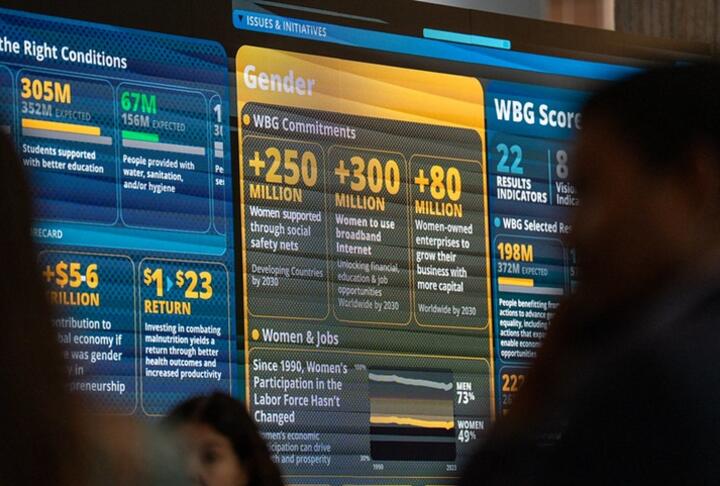

Highlights Women represent a distinct and profitable customer segment that is often underserved by traditional financial products and services. Financial institutions must identify, acknowledge, and address gender biases rooted in cultural norms, stereotypes, and institutional processes. A structured approach, including understanding gender...

Digital Transformation

Jun 04, 2025

Amsterdam, 4 April 2025 – In a bold move reshaping the future of finance, Topicus proudly announces the launch of Akkuro , a cutting-edge composable banking platform set to revolutionize how financial institutions innovate, scale, and serve their customers. This strategic debut unifies the deep capabilities of Five Degrees, including its Matrix...

Alternative Financing

Jun 04, 2025

Washington D.C, May 23, 2025 – Cambridge Centre for Alternative Finance , a leading research hub at Cambridge Judge Business School dedicated to advancing alternative financial systems, has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating...

Trade Finance

Jun 04, 2025

Washington D.C, May 20, 2025 – Trade Treasury Payments (TTP) , the global multimedia and thought leadership platform for liquidity and risk management, has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the...

Jun 03, 2025

Washington D.C, June 3rd., 2025 – Cascade Debt , a global cutting-edge platform revolutionizing private credit has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to...

Supply & Value Chain Finance

Jun 02, 2025

Overview The Centre for Impact Investing and Practices (“CIIP”), a non-profit entity established by Temasek Trust, embarked on this report to study the role of Southeast Asian MSMEs in global supply chains. Throughout the course of this study, CIIP engaged and sought the views of Khazanah Nasional Berhad as we have a shared interest in...

Equity

Gender Finance

Rural & Agriculture Finance

Sustainable Finance

Policy & Regulation

Jun 02, 2025

This report offers strategic and actionable guidance to policymakers in strengthening their access to finance policies for small and medium enterprises (SMEs). This report emphasizes the need to improve the enabling environment for SME debt and equity financing. It outlines a roadmap of eight key actions to guide policymakers in achieving this...

Financial Education

Digital Financial Services

May 22, 2025

CARE’s new Strive Women report finds digital divide, financial stress and household responsibilities limit business success in emerging markets Atlanta, May 12, 2025 – Women entrepreneurs in emerging markets face considerable barriers that hinder their long-term success. While difficulties accessing small business credit and training are...

Financial Inclusion

Sustainable Finance

May 18, 2025

Washington D.C, May 14, 2025 – Dalberg , a global leader in inclusive and sustainable development, has joined the SME finance forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small...

Financial Education

Financial Inclusion

Non Financial Services

May 18, 2025

Global Finance & Technology Network and the SME Finance Forum j oin f orces on SME financing across developed and emerging markets 18th May 2025 – The Global Finance & Technology Network (GFTN), a Singapore head - quartered G lobal F oru m s , A dvisory and Investment company and the SME Finance Forum, a global network established by the...

Guarantees

May 15, 2025

Click here for Catalytic First Loss Guarantee - Expression of Interest (EOI)

Supply & Value Chain Finance

May 08, 2025

Washington D.C, Apr 16th, 2025 – M1xchange revolutionizes MSME Financing in India with Digital TReDS Platform, Facilitating Over Rs 170,000 Crores in Invoice Discounting has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries...

Financial Inclusion

May 07, 2025

10x1000 Tech for Inclusion's Global Challenger Video Contest 2025 is now accepting submissions until June 1, 2025. This is an opportunity for potential game-changers and innovators to gain global exposure, receive mentorship, and fast-track their innovations. Together, let's make your voices heard and make a difference on a global stage. Quick...

May 02, 2025

Washington D.C, May 2nd, 2025 – Produbanco , stands as a key player of Ecuador's SME sector, offering significant financial resources and strategic partnerships that foster sustainable progress, they have joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing...

Data Analytics

Apr 22, 2025

Digitalization accelerated by the pandemic has exponentially increased the number and variability of alternative data sources. The stay-at-home requirements during the pandemic forced several business models to be digitized. This helped spur the digitization that had been ongoing pre-pandemic, largely driven by governments as countries sought to...

Financial Education

Financial Inclusion

Apr 17, 2025

Washington D.C, March 7, 2025 – Yemen Microfinance Network (YMN) , Yemen's microfinance institutions association, an NGO co-funded by UNDP and SFD has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal...

Supply & Value Chain Finance

Apr 16, 2025

Washington D.C, March 12, 2025 – Fauree , UAE’s leading provider of supply chain finance and working capital solutions, has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to...

Equity

Data Analytics

Apr 14, 2025

Washington D.C, March 26, 2025 – Convergence Blended Finance , the global blended finance network driving private investment in developing countries, has joined the SME Finance Forum as the global membership network’s latest affiliate. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the...

Supply & Value Chain Finance

Apr 07, 2025

Washington D.C, April 7, 2025 – Vayana , India's largest Supply Chain Finance Network has joined the SME Finance Forum as the global membership network’s latest member. The 300+ members/affiliates of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide...