External Resources

Digital Financial Services

Nov 14, 2024

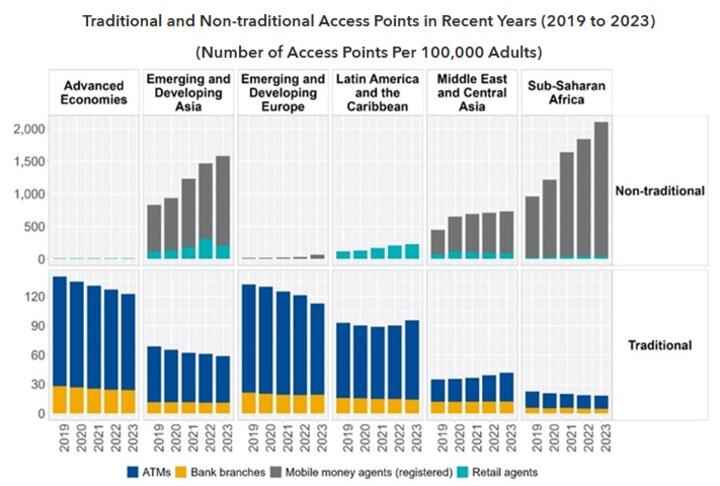

IMF Releases the 2024 Financial Access Survey Results October 30, 2024 Washington, DC: The International Monetary Fund (IMF) released the results of the 2024 Financial Access Survey (FAS), marking the 15th anniversary of the FAS. The report “FAS: 2024 Highlights,” published along with the data release, summarizes the key trends on access to and...

Trade Finance

Policy & Regulation

Oct 08, 2024

Business Ready (B-READY) 2024 report assesses the regulatory framework and public services directed at firms, and the efficiency with which regulatory framework and public services are combined in practice.

Policy & Regulation

Credit Risk & Scoring

Payments

May 29, 2019

New analysis provides a glimpse of the future as countries like China pave the way for a whole new system of banking. China is seeing an “explosive growth of mobile payments. With a record $12.8 trillion in mobile payment transactions from January – October 2017, China far surpasses the U.S. at only $49.3 billion,” according to data. Dana Nino, an...

Non Financial Services

Policy & Regulation

Payments

May 24, 2019

The Future of Business survey is a collaboration between Facebook, the OECD and the World Bank to provide timely insights on the perceptions, challenges, and outlook of online Small and Medium Enterprises (SMEs). The Future of Business survey was first launched as a monthly survey in 17 countries in February 2016 and expanded to 42 countries in...

Non Financial Services

Rural & Agriculture Finance

Apr 19, 2019

Agrifrance*, a specialist division of BNP Paribas Wealth Management (a SME Finance Forum member), has published its special report on France’s rural land market, this year comparing it with the market in Britain. The main findings of the report: Agricultural land in the United Kingdom occupies 17.3 million hectares, versus 26 million hectares in...

Supply & Value Chain Finance

Credit Risk & Scoring

Digital Transformation

Apr 03, 2019

According to a survey of 2000 directors at UK SMEs, almost half of UK SMEs (49%) would seek financing from non-bank lenders as they begin to better understand the business models of companies in this space, including fintechs. A Leeds-based fintech known as Rebuilding Society, founder Dan Rajkumar, recently said: “When you are a business and you...

Alternative Financing

Gender Finance

Feb 04, 2019

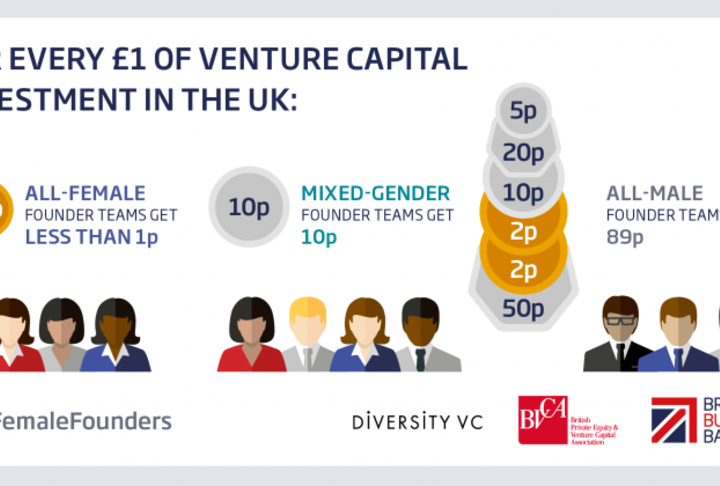

Female start-up founders are missing out on billions of pounds of investment, new research published today finds. The UK VC & Female Founders report found that for every £1 of venture capital (VC) investment in the UK, all-female founder teams get less than 1p. By comparison, all-male founder teams get 89p and mixed-gender teams get the...

Financial Education

Non Financial Services

Jan 30, 2019

Private sector small business employment increased by 63,000 jobs from December to January according to the January ADP Small Business Report. Due to the important contribution that small businesses make to economic growth, employment data that are specific to businesses with 49 or fewer employees is reported each month and broadly distributed to...

Financial Education

Non Financial Services

Governance

Jan 29, 2019

There are two views of the EGM. The first view ‘Digital Finance Studies’ shows the total number of studies that were conducted on a particular product, plotted against the client outcomes which were tested. The objective with this view is to give the user an overview of the impact literature on digital finance and highlight which digital finance...

Equity

Gender Finance

Fintech

Jan 02, 2019

A new study seen exclusively by Yahoo Finance UK shows how difficult it is for women in Britain, compared to men, to start their own business. Yahoo says, men are three times more likely than women to have over £250,000 ($320,479) of investible assets – essential capital for getting a business started – according to private equity house IW Capital...

Gender Finance

Supply & Value Chain Finance

Dec 31, 2018

A study by Calvert Impact Capital found that diversity in senior staff had a greater impact than the number of female directors or the gender of its founder. “We saw a particularly strong relationship to women in leadership,” said Leigh Moran, Calvert’s director of strategy. “We think there’s a common misconception that incorporating gender is...

Financial Education

Non Financial Services

Gender Finance

Dec 05, 2018

This booklet presents a compilation of frequently used graphs on entrepreneurship trends and SME performance drawn from the OECD Statistics and Data Directorate’s databases of Structural and Demographic Business Statistics (SDBS), Timely Indicators of Entrepreneurship (TIE), Trade by Enterprise Characteristics (TEC), Entrepreneurship Finance...

Financial Education

Supply & Value Chain Finance

Nov 01, 2018

TUHF's Integrated Annual Report is used to communicate with their stakeholders, primarily their funders and They use it to explain their performance, strategy and prospects, and compiled it according to International Integrated Reporting Council’s (IIRC) Integrated Reporting <IR> Framework. This report covers the performance of the Trust for...

Non Financial Services

Gender Finance

Supply & Value Chain Finance

Oct 18, 2018

The International Monetary Fund (IMF) released the 2018 Financial Access Survey. The survey includes information from 189 countries spanning over 10 years. Key findings in the report include: Highlighting the use of retail agent outlets, mobile money growth, and progress in women’s financial inclusion. According to data from the report, financial...

Financial Education

Non Financial Services

Sustainable Finance

Policy & Regulation

Oct 05, 2018

Medici examines the widening financial gap in India and their lack of push for institutional credit for consumers. With consumer debt to GDP at only 17 percent, India falls behind major economies of Asia Pacific. According to the article, “In the absence of institutional credit at fair interest rates for a majority of the population, people at the...

Non Financial Services

Policy & Regulation

Credit Risk & Scoring

Aug 20, 2018

A survey conducted by the BDRC between Sept. 2017 and June 2018 revealed the quality of service provided by banks from SME business account customers. SMEs were asked to give feedback in the following areas for their respective bank: Overall service quality Online and mobile banking services Services in branches and banking centers SME overdraft...

Gender Finance

Supply & Value Chain Finance

Aug 13, 2018

Women in the Western Cape are dominating the SME industry. According to the article, “women-owned businesses experienced 50 percent more growth than businesses owned by men in the Western Cape.” This boost can be contributed to women making smarter investment decisions, according to a survey conducted by Retail Capital. Key points revealed in the...

Non Financial Services

Gender Finance

Policy & Regulation

Jul 17, 2018

This report is based on information gathered in the GBA’s Women’s Market Analytics Survey — the only collection of global banking data measuring the performance of financial institutions serving the Women’s Market, with four years of performance data and over 400 data points per institution. This second edition of the report bears out several...

Non Financial Services

Supply & Value Chain Finance

Credit Risk & Scoring

Jul 13, 2018

A study by Fachhochschule des Mittelstands (FHM), the SME University in Bielefeld, revealed that the demands placed on finance and liquidity management have increased, leading to the proliferation and professionalization of cash management systems. In the study, 280 SME finance managers were surveyed and when compared to previous studies there is...

Gender Finance

Payments

Jul 09, 2018

BuyUcoin, an Indian cryptocurrency exchange, has found that female Indian investors, on average, invested over Rs1.4 lakh (around $2,000) on digital currencies—twice the amount that men typically spent. The survey, conducted between March and June, had over 60,000 respondents.

Non Financial Services

Equity

Guarantees

Jul 05, 2018

This analysis provides an overview of the main markets relevant to the EIF. It starts by discussing the general market environment, then looks at the main aspects of equity finance and the guarantee and SME securitisation markets and, finally, it highlights important aspects of microfinance in Europe. A chapter on Fintech also complements the...

Credit Risk & Scoring

May 30, 2018

Digital credit offers enormous promise to enhance provide a valued service to the mass market thus increasing financial inclusion, while also driving uptake and use of digitial financial services (DFS). However, with 2.7 million people already blacklisted on the credit reference bureau in Kenya, concerns are growing about current standards of...

Non Financial Services

Supply & Value Chain Finance

Payments

May 25, 2018

Nielsen and Alipay jointly issued the 2017 Survey: Outbound Chinese Tourism and Consumption Trends, which details how Chinese tourists pay for products in services and their behaviors in making such decisions. Ninety-nine percent of Chinese respondents have the Alipay app installed on their phones. The survey found that discounts and payment...

Supply & Value Chain Finance

Sustainable Finance

Credit Risk & Scoring

Apr 30, 2018

Nearly a third (28%) of small business owners don’t feel financially confident unless they have a buffer big enough to cover running costs for a year, according to new research from credit card machine provider Paymentsense. The study found that despite this, more than four in 10 small business owners (41%) admit to having no such buffer in place...

Financial Education

Sustainable Finance

Apr 27, 2018

The research for Barclays by YouGov showed that almost half of SMEs surveyed (44 per cent) had been targeted by fraudsters, with approximately one in four (23 per cent) of those targeted having fallen victim. Barclays has launched a nationwide campaign to help small businesses tackle cybercrime and fraud, with new research suggesting that online...

Policy & Regulation

Credit Risk & Scoring

Payments

Apr 20, 2018

The 2017 edition of the Global Findex includes updated indicators on access to and use of formal and informal financial services. And it adds new data on the use of financial technology (fintech), including the use of mobile phones and the internet to conduct financial transactions. Financial inclusion is on the rise globally. The 2017 Global...

Supply & Value Chain Finance

Governance

Credit Risk & Scoring

Apr 05, 2018

This Focus Note by Marissa Dean and the supported by the Mastercard Foundation summarizes how 30 leading organizations across Kenya and Tanzania are thinking about or actively using big data and analytics as they explore this space in digital finance. The findings are based on interviews with these organizations—which include banks, microfinance...

Supply & Value Chain Finance

Payments

Jan 17, 2018

The International Monetary Fund (IMF) released the results of the eighth annual Financial Access Survey (FAS). The FAS collects annual data on indicators tracking financial access—an important pillar of financial inclusion. It provides insights on the availability and use of financial products such as consumer and firm deposit accounts, loans, and...

Financial Education

Non Financial Services

Gender Finance

Rural & Agriculture Finance

Sustainable Finance

Youth Entrepreneurship

Policy & Regulation

Jan 08, 2018

The 2017 edition of CGAP’s annual Cross-Border Funder Survey reports funding commitments from the 23 largest international funders of financial inclusion, representing 80 percent of the full set of over 54 international funders and 73 percent of the global estimated funding commitments for financial inclusion in 2016. Major project themes in 2016...

Non Financial Services

Sustainable Finance

Jan 05, 2018

The SAP Business Partnership Study shows that three out of four small and midsize enterprises (SMEs) see IT and technology vendors not just as an external resource but as vital to their business. More and more technology vendors are being used by business leaders for consultation (76 percent), for insight and advice (79 percent) and to anticipate...

Credit Risk & Scoring

Dec 20, 2017

Twenty-four percent of UK SMEs believe that banks have failed to change the way they behave since the global financial crisis in 2008. The survey of UK SMEs from CivilisedBank, the new UK business bank with a Local Banker network, also reveals that over half (55%) of those surveyed believe that it is not a priority for banks to act in a ‘civilised...

Supply & Value Chain Finance

Credit Risk & Scoring

Dec 15, 2017

Findings from the second edition of the SME Financing Survey conducted by SPRING Singapore, revealed that about 13% of SMEs sought external financing in the past year and out of these, 90% that applied for debt financing1 were successful in their applications. The most commonly cited purpose by over 60% of SMEs that sought external financing2 in...

Financial Education

Sustainable Finance

Dec 13, 2017

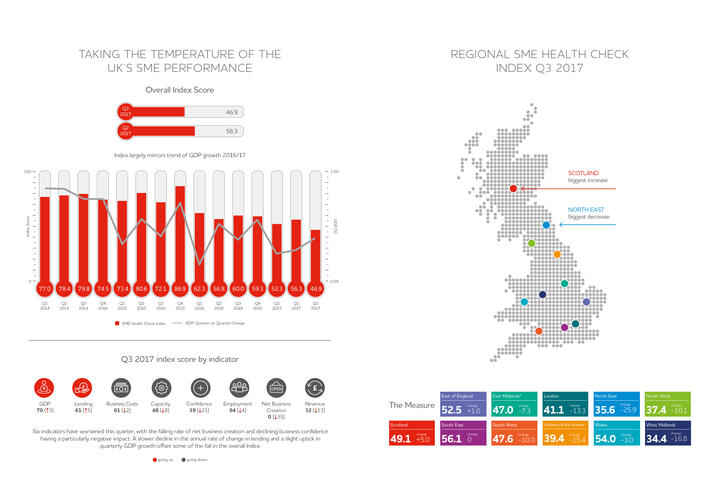

The Q3 2017 SME Health Check Index finds that: SME Health Check Index falls to lowest level since January 2014 - falling from 56.3 in Q2 of 2017 to 46.9 in Q3 Six out of eight Index measures have worsened in last quarter - employment, revenue, confidence and net business creation indicators are all down SME business costs increased by 2.5% this...

Sustainable Finance

Governance

Payments

Nov 20, 2017

The New York Times analyzes consulting firm Capgemini's estimate that electronic payments will grow about 10.9 percent a year between 2015 and 2020. Norway tops the list, with 99 percent of their adults having made a digital payment.Germany lands the second place at 96 percent, followed by the United States at 92 percent and Japan at 89 percent...

Credit Risk & Scoring

Nov 16, 2017

TD Bank conducted an online survey among small business owners whose annual revenue/sales is $1,000,000 or less. This April 2017 survey focuses on understanding business owner expectations, confidence, challenges and use of specific products. Considerations for expansion included adding new products or services is the top path for expanding the...

Financial Education

Non Financial Services

Policy & Regulation

Nov 15, 2017

EUROCHAMBRES assessed how the European Commission applied the SME test by analyzing 13 impact assessments (IAs) on legislative initiatives of relevance to SMEs, such as geo-blocking, posting of workers and insolvency, published in the period of July 2015 - January 2017. One of the main findings was despite the strong emphasis by the current...

Credit Risk & Scoring

Payments

Nov 06, 2017

According to the International Finance Corporation, small and medium-sized enterprises (SMEs) make up 99% of the 125 million companies in the world, and these SMEs contribute a staggering 49% of global GDP. The opportunities are huge for any bank willing to offer the fully digital, personalised service they are seeking. As the Fintech partner for...

Financial Education

Gender Finance

Policy & Regulation

Fintech

Oct 02, 2017

OECD's Entrepreneurship at a Glance 2017 report shares data on SMEs and market proximity and female entrepreneurship. In 2014 start-ups – firms less than two years old - accounted for around 20 percent or more of firms in most countries and for more than 30 percent in the United Kingdom, Hungary, Brazil, Israel and Poland. Start-ups nevertheless...

Supply & Value Chain Finance

Sustainable Finance

Sep 29, 2017

For the 23rd consecutive quarter, SME lending decreased and is down 7.5% for the year, new Central Bank figures show. The Bank said credit to SMEs — considered to be 250 employees or less — declined by 0.8% over the quarter to €27.5bn in its latest report examining lending in the second quarter. The weighted average interest rate on new non-...

Equity

Policy & Regulation

Jul 25, 2017

The World Federation of Exchanges (WFE), jointly created a survey with the Milken Institute Center for Financial Markets a survey to compare how approaches to SME boards have varied across countries. The evidence-based research compiled data such as: Main reasons Indian SMEs list Did firms raise capital at time of listing? Use of IPO proceeds by...

Financial Education

Policy & Regulation

Payments

Jul 14, 2017

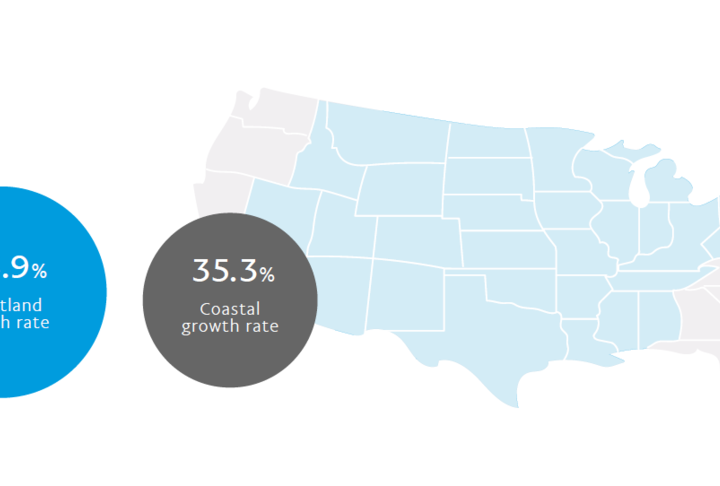

PayPal conducted research in hopes give more small businesses to digital finance and inspire both owners and policymakers in supporting growth for SMEs in the U.S. This research found that SMEs PayPal users grew from 2015-2016 by 22.9 percent. Of these, less than five percent export. Women-owned small businesses grew and export at about 72 percent...

Financial Education

Jul 11, 2017

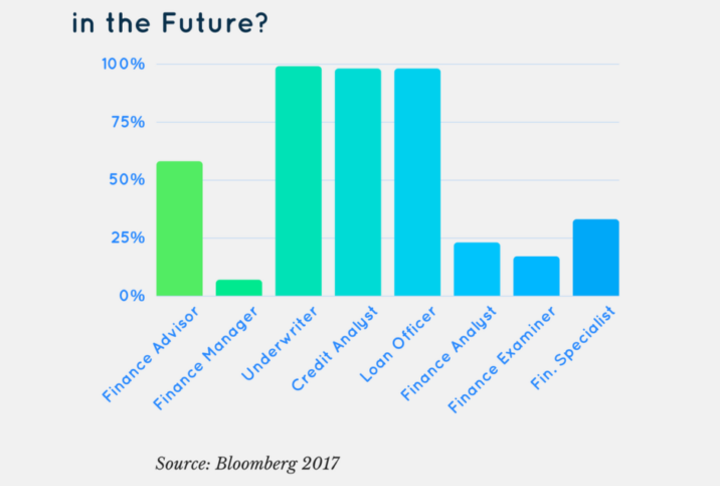

Personal financial advisors have a 58 percent chance of computerization in the future, according to recent data on the probability of computerization. According to Carl Frey and Michael Osborne, financial advisors should be able to escape the rise of automation and artificial intelligence with jobs intact. The data also shows that insurance...

Financial Education

Policy & Regulation

Dec 02, 2016

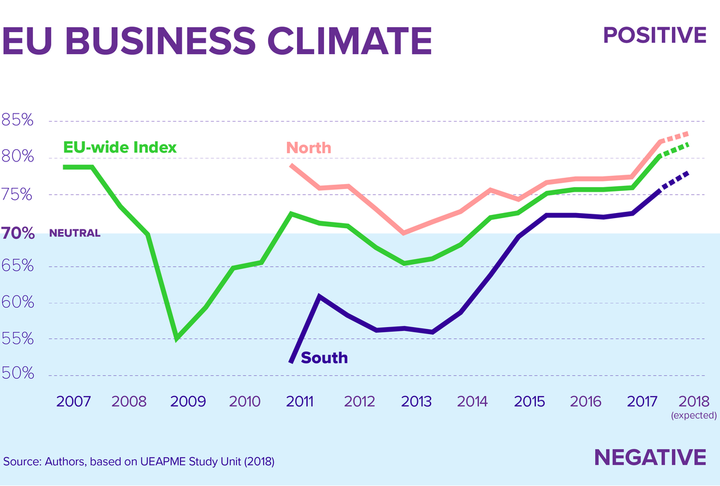

Access to finance is the least pressing problem in general and businesses' demands for financing were often fulfilled. However, financing might still be a barrier for smaller and younger companies or in specific countries. Bank loans and credit lines remain the most relevant sources of financing for SMEs in the EU. 55% of SMEs used credit lines in...

Non Financial Services

Aug 05, 2016

The OECD Scoreboard on SME and entrepreneurship finance provides a comprehensive framework for monitoring SMEs' and entrepreneurs' access to finance over time. The country profiles present data for a number of core indicators, which measure trends in SME debt and equity financing, solvency and policy measures by governments. Taken together, the...

Non Financial Services

Credit Risk & Scoring

Dec 18, 2015

This guideline note on the SME Financial Inclusion Indicators Base Set (SME Finance Base Set) was developed by AFI’s SME Finance Working Group (SMEFWG) in consultation with the Financial Inclusion Data Working Group (FIDWG). The Base Set is intended to serve as a tool for measuring the access, usage and quality of financial services for small and...

Financial Education

Non Financial Services

Apr 27, 2015

The Global Financial Inclusion (Global Findex) database, launched by the World Bank in 2011, provides comparable indicators showing how people around the world save, borrow, make payments, and manage risk. The 2014 edition of the database reveals that 62 percent of adults worldwide have an account at a bank or another type of financial institution...

Apr 19, 2015

Trade Finance Global have compiled key statistics and figures summarising global trade and trends which have been published by the World Trade Organisation and International Chamber of Commerce. Summary: Export vol in 2012-13 was $18.5tn USD 3.1% increase in trade finance year on year (YoY) China, Canada and Mexico were the top 3 exporters http://...

Gender Finance

Dec 17, 2014

Data2X, named for the power women have to multiply progress in their societies, advances gender equality and women’s empowerment. How? By building partnerships to improve data collection and demonstrating how better data on the status of women and girls can guide policy, leverage investments, and inform global development agendas.

Financial Education

Non Financial Services

Credit Risk & Scoring

Oct 20, 2014

This website presents various statistics on the financing of Canadian small and medium-sized enterprises including credit request and approval rates, average value of loan requests and intended use of financing. It also includes data on the number of businesses in Canada, job creation, firm survival, the share of firms that are high-growth firms,...

Non Financial Services

Payments

Oct 06, 2014

The Financial Inclusion Insights program produces original data and practical knowledge on demand-side trends in mobile money and other digital financial services. FII research focuses on how people can access and use these services to improve their lives and livelihoods. The FII research effort covers eight countries in Africa and Asia with a...

Non Financial Services

Oct 03, 2014

Welcome to FINclusion Lab! This platform, developed by MIX, provides financial service providers, policy makers, regulators, and other development professionals the opportunity to identify problems and devise solutions for increasing financial inclusion in their countries through interactive data tools and visualizations. The FINclusion Lab team...

Non Financial Services

Oct 03, 2014

MIX Market is a data hub where microfinance institutions (MFIs) and supporting organizations share institutional data to broaden transparency and market insight. This exchange enables users to establish reporting standards, alleviate reporting burden, and promote responsible investment. Supported by validated social and financial performance data...

Credit Risk & Scoring

Mar 24, 2014

Lack of access to financial services is a key barrier to the growth of micro, small, medium enterprises (MSMEs). IFC is working to develop solutions to close the MSME financing gap, collaborating with 314 financial institutions (FIs) across 90 countries globally. By partnering with many types of financial intermediaries, including microfinance...

Policy & Regulation

Jan 29, 2014

In recent years, the development community has sustained support for microfinance but broadened funding to encompass the wider goal of financial inclusion. International funders have been adapting their priorities to meet this broader vision, and in 2012, funders committed at least $29 billion to support financial inclusion, an increase of 12%...

Gender Finance

Dec 17, 2013

This website compiles all the different provisions related to gender contained in constitutions in countries around the world, available in the original language, along with English translations. The database can be searched by keywords, provisions, regions or countries. With this searchable online database, UN Women seeks to provide a global...

Gender Finance

Dec 02, 2013

This draft report presents a descriptive overview of women’s economic activity in the MENA region based on statistical sources. The report is submitted for discussion to the OECD-MENA Women’s Business Forum annual meeting on 2 December 2013 in Rabat, Morocco. Following the meeting the document will be revised, building on the discussions, and...

Financial Education

Nov 12, 2013

The Global SME Survey takes less than 5 minutes to complete. It gauges the impact of financial markets on SME business conditions around the world.

Policy & Regulation

Nov 08, 2013

The World Economic Forum Global Competitiveness Report 2013-2014 assesses the competitiveness of 148 economies. Use this application to browse, analyse, and gain insights from the results of the Index. The platform includes historical data going back to the 2006-2007 edition of the Report.

Non Financial Services

Oct 24, 2013

This scoreboard establishes a comprehensive international framework for monitoring SMEs’ and entrepreneurs’ access to finance over time. Comprising 18 countries it presents data for a number of debt, equity and financing framework condition indicators. It provides governments with a tool to understand SMEs’ financing needs.

Non Financial Services

Oct 24, 2013

The European Commission has created tools for analysis and monitoring, but is also committed to collecting data on the prevailing conditions in the loan and equity finance markets in order to make European financial markets more responsive to the needs of small businesses. Small and medium-sized enterprises (SMEs) account for 99% of firms in the...

Gender Finance

Policy & Regulation

Sep 25, 2013

The historical data documents the evolution of gender parity in property rights and legal capacity in 100 economies from 1960 to 2010. It provides 14 indicators covering property ownership, marital regimes, inheritance, property titling, legal status and capacity, constitutional rights of equality and non-discrimination and the treatment of legal...

Gender Finance

Sep 09, 2013

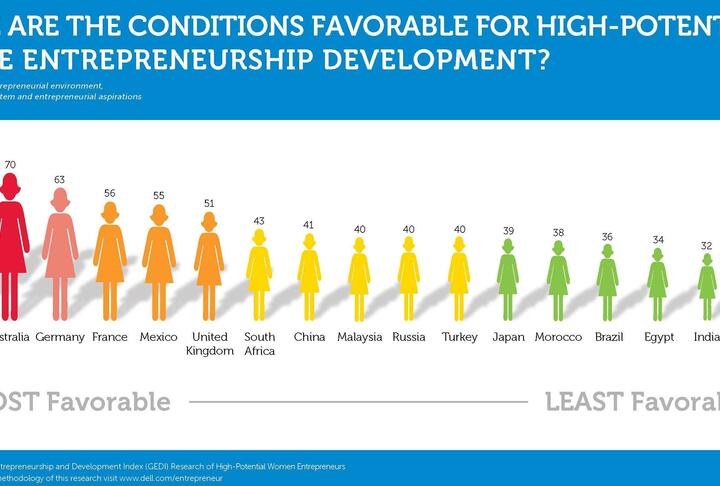

The Global Entrepreneurship and Development Institute, GEDI’s women's entrepreneurship index - the Gender GEDI - measures the development of high potential female entrepreneurship worldwide. Defined as “innovative, market expanding, and export oriented,” this gender specific Index utilizes GEDI’s unique framework, methodology, and global approach...

Non Financial Services

Policy & Regulation

Sep 04, 2013

The Doing Business Project provides objective measures of business regulations and their enforcement across 185 economies and selected cities at the subnational and regional level. The Doing Business Project , launched in 2002, looks at domestic small and medium-size companies and measures the regulations applying to them through their life cycle...

Non Financial Services

Aug 21, 2013

SBP’s SME Growth Index provides an innovative approach to understanding how and why small firms grow, or fail. It provides government and policy makers with much needed empirical evidence that helps differentiate the internal and external factors that influence whether a small business is a survivalist with limited prospects for growth and...

Financial Education

Aug 19, 2013

The Economist/FT global business barometer is a survey conducted four times a year by the Economist Intelligence Unit in order to gauge trends in business confidence. Based on the responses of more than 1,500 senior executives, it measures overall confidence by looking at the balance of those who think global business conditions will improve over...

Gender Finance

Policy & Regulation

Aug 06, 2013

The WEVentureScope examines and ranks 20 countries in Latin America and the Caribbean according to the principal factors influencing the environment for women entrepreneurs as they start and grow businesses. It consists of an in-depth report and an interactive website. The index is comprised of indicators in five areas: business operating risks,...

Non Financial Services

Gender Finance

Mar 21, 2013

There are significant disparities along gender lines in how adults save, make payments, borrow money and manage risk. Worldwide, 55 percent of men report having an account at a formal financial institution, while only 47 percent of women do. The gender gap is largest among lower middle income economies as well as in South Asia and the Middle East...

Gender Finance

Mar 14, 2013

The OECD Gender, Institutions and Development Database (GID-DB) represents a new tool for researchers and policy makers to determine and analyse obstacles to women’s economic development. It covers a total of 160 countries and comprises an array of 60 indicators on gender discrimination. The database has been compiled from various sources and...

Gender Finance

Mar 14, 2013

Women, Business and the Law presents indicators based on laws and regulations affecting women's prospects as entrepreneurs and employees, in part drawing on laws contained in the Gender Law Library. Both resources can inform research and policy discussions on how to improve women's economic opportunities and outcomes.

Non Financial Services

Feb 12, 2013

The 2010 World Bank Entrepreneurship Snapshots (WBGES) provide a unique indicator of business creation around the world and facilitate the investigation of the factors that foster dynamic private sector growth. Now in its fourth year, the WBGES measure entrepreneurial activity in 115 developing and industrial countries over the six year period...

Non Financial Services

Feb 12, 2013

The Global Entrepreneurship Monitor (GEM) project is an annual assessment of the entrepreneurial activity, aspirations and attitudes of individuals across a wide range of countries. Initiated in 1999 as a partnership between London Business School and Babson College, the first study covered 10 countries; since then nearly 100 ‘National Teams’ from...

Financial Education

Non Financial Services

Feb 12, 2013

This report benchmarks the regulatory and operating conditions for microfinance in 55 developing countries globally. Commissioned and funded by MIF, CAF and IFC, Microscope 2012 i s the Economist Intelligence Unit's fourth annual effort to assignratings to microfi nance markets in these 55countries. This also marks the sixth annual assessment of...

Financial Education

Non Financial Services

Jan 29, 2013

The importance of micro, small, and medium-size enterprises (MSMEs) to economic development and job creation is increasingly recognized. In developing countries, formal MSMEs represent approximately 45 percent of employment and approximately 33 percent of GDP. This is even greater when informal MSMEs are included. Despite their importance, this...

Non Financial Services

Jan 29, 2013

Micro, Small and Medium Enterprise Country Indicators record the number of formally registered MSMEs across 132 economies. This database is current as of August 2010 and expands on the January 2007 “Micro, Small, and Medium Enterprises: A Collection of Published Data” edition. More specifically, the MSME Country Indicators database contains...

Non Financial Services

Jan 29, 2013

Enterprise Surveys are firm-level survey of a representative sample of an economy’s private sector. The surveys cover a broad range of business environment topics including access to finance, corruption, infrastructure, crime, competition, and performance measures. The World Bank has collected this data from face-to-face interviews with top...

Credit Risk & Scoring

Jan 23, 2013

Launched in 2006, IFC's South Africa SME Banking Program worked with a variety of financial sector partners to create an environment where entrepreneurs and smaller businesses in South Africa can today more easily and quickly access finance and training. The program, funded by Switzerland's State Secretariat for Economic Affairs (SECO), worked...