Finovate New York 2014 – Big attendance, lots for rich people, but some quality offerings for SMEs and financial inclusion in emerging markets.

Finovate is always a very exciting experience, and my first Finovate New York didn’t disappoint. Over 1450 people were registered, the largest Finovate audience ever. Most were from USA, and USA market oriented, but I saw participants from Asia, Africa and Europe. Out of the 70 companies, several were directly SME-relevant, and many had attractive related technologies. Those most SME-relevant were (in no particular order):

BCSG—they do products that help SMEs manage their business better, particularly cash management. They have an integrated platform where 1 sign-on gets the business owner to a package of 10 key services. They say they now reach over 4 million SMEs worldwide, from their HQ in “Silicon Roundabout” in east London (rapidly becoming a global fintech hub). They do white label SME services for big banks such as Santander,Barclays and Virgin’s online bank. They’re also ready to customize packages for other financial institutions. They’re interested in wider markets, even though now their presence is mostly the UK, USA and Australia.

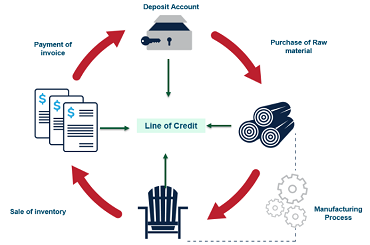

Behalf (formerly Zazma)—they do working capital finance for SMEs, using quite a clever scoring system which looks carefully at business/vendor relationships in developing flexible credit line packages. They’re also developing an interesting B2B platform, though they don’t say too much about how this might evolve. Unfortunately, with new backing from Sequoia and others, they’re firmly focused on the US market for a while…tried to tell them how demand and margins would be bigger elsewhere, but no go so far…one to keep an eye on for later.

Bizequity—previously profiled here, these folks seem to be growing very well, adding 7 new patents in the past year as they seek to become “the turbotax for small business valuation”. With their latest innovations they feel they’re going beyond value to giving firm info on business performance, making the tool even more valuable to financial institutions that choose to incorporate it as a white label product to help in SME client acquisition and service customization. They’ve got 27.5 million SMEs in a database they use for benchmarking (all from North America). They’re now up to 25 private label clients. They have opened an office in Singapore, and are interested in emerging markets, so hopefully we’ll find a way to bring them closer to emerging market FIs in future expos and on-line events we’ll convene through the Forum.

BlueVine—they do advances against invoices (invoice discounting), with a strong US focus, but since a number of the founders come from outside the US, they were potentially interested in looking further. Their tool is on-line and immediate, instantly showing the level of discounting they’ll apply. They’re linked to Quickbooks and other leading accounting software, which the SME applicant can tie into to provide essential financial data in a user-friendly way online. In the US they can make the initial credit decision in 24 hours, with subsequent decisions in minutes (up to $50,000). One of the interesting features is that they establish a special BlueVine account and ACH identity for the SME as part of the system, in the SME's name—to me that integration of the business ID into the wider payments records could help later on in broadening financing options for the future (although, it could work to BlueVine’s detriment in that sense).

Geezeo—working since 2006 in consumer finance (white labeling for over 300 financial institutions), these folks are branching out into SME financial management support. Their product helps in cashflow and receivables management, budgeting and planning. Their tools also help the FIs in understanding their SME clients, and they have applications that can help the FIs in push marketing of products and in customizing other campaigns. These folks don’t have much experience in emerging markets (they focus on smaller banks and credit unions in North America, so far), but are intrigued by the notion.

P2B Investor—crowdfunding for receivables financing. This Denver, CO-based firm focuses on accredited investors only (which I like), offering a partnership with Quickbooks and patented technology to provide a clearer, easier path for both borrowers and financiers to use. Business can acquire as much as $5M in receivables-backed growth capital, with investors getting 7-15% APR (they say, in their promo). They are open to taking their act to emerging markets.

Powerlytics—a powerful tool, using tax returns and other open data from government agencies to create a pretty impressive analytics for underwriting mid-market US companies. They have tax data from 144 million US households and 27 million businesses in over 1000 industries. This data engine can do some pretty impressive benchmarking, as they showed. The bad news is that they’ve invested so much in the US systems, they’re not that interested in expansion, except perhaps to certain markets in developed Europe, like the UK and France, where there is substantial data also available on privately held firms (through Companies House filings in the UK, for example).

Settle—another venture in the PrivatBank stable (they are regular contributors to Finovate). This one provides a very nice looking payments platform for merchants and customers. It includes customer smartphone apps, and merchant table POS, and a merchant dashboard for work in integrating with loyalty schemes. They say they have over 500 merchants and 100,000 consumers on the platform in the Ukraine and Russia. One needs smartphones and 3G networks to be widely available, but that’s coming fast in more and more places…and I continue to be impressed by how the central European developers manage to produce much more thoughtful, customer-friendly interfaces than their competitors from other regions. These folks aren’t really that interested in emerging markets, though…they came to New York with the US market firmly in their sights!

Senor Pago—one of the few emerging market firms there, and they presented a very SME focused product! And a product focused on the unbanked, to boot…. With a strong base as one of the top 2 mPOS providers in Mexico (over 3000 customers), they are seeing how they can give electronic payments privileges to the smallest firms. Sr Pago enables small business and individuals to accept card payments for services through payments cards that work anywhere MasterCard is accepted. Perhaps more important, this can happen with Tier2 KYC, which means that if the customer is a taxi driver or similar very small business, they needn’t do tax registration and other expensive compliance requirements. However, they do get a connection to one of Mexico’s growing microfinance institutions (Te Creemos), so they do link into a financial system (albeit one not mainstreamed, yet) that can offer additional services. They report they’ve also taken their product to the largest bank in Colombia.

And there were a number of fintechs which, while not SME-focused, either have potential benefits for SMEs—or they were just seriously cool!

Backbase—an overall digital banking solution focused on smaller US banks and credit unions, which means it could probably fit more easily for emerging market banks…what I liked about it was how easy it looked to customize by the FI staff. What I liked even more is that they are creating a parallel “open banking marketplace”, where they offer to connect their banks to any fintech vendors who want to connect to the Backbase core digital banking system…on the one hand, that of course helps give them a slice of the other fintech’s action…but on the other, I think it’s the right way to help small banks get more information about what’s possible.

Crowdflower—crowdsourcing turning “big data” into “rich data” (their concepts). These folks have created a network of 5 million (and growing) data grunts out there who are willing to take datasets that cannot easily be worked into a relational database, and manually clean and sort the stuff…for a fraction of the cost of hiring interns (or worse), and with quality control. Examples are going through zillions of satellite photographs of cities to find out how many cars are in parking lots at a given time, and (more interesting for FIs) going through zillions of SEC filings in pdf documents to pull out key company information, such as names of Directors and other performance numbers. Their data cleaning army is from around the world, and they’re interested in how they might move into emerging markets. Wonder how they could do on a task like gender disaggregating client data, or putting employee data from clients and other aspects of SME performance into a more usable data form for FIs???

Eyelock—very impressive iris ID technology…Small, but looked very robust, and can work from batteries, online or offline. they’ve just inked a deal with Sticky Password, which they claim is the world’s #2 password technology backbone provider.

FlexScore—“gameifying financial planning”—set goals, monitor progress, score points…focused on consumers, but pretty cool…wonder about its relevance for emerging markets, and about adapting for small businesses??? Particularly for young entrepreneurs, who respond well to gaming environments.

Knox Payments—facilitating online C2B payments. Disintermediates the banks, reduces interchange fees, both for domestic and forex payments (they have new alliance with Forex.com). But most surprising, key staff have connections to emerging market innovators like KopoKopo, and the top team is definitely interested in expansion, with efforts already underway in India! They said they can do ACH payment for $0.18, and transactions that must be underwritten for that plus only 0.5%...with credit card fees, by comparison, being over 2 percent minimum.

Matchi—another group trying to matchmake fintech innovators with financial institutions (remember our friends from Innovation Café?) They have Standard Bank as an anchor client, and they’re using “innovation challenges” as motivations to get fintechs to join their platform, and to tilt their thinking to certain key areas. They offer subscriptions to FIs to have access to the “curated information” on the fintechs. It’s clear that many see the fintech world as both really important, but also as really hard to navigate…and thus the opportunity for brokers. Certainly we at the Forum need to figure out the best way to plug into these platforms, because there is lots to be gained from piggybacking on the hard work they’re already doing to surface and classify the fintechs…

mCASH—a dominant mobile P2P service provider in Norway, they’re taking their act on the road, and also expanding to enable merchants to accept electronic payments through any channel, using the hardware they already have, including smartphones. Not sure I ever completely understood this one, but they seemed like very credible sponsors, and the interface was very easy and clean.

Rippleshot—these guys offer products for small FIs to enable them to learn of credit card and other data breaches earlier, and to do detailed risk management for each breach. This is related to SME finance in that SMEs that are sites where breaches occur very frequently go out of business, so this tool has portfolio risk management relevance. Not a big issue in emerging markets (yet)…but their technology, using GPS, big data analytics, great screen technology, etc, was seriously cool!

SelfScore—consumer finance focused, but what was novel is that they combine alternative data use (scraping social media, etc) with online psychometric questioning to focus on getting people with virtually no records in the formal credit reporting system started with credit (such as foreign students recently arrived in the USA, etc). Again, not SME relevant, perhaps, but I liked the thinking behind how they’re doing behavioral scoring along with financial metrics…I wonder about how this might be channeled into looking at youth entrepreneurs???

Sender—another PrivatBank investee company. These folks do digital payments with a Facebook/Twitter/etc style instant messaging interface that was very user friendly and very powerful at the same time. But they’re very US-market focused now (started in Ukraine and Russia).

AnchorID—a world with no passwords??? A universal ID that offers the user and the service provider a myriad of ways, starting with a confirming call to the mobile phone number, adding biometrics (voice), PINS, whatever wanted on top (or nothing), so that ones’ Facebook, bank, credit cards, etc, accounts can be made more secure without use of passwords…nothing to do with SMEs, but looked really, really cool as it was demonstrated…someone in the audience even tried to hack it, and failed (and we could see this on the screen real-time—I checked with the CEO/presenter, and he swore up and down this wasn’t planned).

About the author: Matt Gamser, the Head of the SME Finance Forum, has over 30 years of experience in international enterprise development, local economic development, and finance. Prior to joining the SME Finance Forum, he led IFC’s advisory work in increasing access to financial services in the East Asia-Pacific region. Matt has worked for governments and private businesses around the world to create an improved policy and regulatory environment for private-sector growth and poverty reduction. He has edited and authored several books and numerous journal articles. Matt holds a BA and MA degrees from Harvard University, and a M.Sc and PhD from Sussex University (UK).