MSME Finance Gap

MSME Finance Gap

An Updated Estimation and Evolution of the MSME Finance Gap in Emerging Markets and Developing Economies

March 2025

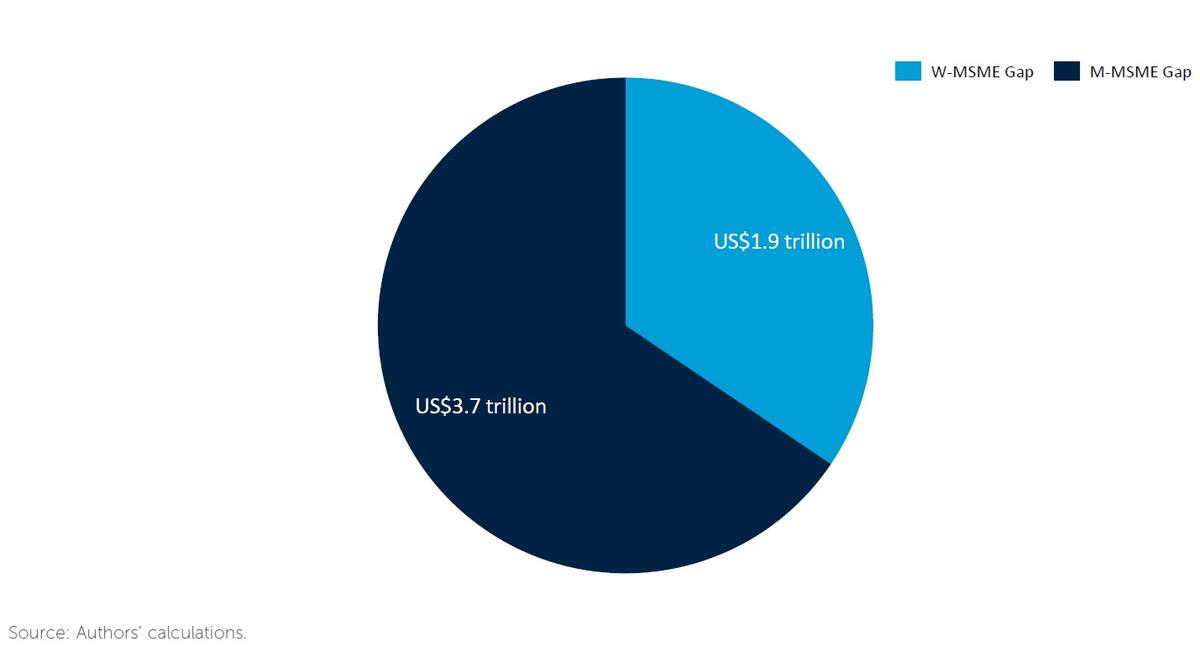

Chart 2: W-MSME Finance Gap

Women-owned businesses account for 34 percent of the MSME finance gap. The total MSME finance gap for women is estimated to be valued at US$1.9 trillion, which is over 7 percent of total GDP (figure below).

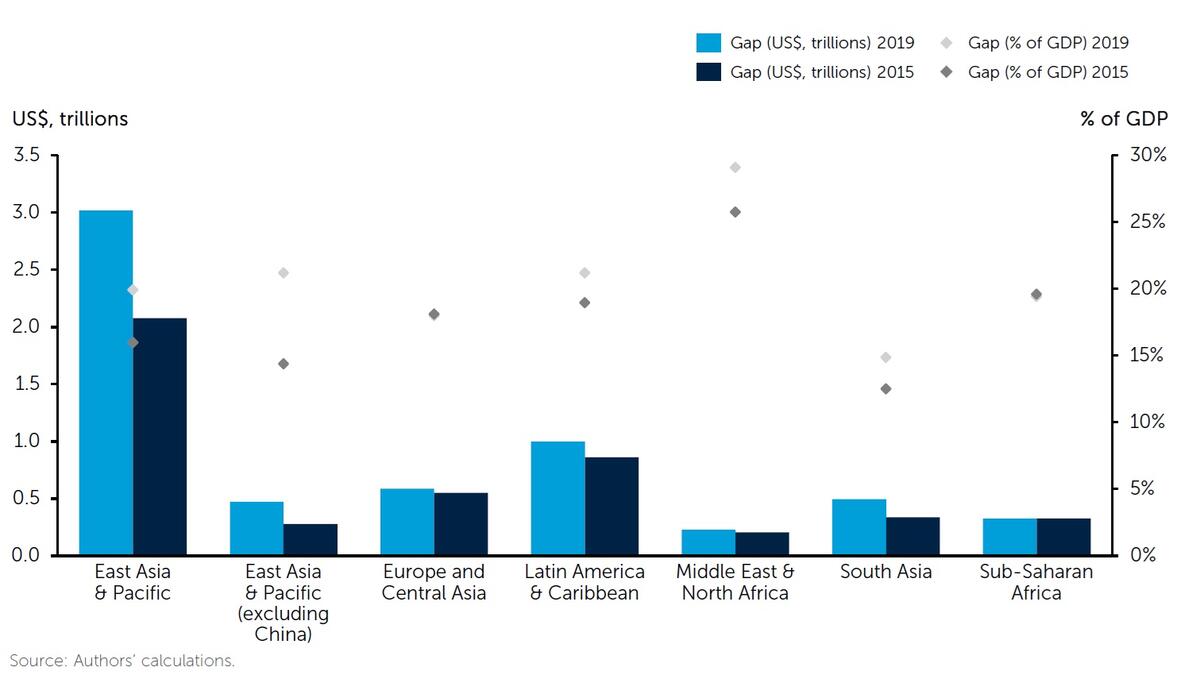

Chart 3: Evolution of the MSME Finance Gap by Region

Regional and income group variations of the MSME finance gap are a result of potential demand and supply variations, as discussed in earlier sections.

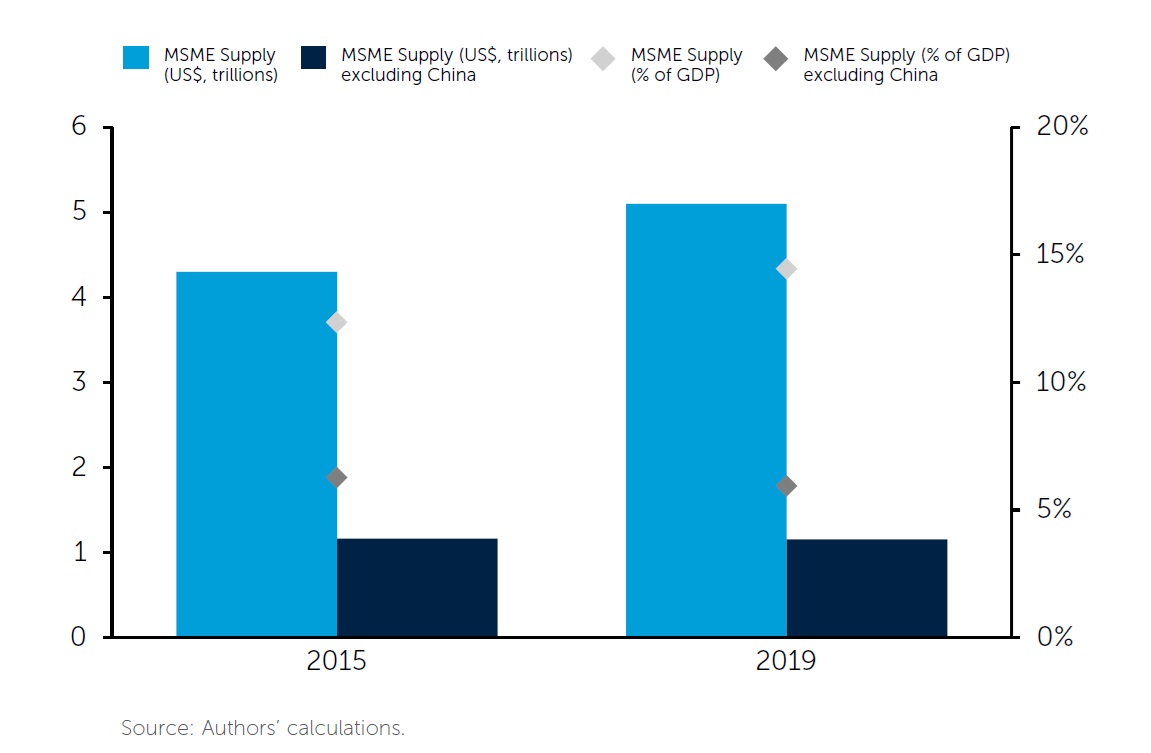

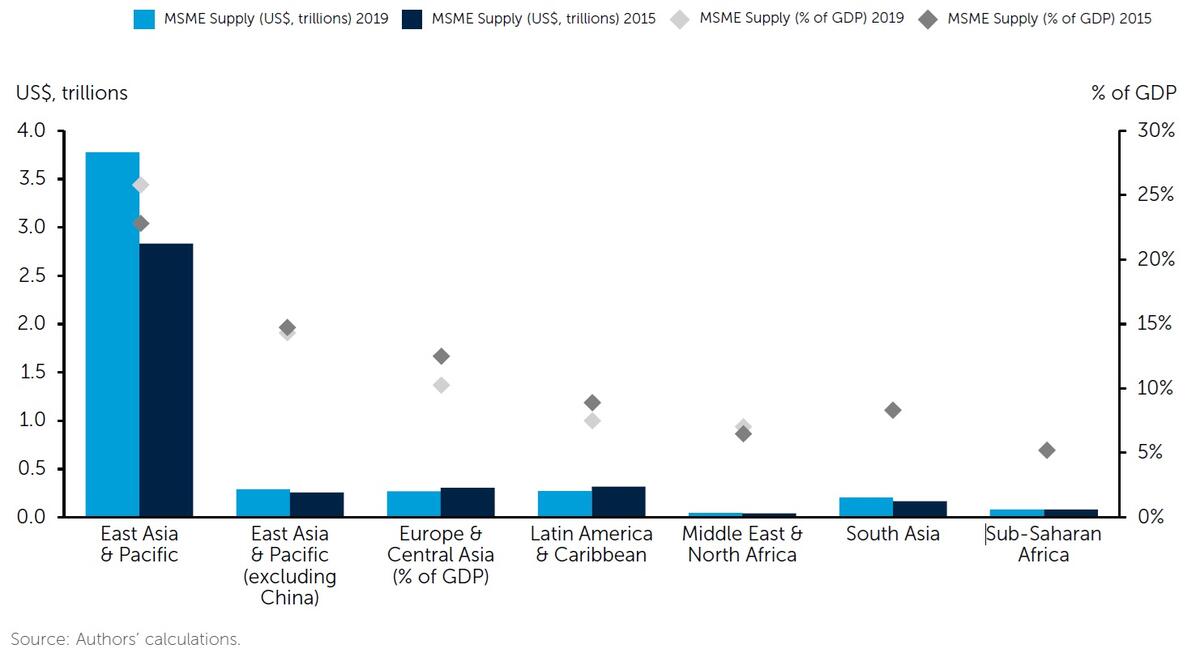

Chart 4: Growth in Supply of MSME Finance

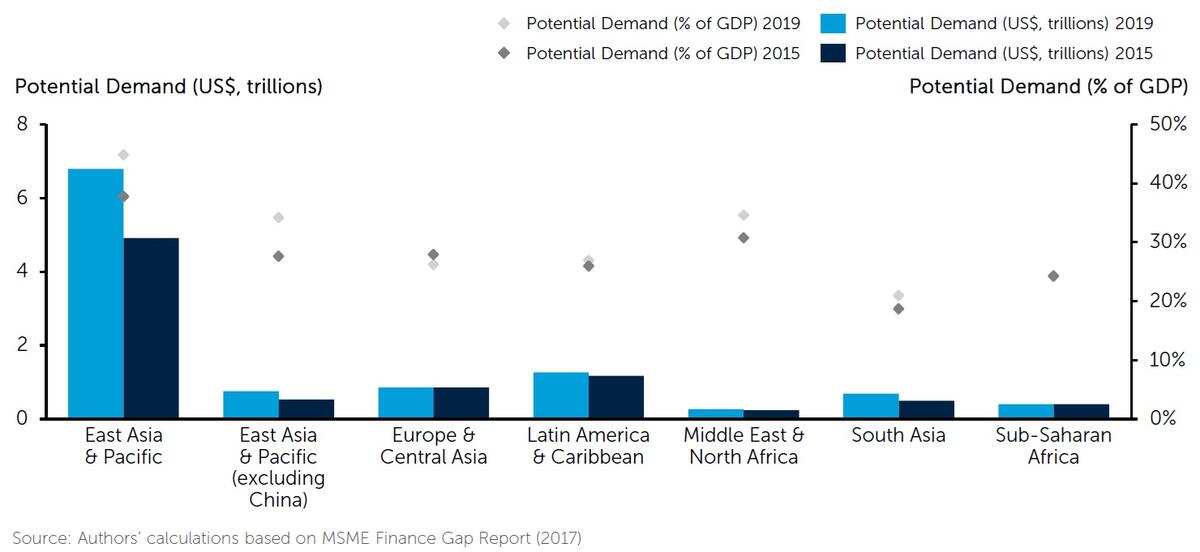

Chart 7: Evolution of the Potential Demand for MSME Finance Gap by Region

From a regional perspective, the growth in demand of MSME financing presents an interesting picture. In most regions, the demand has grown relatively modestly (figure below). However, in terms of volume, the demand for financing increased annually by approximately 10 percent in both East Asia and the Pacific as well as South Asia over the 4-year period. This stands in contrast to the annual average increase in GDP during the same time period, which was 4 percent and 7 percent, respectively. As a result, when expressed as a share of GDP, the potential demand for financing increased by only 3 percentage points in South Asia and 7 percentage points in East Asia and the Pacific. However, it shows a decline of 2 percentage points for ECA. Overall, there is an increase in demand in terms of volume across all regions, with the exception of ECA (figure below).

Compare with

Chart 8: Formal MSME Finance Gap

Chart 9: Formal Finance Gap by Gender

MICRO enterprises are defined as those with less than 10 employees

SMALL AND MEDIUM ENTERPRISES are defined as those with 11-250 employees

LEVEL OF FINANCIAL CONSTRAINTS

Fully credit-constrained firms are defined as those that find it challenging to obtain credit. These are firms that have no source of external financing. They typically fall into two categories: those that applied for a loan and were rejected; and those that were discouraged from applying either because of unfavorable terms and conditions, or because they did not think the application would be approved. The terms and conditions that discourage firms include complex application procedures, unfavorable interest rates, high collateral requirements, and insufficient loan size and maturity.

Partially credit-constrained firms are defined as those that have been somewhat successful in obtaining external financing. PCC firms include those that have external financing, but were discouraged from applying for a loan from a financial institution. They also include firms that have an external source of financing, and firms that applied for a loan that was then partially approved or rejected.

Non-credit-constrained firms are those that do not appear to have any difficulties accessing credit or do not need credit. Firms in this category encompass those that did not apply for a loan as they have sufficient capital either on their own or from other sources. It also includes firms that applied for loans that were approved in full.

WOMEN-OWNED ENTERPRISES

At least 50 percent female ownership, OR Sole Proprietorships that are female-owned, OR female participation in ownership and management (top manager).

Option 1: At least 50 percent female ownership, OR Sole Proprietorships that are female-owned, OR female participation in ownership and management (top manager).

Option 2: Sole Proprietorships that are female-owned, OR female participation in ownership and management (top manager).

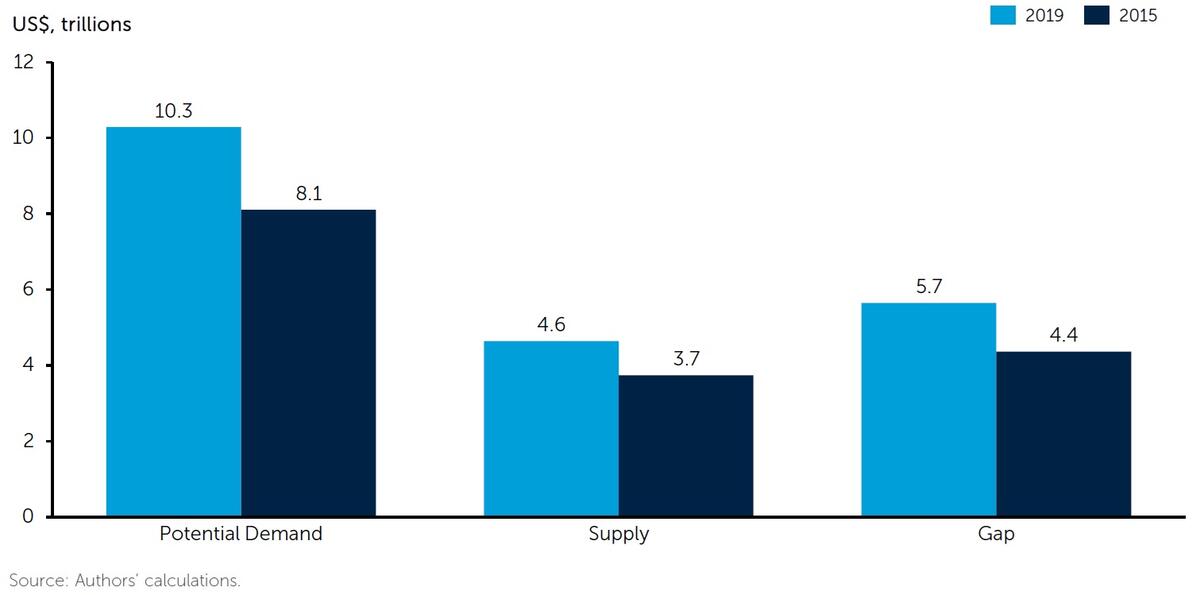

The POTENTIAL DEMAND expresses the amount of financing that MSMEs would need, and financial institutions would be able to supply if they operated in an improved institutional, regulatory and macroeconomic environment.

Section D: Methodology

|

Contact Us Minerva Kotei SME Finance Forum (IFC)

Sandeep Singh Sector Economics and Development Impact (IFC) |

| ssingh13@ifc.org |