Our events

SME Finance Virtual Marketplace - Focus on Supply Chain Finance

Each month we are running sessions featuring leading small business lenders and SME growth facilitators who present their MSMEs offerings in a 7-minute pitch to an audience of potential financial institution clients and partners looking for impactful fintech solutions.

Through those sessions - run by the SME Finance Forum and powered by IFC - we foster collaboration between financial institutions, fintech companies, development finance institutions and investors.

We have featured 130+ companies active in many different markets, attracted +2000 participants and generated many business leads, leading to investments, partnerships, and innovation advancement.

This upcoming Marketplace session, scheduled on Wednesday, July 24 from 8 am to 9 am EDT, will focus on Supply Chain Finance.

Supply Chain Finance for SMEs has the potential to be a game changer as nearly 20% of global MSME finance gap is locked in the supply chains. Technology and supply chain platforms have a key role to play as these platforms enable ease of transactions, data trail, product alignment, transparency, and all key actors to come together to solve SME Finance challenge.

WHY YOU SHOULD JOIN?

-

You are missing a tool in your fintech stack to accelerate your digital transformation and want to discover new products.

-

You are looking to invest in impactful fintech companies that help SME grow.

-

You are in search of new clients and investors for your innovative financing solutions.

COMPANIES PITCHING

E Factor Network

Founded in 2009, E Factor Network is a leading Mexican Fintech offering a web-based SaaS marketplace. It connects corporates and suppliers with funders, facilitating rapid working capital through electronic financing. With over USD 50 billion funded in a decade, the platform supports 20,000+ companies, primarily SMEs, with flexible, multi-currency solutions.

Fin2B

Fin2B's mission is to support small and medium sized enterprises(SMEs) to access efficient financing from the first-tier financial institutions. We focus on supply chain financing as it provides efficient financing to small and medium sized enterprises leveraging credit worthy trading partners. Fin2B currently operates in Vietnam, Indonesia and India.

Invosoko

InvoSoko addresses the $75 billion financing shortfall impeding Sub-Saharan African SMEs with its secure fintech platform offering a de-risked digital ecosystem to empower SMEs gain access to credit, verified partners (suppliers, buyers, financiers), digital payments while revealing the full potential of the digital economy.

Kapitale

Kapitale is a credit fintech that offers SMEs in Brazil economic access to capital using their credit card receivables as collateral. The company utilizes cutting-edge technology to create a marketplace for credit card receivables as an alternative to the existing POS financing provided for acquires and banks.

RXIL

Receivables Exchange of India Limited (RXIL), established as a joint venture of SIDBI, NSE along with State Bank of India, ICICI Bank, and Yes Bank, embarked on its journey as India's inaugural Trade Receivables Discounting System (TReDS) platform, in accordance with Reserve Bank of India’s (RBI) approval granted on December 1, 2016. RXIL facilitates financial growth in the country by providing Micro, Small, and Medium Enterprises (MSMEs) access to credit and improving their cash flow by streamlining payment cycles with minimal delays.

360TF

Ecosphere based in Singapore that instantly connects businesses and financial institutions across the globe digitally to fund trade flows at the best of term.

Moderation

FCI

FCI is the Global Representative Body for Factoring and Financing of Open Account Domestic and International Trade Receivables. FCI was set up in 1968 as a non-profit global association. With today close to 400 member companies in more than 90 countries, FCI offers a unique network for cooperation in cross-border factoring.

SPEAKERS

Neal Harm - Secretary General - FCI

Neal Harm is the Deputy Secretary General at FCI (fci.nl), the Global Representative Body for Factoring and Financing of Open Account Domestic and International Trade Receivables. He has over 30 years of experience in working capital finance, having successfully led and managed complex and large commercial finance, international, and payments businesses at leading US Banks.

Neal is a graduate of Lenoir Rhyne University in North Carolina, USA where he joined Wachovia’s Leadership Management Development Program. At Wachovia (now Wells Fargo) he started his career in the Asset Based Lending division as a collateral analyst. This role led to his interest in working capital-based finance.

Neal later joined Bank of America’s factoring division taking on various leadership roles. He was responsible for all aspects of business operations to include client experience, partnerships with financial institutions, and product development ultimately becoming the President of Business Finance in 1999.

In 2005, he joined BB&T (now Truist) leading to his role as President of the bank’s international banking division to include Trade, FX, Factoring, and Correspondent Banking. While at BB&T, he was a member of FCI’s Business and IT Committee, serving as its Chairman from 2008 to 2012. He later became a member of FCI’s Executive Committee to include a role as Vice Chairman.

Pamela Hierro Kapellmann - Director of Strategic Alliances - E Factor Network

Pamela Hierro Kapellmann is the Director of Strategic Alliances at E Factor Network and E Factor Diez. She excels in forging partnerships with financial institutions and international companies, integrating ESG practices into supply chain financing. Pamela holds a degree from the Faculty of Law of Monterrey and an executive program in sustainable business.

Duke Lee - CSO - Fin2B

Duke Lee is CSO of Fin2B, a supply chain finance fintech company in Asia. He is passionate about using innovations to support small and medium sized enterprises to have access to efficient finance. He has been trained as an engineer receiving Ph.D. degree in Electrical Engineering and Computer Science in UC Berkeley. Since then he has been a management consultant in BCG, corporate managers in LG and a serial entrepreneur.

Duke Lee is CSO of Fin2B, a supply chain finance fintech company in Asia. He is passionate about using innovations to support small and medium sized enterprises to have access to efficient finance. He has been trained as an engineer receiving Ph.D. degree in Electrical Engineering and Computer Science in UC Berkeley. Since then he has been a management consultant in BCG, corporate managers in LG and a serial entrepreneur.

Jeff Mugo - CEO - Invosoko

Jeff Mwangi is a visionary leader with a powerful combination of financial insight and technological competence. He has a proven track record of leading projects from inception to successful launch, utilizing his expertise to translate complex situations into clear, actionable strategies.

Mr. Mwangi fosters strong relationships with buyers, suppliers, and funders within the InvoSoko Ecosystem, ensuring all stakeholders derive maximum value.

Anderson Pereira - Co-founder and CEO - Kapitale

Anderson Pereira is the co-founder and CEO of Kapitale, a fintech dedicated to unlocking the growth potential of SMEs by providing access to affordable capital through credit card receivables. With a master’s degree in Management of Technology from MIT, Anderson combines his expertise in technology with a passion for social impact.

Before founding Kapitale, Anderson served as the CEO of Universia Brasil, a subsidiary of the Santander Bank. His leadership and influence in the business world were further validated when he was named on Forbes' prestigious 'Under 30' list, recognizing him as one of Brazil's most influential young leaders.

His dedication to community engagement was further highlighted when he set a new Guinness World Record for organizing one of the largest classes in the world for 5,000 students, demonstrating his relentless drive to make a positive impact on society. Through Kapitale, Anderson continues to empower small businesses, fostering economic growth and financial inclusion.

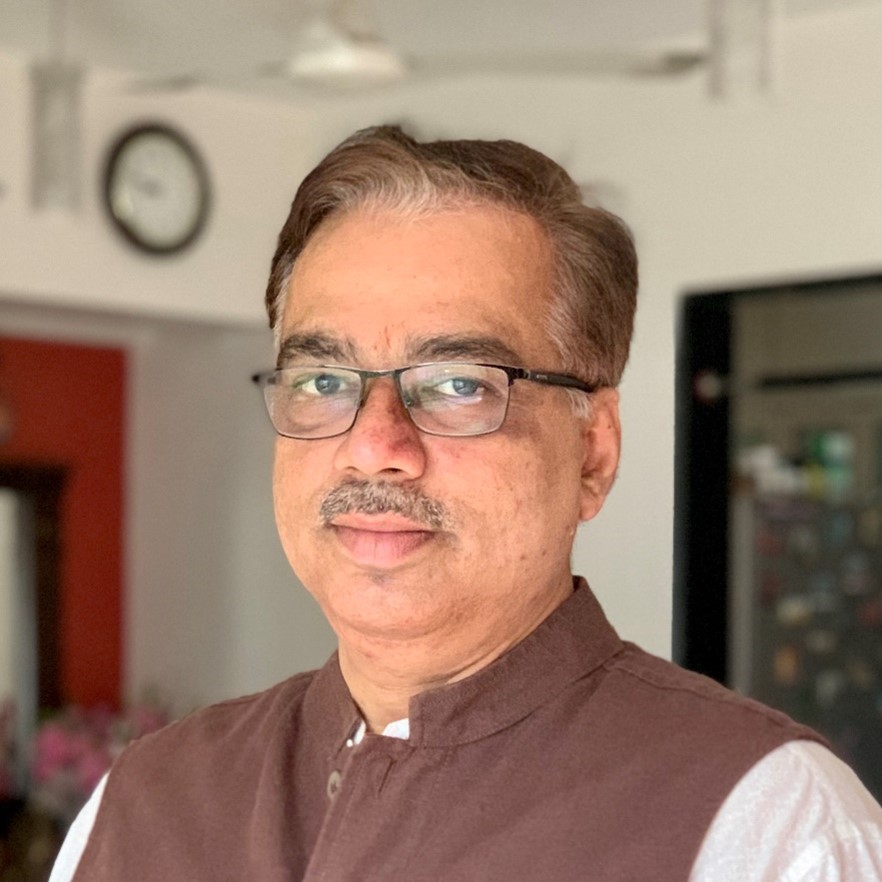

Ketan Gaikwad - Managing Director, and CEO - RXIL

Mr. Ketan Gaikwad, the Managing Director and CEO of Receivables Exchange of India Limited (RXIL), is a banker with a career spanning 30 years.

Mr. Ketan Gaikwad, the Managing Director and CEO of Receivables Exchange of India Limited (RXIL), is a banker with a career spanning 30 years.

Prior to joining RXIL, he has held leadership roles in transaction banking in Barclays Bank and Standard Chartered Bank. He started his career with Bank of Baroda and has had multiple roles in Standard Chartered before heading trade finance in Barclays Bank.

Mr. Ketan Gaikwad is science graduate from Mumbai University and has a Master’s Degree in Management Studies from Symbiosis Institute of Business Management, Pune. He has completed Executive Leadership Program from INSEAD, Fontainebleau, France, and advanced Programme on Fintech from IIM Kolkatta.

Receivables Exchange of India Limited (RXIL), a TReDS platform mandated by RBI is a Joint Venture of Small Industries Development Bank of India (SIDBI) & National Stock Exchange (NSE) along with State Bank of India, ICICI Bank and Yes Bank being other shareholders.

Vikram Lodha - Co-Founder & CEO - Nimai Trade Fintech |360tf

A post-graduate in Management, Vikram is an accomplished career banker with over 20 years of experience with banks like Citibank & Kotak Mahindra Bank in India. In his last assignment he was a part of Global Transaction Banking group at Kotak Mahindra Bank, India, heading the Trade Product and Supply Chain Finance for the bank. He was responsible for Trade & Supply Chain Finance P & L, Product Management, Regulatory Compliance, Technology etc. As part of this role, he was also responsible for Risk Participation of Trade Assets, Equity & Debt related cross-border capital account flows, cross-border Trade flows & arranging Trade funding from Financial Institutions. He was supporting all the businesses of the bank i.e., Consumer Bank, Commercial Bank, Wholesale Bank and offshore branches with additional responsibilities on Priority Sector Lending for the Wholesale Banking Group of the Bank.