KPMG, along with AltFi data, has published a new report on alternative lending in Europe. KPMG also sourced data from the most recent Cambridge Centre for Alternative Finance report. The document, entitled Alternative Lending Market Trends in Continental Europe 2016, provides an interesting snapshot of online lending beyond the UK.

Jevgenijs Kazanins, CEO of Twino, commented on the report;

“This report shows that the UK still leads the way for alternative finance, although continental European lenders are quickly catching up. We believe that alternative finance will continue to grow quickly in Continental Europe, potentially to the detriment of the UK as the effect of the Brexit vote begins to weigh on the British economy.”

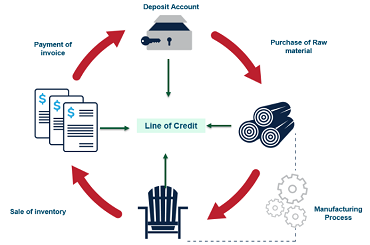

As many industry participants know, the UK was the birthplace of peer to peer lending. In the ensuing years, peer to peer lending has grown into a robust market where borrowers, both business and consumers, may more easily access credit than with traditional banks. Today, the UK generates four times more online lending than the entire continental Europe.